An explanation of why many investors miss the best companies of our time because they are 'extremely overvalued'.

The best companies beat the earnings consistently. Investing is about looking forward and earnings beats are crucial here. They compound. 1/5

The best companies beat the earnings consistently. Investing is about looking forward and earnings beats are crucial here. They compound. 1/5

Take Company A. It has a revenue of $100M and it is expected to grow its revenue by 25% for 10 years. This is what you get then: 2/5

From $100M to $931.3M. If the valuation doesn't change, you will have a 9 bagger over that decade.

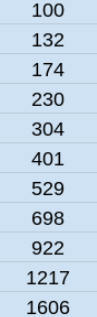

But suppose that this company beats the expectations by 7% each time, which the best companies certainly are capable of (and more). Then you get this: 3/5

But suppose that this company beats the expectations by 7% each time, which the best companies certainly are capable of (and more). Then you get this: 3/5

Instead of $931.3M, the company's revenue now comes in at $1.6B and with the same valuation, you have a 16 bagger. Even if the valuation is cut in half, you have an 8 bagger. That's the power of compounding earnings beats. 4/5

It's one of the elements that are underestimated by so many investors. Premium prices are often warranted for companies that have proven that they can beat the estimates again and again.

In 90% of the cases, the market can value better than you. Be humble and buy quality. 5/5

In 90% of the cases, the market can value better than you. Be humble and buy quality. 5/5

Read on Twitter

Read on Twitter