Back in 2012 buying real estate took courage. I bought 2 senior housing condos for a song, but spent ~$4,000 a month just in HOA fees carrying them!!

FinTwit & ReTwit have more in common than both believe.

Let's look at the deal & at being a market maker in real estate 1/6

FinTwit & ReTwit have more in common than both believe.

Let's look at the deal & at being a market maker in real estate 1/6

We think of market makers as liquidity providers in securities market, buying so people can sell & selling so people can buy. They maintain a smooth functioning market.

But markets can be made in any asset including real estate.

Think of RE investors as buyers & sellers of 2/6

But markets can be made in any asset including real estate.

Think of RE investors as buyers & sellers of 2/6

a commodity. But its a commodity w/ embedded options. Buy a condo that needs a facelift & give it a facelift--turning it into another class of commodity.

Market making's great when liquidity is low for the asset the market maker buys & high for the renovated asset the market 3/6

Market making's great when liquidity is low for the asset the market maker buys & high for the renovated asset the market 3/6

maker sells! Senior housing has natural turnover.

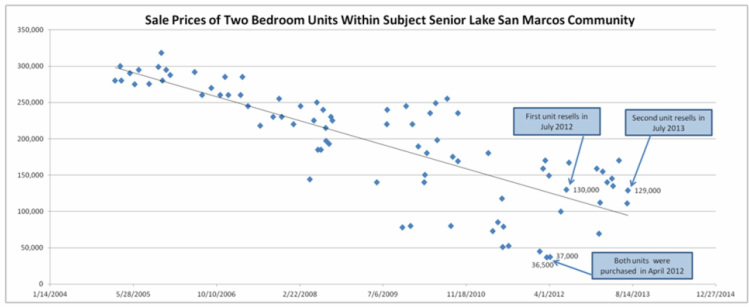

But post GFC heirs didn't adjust to falling values fast enough. In this community in San Marcos prices fell from $200K to $150K to $125K to $75K etc.

At each step heirs lowered asking prices too slowly.

Inventory built! 4/6

But post GFC heirs didn't adjust to falling values fast enough. In this community in San Marcos prices fell from $200K to $150K to $125K to $75K etc.

At each step heirs lowered asking prices too slowly.

Inventory built! 4/6

By 2011 this inventory started to clear but pricing was at all time lows.

I bought the last two unrenovated 2 bed condos for ~$36K each in 2012. Concurrently there was one renovated 2 bed condo in escrow for $190K!

I renovated them, flipped the first for $130K. But events 5/6

I bought the last two unrenovated 2 bed condos for ~$36K each in 2012. Concurrently there was one renovated 2 bed condo in escrow for $190K!

I renovated them, flipped the first for $130K. But events 5/6

unfolded outside the window to the 2nd unit that made it seemingly unsellable.

I'll share the 2nd part to this story next week. If you've enjoyed this thread please Retweet it!

If you'd like more details on this deal please check out my blog: https://inefficientpursuits.com/2021/01/06/making-markets-in-senior-community-condos/ 6/6

I'll share the 2nd part to this story next week. If you've enjoyed this thread please Retweet it!

If you'd like more details on this deal please check out my blog: https://inefficientpursuits.com/2021/01/06/making-markets-in-senior-community-condos/ 6/6

Read on Twitter

Read on Twitter