1/ Charlie Munger: “We have the same problem as everyone else: It's very hard to predict the future...”

"It's highly likely that the people who confidently think they know the consequences – none of whom predicted this – now they know what’s going to happen next?"

"It's highly likely that the people who confidently think they know the consequences – none of whom predicted this – now they know what’s going to happen next?"

2/ Charlie Munger: “Stocks partly sell like bonds, based on expectations of future cash streams" This is investing.

Munger: "Stocks partly sell like Rembrandts, based on the fact that they’ve gone up in the past and are fashionable." This is speculation.

Munger: "Stocks partly sell like Rembrandts, based on the fact that they’ve gone up in the past and are fashionable." This is speculation.

3/ Munger: "If stocks trade more like Rembrandts in the future then stocks will rise. But they will have no anchor. In this case, it’s hard to predict how far, how high and how long it will last.”

Munger puts speculation in the "too hard pile." Margin of safety needs an anchor.

Munger puts speculation in the "too hard pile." Margin of safety needs an anchor.

4/ Why do investors benefit from a margin of safety?

A margin of safety is a cushion against inevitable human mistakes, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.

If you have a margin of safety you can screw up and may still be OK.

A margin of safety is a cushion against inevitable human mistakes, bad luck, or extreme volatility in a complex, unpredictable and rapidly changing world.

If you have a margin of safety you can screw up and may still be OK.

5/ That speculation has no anchor to reality is what Buffett is describing when he says speculators are "dancing a room in which the clocks have no hands.”

In contrast, investing based on discounted free cash flow takes place in a room where the clocks do have hands.

In contrast, investing based on discounted free cash flow takes place in a room where the clocks do have hands.

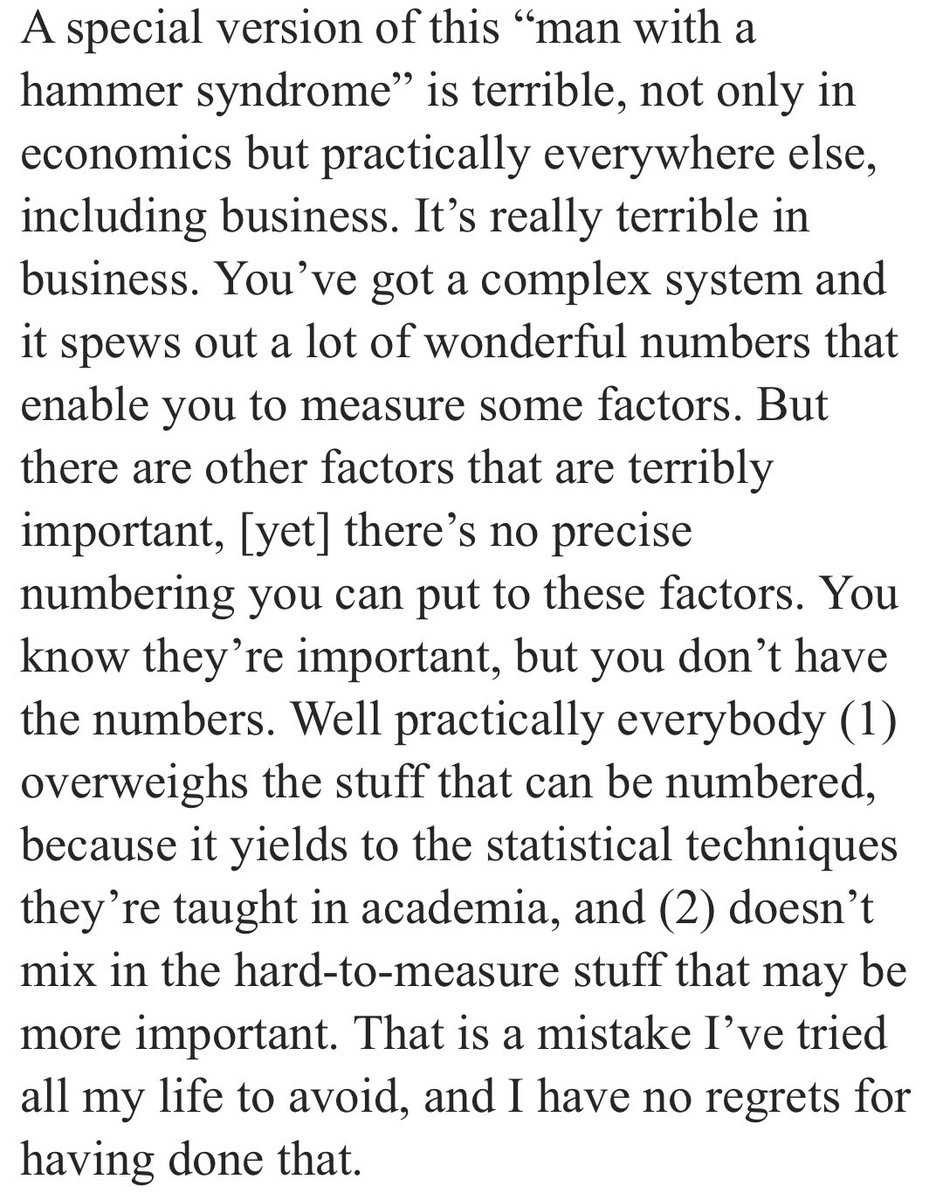

6/ Justifying your professional existence is hard.

Early securities analysts had to find ways to convince customers they could predict which stocks would outperform others in markets. They were attracted to "earnings" due to a mental bias Charlie Munger calls "overcounting."

Early securities analysts had to find ways to convince customers they could predict which stocks would outperform others in markets. They were attracted to "earnings" due to a mental bias Charlie Munger calls "overcounting."

7/ Why not cash flows? First, the requirement of a cash flow statement is relatively young. It wasn't until 1987 that FASB called for a statement of cash flows to replace the statement of changes in financial position.

More importantly, a cash flow analysis requires real work!

More importantly, a cash flow analysis requires real work!

8/ Widespread over focus by others on earnings created a massive opportunity for entrepreneurs like John Malone and Jeff Bezos who would rather have absolute dollar free cash flow than "earnings." This underfocus on free cash flow by many is still a big advantage for investors.

9/ Why was a multiple of earnings used below? Because it is easy. No work is required. Understanding cash flow requires work.

"Four days after ending the year at almost 40 times earnings, the Nasdaq 100 Index posted its biggest rally in two months." https://www.msn.com/en-us/money/markets/e2-80-98full-blown-mania-e2-80-99-stock-market-jackpot-bells-just-keep-ringing/ar-BB1cCYtD

"Four days after ending the year at almost 40 times earnings, the Nasdaq 100 Index posted its biggest rally in two months." https://www.msn.com/en-us/money/markets/e2-80-98full-blown-mania-e2-80-99-stock-market-jackpot-bells-just-keep-ringing/ar-BB1cCYtD

10/ I would rather: 1) do the work to understand the cash flow of a specific business; or 2) poke myself in the eye with a very sharp stick, than use:

"overwriting strategies and call writing strategies to earn yield and manage risk exposure on the upside or the downside.”

"overwriting strategies and call writing strategies to earn yield and manage risk exposure on the upside or the downside.”

11/ "Cboe’s head of derivatives and global client services said Robinhood Markets says only about one-fifth of its customers trade options."

**Only** 20% of "customers" are trading options?

"'We see great upside' for more people to start', she said."

Upside for who exactly?

**Only** 20% of "customers" are trading options?

"'We see great upside' for more people to start', she said."

Upside for who exactly?

Read on Twitter

Read on Twitter