I used to be scared to invest my money.

I’ve now made more money investing than I made at my job.

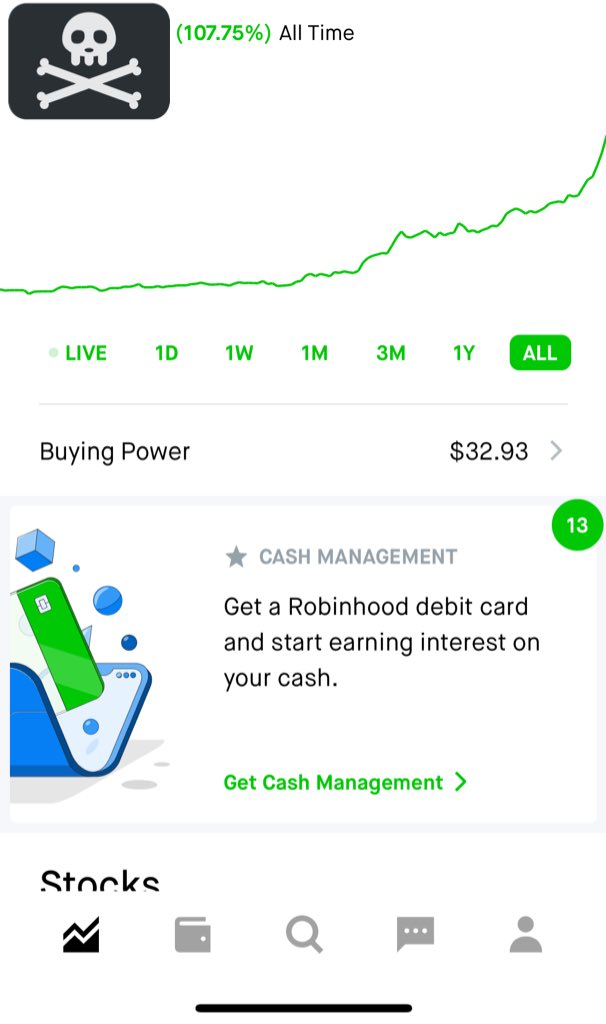

I’ve doubled my money using Robinhood and buying only assets I want to hold for > 10 years

Here’s what happened:

I’ve now made more money investing than I made at my job.

I’ve doubled my money using Robinhood and buying only assets I want to hold for > 10 years

Here’s what happened:

Context/

I was a saver. I still hate spending money.

While saving, I tried so hard to protect the money I had, that I became risk adverse and I missed out on investing opportunities that were obvious to me

I was a saver. I still hate spending money.

While saving, I tried so hard to protect the money I had, that I became risk adverse and I missed out on investing opportunities that were obvious to me

Saving is smart. You should try to always keep some powder dry and live below your means.

My problem was that I had dry powder, but didn’t want to pull the trigger because I was scared to lose it.

My problem was that I had dry powder, but didn’t want to pull the trigger because I was scared to lose it.

I kept seeing the same pattern over the years... I would do research on a company or other asset I heard about. I would gain conviction but, fail to pull the trigger.

One day, I had enough.

One day, I had enough.

I realized that my girlfriend was making money in the stock market based on our conversations.

At the time, She didn’t make as much $$ as me at her job, but her wealth was growing much faster. I was happy that she was crushing it, but, I felt very stupid.

At the time, She didn’t make as much $$ as me at her job, but her wealth was growing much faster. I was happy that she was crushing it, but, I felt very stupid.

I asked myself: If I was having the insights, why is she making the money?

Answer.

She knew herself better than I knew myself AND she knew me better than I knew myself. She knew I was giving her good information but, I didn’t trust myself. Not enough to risk my money on it

Answer.

She knew herself better than I knew myself AND she knew me better than I knew myself. She knew I was giving her good information but, I didn’t trust myself. Not enough to risk my money on it

I’m naturally curious and spend as much of my time as possible researching things I’m interested in. Mostly science, technology and businesses.

I was learning but, getting nothing else. Meanwhile, she was profiting.

I was learning but, getting nothing else. Meanwhile, she was profiting.

Here’s how I did it/

I had to commit. So I put money into Robinhood. *It had the lowest barrier to start.

My goal was to to capture the personal insights I had about a company or technology and translate that into growth.

I had to commit. So I put money into Robinhood. *It had the lowest barrier to start.

My goal was to to capture the personal insights I had about a company or technology and translate that into growth.

I had plenty of excess income because of my frugal habits. So each month I invested 1/3 of my monthly salary.

No set day of the month to invest it, no automation. I just bought stocks or other assets like crypto when I had the conviction. I tried to use all my capital.

No set day of the month to invest it, no automation. I just bought stocks or other assets like crypto when I had the conviction. I tried to use all my capital.

I will publish my full thesis about how I pick assets another day.

Stay tuned for that

Stay tuned for that

Result/

After the three months (and one months salary invested), I had made more money investing than I made at my job. I have returns of over 100% in companies and assets I want to hold for ten years or more.

After the three months (and one months salary invested), I had made more money investing than I made at my job. I have returns of over 100% in companies and assets I want to hold for ten years or more.

Note/

*This is short term. I started on September 2nd, 2020.

I wish the stocks and other things o own hadn’t gone up so much... I plan to hold these assets as long as I have conviction in them. And I will be buying more.

Long term investing is the only true form of investing

*This is short term. I started on September 2nd, 2020.

I wish the stocks and other things o own hadn’t gone up so much... I plan to hold these assets as long as I have conviction in them. And I will be buying more.

Long term investing is the only true form of investing

Action item/

Keep track of what you believe in and participate. Don’t seek approval or permission.

If you believe in an idea, company, or product, put your money or your time where your mouth is. You can learn a lot more from yourself than you think.

Keep track of what you believe in and participate. Don’t seek approval or permission.

If you believe in an idea, company, or product, put your money or your time where your mouth is. You can learn a lot more from yourself than you think.

This is a call to action for you to trust yourself.

Don’t wait to get involved with things you get a gut feeling about. That feeling where you know something but, don’t know why you know it. It means something. Trust yourself.

Don’t wait to get involved with things you get a gut feeling about. That feeling where you know something but, don’t know why you know it. It means something. Trust yourself.

Stay tuned for updates about my portfolio. You may get to watch it crash.

I’m going to be releasing two things in the near future.

1. An essay about how I choose assets (like stocks) to invest in AND how I chose companies to work for

2. Tools I’ve built to help me invest

I’m going to be releasing two things in the near future.

1. An essay about how I choose assets (like stocks) to invest in AND how I chose companies to work for

2. Tools I’ve built to help me invest

Read on Twitter

Read on Twitter