Thread on Short straddle with adjustments:

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Short straddle is non-directional strategy

Selling same strike price CALL/PUT option same underlying with same expiry.

Nifty Spot at 14353, So you can sell 14350 CE as well 14350 PE of 14 Jan. Expiry.

(1/n)

*RETWEET for max response

Bullish short straddle: Selling 14400 CE and 14400 PE of same expiry.

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Bearish short straddle: Selling 14250 CE and 14250 PE of same expiry.

You can sell straddle as per your market view.

If you are natural view sell CE and PE at ATM strike.

(2/n)

Short straddle has limited profit potential (only premium) and unlimited risk without adjustment.

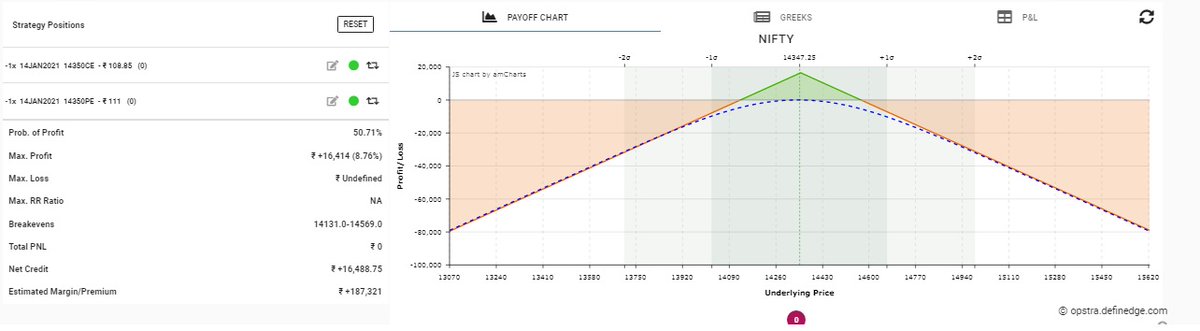

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

In Example, Short straddle of 14350, Breakeven is (14131.0-14569.0), need 1.7Lac Margin to sell straddle.

Maximum profit: 16k and Loss: Unlimited, Winning probability: 50%

(3/n)

If market staying near at 14350 then win. Probability increase slowly. Rewards also increase slowly.

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Volatility(IV) is also play important role in selling straddle, Like If IV increase so straddle premium increase and IV cool off so premium casually comes down.

(4/n)

Short straddle adjustment:

http://1.Best way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

http://1.Best way to limit the overnight risk.

Convert short straddle in Ironfly, its nothing we have to add long strangle in short straddle it become Ironfly. It gives the good Risk Rewards.

(5/n)

Reduce winning probability and reduce the margin approximately (1/3 of straddle)

See the Pay-off. The iron has a less profit than naked short straddle but limited the Risk is good in trading.

(6/n)

See the Pay-off. The iron has a less profit than naked short straddle but limited the Risk is good in trading.

(6/n)

2.Rather than buying both leg, you can buy only one leg (directional side).

Its called partially or broken iron-fly. Ex. Friday you do 14350 short straddle and Monday market looks bullish so you can buy only 14550 CE only .

(7/n)

Its called partially or broken iron-fly. Ex. Friday you do 14350 short straddle and Monday market looks bullish so you can buy only 14550 CE only .

(7/n)

3.Adjust straddle with Delta or premium based, if market moving in one direction so you can adjust the delta of strike. Eg. If your straddle of 14350, Underlying moving at 14440 on Monday so CE delta increase and PUT delta decrease but after some time market move in

(8/n)

(8/n)

uptrend CE delta increase in same speed but PE has vey less delta so you have to adjust the position. Roll up PE at 14450, So your new position delta is comes down, Mostly I recommend the adjustment if any premium loss 50% then you have to adjust that side.

(9/n)

(9/n)

You can adjust your position with delta as well same time you can create debit spread. Ex. Your straddle at 14350 and market reach at 14450. So first you adjust with delta and after open debit CE spread like buy 14500 CE and sell 14600 CE, (it’s not full proof adjustment)

(10/n)

(10/n)

but you get enough time to adjust your trade.

5.Convert straddle into Inverted strangle, it’s only recommended near to expiry. In our weekly we can covert only Wednesday and Thursday.

6. Adjust straddle with straddle but its need very high skill (never recom.)

(11/n)

5.Convert straddle into Inverted strangle, it’s only recommended near to expiry. In our weekly we can covert only Wednesday and Thursday.

6. Adjust straddle with straddle but its need very high skill (never recom.)

(11/n)

if you like the thread kindly retweet so all traders know about short straddle in simple way.

Read on Twitter

Read on Twitter