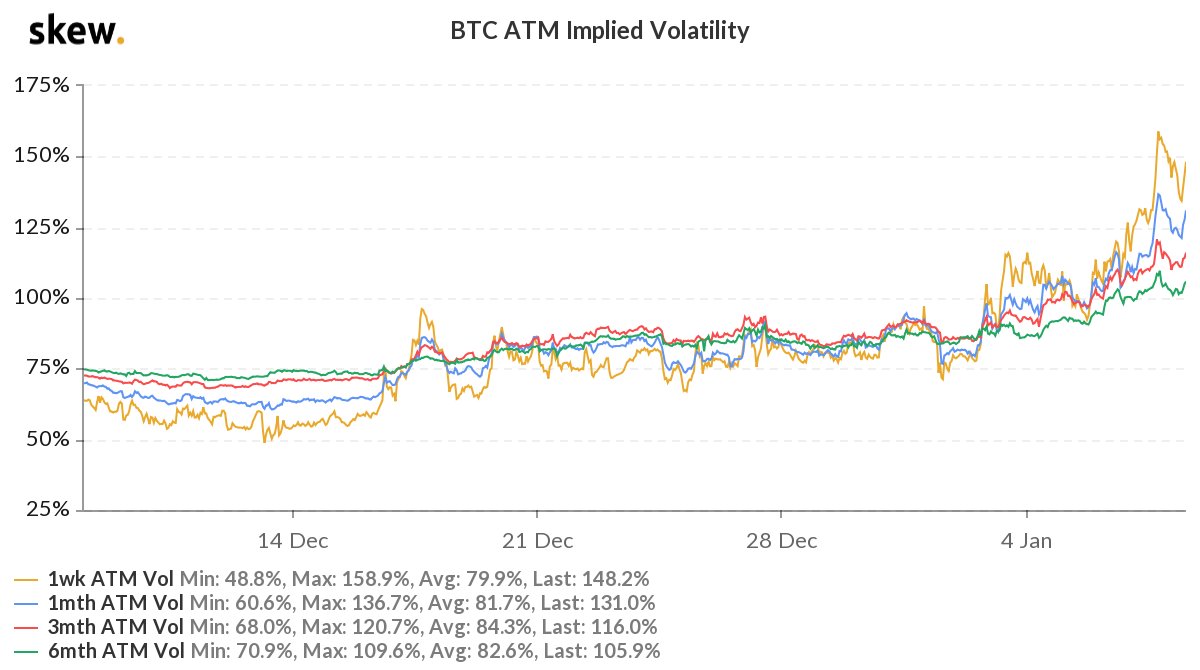

1) Implied Vols (price of options) surge. BTC 1week >150%. Intraday swings, pain on short option trades, anticipated BTC 40k+ spike.

Elevated IV presents opps for brave.

Jan29 40k Call sold x600 at ~$5000 (138% IV).

But huge Short covering in 23-26k Calls x2k sobering reminder.

Elevated IV presents opps for brave.

Jan29 40k Call sold x600 at ~$5000 (138% IV).

But huge Short covering in 23-26k Calls x2k sobering reminder.

2) The Jan29 23-26k Calls were sold on the 24th December - see Deribit Insights commentary 27th Dec - when BTC spot 23.5k.

Implied Vol action implies upside FOMO +fear of loss, but critically BTC spot, gamma and vol reaction to these ITM Calls, specifically the Jan29 36k Call.

Implied Vol action implies upside FOMO +fear of loss, but critically BTC spot, gamma and vol reaction to these ITM Calls, specifically the Jan29 36k Call.

3) Discussed Jan29 32k+36k evolution in Deribit Insights 4th Jan commentary thread.

The main impact now is Gamma.

Gamma is effectively how quickly delta changes.

As spot moves the delta moves. If hedging an options position delta neutral, need to buy/sell delta as market moves.

The main impact now is Gamma.

Gamma is effectively how quickly delta changes.

As spot moves the delta moves. If hedging an options position delta neutral, need to buy/sell delta as market moves.

4) The 32k+36k Calls are ITM.

One buyer. One seller. Bilateral trade.

Publically the seller is unknown.

Some speculate a BTC miner, but short Calls do not protect downside; just limit upside. The miner would now be handcuffed, unable to sell spot BTC.

Possible but inefficient.

One buyer. One seller. Bilateral trade.

Publically the seller is unknown.

Some speculate a BTC miner, but short Calls do not protect downside; just limit upside. The miner would now be handcuffed, unable to sell spot BTC.

Possible but inefficient.

5) Let's assume therefore the Short is a large institution.

At trade origination, the delta was small and a BTC 3x unexpected.

As the market rallied, the Short had to [I hope] start buying delta vs the Short Calls. There has been no indication of material listed option hedges.

At trade origination, the delta was small and a BTC 3x unexpected.

As the market rallied, the Short had to [I hope] start buying delta vs the Short Calls. There has been no indication of material listed option hedges.

6) But now deltas are 75 and 65, that's 13.5k deltas the short needs to have accumulated for delta neutrality v the Calls.

If BTC rallies, gamma impacts delta higher, more delta to buy.

But if the market falls, the option delta drops, and therefore the Short needs to sell deltas.

If BTC rallies, gamma impacts delta higher, more delta to buy.

But if the market falls, the option delta drops, and therefore the Short needs to sell deltas.

7) This pain trade is termed 'Short Gamma'.

Need to buy deltas as the market goes up, and sell when the market falls. Painful in choppy markets.

While options markets are dwarfed by spot markets, this open position is a special situation. It could have an impact on the market.

Need to buy deltas as the market goes up, and sell when the market falls. Painful in choppy markets.

While options markets are dwarfed by spot markets, this open position is a special situation. It could have an impact on the market.

8) Theoretically the Long Call(s) is long gamma. We don't know if he is hedging, but given the initial purchase of such far OTM Calls, it is more likely that the Calls are just being run naked - no opposing impact on delta at the moment.

As such, the Long Calls >$150m profit.

As such, the Long Calls >$150m profit.

9) Of course, there is not only an impact on spot delta but also on implied Vol.

The direct impact of a forced unwind could send IV much higher, unless an agreement is managed. The indirect impact of large active short gamma positions +forced delta hedging increases Realized V.

The direct impact of a forced unwind could send IV much higher, unless an agreement is managed. The indirect impact of large active short gamma positions +forced delta hedging increases Realized V.

10) The highest volatility due to short gamma would be at the 36k strike, should BTC retrace <Jan29th.

At the strike the gamma is high and option delta changes the most. To keep delta-neutral the Short option entity would violently need to adjust.

Hope the Long has taken profits

At the strike the gamma is high and option delta changes the most. To keep delta-neutral the Short option entity would violently need to adjust.

Hope the Long has taken profits

11) As the Call options move further ITM, their gamma decreases, and delta tends to 100.

At this point, the Short we assume would be forcibly delta neutral hedged, but that's a tremendous amount of delta to have bought; 20k BTC.

Action may need to be exercised prior to this.

At this point, the Short we assume would be forcibly delta neutral hedged, but that's a tremendous amount of delta to have bought; 20k BTC.

Action may need to be exercised prior to this.

12). These notional numbers are so huge, a speculative alternative is that there is a bilateral arrangement in place to close the position at a specified $ profit/loss.

This could still lead to both sides delta hedging and interesting games near the 'Touch' spot/BTC or $ barrier.

This could still lead to both sides delta hedging and interesting games near the 'Touch' spot/BTC or $ barrier.

Read on Twitter

Read on Twitter