1/ Shameless plug on why $JSEDSY ( @Discovery_SA) is the worlds best health insurer:

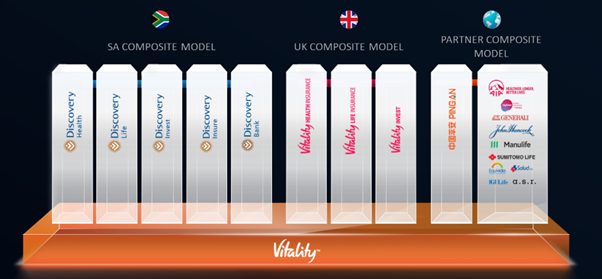

Understanding the complexity of their different verticals is hard, but roughly speaking their established SA insurance businesses are their bread and butter (health and life).

Understanding the complexity of their different verticals is hard, but roughly speaking their established SA insurance businesses are their bread and butter (health and life).

2/ They use SA mainly as a testing lab for these models before expanding overseas.

They use the established profits from their SA ops to invest into new/emerging markets. 2 growth segments at the moment are the Discovery Bank and their partnership with #1 Chinese Insurer Ping An

They use the established profits from their SA ops to invest into new/emerging markets. 2 growth segments at the moment are the Discovery Bank and their partnership with #1 Chinese Insurer Ping An

3/ Vitality is also plugged into roughly 14 insurers in 23 markets whose clients represent 35% of the global insurance market.

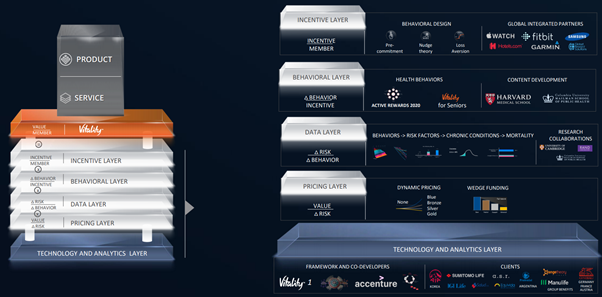

4/ Their health insurance and Vitality programme let them collect huge databanks on customer biometrics & lifestyle – rare data and hard to attain.

This capability allows them to tailor their premiums and risk analyses far better than competitors.

This capability allows them to tailor their premiums and risk analyses far better than competitors.

5/ Customers self-select for better premiums as they display healthier choices. DSY pays less premiums & customers get better prices.

6/ Vitality underpins their entire ecosystem. With it, they use behavioral economics to incentivize customers toward healthier behaviour.

Vitality customers have demonstrating 10% lower hospital admissions, 10-30% lower hospital costs and 15-20% higher life expectancy.

Vitality customers have demonstrating 10% lower hospital admissions, 10-30% lower hospital costs and 15-20% higher life expectancy.

7/ This is by far the world’s largest and most sophisticated behavioral platform linked to financial services.

8/ Locally, they compete with Momentum (in a near oligopoly).

Given the commoditization of insurance and many financial products, DSY has managed to differentiate themselves by offering better customer rewards (like discounts on food, flights and gym).

Given the commoditization of insurance and many financial products, DSY has managed to differentiate themselves by offering better customer rewards (like discounts on food, flights and gym).

9/ These benefits and the tiered pricing creates a lock-in effect on the customer’s side.

Competitors cannot match these benefits as DSY has contractually locked up & incentivized the best suppliers by being both early & by having the majority market.

Competitors cannot match these benefits as DSY has contractually locked up & incentivized the best suppliers by being both early & by having the majority market.

10/ This creates a positive feedback loop where DSY gives more customers to a supplier, which means better supplier terms, which allows DSY to transfer more value to the customers, thus cycling in more customers.

11/ Heard enough? It gets better.

The real beauty of DSY is their Apple-like ecosystem.

Christensen writes in the Innovator’s Dilemma about interdependent product architectures and the excess profits they deliver.

The real beauty of DSY is their Apple-like ecosystem.

Christensen writes in the Innovator’s Dilemma about interdependent product architectures and the excess profits they deliver.

12/ Apple’s iPhone, Macs, App Store services and the smart watch all link together to create network effects.

As a customer adds each subsequent Apple product/app, the prior ones become more valuable.

As a customer adds each subsequent Apple product/app, the prior ones become more valuable.

13/ In the same way, DSY’s Vitality serves to link each of their verticals (banking, insurance, and health) in a way that promotes cross-selling and increase switching costs. Interdependent systems are incredibly hard to build (and thus to copy).

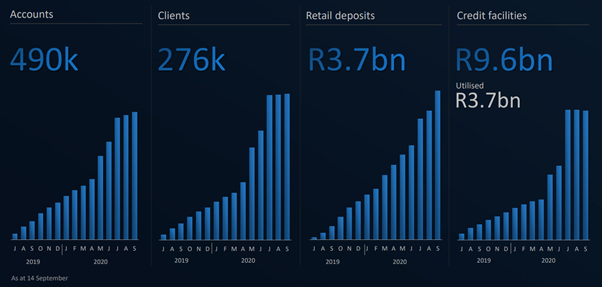

14/ Alright, now that you know the basics, let’s have a squiz at their new bank.

A wildly criticized R3.17b has been spent developing their platform and a positive ROIC is only expected in between 4-8 years from now. So what’s the fuss?

A wildly criticized R3.17b has been spent developing their platform and a positive ROIC is only expected in between 4-8 years from now. So what’s the fuss?

15/ As a challenger bank to the SA Big 5 oligopoly, Discovery Bank has a tough task.

Their primary targets are their upper-middle class beneficiaries of their health insurance products – people who are majorly banking already with one of the incumbents.

Their primary targets are their upper-middle class beneficiaries of their health insurance products – people who are majorly banking already with one of the incumbents.

16/ DSY presumably began the bank with the intention to get more complete data on customer spend and to grab more of the customer’s wallet.

17/ There is a lot of hype around data at the moment, but not unduly so – if DSY had access to both customers spend and health habits, they arguably have some of the best data in the world.

So will the bank work?

So will the bank work?

18/ Existing customers are incentivized to switch because it will

a) benefit them across the platforms they are already a part of, and

b) offer better rates than alternatives if they adjust spending/savings behaviour.

a) benefit them across the platforms they are already a part of, and

b) offer better rates than alternatives if they adjust spending/savings behaviour.

19/ Being fintech, the bank is far leaner than incumbents, with a heavy behavioral focus.

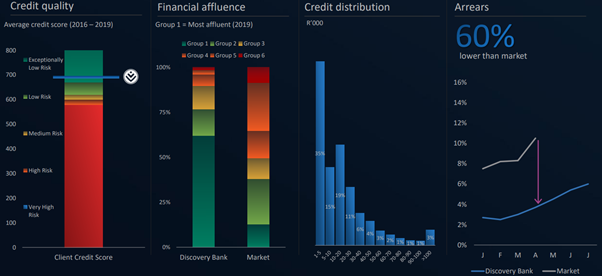

So how has growth gone? By all accounts, decently and with very high-quality clients. Relative to incumbents, DSY Bank is set to incur far less credit loss.

So how has growth gone? By all accounts, decently and with very high-quality clients. Relative to incumbents, DSY Bank is set to incur far less credit loss.

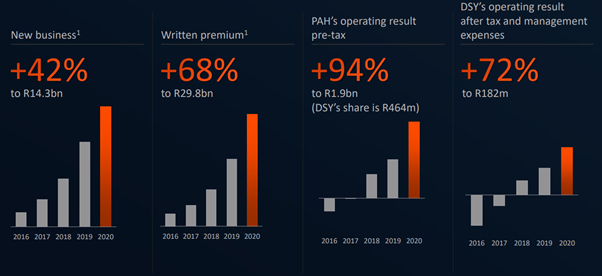

20/ Another big growth area is their partnership with Ping An – the leading Chinese health insurer. DSY has a 25% share in Ping An, which has the lion’s share of the huge, fragmented Chinese insurance market and targets high-end customers too.

21/ Ping An leverages DSY’s expertise, tech and insights over their own distribution network.

They are highly scalable, growing quickly and offer the same Discovery-quality products.

However, they do have stiff competition from Alibaba/Tencent's investments.

They are highly scalable, growing quickly and offer the same Discovery-quality products.

However, they do have stiff competition from Alibaba/Tencent's investments.

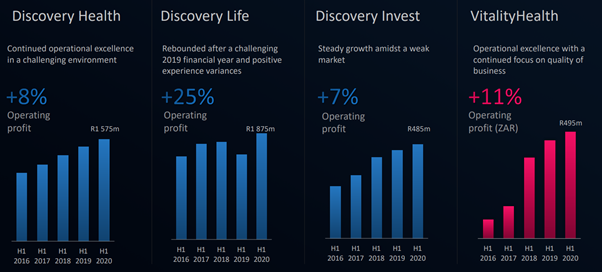

22/ Back to Discovery:

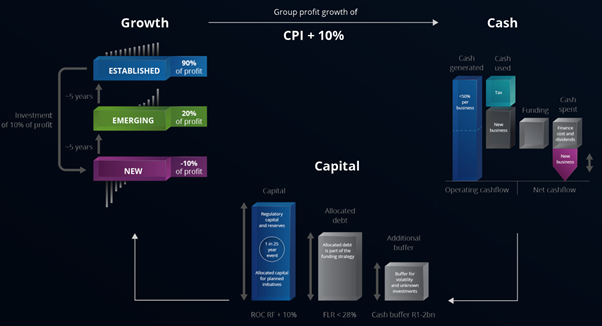

From a financial perspective, the established companies have all done pretty well – although the full results from COVID have yet to kick in & the major growth initiatives and emerging businesses are showing expected progress.

From a financial perspective, the established companies have all done pretty well – although the full results from COVID have yet to kick in & the major growth initiatives and emerging businesses are showing expected progress.

23/ Since all major investments have been made, from hereon out the incremental CAC across all platforms is theoretically going to be negligible.

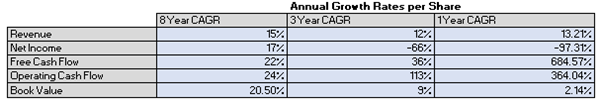

24/ They’ve grown nicely over the past 8 years, and the price is buffeted after poor sentiment towards the capex spent towards the bank and COVID’s effect.

They’ve consistently generated return on tangible capital of ~20% and net margin of ~10%.

They’ve consistently generated return on tangible capital of ~20% and net margin of ~10%.

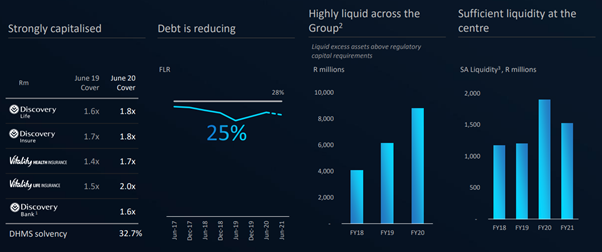

25/ They are well capitalized with decent liquidity to buffer their COVID exposure risk.

At a forward PE of ~15, and FCF expected to increase now that the investment capex is mostly finished, DSY is well below fair value at ~R100bn market cap.

At a forward PE of ~15, and FCF expected to increase now that the investment capex is mostly finished, DSY is well below fair value at ~R100bn market cap.

26/ All said and done – I’m a big fan of DSY. Their model is high quality, very hard to replicate and already has scale advantages.

They are founder led, are comfortable making criticized decisions and have a worldwide head-start in disruptive behavioral health tech.

They are founder led, are comfortable making criticized decisions and have a worldwide head-start in disruptive behavioral health tech.

27/ Toss in the decent bank and China growth prospects and the buffered valuation due to COVID and you have a pretty good looking opportunity.

Tbh though, their best function is their focus on shared value – when they win, everyone wins.

Tbh though, their best function is their focus on shared value – when they win, everyone wins.

Read on Twitter

Read on Twitter