1/ Are we observing the first of many $UNI- $SUSHI flippening?

High tides lift all boats - Volatile markets are good for generating fees for all bonding AMMs.

However, looking deeper shows several funda metrics flippening towards $SUSHI vs $UNI.

I list 6.

Let me share.

High tides lift all boats - Volatile markets are good for generating fees for all bonding AMMs.

However, looking deeper shows several funda metrics flippening towards $SUSHI vs $UNI.

I list 6.

Let me share.

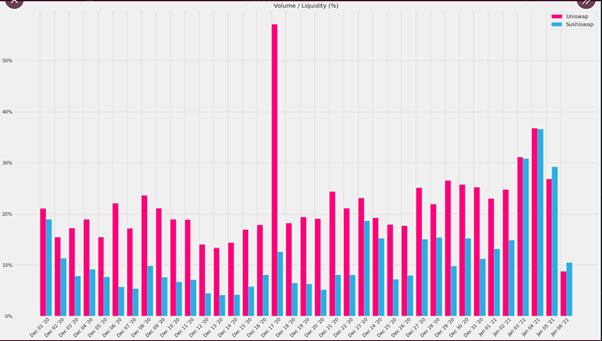

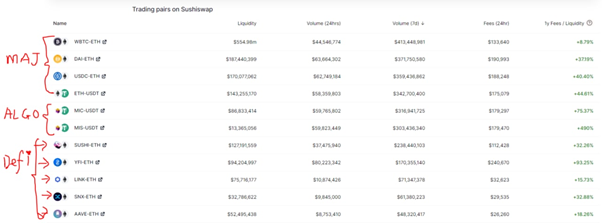

2/ #1 Volume/liquidity (%) flippening toward $SUSHI – branded name premium?

One recent observation is more efficient use of liquidity in $SUSHI as compared to $UNI.

This is unusual as a larger liquidity pool will generate a higher rev by virtue of bonding curve.

hmm.

One recent observation is more efficient use of liquidity in $SUSHI as compared to $UNI.

This is unusual as a larger liquidity pool will generate a higher rev by virtue of bonding curve.

hmm.

2.b/ $SUSHI’s more efficient pools could mean:

(1) more popular pools in @SushiSwap

(2) REAL n sticky user demand.

I explain later. That's part of the puzzle though.

Previous post inspired by @realmubaris (pic from him)

(1) more popular pools in @SushiSwap

(2) REAL n sticky user demand.

I explain later. That's part of the puzzle though.

Previous post inspired by @realmubaris (pic from him)

3/

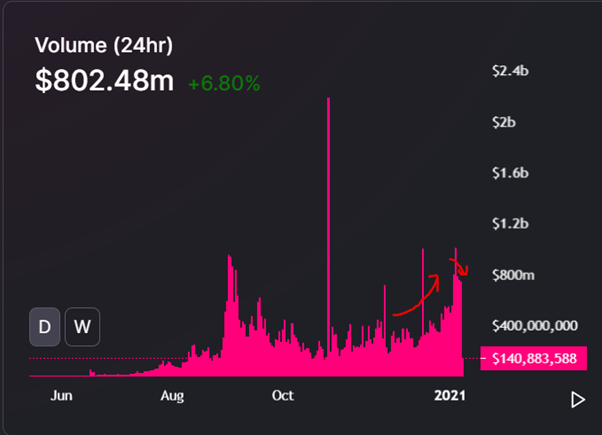

#2: Structure shift/flippening in $SUSHI’s volume – now at 500m daily

(BTW, 500m vol means a sick USD150k daily dividend to stakers.)

Again, we see a structure shift in SUSHI’s volume not seen in $UNI.

#2: Structure shift/flippening in $SUSHI’s volume – now at 500m daily

(BTW, 500m vol means a sick USD150k daily dividend to stakers.)

Again, we see a structure shift in SUSHI’s volume not seen in $UNI.

3.b/

This could be new sources of liquidity pools not available in $UNI.

Intuitively, we could think about the new pools generated by the ONSEN program.

But there is another explanation too.

This could be new sources of liquidity pools not available in $UNI.

Intuitively, we could think about the new pools generated by the ONSEN program.

But there is another explanation too.

4/

3# TVL flippening: SUSHI broke prev ATH, UNI not really.

@SushiSwap TVL is even higher than @NomiChef and UNI LP event, suggesting that liquidity is organically driven by $SUSHI rather than events somewhere else.

$SUSHI is standing on its own feet!

3# TVL flippening: SUSHI broke prev ATH, UNI not really.

@SushiSwap TVL is even higher than @NomiChef and UNI LP event, suggesting that liquidity is organically driven by $SUSHI rather than events somewhere else.

$SUSHI is standing on its own feet!

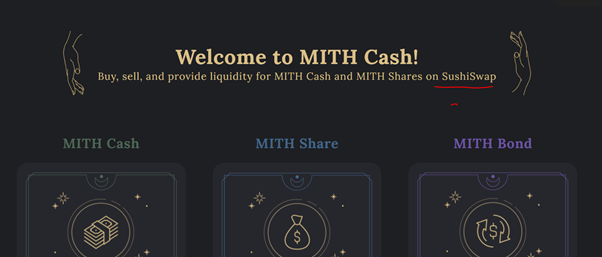

5/ 4# Project flippening:

Project in the past tend to provide liquidity on $UNI because that is the go-to place for AMM and LP tokens.

This has changed with @mith cash.

These pools one of the top vol generators for $SUSHI. $MIC $MIS

Given success, more to follow?

Project in the past tend to provide liquidity on $UNI because that is the go-to place for AMM and LP tokens.

This has changed with @mith cash.

These pools one of the top vol generators for $SUSHI. $MIC $MIS

Given success, more to follow?

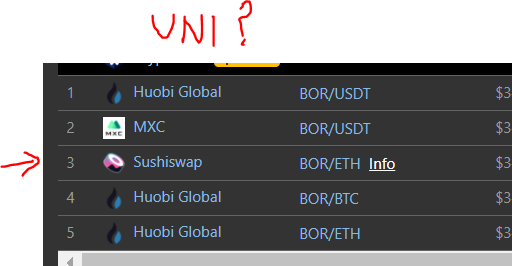

6/

#5 Strategy flippening: new promising projects like @boringdao only provides $BOR liquidity on @sushiswap, totally bypassing @uniswap now.

This strategy is completely unheard-of weeks ago.

Will more switch given liquidity is precious to maintain both sides?

#5 Strategy flippening: new promising projects like @boringdao only provides $BOR liquidity on @sushiswap, totally bypassing @uniswap now.

This strategy is completely unheard-of weeks ago.

Will more switch given liquidity is precious to maintain both sides?

7/ #6 MOST importantly: DeFi flippening

$SUSHI is cornering the whole DeFi market space.

Major DeFi project are listing their primary AMM pools on @sushiswap.

Impact is most prominent in the past few days, with YFI ecosystem news and DeFi price volatility.

$SUSHI is cornering the whole DeFi market space.

Major DeFi project are listing their primary AMM pools on @sushiswap.

Impact is most prominent in the past few days, with YFI ecosystem news and DeFi price volatility.

8/

In conclusion: BIG NEWS.

Cumulatively, SUSHI can generate rev in ANY crypto mkt rotation (BED @safetyth1rd ):

(1) Majors > Stables

(2) Majors > DeFi

(3) Second order transfers impacts

(4) and also, algo stables.

TL:DR

majors up/downs = SUSHI $$

defi up/down = SUSHI $$

In conclusion: BIG NEWS.

Cumulatively, SUSHI can generate rev in ANY crypto mkt rotation (BED @safetyth1rd ):

(1) Majors > Stables

(2) Majors > DeFi

(3) Second order transfers impacts

(4) and also, algo stables.

TL:DR

majors up/downs = SUSHI $$

defi up/down = SUSHI $$

Read on Twitter

Read on Twitter