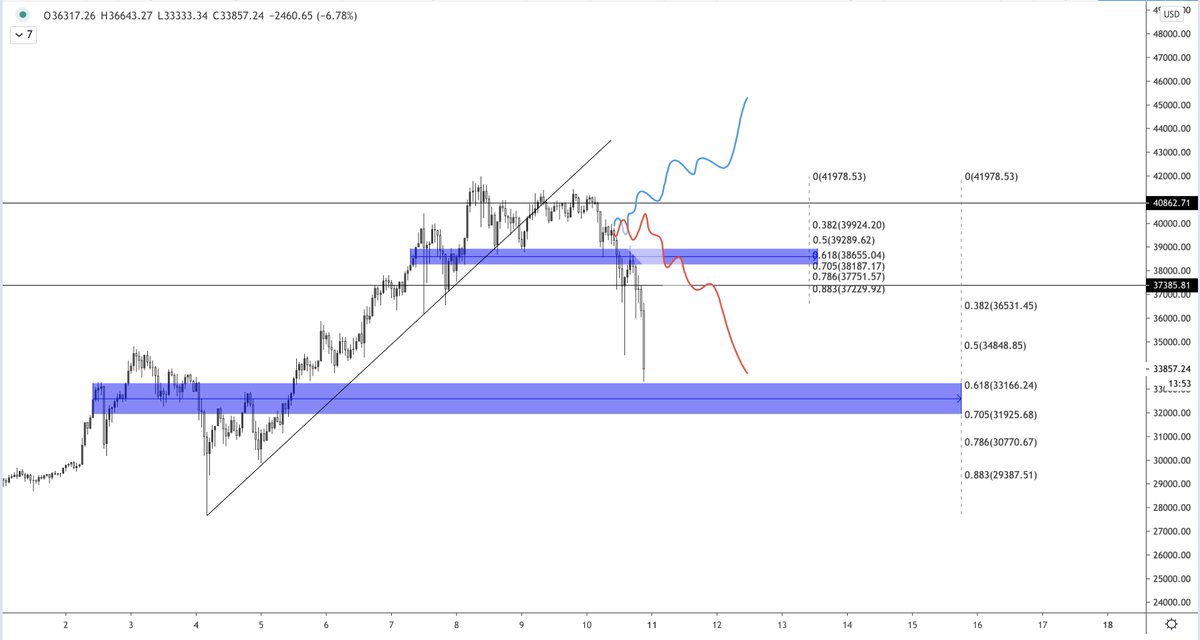

Let's keep this thread of fibs going.

Don't get greedy and think you caught the bottom.

Just play the levels and fibs.

Price has been clean.

If price continues up adjust the fib.

Wait for the potential higher low.

Can all still be a bearish retest of an SSR.

Large range.

Don't get greedy and think you caught the bottom.

Just play the levels and fibs.

Price has been clean.

If price continues up adjust the fib.

Wait for the potential higher low.

Can all still be a bearish retest of an SSR.

Large range.

If that was near term top the 32.4-6k level looks nice for the retrace.

SSR turns DBS.

61.8 fib is 32,349 as of now.

SSR turns DBS.

61.8 fib is 32,349 as of now.

Clear top identified after taking the highs.

Fibs adjusted.

Mid 32k's is bid zone for potential higher low.

Fibs adjusted.

Mid 32k's is bid zone for potential higher low.

Potential near term top.

Look at fibs below.

Daily open run and back below.

Similar setup as last potential higher low.

SSR turned into DBS.

Look at fibs below.

Daily open run and back below.

Similar setup as last potential higher low.

SSR turned into DBS.

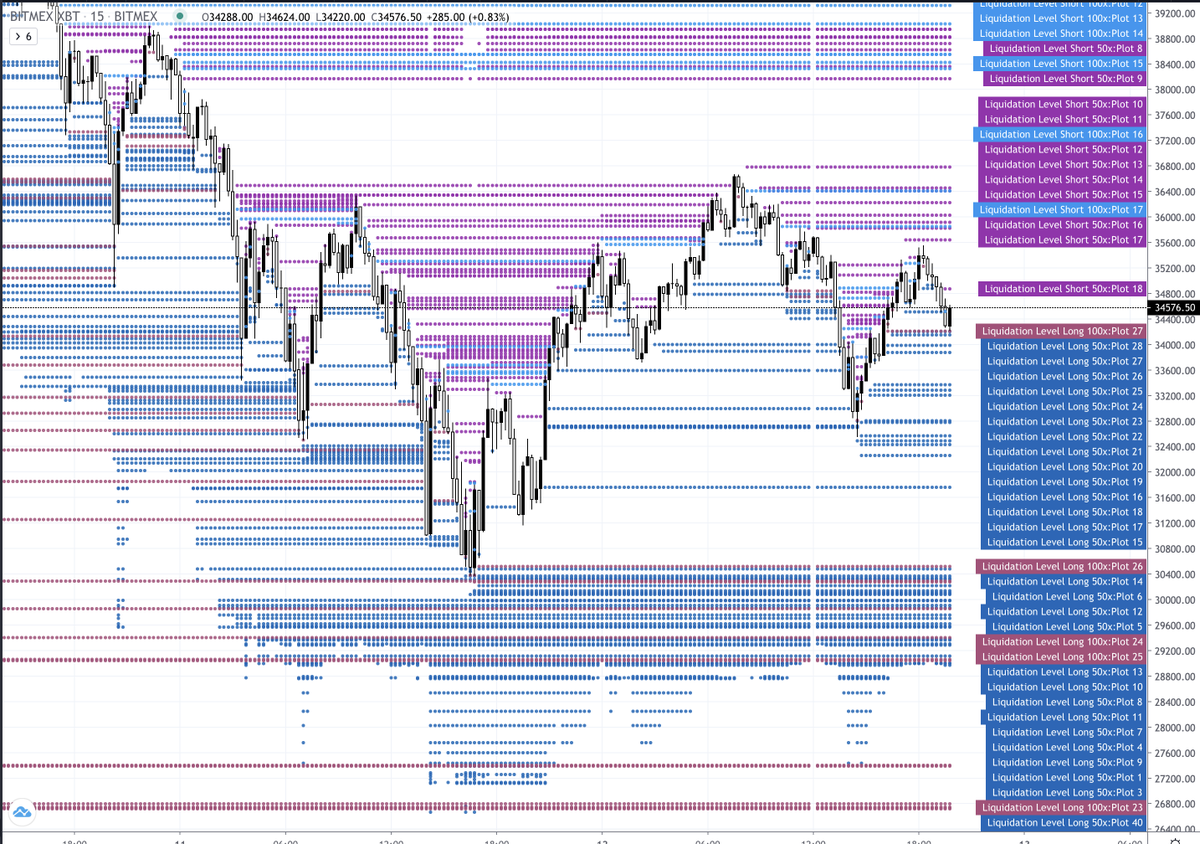

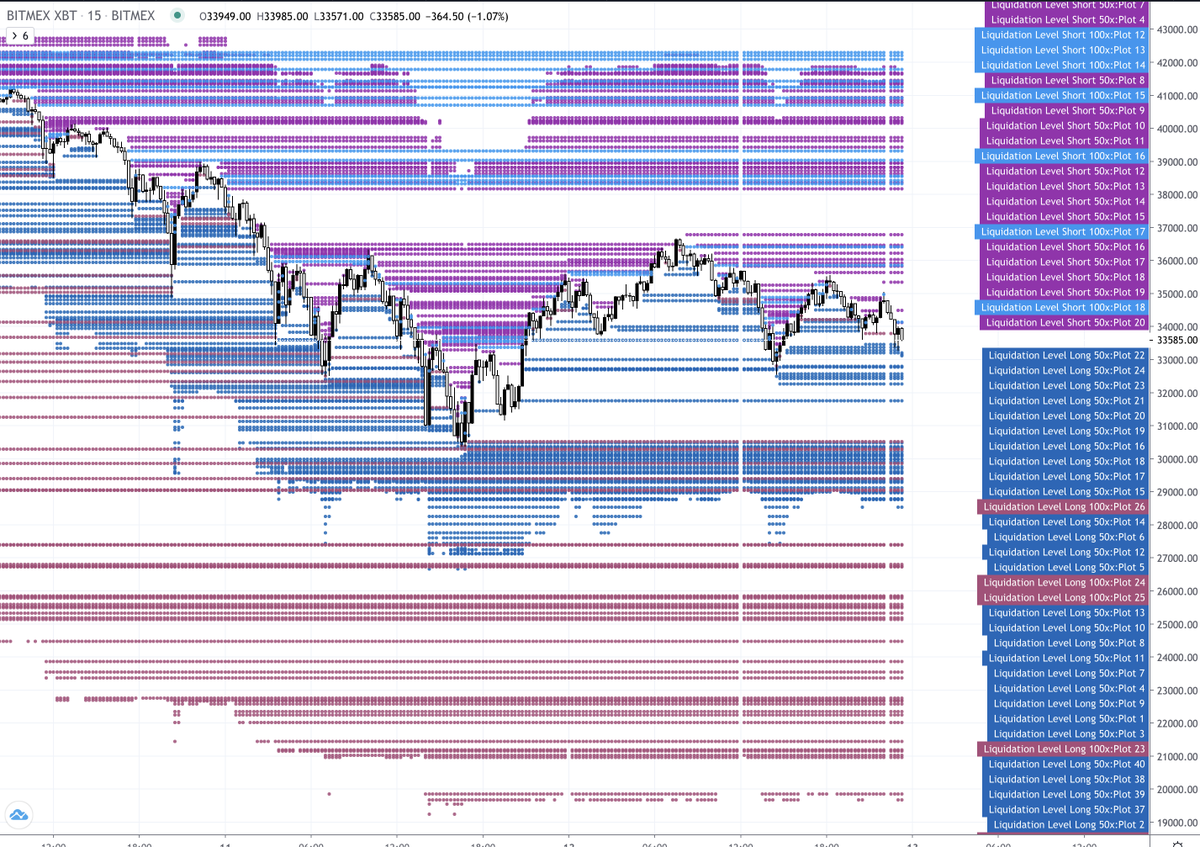

Keep an open mind here.

This could be a range.

Lose the mid and take a trip back down to range low.

Would fill out nicely.

This could be a range.

Lose the mid and take a trip back down to range low.

Would fill out nicely.

Would be double bottom target and fib retrace back up.

Prepared otherwise.

Would be continuation of bearish ms on low time frame.

Prepared otherwise.

Would be continuation of bearish ms on low time frame.

Read on Twitter

Read on Twitter