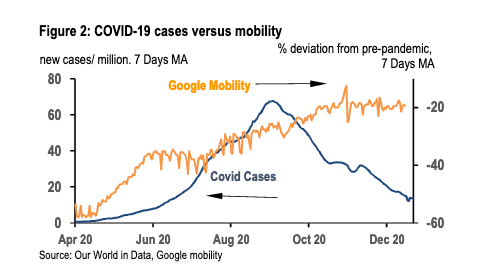

1/ Interesting insights on the Indian economy in this note by Sajjid Chinoy. "India has broken the link between COVID proliferation & mobility much earlier & more successfully than many countries." Private sector activity levels jumped back up to 95% of pre-COVID levels by Oct.

2/ This is being complemented by the long-awaited pick-up in central government spending. Even as state government spending continues to contract, central government spending has surged.

3/ "A second phenomenon playing out in tandem, however, is labour market scarring...The recovery appears to be led by capital and profits, not labour and wages."

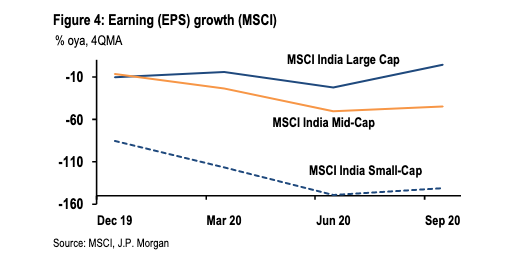

4/ "A third phenomenon visible across sectors is larger firms enduring the crisis better and gaining market share at the expense of smaller firms."

5/ This increases the prospect of a "K-shaped" recovery in which HH at the top of the income pyramid are protected while those at the bottom see permanent hits to income and jobs.

6/ "Upper income households have benefitted from a one-time stock effect, on account of higher savings for two quarters. What we are currently witnessing is a sugar-rush from those savings being spent."

7/ "While markets are focused on the consumption revival, the key will be whether the private sector starts re-investing and re-hiring, and thereby sets the economy onto a more virtuous path." Any investment revival will depend crucially on demand dynamics.

8/ All of this sets up lofty expectations for the 2021 Budget on Feb 1.

9/ Link to note: https://markets.jpmorgan.com/research/email/9bpi8et6/sRDrD_tY0FGJ-NRMa4rb0w/GPS-3604228-0

Read on Twitter

Read on Twitter