There is a phenomena that I have observed over the last 30 years in markets...

The New Year Head Fake. 1/2

The New Year Head Fake. 1/2

Hedge funds and asset managers start the year with zero P&L and new risk buckets to allocate.

After a 2-week break they want to get some trades on their shiny new books.

Wall St tends to publish a bunch of consensus Year Ahead trades. So, people pile in...

After a 2-week break they want to get some trades on their shiny new books.

Wall St tends to publish a bunch of consensus Year Ahead trades. So, people pile in...

Then, once everyone is in, the trend often reverses or has a massive correction, taking everyone back to flat or negative on the year and they begin the P&L grind again...

I write about this almost every year in GMI to warn people not to pile into new risks in Jan and wait

I write about this almost every year in GMI to warn people not to pile into new risks in Jan and wait

It feels like we could see this happen again, where Fed/March is a complete reverse of Jan or even Nov/Dec/Jan.

The reflation trade is what I fear gets unwound.

Dollar, bonds and stocks. We are seeing first few signs of cracks.

The reflation trade is what I fear gets unwound.

Dollar, bonds and stocks. We are seeing first few signs of cracks.

The dollar going up is a wrecking ball. Rates at let's say 1.20 in 10 years is similar and a potential dark 3 months for the global economy from lockdowns lies ahead.

Just exercise some caution. I could well be wrong but Im more tempted to add 3 month S&P puts and bond calls.

Just exercise some caution. I could well be wrong but Im more tempted to add 3 month S&P puts and bond calls.

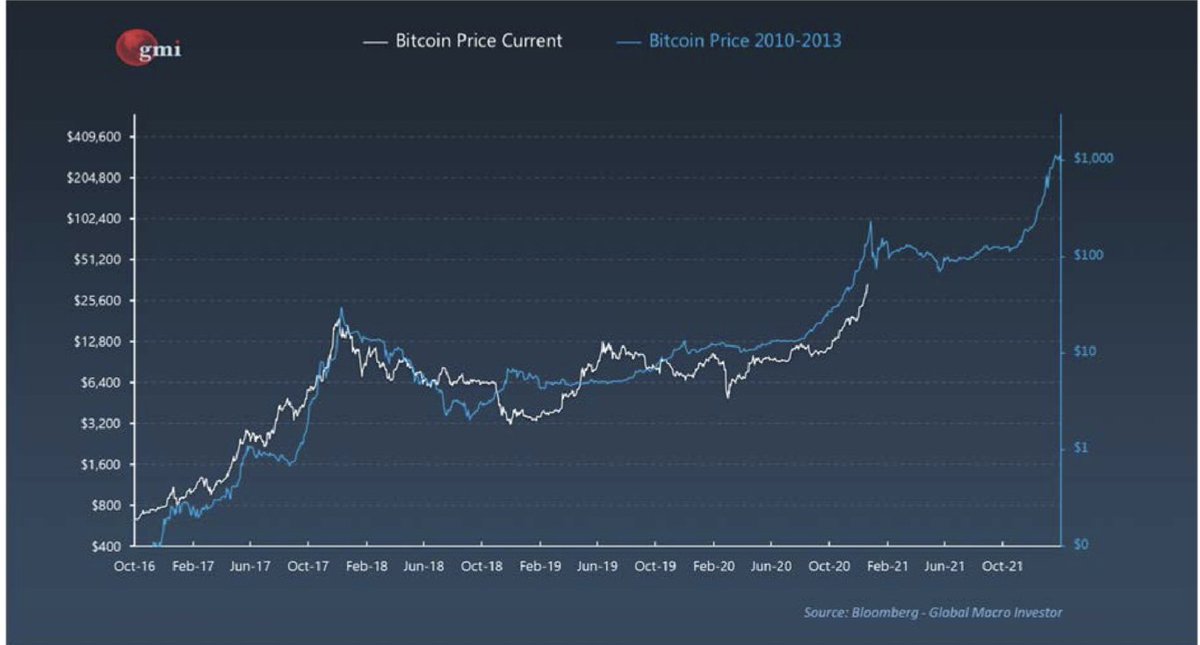

As you are all asking - I dont know how it affects BTC but its not on institutional or hedge fund books much so possible is not affected, yet. But a big 40% correction will come but my guess is from higher prices but I dont know.

Read on Twitter

Read on Twitter