1/  Fathom Holdings - $FTHM

Fathom Holdings - $FTHM

$FTHM wants to hire and serve the very best real estate agents while offering industry best commissions

74% rev growth

56% increase in real estate transactions

transactions

Average revenue per transaction up 12%

Agent count up 38% to over 5,000

Fathom Holdings - $FTHM

Fathom Holdings - $FTHM

$FTHM wants to hire and serve the very best real estate agents while offering industry best commissions

74% rev growth

56% increase in real estate

transactions

transactions Average revenue per transaction up 12%

Agent count up 38% to over 5,000

2/ Fathom Holdings $FTHM is a real estate company that's disrupting the real estate agent market via an innovative platform as a service (PAAS) model which is powered by their proprietary cloud  based technology called intelliagent. https://www.fathomcareers.com/technology/

based technology called intelliagent. https://www.fathomcareers.com/technology/

based technology called intelliagent. https://www.fathomcareers.com/technology/

based technology called intelliagent. https://www.fathomcareers.com/technology/

3/ This allows $FTHM to streamline and automate  back office operations and reduce personnel requirements. Their agents are able to operate virtually

back office operations and reduce personnel requirements. Their agents are able to operate virtually

without the need for an office and the fees

without the need for an office and the fees

associated

associated

back office operations and reduce personnel requirements. Their agents are able to operate virtually

back office operations and reduce personnel requirements. Their agents are able to operate virtually

without the need for an office and the fees

without the need for an office and the fees

associated

associated

4/ Because of this agents tend to be more productive by reducing the time it takes to manage the transaction process and get in front of more buyers and sellers

by reducing the time it takes to manage the transaction process and get in front of more buyers and sellers

by reducing the time it takes to manage the transaction process and get in front of more buyers and sellers

by reducing the time it takes to manage the transaction process and get in front of more buyers and sellers

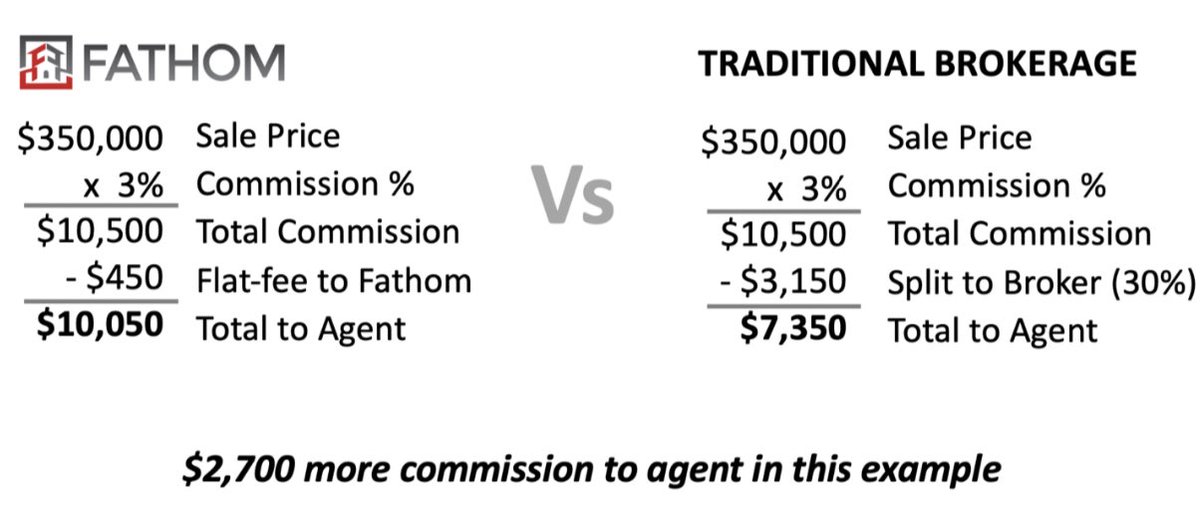

5/ Their agents get  % of their commission minus a flat fee and earn 35% more on average.

% of their commission minus a flat fee and earn 35% more on average.

This helps bring new agents in which is driving new sales which leads to more growth

% of their commission minus a flat fee and earn 35% more on average.

% of their commission minus a flat fee and earn 35% more on average. This helps bring new agents in which is driving new sales which leads to more growth

6/ On the  you can see an example of an agent’s potential earnings on a $350k house with $FTHM.

you can see an example of an agent’s potential earnings on a $350k house with $FTHM.

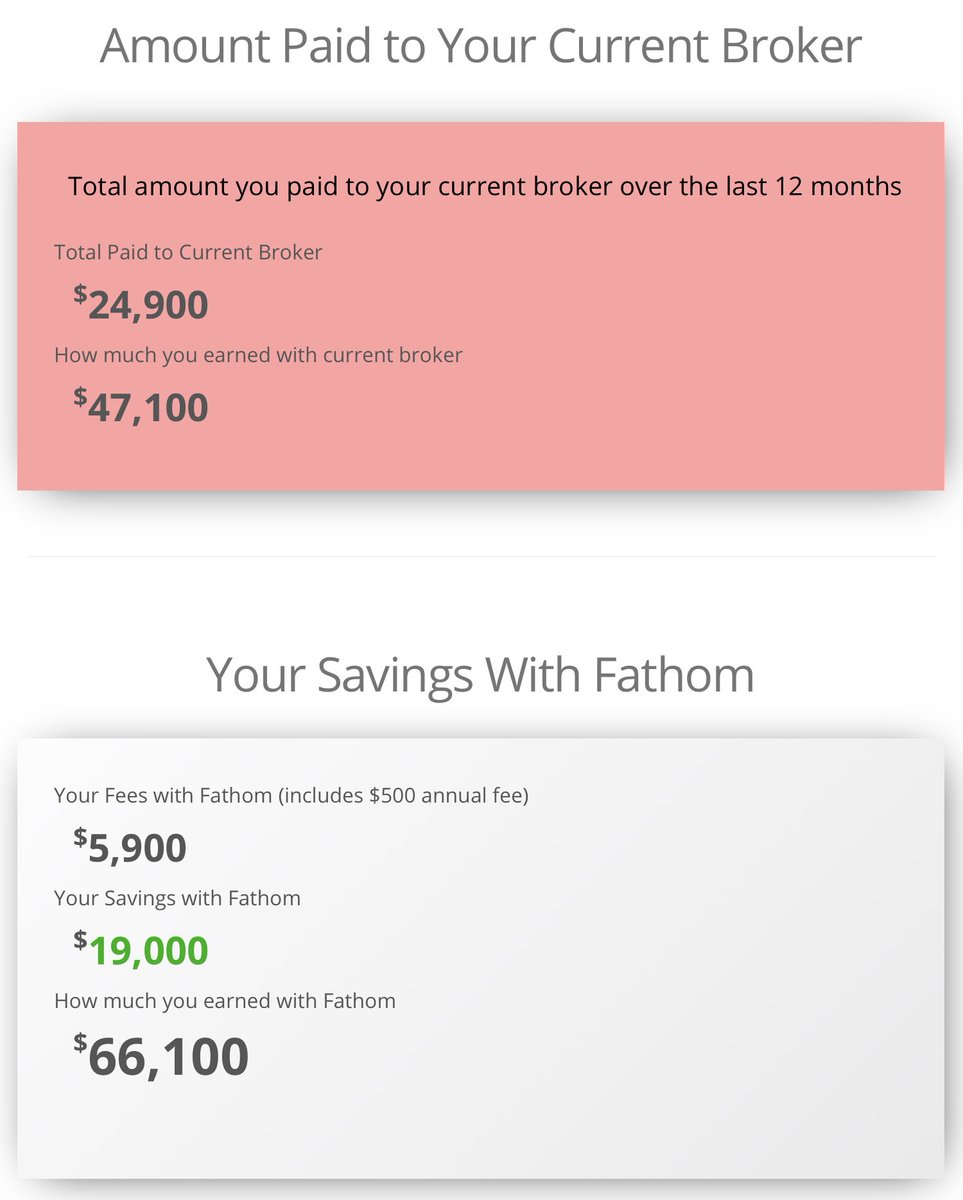

On the we see a yearly breakout with 12 $200k

we see a yearly breakout with 12 $200k  sold from their current broker vs $FTHM. This agent would earn $19k more per year with $FTHM.

sold from their current broker vs $FTHM. This agent would earn $19k more per year with $FTHM.

you can see an example of an agent’s potential earnings on a $350k house with $FTHM.

you can see an example of an agent’s potential earnings on a $350k house with $FTHM. On the

we see a yearly breakout with 12 $200k

we see a yearly breakout with 12 $200k  sold from their current broker vs $FTHM. This agent would earn $19k more per year with $FTHM.

sold from their current broker vs $FTHM. This agent would earn $19k more per year with $FTHM.

7/ Importantly the breakeven from each additional new agent they add is only $920 which they generate on just their first sale  and this number is expected to drop

and this number is expected to drop in the long run. Currently, the lifetime value of an agent is $18,000

in the long run. Currently, the lifetime value of an agent is $18,000

and this number is expected to drop

and this number is expected to drop in the long run. Currently, the lifetime value of an agent is $18,000

in the long run. Currently, the lifetime value of an agent is $18,000

8/ Agents success  is a big part of $FTHM s success

is a big part of $FTHM s success

“Agents join to earn more commission but they stay for the culture” - CEO Josh Harley

Attrition is 1/2 the industry standard

4th year in a row top place to

4.9/5 on Glassdoor! Incredible

on Glassdoor! Incredible  Reminds me of $DOCU.

Reminds me of $DOCU.

is a big part of $FTHM s success

is a big part of $FTHM s success“Agents join to earn more commission but they stay for the culture” - CEO Josh Harley

Attrition is 1/2 the industry standard

4th year in a row top place to

4.9/5

on Glassdoor! Incredible

on Glassdoor! Incredible  Reminds me of $DOCU.

Reminds me of $DOCU.

9/ They were only public for 1/2 of the last quarter so they didn’t get a full benefit of the capital raised in the IPO. Entrance into new markets (like recently Michigan) and acquisitions (like Verus Title) are expected to continue with their IPO funding

10/ They acquired Verus Titles for about $1.7 million which is a technology-driven and virtual titling service as a bolt-on. Most agents don’t have a financial relationship with a titling company. This allows $FTHM to add easy incremental revenue when their agents use Verus

11/ Today’s standard practice is to add the title company on the MLS for whichever one is closest to the closing of the house  . Being virtual $FTHM can make the transaction even easier

. Being virtual $FTHM can make the transaction even easier

. Being virtual $FTHM can make the transaction even easier

. Being virtual $FTHM can make the transaction even easier

12/ 5k closings per year could add about $2 million of EBIT. If closing transactions go to 10k per year it would add about $4 million of EBIT. And with 25k transactions $FTHM could see an excess of $12.5 million of EBIT

Conservatively 5k agents x 5 closings = 25k or 12.5 MM

Conservatively 5k agents x 5 closings = 25k or 12.5 MM

13/ They are continuing to leverage their high-efficiency model to maintain sustained future growth through opportunities such as:

Adding ancillary services (mortgage, insurance, lead sales)

Adding ancillary services (mortgage, insurance, lead sales)

Enhancing their technology platform

Enhancing their technology platform

Finding ways to increase agent productivity

Finding ways to increase agent productivity

Adding ancillary services (mortgage, insurance, lead sales)

Adding ancillary services (mortgage, insurance, lead sales) Enhancing their technology platform

Enhancing their technology platform  Finding ways to increase agent productivity

Finding ways to increase agent productivity

14/ $FTHM is in 27 states. Because of their technology-driven model, it is a very low cost to enter a new market  compared to competitors.

compared to competitors.

compared to competitors.

compared to competitors.

15/ $FTHM management

Joshua Harley - Founder and been with Fathom for over 11 years. HUGE inside ownership

HUGE inside ownership  Owns 36.3%

Owns 36.3%

Grady Ligon - recently hired as CIO from Berkshire Hathaway Home Services

Joshua Harley - Founder and been with Fathom for over 11 years.

HUGE inside ownership

HUGE inside ownership  Owns 36.3%

Owns 36.3% Grady Ligon - recently hired as CIO from Berkshire Hathaway Home Services

16/ Financial Check

Total revenue - $123.4 MM which is up 58% compared to 2019

- $123.4 MM which is up 58% compared to 2019

Est. Rev growth of 29%

Cash of $31.0 MM up from 579k in 2019 (mostly from IPO)

of $31.0 MM up from 579k in 2019 (mostly from IPO)

Gross Margins are 5-6% compared to competitors around 8-10%

Operating expenses up from 1.98 MM to 3.11 MM

Total revenue

- $123.4 MM which is up 58% compared to 2019

- $123.4 MM which is up 58% compared to 2019Est. Rev growth of 29%

Cash

of $31.0 MM up from 579k in 2019 (mostly from IPO)

of $31.0 MM up from 579k in 2019 (mostly from IPO)Gross Margins are 5-6% compared to competitors around 8-10%

Operating expenses up from 1.98 MM to 3.11 MM

17/ Risks

Small Cap company (~ 500 MM market cap) with low volume

Small Cap company (~ 500 MM market cap) with low volume

Margins currently lower than competition

Margins currently lower than competition

Operating at a net loss and will need sustained growth for a path to profitability

Operating at a net loss and will need sustained growth for a path to profitability

P/S has jumped over 3 from ~1.5 recently. Next earnings on 2/10/21.

P/S has jumped over 3 from ~1.5 recently. Next earnings on 2/10/21.

Small Cap company (~ 500 MM market cap) with low volume

Small Cap company (~ 500 MM market cap) with low volume Margins currently lower than competition

Margins currently lower than competition Operating at a net loss and will need sustained growth for a path to profitability

Operating at a net loss and will need sustained growth for a path to profitability  P/S has jumped over 3 from ~1.5 recently. Next earnings on 2/10/21.

P/S has jumped over 3 from ~1.5 recently. Next earnings on 2/10/21.

18/ Overall I think there is a huge opportunity for growth and future success. I think the estimates might be too conservative given the easy scalability, low attrition rates, and housing tailwinds. I am long $FTHM and it is quickly becoming a top holding

19/ Let me know what you think below!

I originally bought for $16 on 9/9/20 but I don’t see $FTHM talked about often so wanted to make a

*This is not intended to be a recommendation to buy, sell, or hold. I encourage everyone to do your own research and due diligence*

I originally bought for $16 on 9/9/20 but I don’t see $FTHM talked about often so wanted to make a

*This is not intended to be a recommendation to buy, sell, or hold. I encourage everyone to do your own research and due diligence*

Read on Twitter

Read on Twitter