Thread on my research on "Buy Now Pay Later" #BNPL companies.

Affirm $AFRM, Klarna, Afterpay $AFTPY, Hoolah, Split It, Quadpay, Paypal CreditBill Me later $PYPL, Marcus Pay $GS, Future Pay, Sezzle, Uplift, Open Pay, Zip Pay, Flexi Group, Go CardLess, Fondy, Clear Pay, Lay Buy

Affirm $AFRM, Klarna, Afterpay $AFTPY, Hoolah, Split It, Quadpay, Paypal CreditBill Me later $PYPL, Marcus Pay $GS, Future Pay, Sezzle, Uplift, Open Pay, Zip Pay, Flexi Group, Go CardLess, Fondy, Clear Pay, Lay Buy

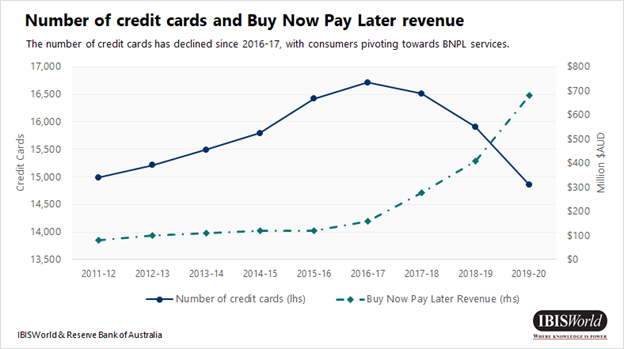

BNPL: Buy Now, Pay Later companies enable consumers to defer payments on purchases through installment-based loans. In 2020, it is a $24 Billion market

https://uniquebusinessmodels.substack.com/p/26-how-do-buy-now-pay-later-bnpl

https://uniquebusinessmodels.substack.com/p/26-how-do-buy-now-pay-later-bnpl

https://uniquebusinessmodels.substack.com/p/26-how-do-buy-now-pay-later-bnpl

https://uniquebusinessmodels.substack.com/p/26-how-do-buy-now-pay-later-bnpl

BNPL is gaining traction in the U.S especially among credit card holders, millennials and Gen Z consumers. 18% of millennials made at least one BNPL purchase within the last two years. https://www.fool.com/the-ascent/research/buy-now-pay-later-statistics/

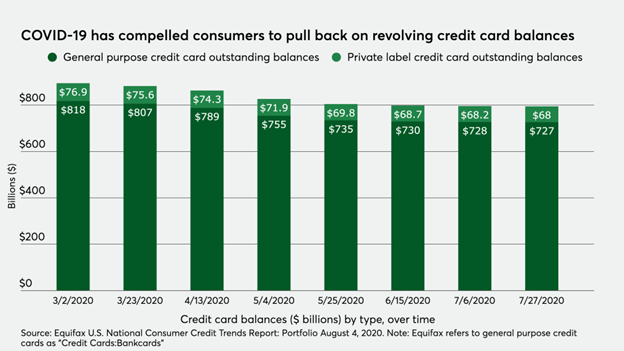

BNPL: Nowadays, consumers are more budget conscious and increasingly seek out BNPL providers to finance single purchases to avoid revolving credit card debt.

BNPL: Just 7% of Americans made a BNPL purchase through the first nine months of 2020—the same percentage that used the service in 2019.

Although 7% of consumers seems like a small number, users make an average of $1400 purchase mostly electronics.

Although 7% of consumers seems like a small number, users make an average of $1400 purchase mostly electronics.

BNPL’s value will reach over 12% of total eCommerce spend on physical goods by 2025

, according to Kaleido’s new report on Digital BNPL & ePOS Financing: Market Outlook 2020

, according to Kaleido’s new report on Digital BNPL & ePOS Financing: Market Outlook 2020

, according to Kaleido’s new report on Digital BNPL & ePOS Financing: Market Outlook 2020

, according to Kaleido’s new report on Digital BNPL & ePOS Financing: Market Outlook 2020

Who’s making BNPL purchases?

High-income consumers. 70% earn > $75K a year. They’re highly educated

Credit cardholders. 97% of them have at least one credit card.

Millennials.18% made at least one BNPL purchase over the past two years,

High-income consumers. 70% earn > $75K a year. They’re highly educated

Credit cardholders. 97% of them have at least one credit card.

Millennials.18% made at least one BNPL purchase over the past two years,

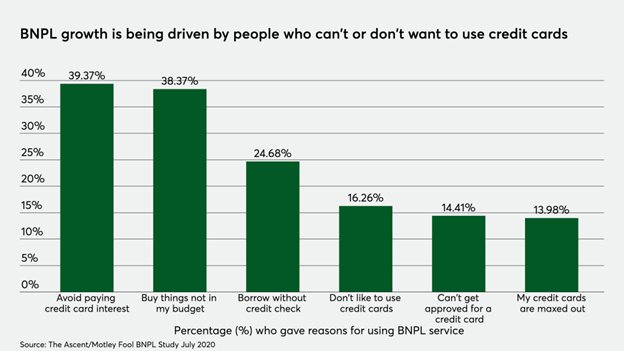

Why use BPNL?

The three most-frequently cited reasons for using BNPL according to a study from The Ascent is to:

1) Avoid paying credit card interest;

2) Make purchases that otherwise wouldn't fit in my budget;

3) Borrow money without a credit check. https://www.fintechtris.com/blog/buy-now-pay-later-fintech

The three most-frequently cited reasons for using BNPL according to a study from The Ascent is to:

1) Avoid paying credit card interest;

2) Make purchases that otherwise wouldn't fit in my budget;

3) Borrow money without a credit check. https://www.fintechtris.com/blog/buy-now-pay-later-fintech

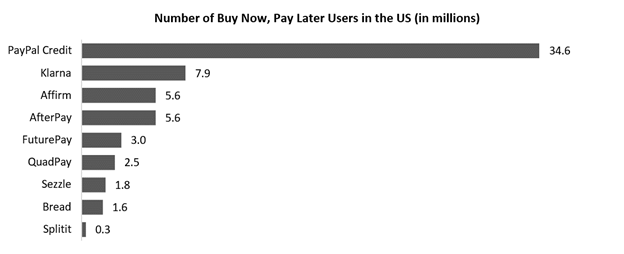

BNPL: The "Big 4" companies are : $PYPL acquired Bill me later - 2008), Klarna, $AFRM and $AFTPY (Australia). There are 30-50 other cos. https://www.pymnts.com/buy-now-pay-later/2021/bnpl-company-affirm-completes-264-million-paybright-deal/

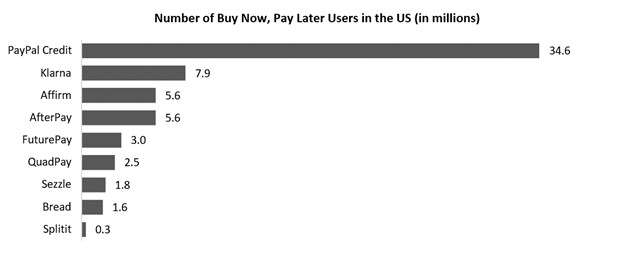

As you can see below, $PYPL, Klarna, Afterpay $AFTPY and $AFRM have the highest # of "merchants" and "consumers.

PayPal Credit has far more users than its competitors-2008 acquisition of Bill Me Later, has been in the game far longer than anyone else.

1)It’s not a winner-take-all game.

2)BNPL providers will need to sharpen their sales attribution stories.

3)BNPL providers will specialize

1)It’s not a winner-take-all game.

2)BNPL providers will need to sharpen their sales attribution stories.

3)BNPL providers will specialize

Who are the Losers in BNPL?

The banks and payment networks.

Merchants have two things in common: 1) They’ll do anything to make a sale, and 2) They hate (with a passion) interchange fees

"Micro loans at the point of sale" https://www.huffpost.com/entry/buy-now-pay-later-popular-pandemic-safe_l_5f3d4fa2c5b6d8a917411568

The banks and payment networks.

Merchants have two things in common: 1) They’ll do anything to make a sale, and 2) They hate (with a passion) interchange fees

"Micro loans at the point of sale" https://www.huffpost.com/entry/buy-now-pay-later-popular-pandemic-safe_l_5f3d4fa2c5b6d8a917411568

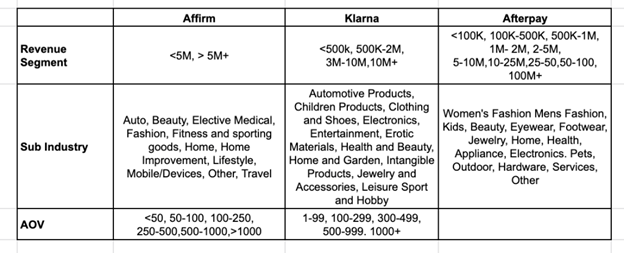

Besides $PYPL the big 3 are going after different segments of customers.

https://blog.thesharmas.org/2020/10/31/bnpl-affirm-klarna-afterpay-gtm/

https://blog.thesharmas.org/2020/10/31/bnpl-affirm-klarna-afterpay-gtm/

Benefits for Customers

Take home the product even if you don't have enough money to purchase it at that moment

Smaller, manageable repayments

Simple sign-up and almost instant assessment (much simpler and quicker than getting a credit card)

https://tearsheet.co/online-lenders/what-affirms-ipo-and-chases-new-installment-product-say-about-the-bnpl-market/

Take home the product even if you don't have enough money to purchase it at that moment

Smaller, manageable repayments

Simple sign-up and almost instant assessment (much simpler and quicker than getting a credit card)

https://tearsheet.co/online-lenders/what-affirms-ipo-and-chases-new-installment-product-say-about-the-bnpl-market/

Benefits for Merchants

Increased conversion

Increased average transaction value

Comparatively easy integration

No Chargeback risk

How do BNPL Companies make money?

From Sellers

Merchants usually pay a BNPL charge ranging from 2 to 8 percent of the purchase amount

Increased conversion

Increased average transaction value

Comparatively easy integration

No Chargeback risk

How do BNPL Companies make money?

From Sellers

Merchants usually pay a BNPL charge ranging from 2 to 8 percent of the purchase amount

Most third-party BNPL providers do a soft credit check to avoid giving money to people who have shown general disregard for repaying obligations, but this isn’t universal. https://www.businesswire.com/news/home/20200922005066/en/Buy-Now-Pay-Later-Digital-Spend-Led-by-Klarna-PayPal-Afterpay-to-Double-by-2025-Reaching-680-Billion---Kaleido-Intelligence

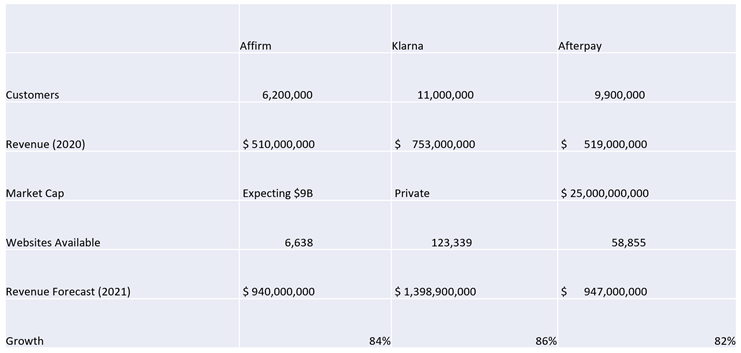

The big 3 are still growing at over 80% annually and expect to next year as well. Covid increased their growth rates to over 100%

One other company in the space is Katapult, coming public via a SPAC, $FSRV - they focus on the higher risk customers - who have more credit risk https://katapult.com/

@HaydenCapital has a great presentation on $AFTPY - Afterpay. The stock has been on a tear in 2020.

http://www.haydencapital.com/wp-content/uploads/Hayden-Captal_APT-Presentation.pdf

http://www.haydencapital.com/wp-content/uploads/Hayden-Captal_APT-Presentation.pdf

Mukund's analysis: I like the space as a subset of #FinTech. I already own $PYPL. I might buy a very small position in $AFRM if the Market Cap is < $15B, which is unlikely since they are going public at $33 - $38 expecting $9B valuation, but likely to end up at $50

$AFRM - alternative data to check merchant acquisition

$AFTPY and $PYPL data as well available

https://trends.builtwith.com/payment/Affirm

https://trends.builtwith.com/payment/Klarna

https://trends.builtwith.com/payment/Afterpay

$AFTPY and $PYPL data as well available

https://trends.builtwith.com/payment/Affirm

https://trends.builtwith.com/payment/Klarna

https://trends.builtwith.com/payment/Afterpay

I will add some words of caution, but I am a "risk averse" investor, so take my caution with a grain or bushel of salt.

The valuations on these are RICH

I cant see myself holding $AFRM but I am also paying rich valuations for many other "growth stocks"

The valuations on these are RICH

I cant see myself holding $AFRM but I am also paying rich valuations for many other "growth stocks"

Read on Twitter

Read on Twitter