An interesting #NUFC takeover update today. Saudi government confirm they will "review" their WTO appeal against beoutQ following the GCC Summit. They are expected to eventually withdraw it. This would pacify EPL, who testified on beIN's behalf.

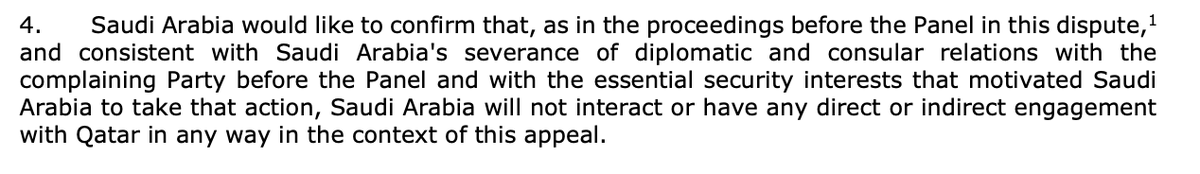

However, Saudi gov. also confirm they will only "provide an update directly to the WTO" & stand by clause four in their appeal stating they will not engage with Qatar. This shows, despite open borders, how long it may take for diplomatic relations (or just interactions) to occur.

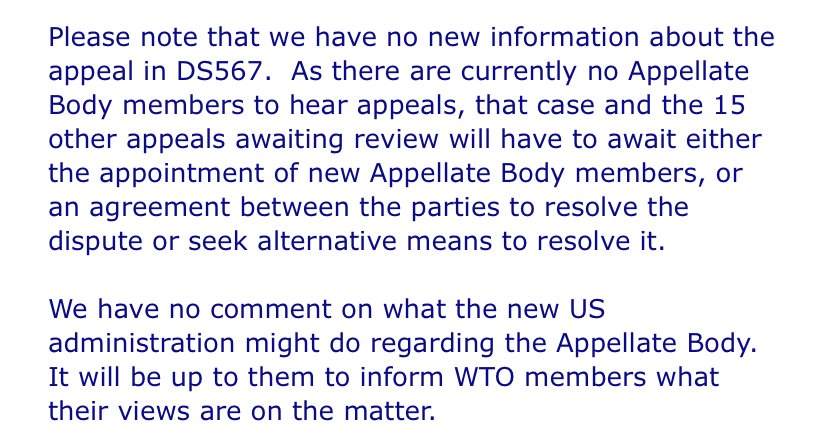

WTO have also provided me with a statement confirming the appeal is in limbo & that Saudi gov. have provided no further information or documentation since July 2020. They await instruction from the Biden administration on how the gridlock, for 16 appeal cases, might be resolved.

Quotes from the GGC Summit strongly intimated all significant legal challenges between Saudi & Qatar might be dropped, but the actual AlUla Declaration signed by GCC members did not say this. There was 120 different agreement points & this wasn't one of them.

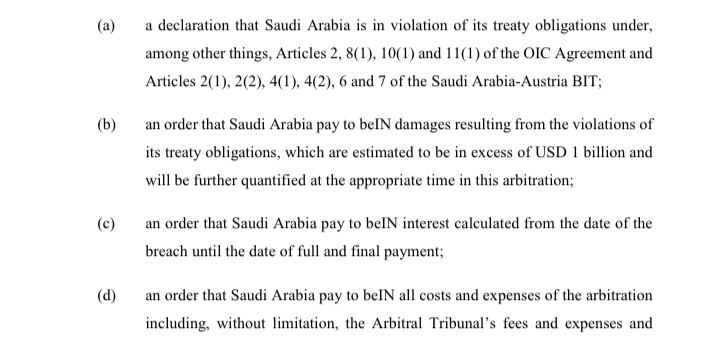

If Saudi gov. drop WTO appeal, they'll also want beIN to withdraw their own arbitration case on beoutQ tabled in Oct 18. Interestingly, & contrary to Saudi stance, terms of reference have been agreed between beIN & Saudi gov. here. & this will be heard in London not Riyadh.

beIN have made (they legally can) their initial case public, but if/when proceedings start they will likely become confidential. But beIN ideally want public hearings. The end-goal is largely for damages...

As for the consortium, they continue to wait on news of the club case before assessing options. But it is true that a private equity model has been (at least superficially) explored. This, in some respects, acknowledges EPL concerns, but still seems more of a 'plan B'.

There has been some talk in Saudi about Aramco supporting PIF. Aramco have dodged commenting on #NUFC links, but they aren't a private equity buyer. They are 98.5% gov. owned. Unlikely they are the solution.

But Aramco may be coming up in conversation because they have spoken before about supporting PIF projects, they sponsor plenty of sport in Saudi and Yasir Al Rumayyan is their chair. If PIF assume control, Aramco will no doubt sponsor something club-related.

Arguably Saudi's highest-profile private investor is Prince Alwaleed bin Talal. It is unclear whether he also owns Aramco bonds. The official (& on-record) line is no, but some Saudi sources still say he covertly purchased them.

Prince Talal is also a name currently being linked with Marseille having expressed a vague interest in 2014 & explored a more serious bid last May. He could probably help consortium find a private investor, but unlikely he'd get involved directly because he may not pass O&D Test.

Talal was arrested in Nov 2017 on corruption charges. In practice, this meant being detained in the Ritz hotel. A settlement was reached in 2018, & Talal called the situation a "misunderstanding". But he wouldn't be an easy name to clear despite strongly affirming his innocence.

It is unlikely, if Saudi drops WTO appeal & wins club case, that they will need to rethink the ownership structure behind their bid. But the fact consortium are (to some extent) looking at alternative options shows their continued interest & willingness to be flexible if needed.

Read on Twitter

Read on Twitter