$MSTR and #Bitcoin  relationship update through yesterday's close.

relationship update through yesterday's close.

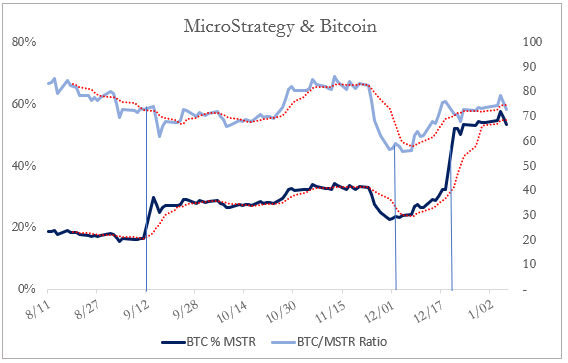

First vertical line is when they increased BTC holdings from 21,454 to 38,250. Second is when they increased to 40,824 and third to 70,470.

relationship update through yesterday's close.

relationship update through yesterday's close.First vertical line is when they increased BTC holdings from 21,454 to 38,250. Second is when they increased to 40,824 and third to 70,470.

Dark blue line = BTC holdings as % of market cap (currently 53.44%). Think of this as $1 of MSTR = $0.5344 of underlying BTC.

Light blue line = ratio of BTC/price of MSTR shares. A higher ratio implies a lower premium being put on MSTR shares for the underlying Bitcoin exposure

Light blue line = ratio of BTC/price of MSTR shares. A higher ratio implies a lower premium being put on MSTR shares for the underlying Bitcoin exposure

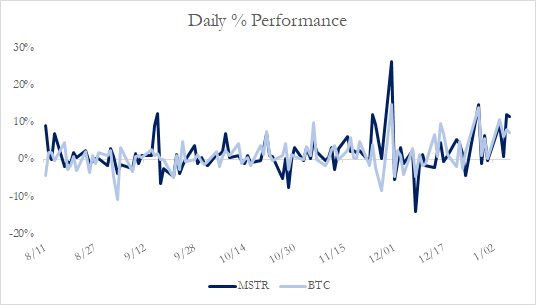

The two asset's daily return are becoming increasingly correlated. Both ratios above are two simple ways to quickly gauge the current premium investors are willing to pay for MSTR's underlying BTC holdings. Will be interesting to see how this relationship plays out into 2021+

@MicroStrategy is simply a software and data analytics company that has very deliberately adopted #Bitcoin  as part of their long term corporate reserve strategy.

as part of their long term corporate reserve strategy.

Read more about @michael_saylor journey down the #Bitcoin rabbit hole here

rabbit hole here

https://link.medium.com/yfSEdn1Oxcb

https://link.medium.com/yfSEdn1Oxcb

as part of their long term corporate reserve strategy.

as part of their long term corporate reserve strategy. Read more about @michael_saylor journey down the #Bitcoin

rabbit hole here

rabbit hole here

https://link.medium.com/yfSEdn1Oxcb

https://link.medium.com/yfSEdn1Oxcb

@edstromandrew @meatportmusic @michael_saylor @PrestonPysh @CitizenBitcoin @JanWues @PsychedelicBart @martys_owl

Red dots = 7 day moving average for both

Read on Twitter

Read on Twitter