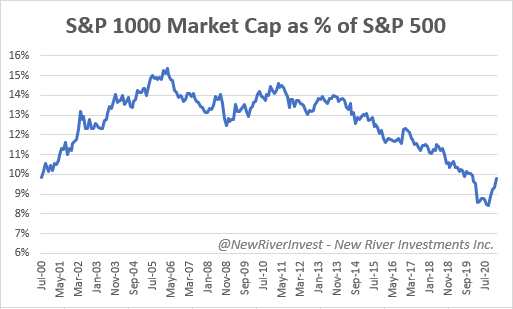

The Value bull-case is not that growth is overvalued and due for a tumble, that would suck for everyone. the Value bull-case is that if you get lucky the growth investors might diversify a little into value names near the peak and in doing so have a huge impact in value prices

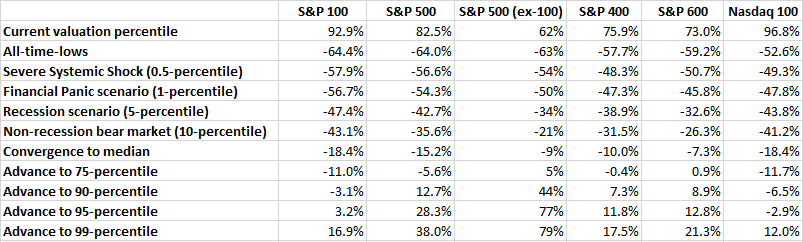

Ditto for small and mid caps. S&P 100 is 66% of S&P500, S&P 600 mkt cap is 3% of S&P 500 market cap. If some combination of price insensitive actors decides to deviate from market-cap weighing, well, the market impact is very big. this stuff *really* *really* matters

I've been talking about this stuff for months. as high-valuation jitters push mkt participants to look deviate more from the universe by leaning on more selective sampling and deviating from cap weights you will see more of this and it will be amplified by alternative-beta ETFs

Your average HF PM is not out there lifting offers willy nilly and moving the price of some backwater small-cap 10% in a day for kicks, but the average RIA is absolutely throwing $20mm into some backwater equal-weighted ETF where the ETF trades 20x more volume than the underlying

anyways total tangent but i'll leave it here as a note-to-self but indices should be free-float weighted not market-cap weighted.

Read on Twitter

Read on Twitter