A quick thread on $IPOE (SoFi) if you have not seen it elsewhere. I know there may be others with better information and analysis so I will link to them later.

SoFi was founded in 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady, four students who met at Stanford

SoFi was founded in 2011 by Mike Cagney, Dan Macklin, James Finnigan, and Ian Brady, four students who met at Stanford

$IPOE SoFi The founders hoped SoFi could provide more affordable options for those taking on debt to fund their education. - Student loans was their start.

See their 2015 slide deck for raising funding.

http://www.jeremy-knight.com/2015/10/03/sofi-investor-presentation/nggallery/slideshow

See their 2015 slide deck for raising funding.

http://www.jeremy-knight.com/2015/10/03/sofi-investor-presentation/nggallery/slideshow

$IPOE: SoFi:

In September 2012, SoFi raised $77.2 million, led by Baseline Ventures

On October 2, 2013, SoFi announced it had raised $500 million to fund and refinance student loans.

In September 2012, SoFi raised $77.2 million, led by Baseline Ventures

On October 2, 2013, SoFi announced it had raised $500 million to fund and refinance student loans.

$IPOE: SoFi In April 2014, SoFi raised $80 million in a Series C round led by Discovery Capital Management with participation from Peter Thiel,

In February 2015, the company announced a $200 million funding round led by Third Point Management.

In February 2015, the company announced a $200 million funding round led by Third Point Management.

$IPOE: SoFi 2015: SoFi branches out from student loans to personal loans, mortgages, etc.

October 2016, SoFi funded more than $12 billion in total loan volume and has 175,000 members / customers

October 2016, SoFi funded more than $12 billion in total loan volume and has 175,000 members / customers

$IPOE: SoFi January 2018, Anthony Noto (who was COO of Twitter), becam the CEO

In May 2019, SoFi closed $500 million

Total raised $2.5 Billion https://www.crunchbase.com/organization/social-finance

In May 2019, SoFi closed $500 million

Total raised $2.5 Billion https://www.crunchbase.com/organization/social-finance

$IPOE: SoFi

May 2019: its pre-money valuation is $4.3 billion, ($4.8 post). https://techcrunch.com/2019/05/29/online-lender-sofi-has-quietly-raised-500-million-in-funding-led-by-qatar/

May 2019: its pre-money valuation is $4.3 billion, ($4.8 post). https://techcrunch.com/2019/05/29/online-lender-sofi-has-quietly-raised-500-million-in-funding-led-by-qatar/

$IPOE: Lots of competitors:

Lending Club, Prosper for consumer loans,

OnDeck for small and mid-size business loans,

StreetShares for veteran-owned businesses and CommonBond for student loans.

Lending Club, Prosper for consumer loans,

OnDeck for small and mid-size business loans,

StreetShares for veteran-owned businesses and CommonBond for student loans.

$IPOE, SoFi

The company has more than 1.8 million active customers.

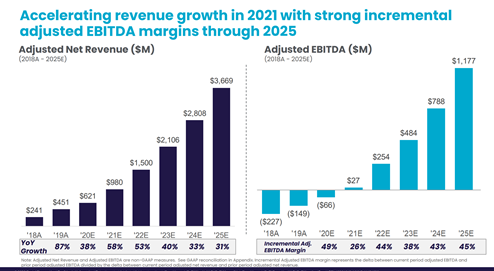

Expectations for revenues to grow with a five-year CAGR of 43%. Estimated profits of $27 million in 2021 expanding to profits of $1.17 billion in 2025. https://investorplace.com/2021/01/ipoe-stock-9-things-to-know-ahead-of-the-sofi-spac-merger/

The company has more than 1.8 million active customers.

Expectations for revenues to grow with a five-year CAGR of 43%. Estimated profits of $27 million in 2021 expanding to profits of $1.17 billion in 2025. https://investorplace.com/2021/01/ipoe-stock-9-things-to-know-ahead-of-the-sofi-spac-merger/

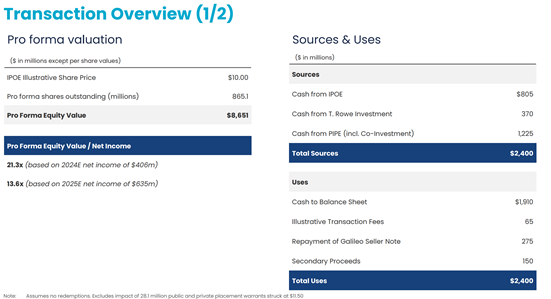

$IPOE SoFi $8.65B Valuation at $10 IPO

At 1/7/21 price of $19, the Market Capitalization is

$16.43 Billion

https://pbs.twimg.com/media/ErJPIzZVkAArRm1?format=jpg&name=large

At 1/7/21 price of $19, the Market Capitalization is

$16.43 Billion

https://pbs.twimg.com/media/ErJPIzZVkAArRm1?format=jpg&name=large

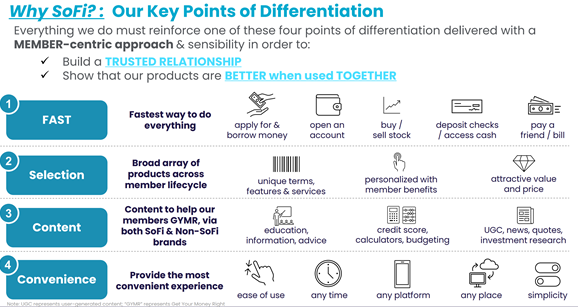

$IPOE SoFi Key differentiation: Fast, Convenient, Lots of Content and good selection (of loans, products, etc.)

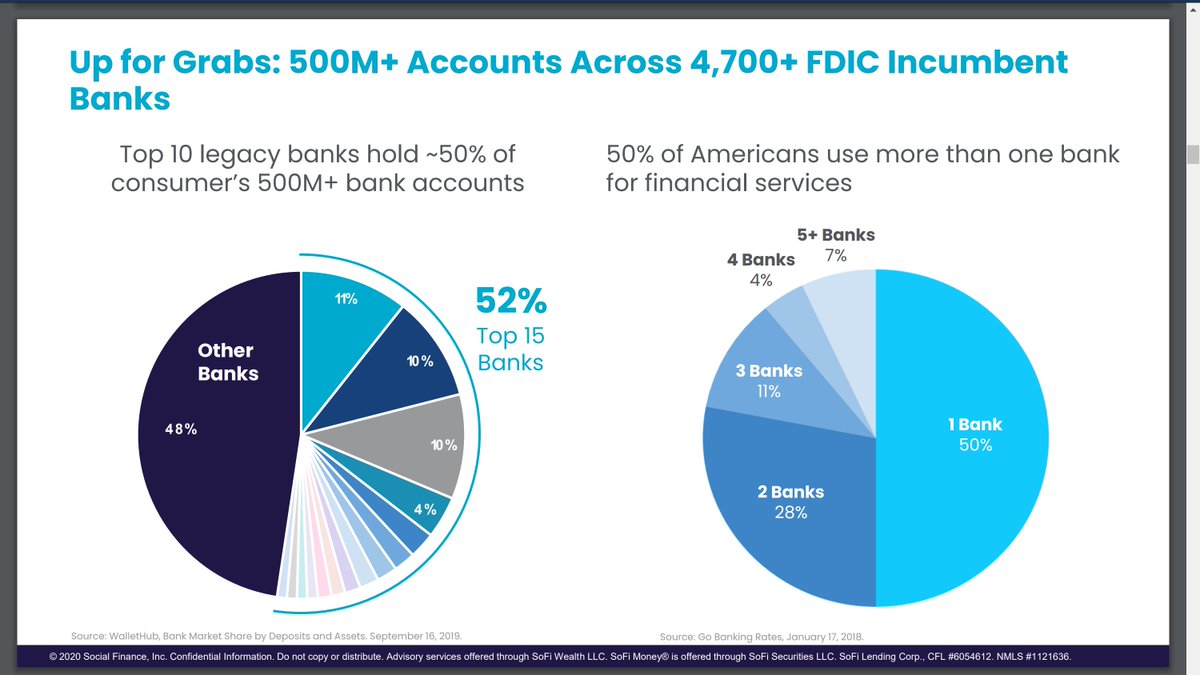

$IPOE, SoFi, although they claim the opportunity is *all* Americans to get a new banking / financial relationship account, the short term (5 year) opportunity is in younger Millennials.

$IPOE: SoFi Terrific management team. I know Assaf from $AMZN and Maria Renz (heard of her) - absolute superstars.

https://www.linkedin.com/in/assafronen/

https://www.linkedin.com/in/assafronen/

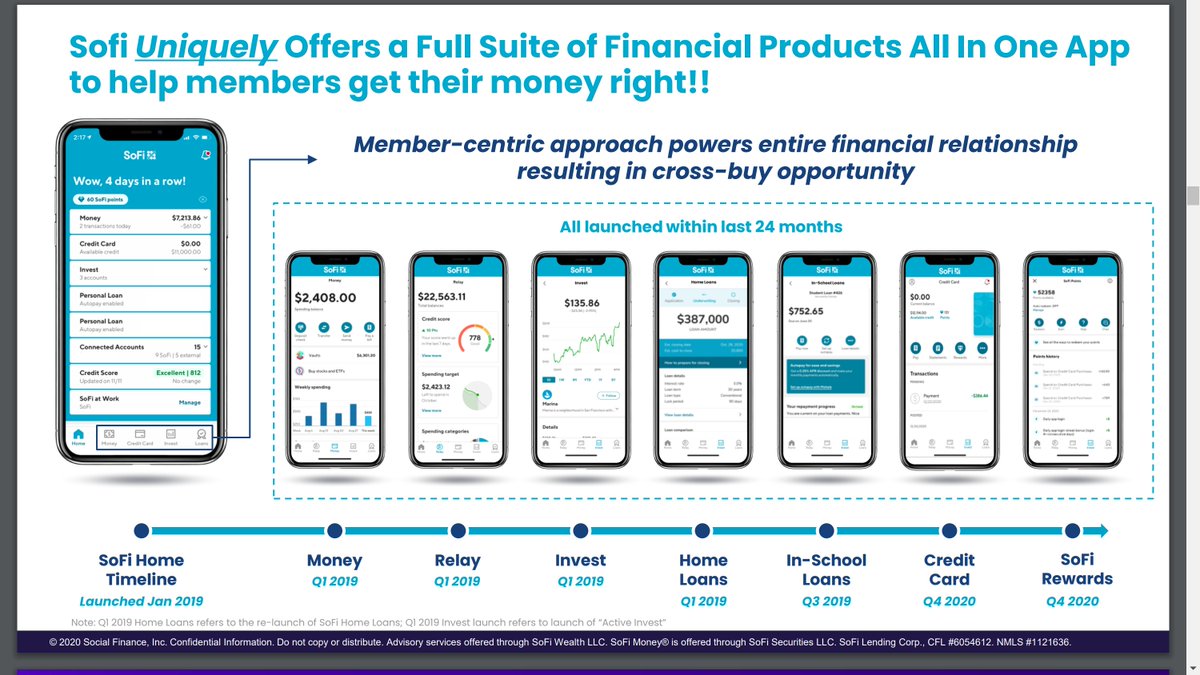

$IPOE: SoFi Product - this might well be the "SuperApp" for US - like many in China (AliPay/ Ant), India (PayTM, etc.)

Everything a millennial needs in one place.

Everything a millennial needs in one place.

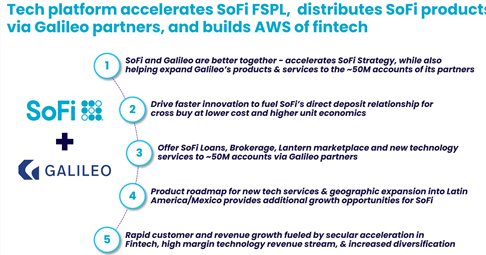

$IPOE SoFi acquired Galileo on April 2020 a powerful financial services API and payments platform. SoFi paid$1.2B to acquire Galileo, comprising cash and stock. https://www.sofi.com/blog/investors/

$IPOE SoFi

Galileo processed over $53B of annualized payments volume in March 2020, up from $26B in September 2019. SoFi Money is already tightly integrated with Galileo’s payment platform including several of its leading account and events API functionalities.

Galileo processed over $53B of annualized payments volume in March 2020, up from $26B in September 2019. SoFi Money is already tightly integrated with Galileo’s payment platform including several of its leading account and events API functionalities.

$IPOE: SoFi

Strong growth profile, and terrific CAGR growth for 5-7 projected years.

This belongs in your Fintech portfolio

Strong growth profile, and terrific CAGR growth for 5-7 projected years.

This belongs in your Fintech portfolio

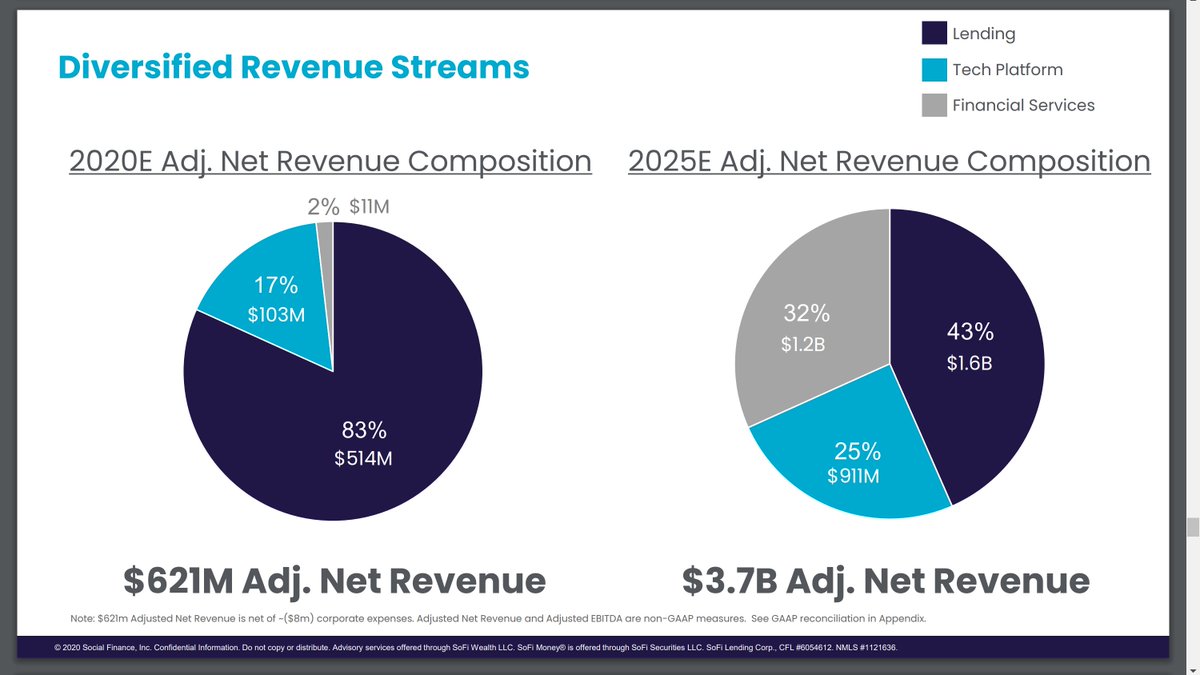

$IPOE: SoFi - 3 business segments - Loans (83% of revenue), Tech platform - 17% of rev (like Plaid) and financial services (2% of rev)

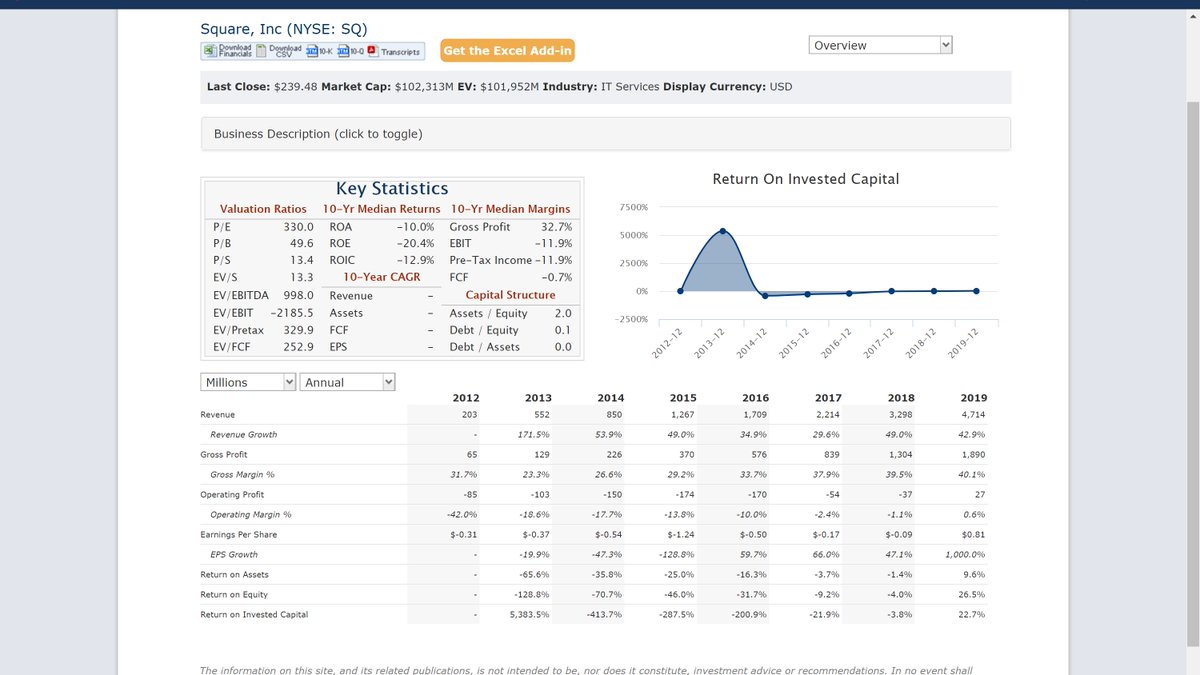

Fintech companies - $SQ, $PYPL, (Stripe & Robinhood - private), $AFRM, etc. The valuations of all these companies = RICH.

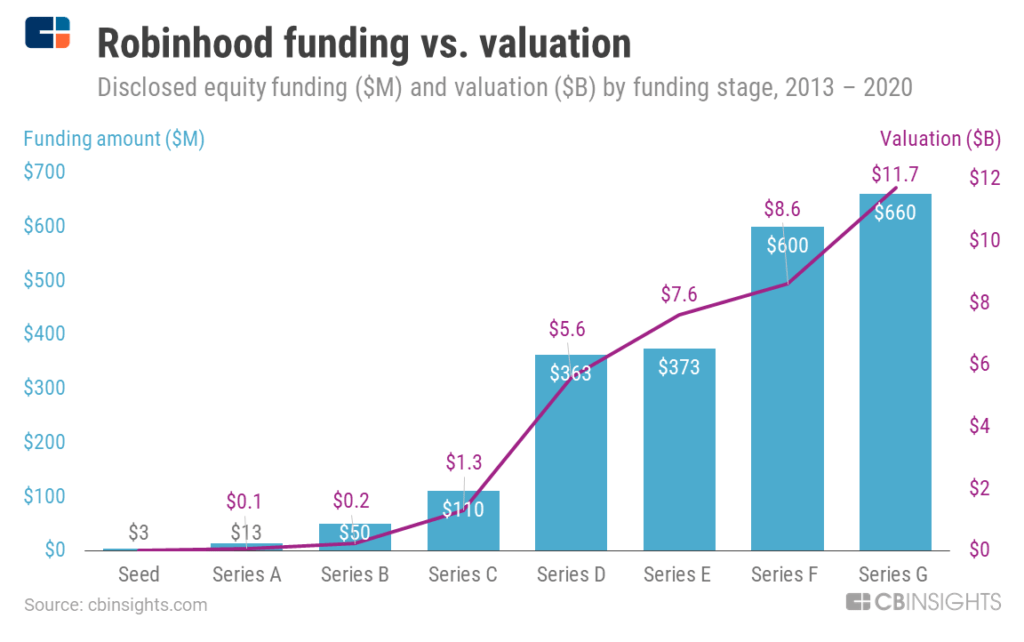

Relatively speaking, if Stripe claims to have a $70B valuation, then at $16B, and Robinhood at $25B, this is a good value. https://www.bloomberg.com/news/articles/2020-11-24/payments-startup-stripe-is-said-in-talks-to-raise-new-funding

Relatively speaking, if Stripe claims to have a $70B valuation, then at $16B, and Robinhood at $25B, this is a good value. https://www.bloomberg.com/news/articles/2020-11-24/payments-startup-stripe-is-said-in-talks-to-raise-new-funding

$IPOE: SoFi $PYPL is valued at $272B ($17B 2020 rev) and $SQ ($5B 2020 rev) at $110B. They are *much* bigger, so they deserve it, but when $SQ was at $1B in rev, it was valued at $20B - in the range for $IPOE - SoFi

$IPOE: SoFi risks:

1. Millennial centric - short term ok, but in the long term these folks should become "multi-product " customers

2. Fintech is very dependent on interest rates and overall economy

3. Very competitive space, if underwriting process breaks, expect losses

1. Millennial centric - short term ok, but in the long term these folks should become "multi-product " customers

2. Fintech is very dependent on interest rates and overall economy

3. Very competitive space, if underwriting process breaks, expect losses

$IPOE: SoFi More risks: In 2017 it tried to sell itself for $8B - $10B after its founder and CEO and founder departed. This is before the current CEO Anthony Noto came on board. The acquisition discussions went nowhere. https://www.pymnts.com/news/alternative-financial-services/2017/sofi-tried-to-sell-itself-for-8b-last-year/

$IPOE: SoFi -there had been a bro-culture (before 2017) and bad behavior, but from what I read that's why the new CEO and management team had been brought in.

I *suspect* this is similar to $UBER (it is in the past), but something to keep in mind. https://www.wsj.com/articles/employees-of-fintech-firm-sofi-allege-women-are-treated-improperly-1505062155

I *suspect* this is similar to $UBER (it is in the past), but something to keep in mind. https://www.wsj.com/articles/employees-of-fintech-firm-sofi-allege-women-are-treated-improperly-1505062155

$IPOE: $SOFI Comparable: Robinhood is reported to be at $400 - $600 Million in revenue and valued at $12B in their previous round. So one can make the case for a $20B - $24B valuation (stretch case) for $IPOE so implied stock price of $20 - $24

In listening to the conference call (51 minutes)

https://event.on24.com/eventRegistration/console/EventConsoleApollo.jsp

Lots of focus on new bank accounts that help bank the way people need to - faster transfers, flexible checking, mobile accounts

Robinhood uses Galileo (acquisition) banking API for checking accounts

https://event.on24.com/eventRegistration/console/EventConsoleApollo.jsp

Lots of focus on new bank accounts that help bank the way people need to - faster transfers, flexible checking, mobile accounts

Robinhood uses Galileo (acquisition) banking API for checking accounts

Read on Twitter

Read on Twitter