1/26: It’s hard to produce a 3X+ #VC fund. It’s much harder to do this consistently. Our first 4 funds are mature enough to know where they’ll end up and all of them will handily beat this benchmark. I reviewed our portfolio this morning and jotted down 12 notes. Shared:

2/26: Insight 1: It’s more important to be an average investor in a target rich ecosystem than a great investor chasing windmills. It’s been a great decade for #fintech which made our jobs easier.

3/26: The incumbents have been among the most profitable companies in the world and almost every sub-vertical within #fintech was in dire need of modernization. We believe this is still true which is why we’re comfortable with the pond we’ll be fishing in over the next decade.

4/26: Unseating profitable players is a great starting point. We’ve invested in more than a dozen companies now valued at > $1B+ (a Blessing of Unicorns!). Some are generating $1B+ of revenue and throwing hundreds of millions of dollars of profit to their bottom lines.

5/26: Insight 2: Winning with consistency requires discipline. Finding breakout winners is everything but how a #VC fund operates determines repeatability. What worked for us: Trusting our own insight, diligence and future casting vs. investing entirely based on team and TAM.

6/26: To us, outcomes are a result of inputs and processes. We’re in a SAW asset class (see, analyze, win) and our team has been assembled (skills, experience and work ethic) and our processes have been designed to produce consistent outcomes.

7/26: We obsess about how much of the ecosystem our team is able to cover. We obsess about having the expertise to understand the businesses we dig into. And we obsess about “doing the work” during diligence.

8/26: Insight 3: Our best investments were in companies or themes that other investors didn’t want to bet on. Being early to a trend or a geo drove returns. Our best investments only looked good to us early on and then suddenly looked good to everyone once they scaled a bit.

9/26: Insight 4: Holding a high bar works when you have confidence you can win all the deals that get through your gauntlet. My rough analysis of our first 4 funds is that we were able to invest in 95%+ of the deals that made it through our process.

10/26: And price wasn’t what won us deals because were almost never the highest bid. We obsessed about having a value proposition for Founders that won us the deals we were interested in. Our 95%+ success rate paired with price discipline drove real economic return.

11/26: Insight 5: When we blindly trusted someone else’s diligence or strayed from what we new well we almost always stubbed our toe. The “hot deal with great lead investor” thesis didn’t serve us well. The farther we strayed from #fintech the worse we did.

12/26: Insight 6: Portfolio construction matters. You need enough “at bats” in any given fund to give yourself the chance to find breakout winners. But if you have too many investments you end up spreading the peanut butter too thin and returns will suffer.

13/26: Our first 4 funds consist of roughly 80 companies and ~25% of them will end up returning 5X+. About half of these will return 10X+. And 2 will return greater than 100X. Every fund has between 1 and 3 “return the fund” investments. N matters.

14/26: And our winners would have been even more concentrated if we had been more disciplined in Fund I and II. There were too many tiny investments (we were still learning) and none of them made a difference. When we wrote a real check our hit rate was much better.

15/26: Insight 7: Our winners emerged within 2 years of our investment. Our best companies started strong and rarely encountered periods of slow growth. Our “red” companies occasionally made it to “yellow” but never permanently to “green”.

16/26: But there were companies that lost 50%+ of their peak valuation. A few were due to new regulations that impacted their business models. Others were due to self-inflicted wounds. And some suffered from multiple compression. Up can go down but down usually stays down.

17/26: Insight 8: Investments based on anything other than table pounding conviction sucked. Insider rounds that extended runway sucked. Investments justified based on their deal structures sucked. Investments based on “the price reflects the flaws” sucked.

18/26: Insight 9: Our initial ownership shaped the journey we were on. When we were a “tuck-in” investor, it was nearly impossible to upsize our ownership over time. But by not leading we also had more license to say “no” in bad situations.

19/26: When we led rounds, we were able to set price and then maintain or buy-up our positions over time. But we also faced significant pressure when it came to investing in future rounds due to signaling risk. On balance, leading worked better for us than following.

20/26: Insight 10: Selling when liquidity was available had a real financial cost (reduced upside) but it also calmed our nerves. In our early funds, all the money was our own so having massive concentration in a few winners was scary.

21/26: Liquidity wasn’t always available so taking 10-20% off when we could allowed us to focus on generating as much upside as possible vs. protecting our gains. Truth be told, our advice was more clear-minded after de-risking.

22/26: Insight 11: Confidence empowered risk taking which drove returns. There are no “sure things” ---every investment comes with risk. Understanding risk is a beginner level skill. Taking the risk is a more advanced competency. Embracing risk earns you a black belt.

23/26: Our first write-offs came before our first big mark-ups which made us question our chops as investors. It was our own money so nobody was looking over our shoulder and putting pressure on us, but the early write-offs did hurt.

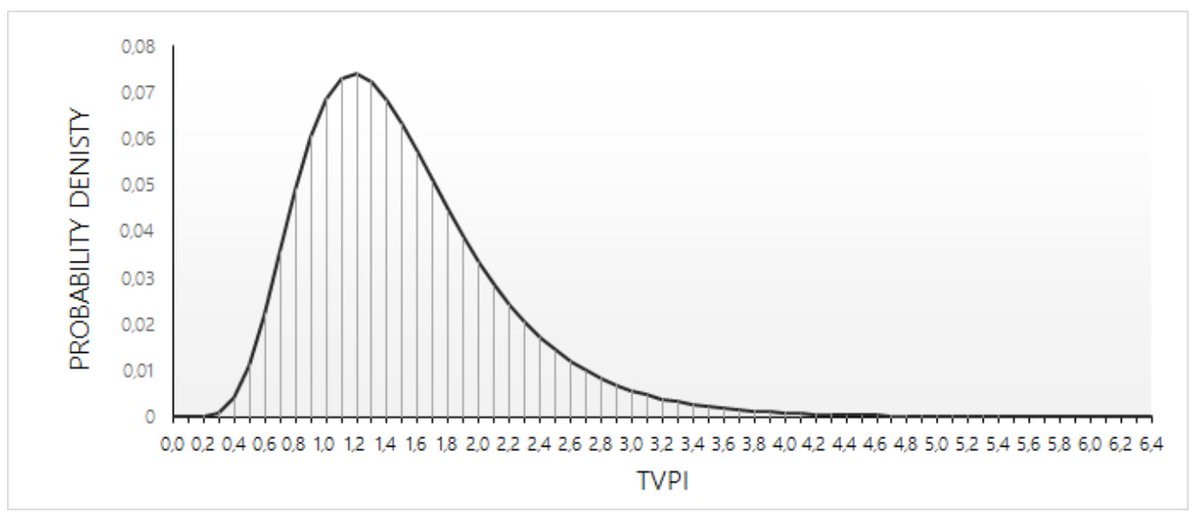

24/26: Over time, we internalized that investing was about a distribution of outcomes vs. any single outcome. Our successes enabled us to double down on our way of thinking because we saw it was working.

25/26: Insight 12: You can only bet on one horse so you better pick a great one. Break-out winners drove our best returns. Good only drove good returns. Our @creditkarma and @nubank draft picks were perfect. But Braintree vs. @stripe? As a fund we didn’t bat a thousand.

Read on Twitter

Read on Twitter