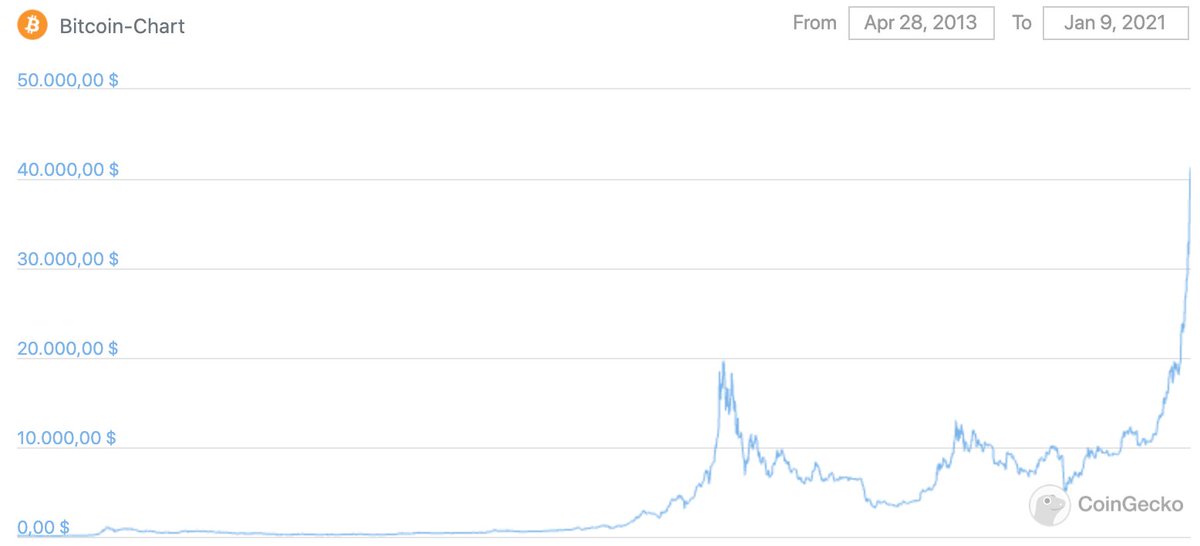

#Bitcoiners & consumer watchdogs are doing a bad job! That's why retail investors are losing money on an asset that made over 50,000,000% (right: 50m%) profit in the last 10yrs. There is a misleading communication about BTC, from consumer protectors + bitcoiners. A thread.

2) End of 2017 ( #BTC  surge from $1,000->$17,000) the mass media started to report daily about the #Bitcoin

surge from $1,000->$17,000) the mass media started to report daily about the #Bitcoin  price, like about the weather forecast for next weekend. Unfortunately, most of the price gains had already been made. But the end consumer was stepping in just now.

price, like about the weather forecast for next weekend. Unfortunately, most of the price gains had already been made. But the end consumer was stepping in just now.

surge from $1,000->$17,000) the mass media started to report daily about the #Bitcoin

surge from $1,000->$17,000) the mass media started to report daily about the #Bitcoin  price, like about the weather forecast for next weekend. Unfortunately, most of the price gains had already been made. But the end consumer was stepping in just now.

price, like about the weather forecast for next weekend. Unfortunately, most of the price gains had already been made. But the end consumer was stepping in just now.

3) After a short price fireworks ($19,500), the late movers were in the red after a few months: -50% or even up to -80% in 2019. Many who got out now booked losses. Even worse, they never got back in or are getting back in right now at BTC > $40,000...

4) ... and history is in danger of repeating itself. Bottom line: bitcoin went from $0.08 to $40,000 and is still a story of losing for many. Why is that?

5) I think a big responsibility here lies with consumer protection & media. They advise not to invest in BTC out of fear of potential brutal losses. Unfortunately, however, the #FOMO (fear of missing out) in the next hype phase is stronger than the warning of "rational voices".

6) And that is why many come too late and do the almost impossible: they lose money with Bitcoin. But what could a solution look like?

7) Consumer protection agencies & "the media" should be much more active in educating people about Bitcoin - especially when prices are down. If hedge funds, family offices, banks and now even treasurers started investing in BTC as a reserve currency in 2020...

Read on Twitter

Read on Twitter