I want to put to bed this BS article propagated by Bloomberg saying BTC is highly concentrated.

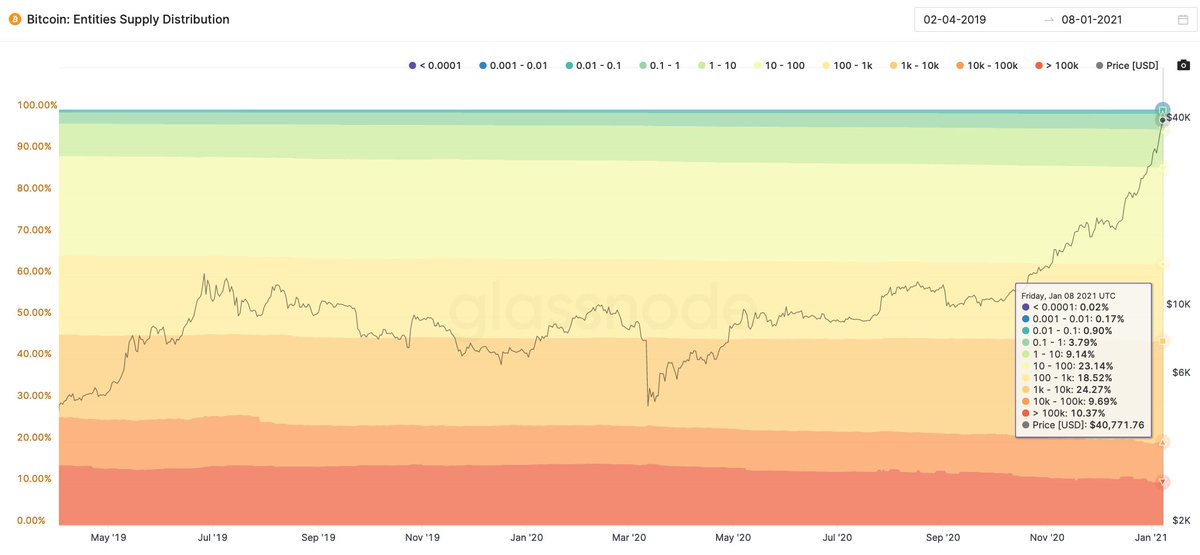

This is the breakdown from @glassnode data:

- 13% exchanges (130m+ users)

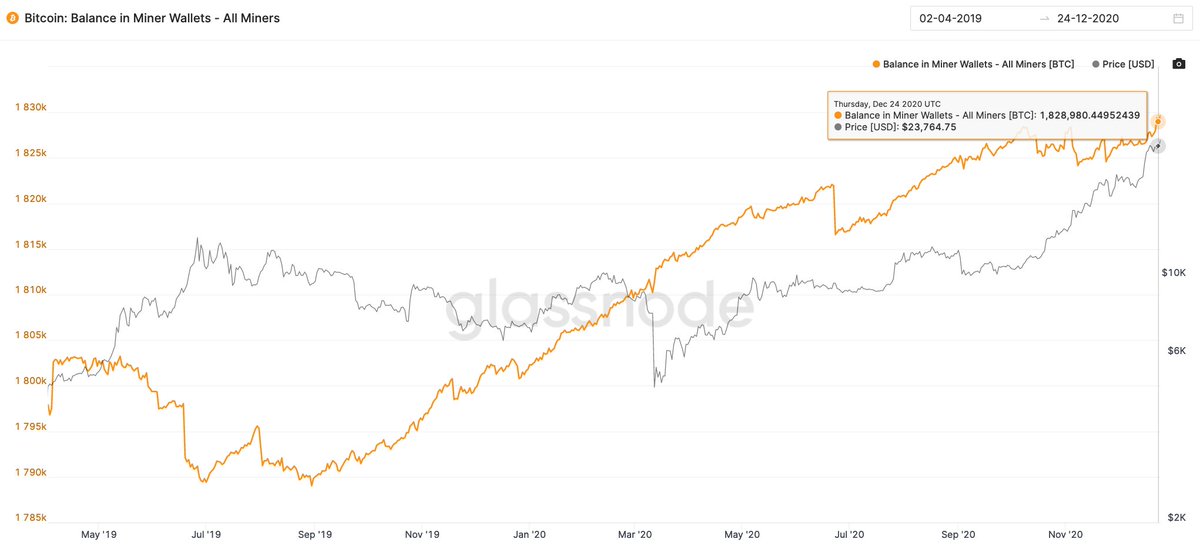

- 10% miners (includes Satoshi's coins)

- 56% non-whale HODLers

- 21% whales and custody providers https://twitter.com/u108119/status/1347912608196620289

This is the breakdown from @glassnode data:

- 13% exchanges (130m+ users)

- 10% miners (includes Satoshi's coins)

- 56% non-whale HODLers

- 21% whales and custody providers https://twitter.com/u108119/status/1347912608196620289

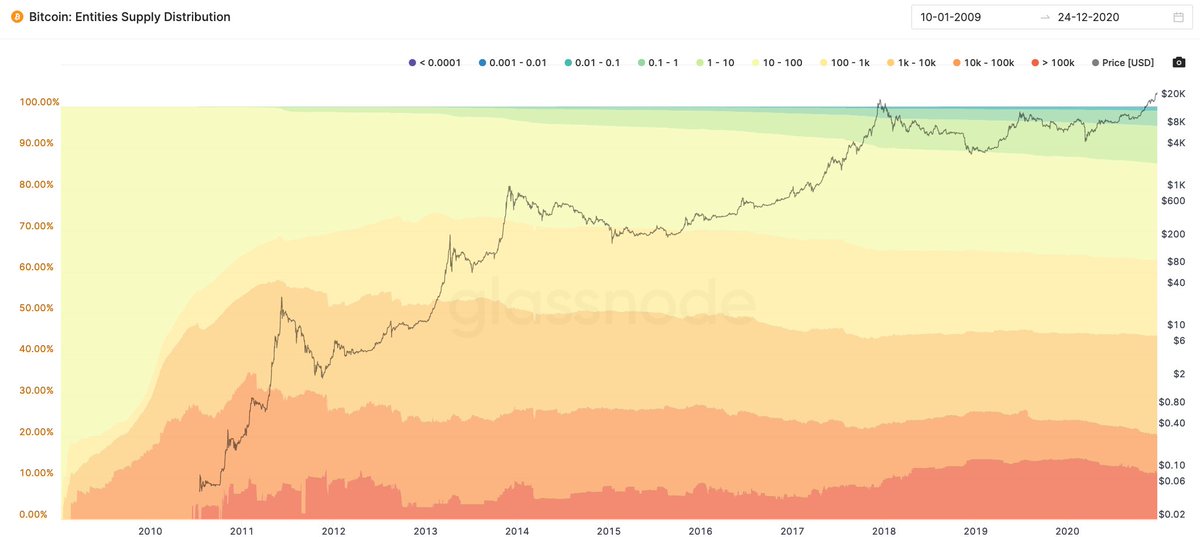

This is the supply breakdown by participants. This is worked out by forensically clustering wallet addresses belonging to individual entities. 56% are holders below 1000 BTC.

Whales are defined as holding greater than 1000 BTC.

Whales are defined as holding greater than 1000 BTC.

Balances on exchanges. There's about 130m individual ID-verified unique users on exchanges right now as a lower bound estimate.

I'll add also that Bitcoin continues to improve its distribution over time. That lower red band over >100k BTC that's increasing reflects the rise of coins on exchanges, so the distribution trend looks even better than the graphic suggests.

Read on Twitter

Read on Twitter