1. I’ve recently been looking into @NexusMutual and was surprised to see cover protection for so many different DeFi projects. Throughout my analysis I came across some findings and wanted to get some thoughts from the community.

2. I like to think of @NexusMutual as a decentralized options market-maker — they’re essentially selling deep OTM options for various DeFi projects. I look at the cover contracts similar to “cash or nothing barrier puts”.

3. A cash or nothing barrier put is an exotic option which pays out a fixed amount if the underlying asset price falls and hits the barrier price. If it doesn’t hit the barrier, then the option will expire worthless (similar to WIX contracts @RealHxro).

4. @NexusMutual cover acts in similar way. We can pre-specify the fixed payout if a project’s contract gets hacked. As a result, the premium of the barrier put itself represents the implied probability of these options landing in the money.

5. In other words, the yearly cost of insurance is the same as the risk-neutral probability of the project getting hacked.

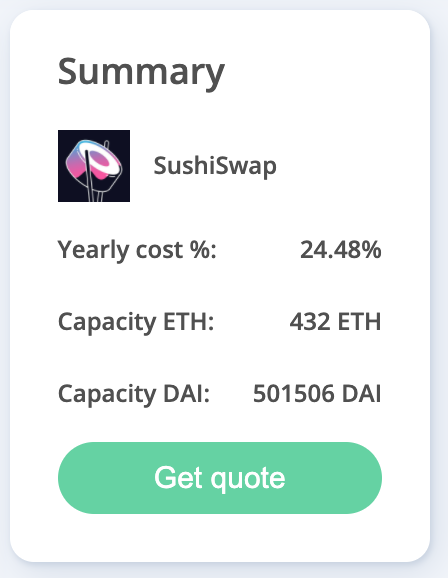

6. For example, SushiSwap currently has a yearly cost of 24.48%. This implies the market is pricing in a 24.48% chance that SushiSwap will get hacked over the year. Implicitly, this makes sense as we’d expect newer risky projects to have higher yearly costs.

7. However, a few things don’t make sense which I’d like to get more clarification on...

8. While many projects such as @iearnfinance and @1inchExchange all have world-class teams, from a smart contract risk perspective I don’t think grouping them in the same bucket as ETH 2.0 makes sense. I was surprised to see the premium cost for all these projects were equal.

9. I don’t have an edge in smart contract auditing but on a high-level it doesn’t seem the market is pricing these risks correctly. Not all projects should be equal from a risk perspective so there may be some deeply undervalued insurance on sale for these projects.

10. For example, despite the hack last year, the cost to insure @BalancerLabs for 1 yr is 2.60% which is the same as ETH 2.0. Also, the cost to insure BAL is the same as @BlockFi which is a federally regulated entity - it's hard to see how these risks are equal.

11. This makes me think about how these risks are priced and whether there's opportunity to somehow arbitrage the undervalued insurance. Also, I'd imagine technically savvy devs could sell insurance on projects with solid code and have massive edge here.

12. What do you folks think and what may I be missing here? @tarunchitra @samczsun @krugman25 @HughKarp

Read on Twitter

Read on Twitter