The best long-term businesses and investments are built on the mastery of CAPITAL ALLOCATION.

In this thread ( ), we'll take a look at different ways to manage capital by well-known companies as examples.

), we'll take a look at different ways to manage capital by well-known companies as examples.

Best served with a hot cup of coffee...

1/

In this thread (

), we'll take a look at different ways to manage capital by well-known companies as examples.

), we'll take a look at different ways to manage capital by well-known companies as examples.Best served with a hot cup of coffee...

1/

In his excellent book "The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success", author William Thorndike concluded "great CEOs must understand capital allocation".

But how does it work in practice?

2/ https://www.amazon.com/Outsiders-Unconventional-Radically-Rational-Blueprint/dp/1422162672

But how does it work in practice?

2/ https://www.amazon.com/Outsiders-Unconventional-Radically-Rational-Blueprint/dp/1422162672

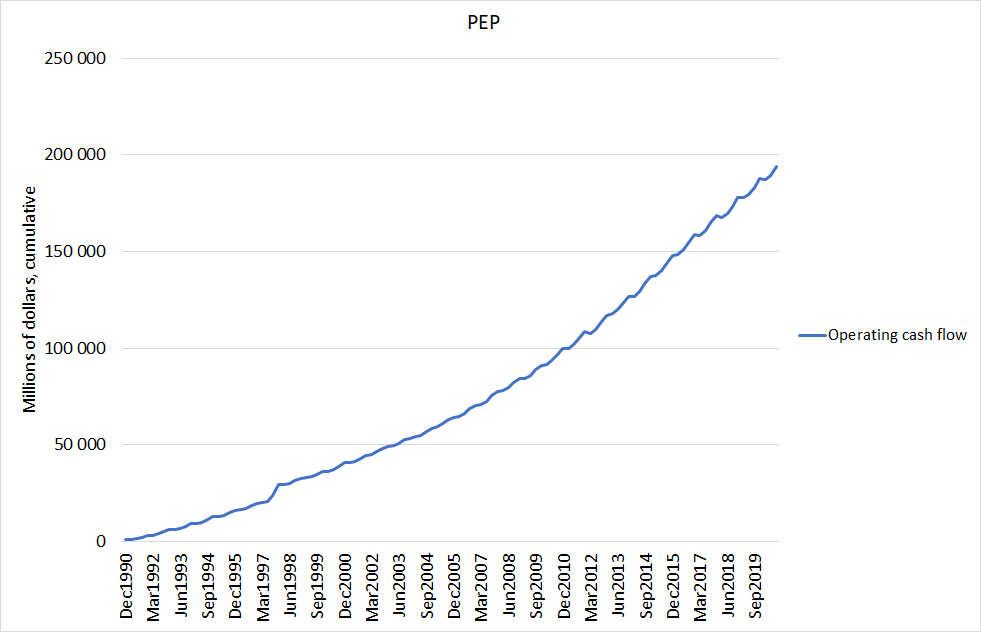

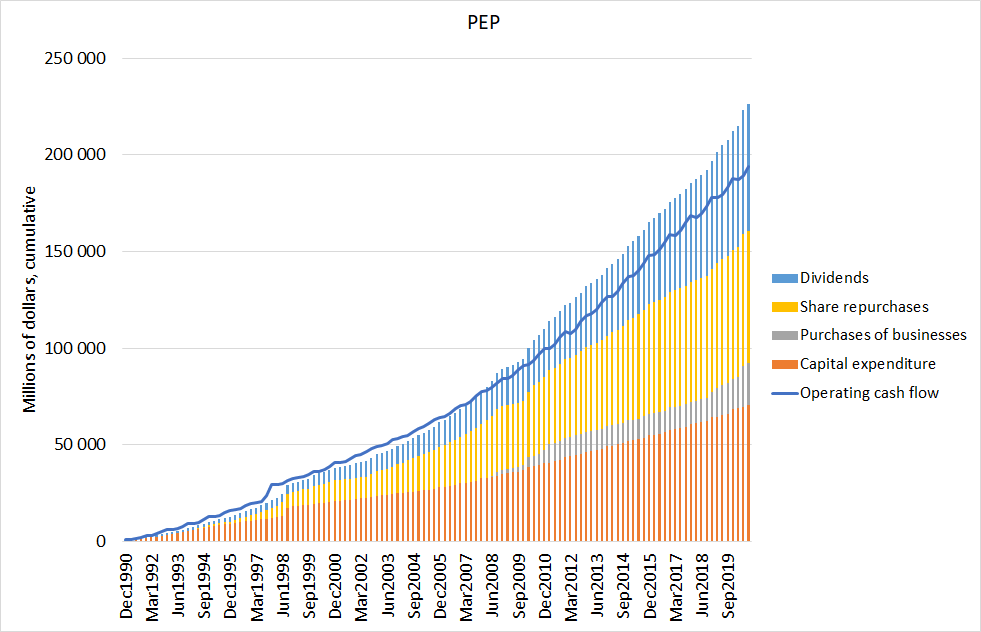

To allocate capital, the company should earn it first.

If it doesn't, the capital has to come from investors (new shares issued) or creditors (new debt raised).

Hence, our starting point is Operating Cash Flow (money coming in the door), example of PepsiCo below.

3/

If it doesn't, the capital has to come from investors (new shares issued) or creditors (new debt raised).

Hence, our starting point is Operating Cash Flow (money coming in the door), example of PepsiCo below.

3/

Earned capital can be used mainly four different ways:

(i) reinvesting in the business

(ii) paying out dividends

(iii) repurchasing company stock

(iv) acquiring businesses

Let's take a look at each one, while comparing them to the money coming in (operating cash flow).

4/

(i) reinvesting in the business

(ii) paying out dividends

(iii) repurchasing company stock

(iv) acquiring businesses

Let's take a look at each one, while comparing them to the money coming in (operating cash flow).

4/

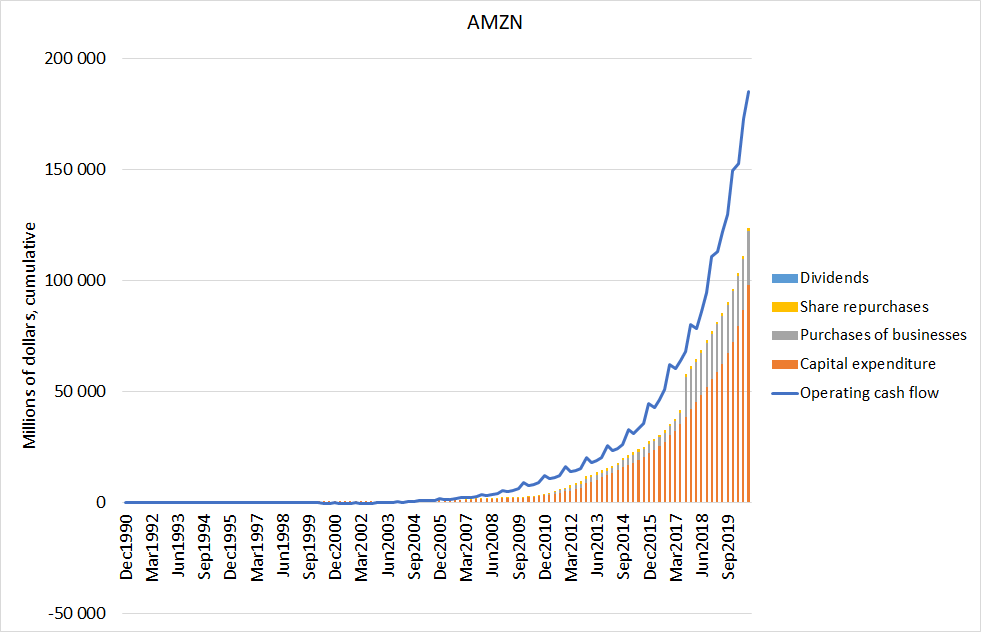

(i) reinvesting in the business

Some companies can find attractive investment options at scale within their core competence. Maybe the most famous example is Amazon $AMZN.

They've acquired some businesses along the way (grey) but mainly capital has been reinvested (orange)

5/

Some companies can find attractive investment options at scale within their core competence. Maybe the most famous example is Amazon $AMZN.

They've acquired some businesses along the way (grey) but mainly capital has been reinvested (orange)

5/

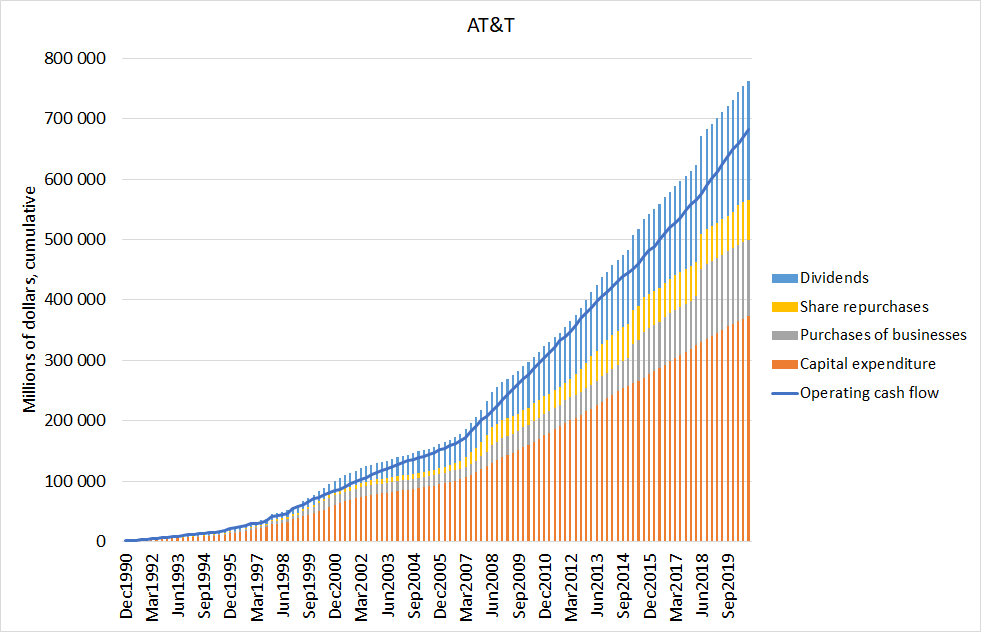

(ii) paying out dividends

If there are no attractive investments to make, it makes sense to return the capital to shareholders.

Take a look at $T AT&T. Certainly they've had to invest in the business but remainder has mainly distributed as dividends.

6/

If there are no attractive investments to make, it makes sense to return the capital to shareholders.

Take a look at $T AT&T. Certainly they've had to invest in the business but remainder has mainly distributed as dividends.

6/

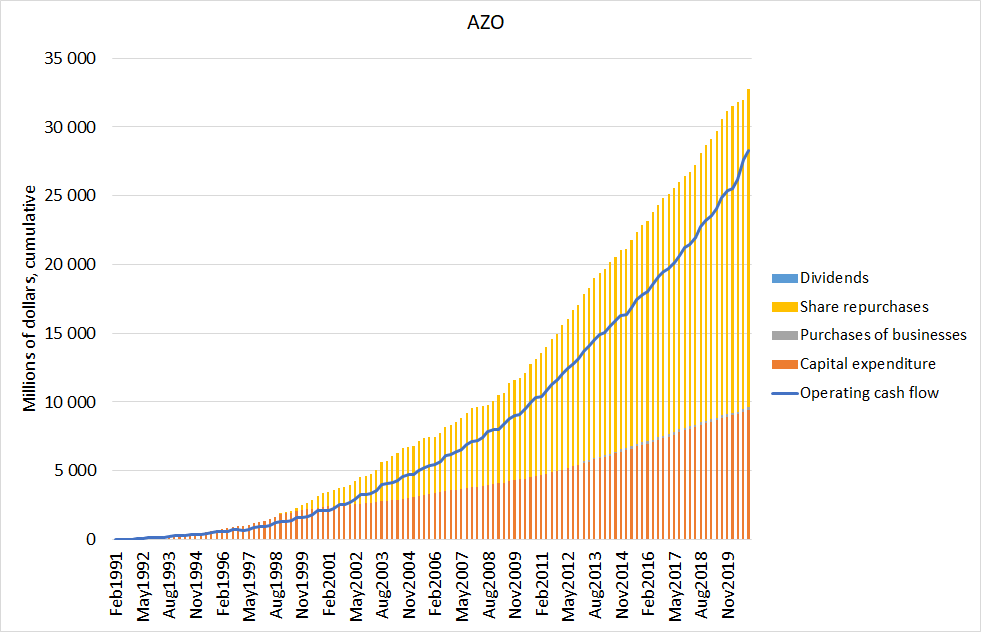

(iii) repurchasing company stock

If management sees company stock as greatly undervalued, it makes a lot of sense to repurchase stock (yellow) from the markets.

Take Autozone $AZO that has bought back 82% of its stock in 2000-2018 for a total shareholder return of ~2,500%.

7/

If management sees company stock as greatly undervalued, it makes a lot of sense to repurchase stock (yellow) from the markets.

Take Autozone $AZO that has bought back 82% of its stock in 2000-2018 for a total shareholder return of ~2,500%.

7/

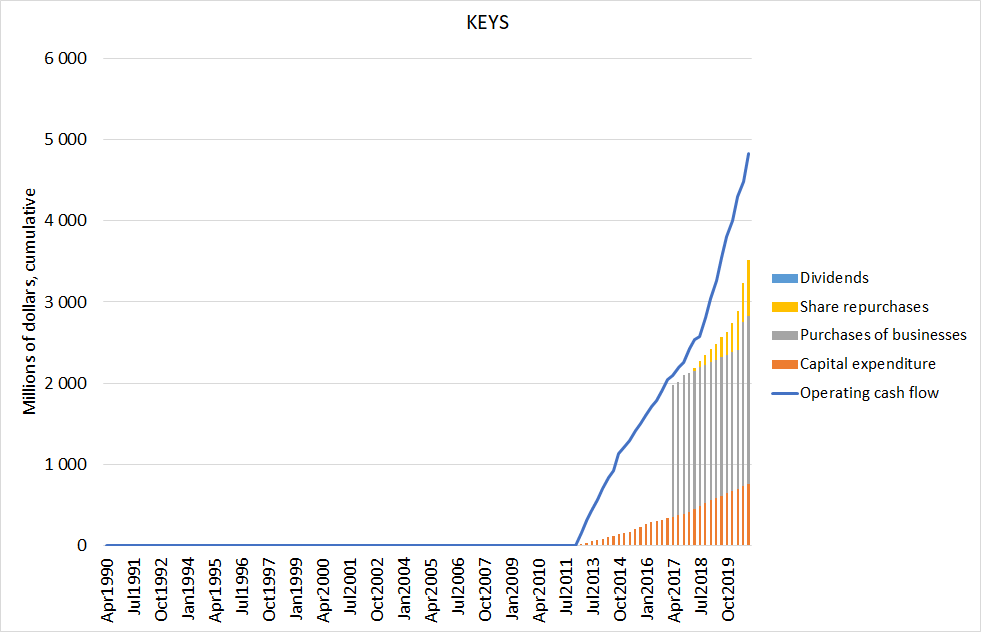

(iv) acquiring businesses

Sometimes growth should be pursuit with mergers and acquisitions (M&A). Since its IPO mid-2010s, Keysight Technologies $KEYS has mostly spent its earned cash on acquisitions, seen here in grey.

8/

Sometimes growth should be pursuit with mergers and acquisitions (M&A). Since its IPO mid-2010s, Keysight Technologies $KEYS has mostly spent its earned cash on acquisitions, seen here in grey.

8/

As you can see from the most graphs, many uses of cash exceed the actual money earned.

Going back to PepsiCo, the difference between these uses of cash and the operating cash flow stems from raised debt (found on balance sheet) or new share issuance.

9/

Going back to PepsiCo, the difference between these uses of cash and the operating cash flow stems from raised debt (found on balance sheet) or new share issuance.

9/

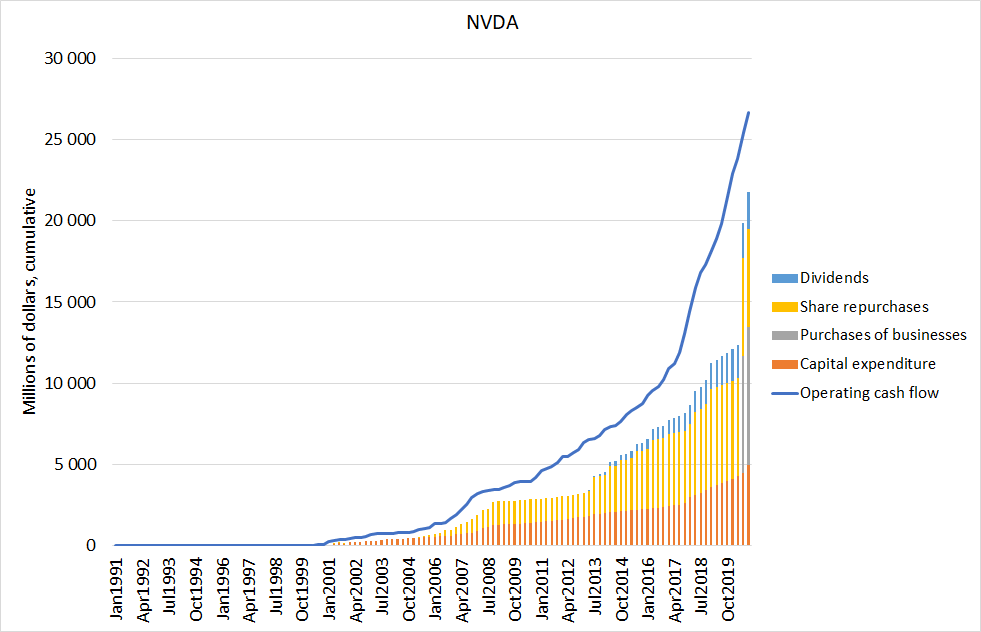

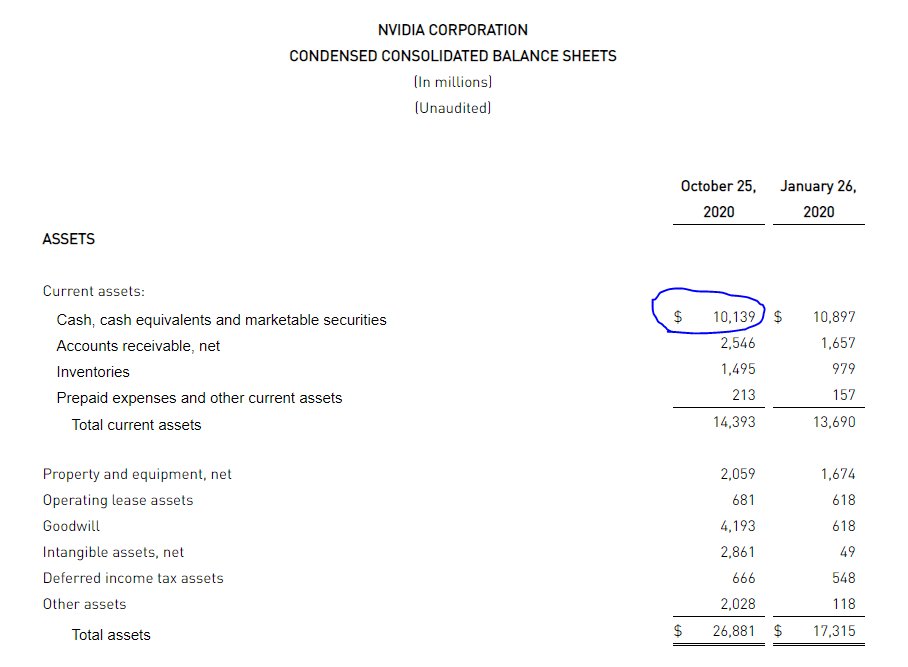

The other way around, see how NVIDIA $NVDA has a gap between the USES of cash and the EARNED cash. This is exactly why it boasts more than $10 billion of cash on its balance sheet.

10/

10/

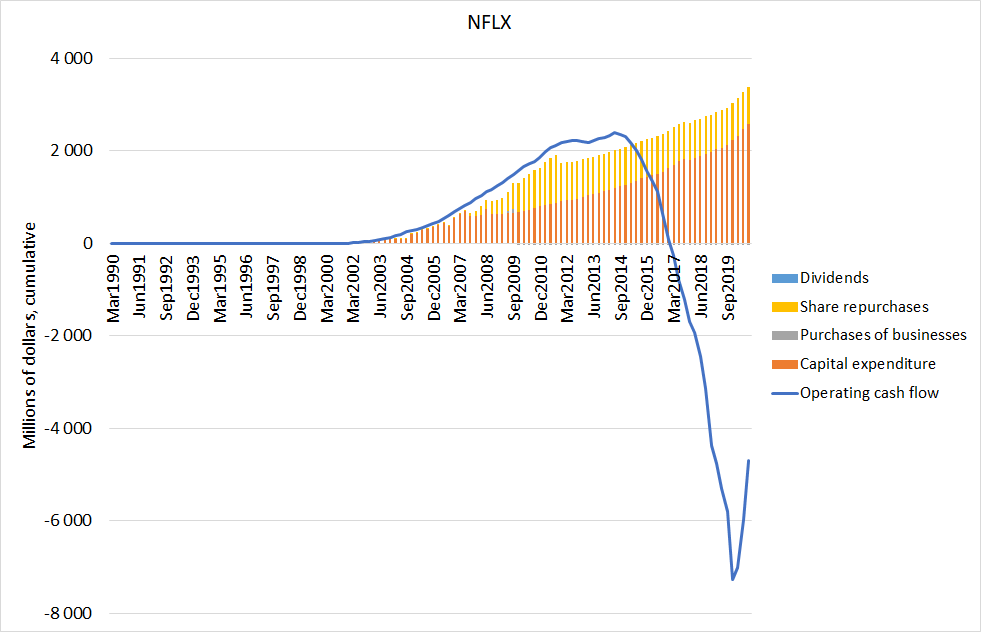

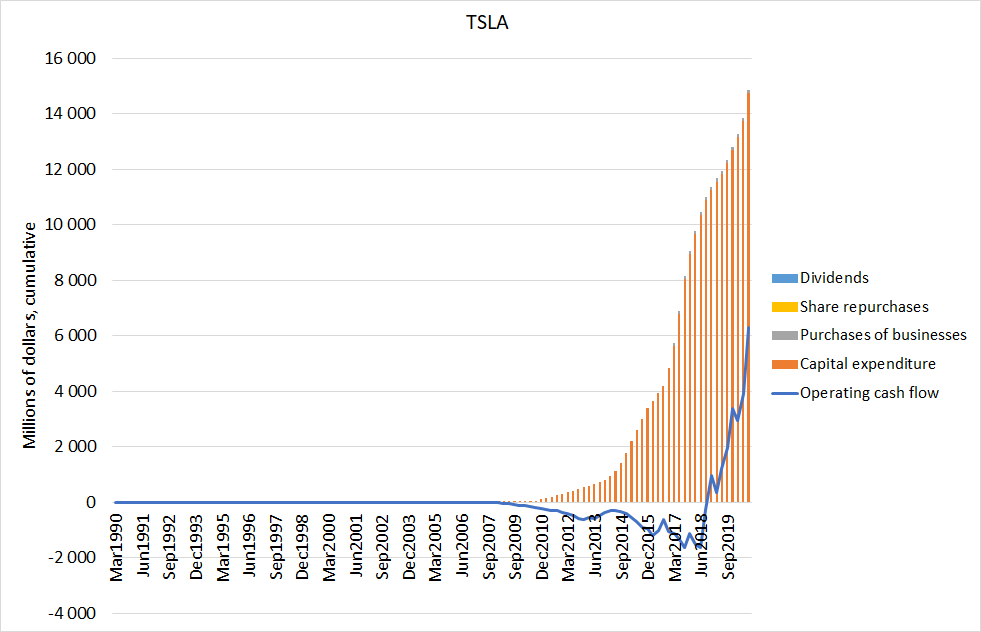

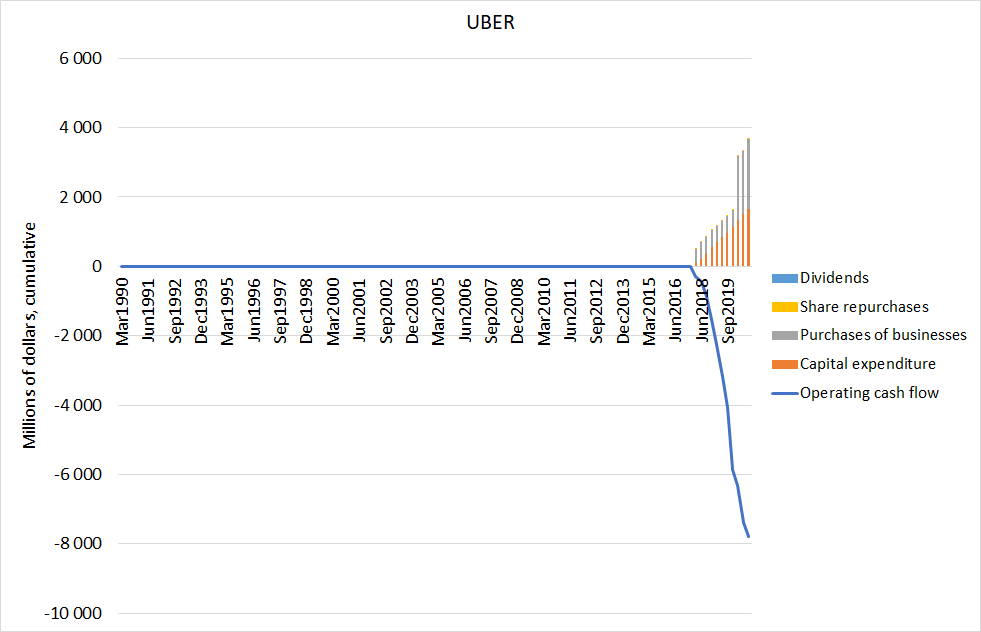

Not all companies generate cash. That seems to be the hot trend today.

For example, Netflix $NFLX, Tesla $TSLA, and Uber $UBER area HEAVILY reliant on capital from investors and creditors. Personally, I don't like such dependencies (read: risks) but many understandably do.

11/

For example, Netflix $NFLX, Tesla $TSLA, and Uber $UBER area HEAVILY reliant on capital from investors and creditors. Personally, I don't like such dependencies (read: risks) but many understandably do.

11/

That's capital allocation in a nutshell! Happy to provide more related graphs at request.

If you crave for high-quality threads in the business domain, follow at least @10kdiver, @SahilBloom, @BrianFeroldi, and @borrowed_ideas.

Thank you very much for your kind attention!

12/

If you crave for high-quality threads in the business domain, follow at least @10kdiver, @SahilBloom, @BrianFeroldi, and @borrowed_ideas.

Thank you very much for your kind attention!

12/

Read on Twitter

Read on Twitter