I've been looking at $U (no position) as a direct comp to $RBLX now that Roblox has announced a Direct Listing Vs IPO.

Fintwit seems to have the same reaction as in " OMG they 3-4X valuation in a few months!"

The nuance here is direct listing will not have the same-day IPO pop

Fintwit seems to have the same reaction as in " OMG they 3-4X valuation in a few months!"

The nuance here is direct listing will not have the same-day IPO pop

which was expected with $RBLX on IPO day.

We can assume $RBLX could've had a 100% type day like $ABNB or $DASH had in 2020.

This would've brought the mkt cap near the ~ 20B$ mark.

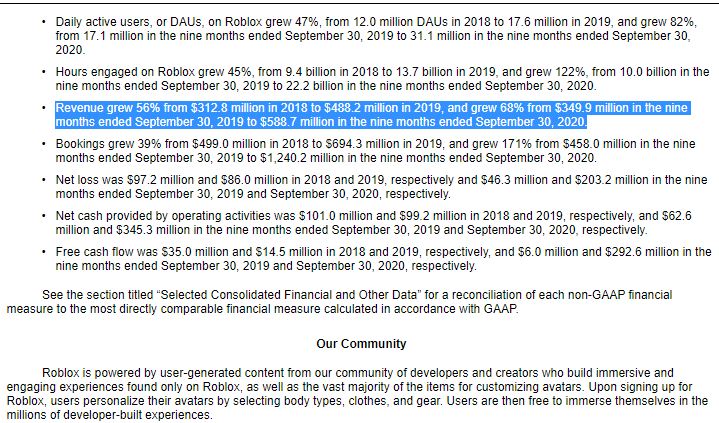

Also, in first 9 months of 2020, look at the difference in operating cashflows in $U and $RBLX.

We can assume $RBLX could've had a 100% type day like $ABNB or $DASH had in 2020.

This would've brought the mkt cap near the ~ 20B$ mark.

Also, in first 9 months of 2020, look at the difference in operating cashflows in $U and $RBLX.

a massive advantage for $RBLX vs $U

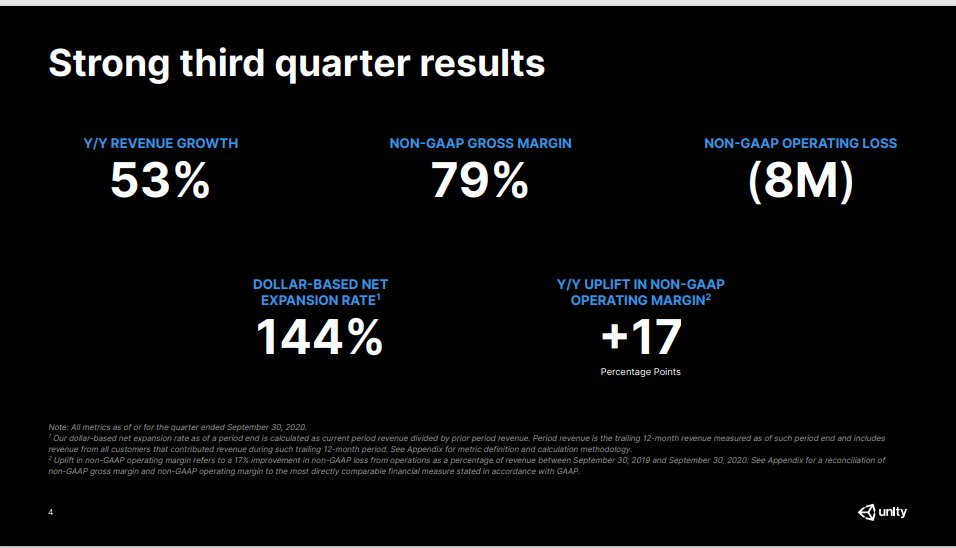

If you look at sales growth: 68% $RBLX vs 53% for $U

If you look at FCF, $RBLX had 292mm$ in the first 9-months of 2020 , nothing close for $U.

If you look at sales growth: 68% $RBLX vs 53% for $U

If you look at FCF, $RBLX had 292mm$ in the first 9-months of 2020 , nothing close for $U.

Keep in mind, growth rates are very similar but $U has a ~ 40B$ mkt cap vs 29.5B$ for $RBLX based on the latest round of funding which got press released yesterday.

Now there's a lot more research to be done but just wanted to give a heads up to people that got turned off by the latest round of funding.

I'm actually very glad that they went the direct listing route, and i'm very much looking forward to adding on day 1.

Long $RBLX

I'm actually very glad that they went the direct listing route, and i'm very much looking forward to adding on day 1.

Long $RBLX

Read on Twitter

Read on Twitter