1) With the market up again after yesterday’s events, I think we must all take a look at current state of the market cycle and economy. In short, the economy is not productive, the virus is raging, geopolitical risk is at dangerous levels and asset prices are tremendously high.

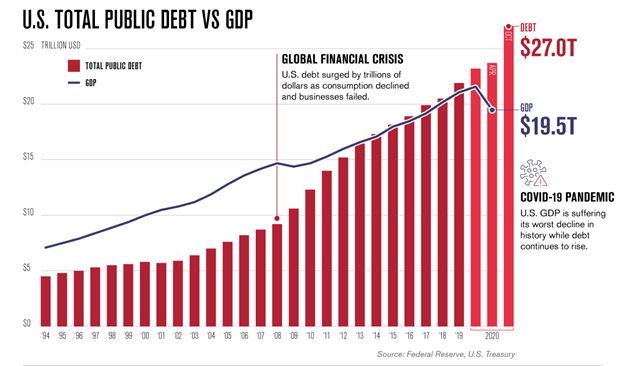

2) Yes, stimulus is coming, but $ isn’t free. We’re likely to approach $30 T in national debt by the end of 2021. That’s 2x where we were in 2012 and 5x where we were two decades ago. Stimulus without a path to productivity gains will put us at significant risk of stagflation.

3) The stimulus kept businesses alive and helped families weather the storm, but countless businesses have closed, trade lanes shut down and spending behavior permanently changed. Absent the stimulus, both earnings and spending are sharply down in 2020.

https://www.nytimes.com/2021/01/01/upshot/why-markets-boomed-2020.html?

https://www.nytimes.com/2021/01/01/upshot/why-markets-boomed-2020.html?

4) These effects are most acutely not by the bedrock of the economy – lower/middle income individuals and small business. Income inequality is approaching an all-time high and economic displacement is hard to recover from. https://www.cnbc.com/2020/10/23/coronavirus-is-exacerbating-economic-inequality-in-the-us.html

5) Despite these distressing signals, we are seeing all-time highs across nearly every asset class with prices going higher despite a coup attempt on our nation’s capitol.

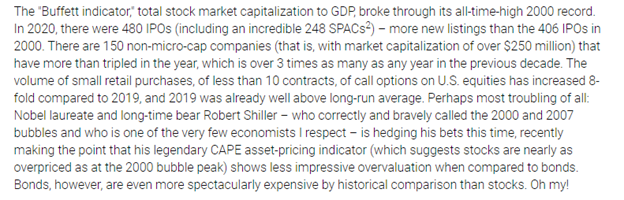

6) This is a highly concise and well-structured argument for where we are in the market cycle courtesy of GMO. TLDR, we are in the latest innings of US asset bubble. https://www.gmo.com/americas/research-library/waiting-for-the-last-dance/

7) While this has been long-coming, the acceleration of behavior and detachment away from fundamentals suggests an appetite for risk that is insatiable, but ultimately impossible to satisfy. This is the canary in the coal mine for MAJOR corrections.

8) As I spoke to the CIO of a major university endowment, they said that “risk is priced at an all-time low”. My vantage point is shorter, but I tend to agree.

9) While traditional valuation (e.g. p/e ratios), benchmarks (e.g. buffet ratio) and indices all suggest historically peak levels (despite an economy propped up by stimulus that is otherwise in shambles), more concerning are the psychological factors.

10) Perhaps most terrifying is the volume of retail options trading which is 8x what its ever been – this is the Robinhood effect.

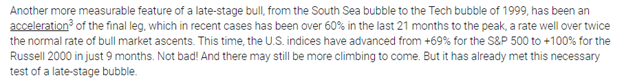

11) Dually, we’re seeing a run-up in equity values (as well as in private assets, crypto and other asset classes) that extends well above those of traditional bull-runs and devoid of underlying economic support.

12) This is characteristic late-cycle behavior. The nature of these runs occurs as late movers seek the last profit pools, eroding any potential for upside. This run has been so long-standing that retail investors believes these valuations are “normal”, which is indeed scary.

13) As Jeremy Grantham of GMO puts it “The great bull markets typically turn down when the market conditions are very favorable, just subtly less favorable than they were yesterday. And that is why they are always missed.”

14) FWIW, Jeremy and his firm has been a huge beneficiary of this with his position in $QS (a pre-revenue company valued at nearly $40B just a few weeks ago) still being years away from having a commercial product or any revenue.

15) Listening to the words of investors like GMO is always preferable to those from banks who have a bias for bullishness. Their job is to sell and they profit during bull-markets. Don’t expect goldman to make a bear call until its already in place and the music has stopped.

16) Timing market cycles is nearly impossible and I tend to follow the @howardmarks school of thought, choosing not to time the market, but gauge where we are in the cycle. For me, it seems we are in the final legs.

17) For me, a return to heuristics seems like an inevitability. With Dems controlling the senate and more stimulus to come, inflation is coming. This likely will lead to a rotation from equities to bonds that will deflate equity markets and cascade through other asset classes.

18) While this is concerning, investment careers can be made during times like these. I graduated college just before the recession and "going big" into the market in 2009 was one of the best investment decisions I’ve made (some of these equity positions are up >20x since then)

19) Figuring out where to be when the hammer drops (and it always, inevitably does) and how to play this game will be incredibly impactful for all investors – public or private.

20) For those looking at yesterday's events and trying to rationalize them amongst this landscape, consider the many forms of psychological bias that enable Americans to normalize the juxtaposition for these contradictory events. As humans, we succumb to recency bias easily.

21) This behavior, both in politics and markets. Is NOT normal. Countless folks highlighted that our democracy was impenetrable and that Trump was "done" when the election happened. Politics aside, they were wrong and likely would have never imagined yesterday just 2 months ago.

22) Understanding the past is the best way to have context on the present and the future. As a mentor once told me in reference to market cycles "It always feels like this time is different". While history doesn't repeat itself, it does rhyme.

23) In the meantime, stay safe, stay well and do your best to tread carefully amongst these volatile times. My greatest hope is that we can look toward a future that is brighter than today.

Read on Twitter

Read on Twitter