Cantor Fitzgerald SPAC $CFII (ht @questioneer99) - the target was announced a few days ago - a "Dynamic Glass / Smart Window company called View - https://www.view.com

View is in the smart buildings (IoT) space - making *mostly* commercial buildings more ecofriendly

View is in the smart buildings (IoT) space - making *mostly* commercial buildings more ecofriendly

$CFII or $VIEW has unique technology with over 1000 patents to make windows more open to sunlight, energy efficient and smart.

Their windows make workspaces more daylight friendly and save costs on heating / air conditioning.

Their windows make workspaces more daylight friendly and save costs on heating / air conditioning.

$CFII / $VIEW - quick summary - I am going to pass on this for 3 reasons.

1. Product is expensive (4-5X cost of regular glass), making adoption really slow - they have been around since 2007

2. High capex model - custom manuf

3. Aggressive & unlikely to reach growth targets

1. Product is expensive (4-5X cost of regular glass), making adoption really slow - they have been around since 2007

2. High capex model - custom manuf

3. Aggressive & unlikely to reach growth targets

$CFII / $VIEW was founded in 2007 and has raised over $1.8 Billion to date

Most recently $1B+ from Softbank https://www.prnewswire.com/news-releases/view-the-leader-in-smart-windows-to-merge-with-cf-finance-acquisition-corp-ii-301181897.html

Most recently $1B+ from Softbank https://www.prnewswire.com/news-releases/view-the-leader-in-smart-windows-to-merge-with-cf-finance-acquisition-corp-ii-301181897.html

View’s allows customers to control the level of tinting in windows. This sort of “dynamic glass” can help lower cooling costs and remove the need for blinds or other accessories. It took View a decade to develop this glass, and sells to airports, hospitals and office buildings

There are 2 players in the market - View and Kinestral. View opened their first factory – in 2012 which is capable of producing 5M sq ft of glass per year. As of today, the company has deployed 75 M Sq ft of smart glass that’s either installed or in the process of being installed

$CFII: $VIEW: Tech: By adapting semiconductor manufacturing techniques, View found a way to deposit a set of metal oxide films on a pane of glass. It can then pass a very low electrical current through the film to darken the glass at varying degrees.

$CFII: $VIEW The frame around the glass contains a computing device that regulates tinting and connects to the internet and a weather radar. Customers can use a mobile app to automate the tinting process based on the amount of sunshine hitting a building

The View product costs about four times more than regular glass. For e.g. 100K Sq Ft regular glass is $1.2M + installation, but View is $6M + installation = $60/sq ft

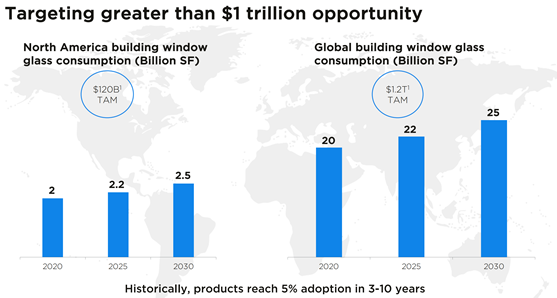

It claims the dynamic glass market is $1 Trillion

It claims the dynamic glass market is $1 Trillion

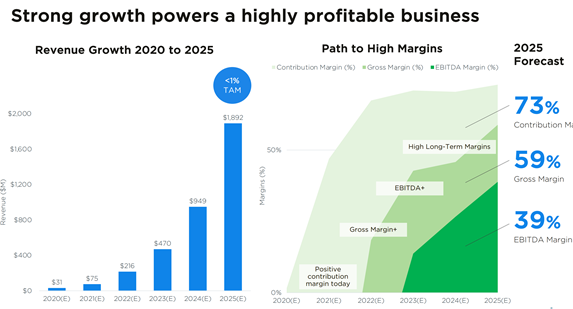

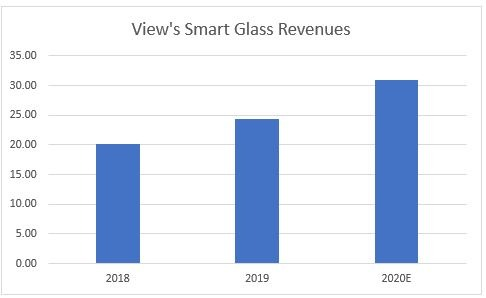

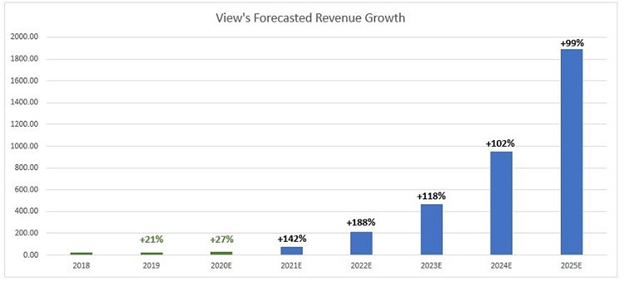

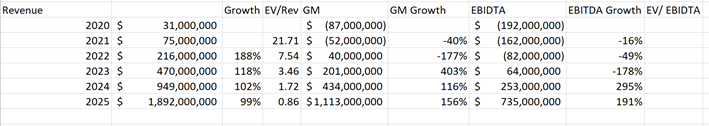

$CFII $VIEW The company will do $30M+ in revenue in 2020 and is expecting to do over $1.8B by 2025 ( I think they are very aggressive and over estimating market adoption, but they also claim to have a backlog of $500M.

$CFII $VIEW The last 3 years have not been stellar growth for the company and revenues it has struggled but is expecting forecast revenue to be strong

$CFII $VIEW One of View’s largest customers is Dallas Fort Worth International Airport, which found that the windows kept terminals cooler. View also counts Facebook Inc., FedEx Corp., JPMorgan Chase & Co., USAA and Texas A&M

$CFII $VIEW SageGlass and Kinestral Technologies Inc. (HALIO) also make this type of dynamic glass and are backed by major glass manufacturers. https://www.kinestral.com/

$CFII / $VIEW Deal provides $750M in cash to View to retire debt, values the company at EV of $1.628B.

It is expecting to grow at a 100%+CAGR for 5 years, and EV/Next 12 months revenue is 21X

It is expecting to grow at a 100%+CAGR for 5 years, and EV/Next 12 months revenue is 21X

$CFII $VIEW Interesting company. Lots of good technology and some unique differentiation, in what *seems* like a large market, but seems way over engineered and very expensive for what it delivers. You can view their entire presentation here.

https://view.com/sites/default/files/documents/View-Investor-Presentation-High.pdf

https://view.com/sites/default/files/documents/View-Investor-Presentation-High.pdf

Read on Twitter

Read on Twitter