Why Investing is the single best decision a European citizen can make right now (a long thread

):

):

):

):

Printing of money by the #ECB has led to one of the biggest wealth transfers in European modern history.

People that save and count on the government to provide for them in retirement are on the losing end.

People that save and count on the government to provide for them in retirement are on the losing end.

People that own income generating assets are on the winning end

People that own income generating assets are on the winning end

People that save and count on the government to provide for them in retirement are on the losing end.

People that save and count on the government to provide for them in retirement are on the losing end.  People that own income generating assets are on the winning end

People that own income generating assets are on the winning end

As an example:

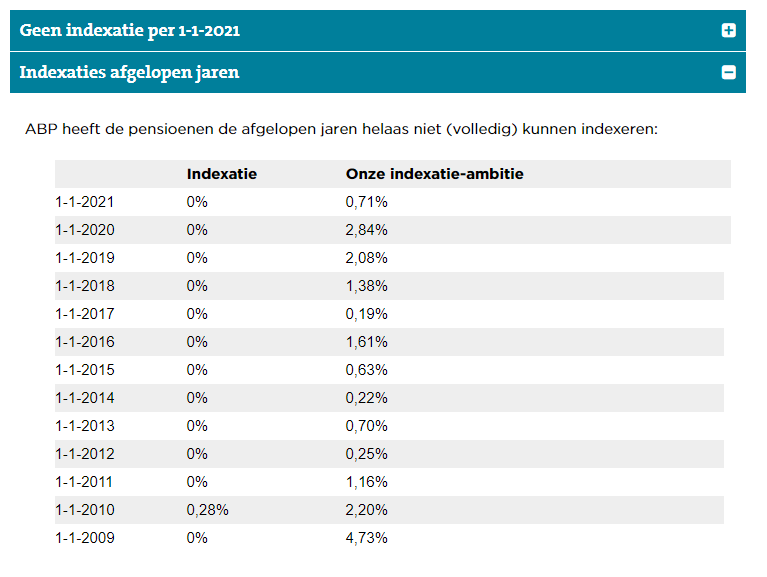

Take the Dutch pension fund #ABP. They decided again to not re-index their pensions to correct for inflation.

https://www.abp.nl/over-abp/financiele-situatie/indexatie.aspx

This is not the first time (see pic ) and inflations ate away 20% of our future ability to consume when retired!

) and inflations ate away 20% of our future ability to consume when retired!

Take the Dutch pension fund #ABP. They decided again to not re-index their pensions to correct for inflation.

https://www.abp.nl/over-abp/financiele-situatie/indexatie.aspx

This is not the first time (see pic

) and inflations ate away 20% of our future ability to consume when retired!

) and inflations ate away 20% of our future ability to consume when retired!

20%, let that sink in please

I still have 30 years before retirement

Will inflation eat away 50% of my retirement income which was promised at the start of my career?

Something our grandparents are most likely still experiencing?

This is insane and it gets worse...

I still have 30 years before retirement

Will inflation eat away 50% of my retirement income which was promised at the start of my career?

Something our grandparents are most likely still experiencing?

This is insane and it gets worse...

At the same time we keep living longer.

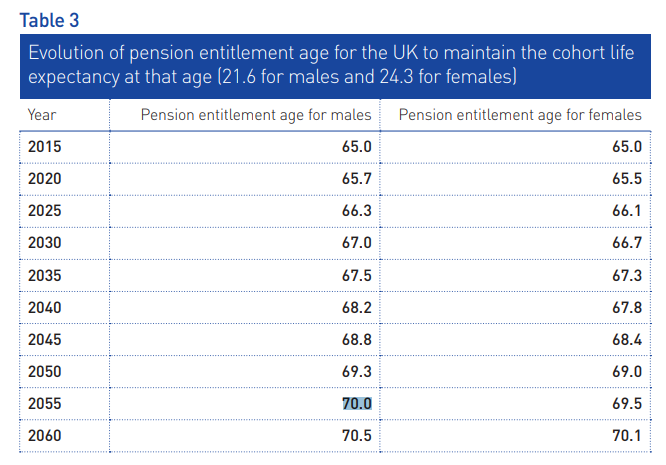

Therefore our retirement age is also being pushed back.

At the start of my career I was expecting to work until 65.

Now it’s 70 (see pic ) and who knows whether it won’t be 75 by then.

) and who knows whether it won’t be 75 by then.

Therefore our retirement age is also being pushed back.

At the start of my career I was expecting to work until 65.

Now it’s 70 (see pic

) and who knows whether it won’t be 75 by then.

) and who knows whether it won’t be 75 by then.

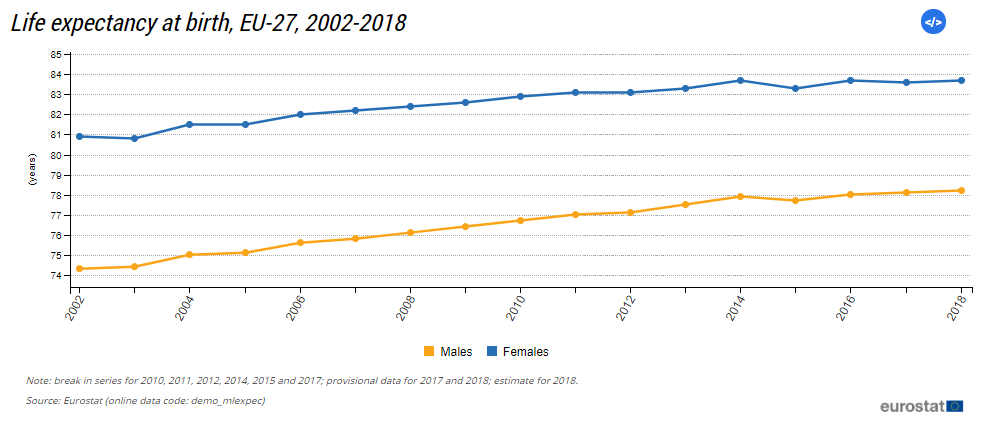

This is just partially true, because over the last decade our life expectancy only grew by about 1 year (see pic  ).

).

While our retirement date got pushed-back about 5 years.

I know, some of this is making up from life-expectancy growth in the past.

).

).While our retirement date got pushed-back about 5 years.

I know, some of this is making up from life-expectancy growth in the past.

Though, what it really tells me is that our government wants us (i.e.: male) to be alive for an average maximum of 8 years after retirement.

Just 8 years!

So, there's just one conclusion:

OUR PENSION SYSTEM IS BROKEN!

Just 8 years!

So, there's just one conclusion:

OUR PENSION SYSTEM IS BROKEN!

And you know:

At the same time our politicians and lawmakers have prioritized corporate wealth over personal wealth over the last few decades

Recommended Read : Capital in the 21st century from @PikettyLeMonde).

: Capital in the 21st century from @PikettyLeMonde).

At the same time our politicians and lawmakers have prioritized corporate wealth over personal wealth over the last few decades

Recommended Read

: Capital in the 21st century from @PikettyLeMonde).

: Capital in the 21st century from @PikettyLeMonde).

And this is it.

This is the single # reason that triggered me to start taking matters in my own hands back in 2016.

reason that triggered me to start taking matters in my own hands back in 2016.

I realized that I needed to be on the winning side and benefit from corporate wealth.

This is the single #

reason that triggered me to start taking matters in my own hands back in 2016.

reason that triggered me to start taking matters in my own hands back in 2016.I realized that I needed to be on the winning side and benefit from corporate wealth.

Realizing this and waking-up to this reality changed my life

I realized that I shouldn’t blame the government, politicians and greedy corporates (explains to me the rise of anti-government feelings).

It just makes no sense, because it would just be a waste of energy.

I realized that I shouldn’t blame the government, politicians and greedy corporates (explains to me the rise of anti-government feelings).

It just makes no sense, because it would just be a waste of energy.

That’s why I started to ask myself how I can start investing myself

And important to note:

I come from a poor family.

I had no-one guiding me on this journey.

So believe me, this was not easy for someone who’s been born and raised to put money on a savings account

And important to note:

I come from a poor family.

I had no-one guiding me on this journey.

So believe me, this was not easy for someone who’s been born and raised to put money on a savings account

Saving would be “the safest thing to do” with your money.

Definitely don’t put it in the stock market, because you might lose it .

.

Risk-averse all the way!

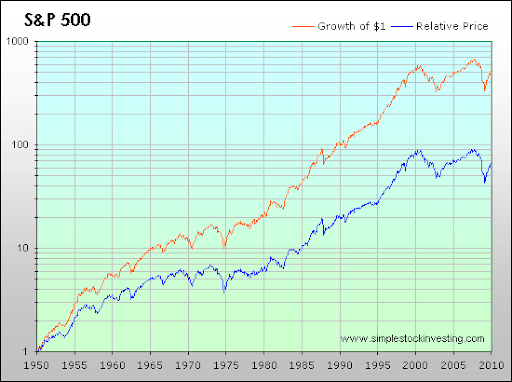

But why never someone showed me a picture of the historical performance of the S&P 500 before? #school ??

Definitely don’t put it in the stock market, because you might lose it

.

.Risk-averse all the way!

But why never someone showed me a picture of the historical performance of the S&P 500 before? #school ??

To be honest though.

I’m actually afraid that maybe someone might even have done it.

I’m sure I just wouldn't have been open for it because of the “savings-doctrine”

But let’s go back to 2016.

I’m actually afraid that maybe someone might even have done it.

I’m sure I just wouldn't have been open for it because of the “savings-doctrine”

But let’s go back to 2016.

I’m just so grateful that something like #Google already exists

It allowed me to search for how to #invest.

This is how I stumbled on Real Estate Investing and Dividend Growth Investing

Looking at my personality, it was no surprise that I chose Dividend Growth Investing

It allowed me to search for how to #invest.

This is how I stumbled on Real Estate Investing and Dividend Growth Investing

Looking at my personality, it was no surprise that I chose Dividend Growth Investing

It just fits me better, because I can do this from behind my desk without needing to physically look for properties.

At the same time I wouldn't feel comfortable about the thoughts of potential bad tenants and neither about the fact that I couldn’t sell my property in a blink.

At the same time I wouldn't feel comfortable about the thoughts of potential bad tenants and neither about the fact that I couldn’t sell my property in a blink.

So, Dividend Growth Investing it was

And here I really would really like to call-out @JasonFieber, @ianlopuch, @DividendGrowth and @DvdndDiplomats

All of you have been really great inspirations to me .

.

Sharing your journey has given me proof that it’s possible!

And here I really would really like to call-out @JasonFieber, @ianlopuch, @DividendGrowth and @DvdndDiplomats

All of you have been really great inspirations to me

.

. Sharing your journey has given me proof that it’s possible!

And it is possible!

I am 6 years further now, living in a low-income country, but I already passed the #100K mark.

It’s true what they say.

The first 100K are the most difficult and from there onwards you really start to feel the impact of #compounding (aka the snowball).

I am 6 years further now, living in a low-income country, but I already passed the #100K mark.

It’s true what they say.

The first 100K are the most difficult and from there onwards you really start to feel the impact of #compounding (aka the snowball).

Though, it all goes in ups and downs.

Shell’s dividend cut was hurting my dividend income in 2020 and it was a good lesson in diversification. #RDSA

I fixed this in #2020 and I am really proud to say that my expenses are now covered for 27+% by #dividend income

Shell’s dividend cut was hurting my dividend income in 2020 and it was a good lesson in diversification. #RDSA

I fixed this in #2020 and I am really proud to say that my expenses are now covered for 27+% by #dividend income

Actually, I’m also sure that I will reach 35% by the end of the year.

Look at this!

Just 6 years ago I was angry about the financial crisis, the bailouts and the wealth transfer and now I have already covered 27% of my expenses

PS: I'm still angry at banks though .

.

Look at this!

Just 6 years ago I was angry about the financial crisis, the bailouts and the wealth transfer and now I have already covered 27% of my expenses

PS: I'm still angry at banks though

.

.

But I didn’t mention the best thing out of all of this yet:

I will most likely retire before I’m 50

Let’s say it again: BEFORE I’M 50!!

This awakening has giving me 20 years back in my life to spend the time as I want it.

Not 8 years as desired by the government.

28 years!

I will most likely retire before I’m 50

Let’s say it again: BEFORE I’M 50!!

This awakening has giving me 20 years back in my life to spend the time as I want it.

Not 8 years as desired by the government.

28 years!

The only wish I have left besides this is to stay healthy

And that's all.

This is my story on why I started Dividend Growth Investing.

And to be honest, I have learnt a lot, but it took me a while to feel comfortable sharing my knowledge.

And that's all.

This is my story on why I started Dividend Growth Investing.

And to be honest, I have learnt a lot, but it took me a while to feel comfortable sharing my knowledge.

But I am happy that I can say that I have been blogging for  year now

year now

The feedback I received from you has made me very proud

Maybe 1 day I can be having such an impact to inspire you as the great ones among us @ianlopuch @DividendGrowth @JasonFieber & @DvdndDiplomats

year now

year nowThe feedback I received from you has made me very proud

Maybe 1 day I can be having such an impact to inspire you as the great ones among us @ianlopuch @DividendGrowth @JasonFieber & @DvdndDiplomats

But for now, I'll keep improving myself!

---

Last but not least, and I am probably preaching to the choir here

If you read this far, then let’s wake up some people around us.

Just tag them under one of the (sub)tweets which you think might resonate best with them

---

Last but not least, and I am probably preaching to the choir here

If you read this far, then let’s wake up some people around us.

Just tag them under one of the (sub)tweets which you think might resonate best with them

Maybe we just trigger one person to take matters into their own hands

That would just be a single life-changing event all by itself.

#shareOurKnowledge

Yours Truly,

European Dividend Growth Investor http://www.europeandgi.com

That would just be a single life-changing event all by itself.

#shareOurKnowledge

Yours Truly,

European Dividend Growth Investor http://www.europeandgi.com

Read on Twitter

Read on Twitter