Insights of a noob:

10 things I've learned from 18 months in the financial services industry.

10 things I've learned from 18 months in the financial services industry.

1/ The financial industry is set up to extract value from you - the key is to learn how to extract value from it.

2/ An understanding of compounding is essential - it can be your best friend, or your worst enemy.

Negative compounding is a thing, it occurs from the buildup of fees and taxes over time (there is a link to an article which explains this in more detail in point 9).

Negative compounding is a thing, it occurs from the buildup of fees and taxes over time (there is a link to an article which explains this in more detail in point 9).

3/ Behaviour is everything - you are an emotional creature not a robot.

@MavenAdviser summed it up perfectly in a recent podcast, 'financial success takes place between your ears, not on a computer screen'.

@MavenAdviser summed it up perfectly in a recent podcast, 'financial success takes place between your ears, not on a computer screen'.

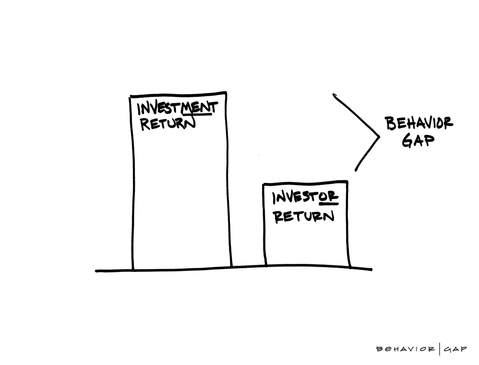

4/ Behaviour is everything - familiarise yourself with @behaviourgap.

Over the long term markets do not lose money, however investors do.

A study found that over a 20 year period ‘the average investment return was 11.81%. The average investor return was 4.48%.’

Over the long term markets do not lose money, however investors do.

A study found that over a 20 year period ‘the average investment return was 11.81%. The average investor return was 4.48%.’

5.1/ Behaviour is everything - you are not an investment guru.

You are not god's gift.

You can't predict the future.

Market timing is futile.

Day trading may sound exciting and you may feel like the Wolf of Wall Street - most of the time you are just mugging yourself off.

You are not god's gift.

You can't predict the future.

Market timing is futile.

Day trading may sound exciting and you may feel like the Wolf of Wall Street - most of the time you are just mugging yourself off.

5.2/ Buy the market, invest regularly, keep your costs low, hold for the long term.

If you want to have an extra focus on a particular asset/market, dabble in that on the side, do not make it the centre of your portfolio (if you are unsure why, see point 4).

If you want to have an extra focus on a particular asset/market, dabble in that on the side, do not make it the centre of your portfolio (if you are unsure why, see point 4).

6.1/ Behaviour is everything - selling when the markets are low and buying back in when they start to rise again is financially destructive.

It may be the worst possible decision an investor can ever make, potentially wiping out a huge chunk of their net worth in one go.

It may be the worst possible decision an investor can ever make, potentially wiping out a huge chunk of their net worth in one go.

6.2/ Unfortunately I have seen this strategy multiple times in my short career.

Take a breath, step back and THINK.

If you are going to buy back in when the markets start to rise again, then YOU have acknowledged that it is just a TEMPORARY decline!

DON’T DO IT!

Take a breath, step back and THINK.

If you are going to buy back in when the markets start to rise again, then YOU have acknowledged that it is just a TEMPORARY decline!

DON’T DO IT!

7/ 'Volatility is the price of admission’ @morganhousel.

Learn the difference between volatility and risk and you will soon realise that the real risk is not being in the market.

Learn the difference between volatility and risk and you will soon realise that the real risk is not being in the market.

8.1/ 'The goal of the media is to make every problem your problem' @naval.

This rings especially true for the financial media.

Sensationalist writing sells - unfortunately level headed, evidence based commentary does not. Learn to tune out the noise and crack on.

This rings especially true for the financial media.

Sensationalist writing sells - unfortunately level headed, evidence based commentary does not. Learn to tune out the noise and crack on.

8.2/ The Evidence Based Investor, @RobinJPowell, is a great place to start for useful insights.

9.1/ Your savings rate, more than your investment choices, will determine your path to financial freedom.

Spend less than you earn.

Pay yourself first.

Keep a close eye on fees and tax.

Spend less than you earn.

Pay yourself first.

Keep a close eye on fees and tax.

9.2/ @TheEscapeART1ST has a great article called ‘3 numbers that can make you a millionaire’.

It drives home the importance of your savings rate and the impact of negative compounding (touched upon in point 2). https://theescapeartist.me/2016/01/21/the-3-numbers-that-can-make-you-a-millionaire/

It drives home the importance of your savings rate and the impact of negative compounding (touched upon in point 2). https://theescapeartist.me/2016/01/21/the-3-numbers-that-can-make-you-a-millionaire/

10/ Don’t put your eggs in one basket. Diversify.

Whilst the concentration of capital can yield large returns, it can also lead to 100% loss of your money.

Do your future self a favour and avoid 100% capital loss.

Whilst the concentration of capital can yield large returns, it can also lead to 100% loss of your money.

Do your future self a favour and avoid 100% capital loss.

If you made it this far, thank you for reading.

I’m still new to the industry and have a lot to learn, however I hope you may have found something here of value.

I’m still new to the industry and have a lot to learn, however I hope you may have found something here of value.

Read on Twitter

Read on Twitter