1/ People starting to wake up to $AVAX

Avalanche is not just an incredible heterogeneous interoperable platform of platforms offering VISA level throughput, sub second finality with ability to scale to millions of validators, but it also has the tokenomics to match.

Avalanche is not just an incredible heterogeneous interoperable platform of platforms offering VISA level throughput, sub second finality with ability to scale to millions of validators, but it also has the tokenomics to match.

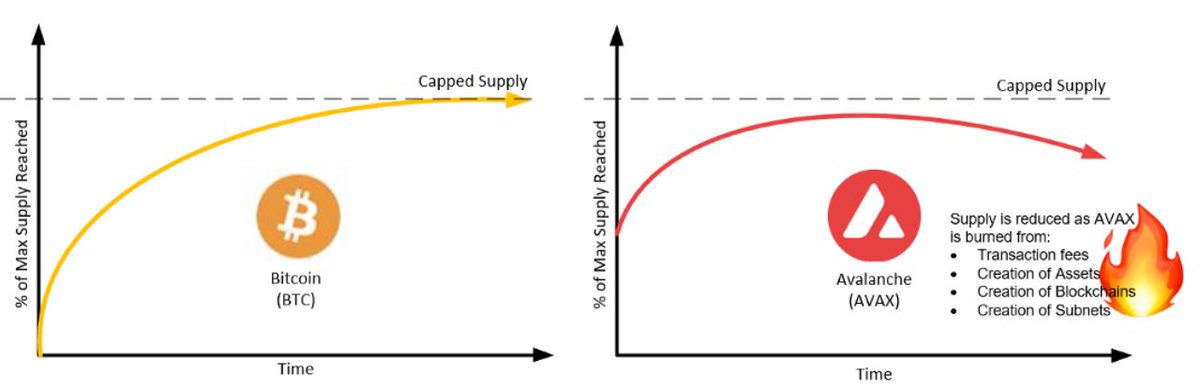

2/ $AVAX is a fixed capped supply token like $BTC which creates scarcity and won’t suffer from the continuous dilution through inflation like other staking platforms. Avalanche makes an excellent payment platform with VISA throughput speeds and low latency and cheap fees.

3/ Transaction fees across all the blockchains in the Primary network, fees for creating and minting of assets, creation of blockchains and the creation of subnets are all paid in AVAX which are burned, reducing total supply. https://medium.com/avalanche-hub/avalanche-consensus-the-biggest-breakthrough-since-nakamoto-66e9917fd656

4/ Avalanche is not just a single blockchain, it is a platform of platforms ultimately consisting of thousands of subnets to form a heterogeneous interoperable network of many blockchains, that takes advantage of the revolutionary Avalanche Consensus https://medium.com/avalanche-hub/avalanche-a-revolutionary-consensus-engine-and-platform-a-game-changer-for-blockchain-fdac008edc35

5/ Avalanche's C-Chain is a smart contract chain that uses the EVM and is 100% compatible with existing Ethereum tooling. Everything you can do on Ethereum you can do on the C-Chain with the added benefit of 1000's of tps, sub-second finality and low fees.

6/ Existing Ethereum DAPPs can easily be ported over and use all the existing tooling such as Metamask / Truffle etc making it easy for existing Ethereum developers to build on Avalanche.

The Ethereum bridge is due to go live later this month https://medium.com/@CryptoSeq/the-avalanche-ecosystem-is-rapidly-expanding-private-securities-ilos-dexs-synthetics-2563a8649d40

The Ethereum bridge is due to go live later this month https://medium.com/@CryptoSeq/the-avalanche-ecosystem-is-rapidly-expanding-private-securities-ilos-dexs-synthetics-2563a8649d40

7/ It's not limited to just the EVM though and migrating DAPPs from Ethereum, any custom VM can be used. Allowing projects from any blockchain to ultimately be easily ported over and benefit from the performance, decentralisation, low fees and customisation Avalanche offers.

8/ Metcalfe’s Law states that a network’s value is proportional to the square of the number of its users. This Network of Networks effects will cause not only the ecosystem to grow exponentially but also the value of the network as more and more join the ecosystem.

9/ Multiple bridges are being released soon to connect to other ecosystems, enabling tokens from other ecosystems to be ported over to provide universal composability and having enormous network effects. https://twitter.com/kevinsekniqi/status/1326552089871278083

10/ Avalanche is creating the Internet of Finance, offering the best place to build DeFi applications but also the traditional finance market, where the derivatives market alone is worth a staggering $800 trillion and able to meet regulatory compliance and Enterprise adoption

11/ Enterprises can create their own permissioned subnets if they need for regulatory purposes or require validators hold certain licenses or located within a certain jurisdiction. Unlike Enterprise deployments of permissioned forks of Ethereum where the token ETH isn't used

12/ AVAX is one of very few projects where enterprise use still provides utility for the token. All validators of any subnet have to validate the primary network and stake a minimum of 2000 AVAX. In addition, subnet and blockchain creation fees are paid in AVAX which are burned

13/ 68% of the supply is currently locked up with staking securing the network with staked value more than Cosmos and only 3 months since Avalanche Mainnet.

14/ Staking offers very competitive rates of between 9.32% and 11.1%, especially when the price of AVAX is likely to rise over time due to the above, making it an excellent long-term investment and there is no risk of slashing and losing your funds like other staking protocols

15/ Staking encourages large amounts of tokens to be locked up for long periods of time, reducing circulating supply and when combined with increased of demand for the token due to excellent utility as mentioned above then price is likely to increase significantly.

16/ $AVAX has:

Fixed Capped supply like $BTC creating scarcity

Fixed Capped supply like $BTC creating scarcity

Transaction fees as well as asset, subnet and blockchain creation fees are burnt reducing supply

Transaction fees as well as asset, subnet and blockchain creation fees are burnt reducing supply

Tremendous network effects from subnets / blockchains building on the platform and bridges to other ecosystems

Tremendous network effects from subnets / blockchains building on the platform and bridges to other ecosystems

Fixed Capped supply like $BTC creating scarcity

Fixed Capped supply like $BTC creating scarcity Transaction fees as well as asset, subnet and blockchain creation fees are burnt reducing supply

Transaction fees as well as asset, subnet and blockchain creation fees are burnt reducing supply Tremendous network effects from subnets / blockchains building on the platform and bridges to other ecosystems

Tremendous network effects from subnets / blockchains building on the platform and bridges to other ecosystems

17/ Supports multiple VMs to enable DAPPs to easily migrate to Avalanche regardless of platform

Supports multiple VMs to enable DAPPs to easily migrate to Avalanche regardless of platform

Enterprises can use the platform and comply with regulation whilst still having utility for $AVAX

Enterprises can use the platform and comply with regulation whilst still having utility for $AVAX

Excellent payment platform with high throughput, sub second finality and low fees

Excellent payment platform with high throughput, sub second finality and low fees

Supports multiple VMs to enable DAPPs to easily migrate to Avalanche regardless of platform

Supports multiple VMs to enable DAPPs to easily migrate to Avalanche regardless of platform Enterprises can use the platform and comply with regulation whilst still having utility for $AVAX

Enterprises can use the platform and comply with regulation whilst still having utility for $AVAX Excellent payment platform with high throughput, sub second finality and low fees

Excellent payment platform with high throughput, sub second finality and low fees

18/  68% of $AVAX is currently staked with rewards of 11.1% and incentivised to lock up for a year for large rewards, reducing circulating supply.

68% of $AVAX is currently staked with rewards of 11.1% and incentivised to lock up for a year for large rewards, reducing circulating supply.

Compares favourably to other projects such as Polkadot $DOT and Cosmos $ATOM https://medium.com/avalanche-hub/comparison-between-avalanche-cosmos-and-polkadot-a2a98f46c03b

Compares favourably to other projects such as Polkadot $DOT and Cosmos $ATOM https://medium.com/avalanche-hub/comparison-between-avalanche-cosmos-and-polkadot-a2a98f46c03b

68% of $AVAX is currently staked with rewards of 11.1% and incentivised to lock up for a year for large rewards, reducing circulating supply.

68% of $AVAX is currently staked with rewards of 11.1% and incentivised to lock up for a year for large rewards, reducing circulating supply. Compares favourably to other projects such as Polkadot $DOT and Cosmos $ATOM https://medium.com/avalanche-hub/comparison-between-avalanche-cosmos-and-polkadot-a2a98f46c03b

Compares favourably to other projects such as Polkadot $DOT and Cosmos $ATOM https://medium.com/avalanche-hub/comparison-between-avalanche-cosmos-and-polkadot-a2a98f46c03b

19/ For more info see this thread https://twitter.com/CryptoSeq/status/1336402398626127874

and this article https://medium.com/avalanche-hub/avalanche-a-revolutionary-consensus-engine-and-platform-a-game-changer-for-blockchain-fdac008edc35

and this article https://medium.com/avalanche-hub/avalanche-a-revolutionary-consensus-engine-and-platform-a-game-changer-for-blockchain-fdac008edc35

20/ Why Avalanche $AVAX has the potential to be an incredible store of value and investment.

This is just the beginning. DYOR it's definitely worth your time. https://medium.com/avalanche-hub/why-avalanche-avax-has-the-potential-to-be-an-incredible-store-of-value-8ef6e68cbb60

DYOR it's definitely worth your time. https://medium.com/avalanche-hub/why-avalanche-avax-has-the-potential-to-be-an-incredible-store-of-value-8ef6e68cbb60

This is just the beginning.

DYOR it's definitely worth your time. https://medium.com/avalanche-hub/why-avalanche-avax-has-the-potential-to-be-an-incredible-store-of-value-8ef6e68cbb60

DYOR it's definitely worth your time. https://medium.com/avalanche-hub/why-avalanche-avax-has-the-potential-to-be-an-incredible-store-of-value-8ef6e68cbb60

Read on Twitter

Read on Twitter