2) We have previously written about our reasoning behind investing in @ProjectSerum, a decentralized exchange (DEX) that has many benefits over centralized exchanges. However, DEXes are popular with certain kinds of users but are not for everyone.

3) Centralized exchanges play an equally critical role in the development of the crypto industry and still account for the vast majority of trading volume. The benefits of CEXes include:

4) - Consistently high liquidity

- Fast transaction speeds

- More complex trading types

- Insurance: most CEXes are insured and guarantee user funds

- Recovery: funds and account can be recovered. For non-custodial ex, if you lose your seed phrase, your assets are lost forever

- Fast transaction speeds

- More complex trading types

- Insurance: most CEXes are insured and guarantee user funds

- Recovery: funds and account can be recovered. For non-custodial ex, if you lose your seed phrase, your assets are lost forever

5) There are a range of options of crypto exchanges across geographies and product offerings, however we believe Delta is among the top for number of reasons; experienced team, constant innovation, consistent growth and momentum.

6) We invest in teams with a vision. Furthermore, we believe in blockchain and the crypto industry as a means of democratizing finance and giving access to wealth creation opportunities to the masses.

7) We believe in supporting the development and ongoing maturity of the industry so that more and more people will learn of its benefits and view it as a viable alternative to traditional finance.

8) In line with these values we are proud to announce our investment in Delta Exchange. Delta is a crypto derivatives exchange based in India, with global ambitions, offering futures, options, perpetual swaps, interest and calendar spreads among other advanced products.

9) Before getting into Delta, let’s explore the increased interest in crypto derivatives on a global scale and the potential of the Indian crypto derivatives market at a solid foothold.

10) Global Crypto Derivatives Market

- The demand for crypto derivatives has grown significantly in 2020. BTC and ETH derivatives have grown vastly throughout 2020 as large platforms such as Deribit, CME Group, OKEx and Binance have been offering futures and options services

- The demand for crypto derivatives has grown significantly in 2020. BTC and ETH derivatives have grown vastly throughout 2020 as large platforms such as Deribit, CME Group, OKEx and Binance have been offering futures and options services

11) - As new institutions like Microstrategy and MassMutual are entering the industry, seeking a hedge for the USD dollar as well as traditional markets affected by the pandemic, crypto derivatives are becoming more popular.

12) - In addition to the Bitcoin futures and options currently available, the CME will be launching Ether futures in February this year, which we expect to further amplify the interest of crypto derivatives markets.

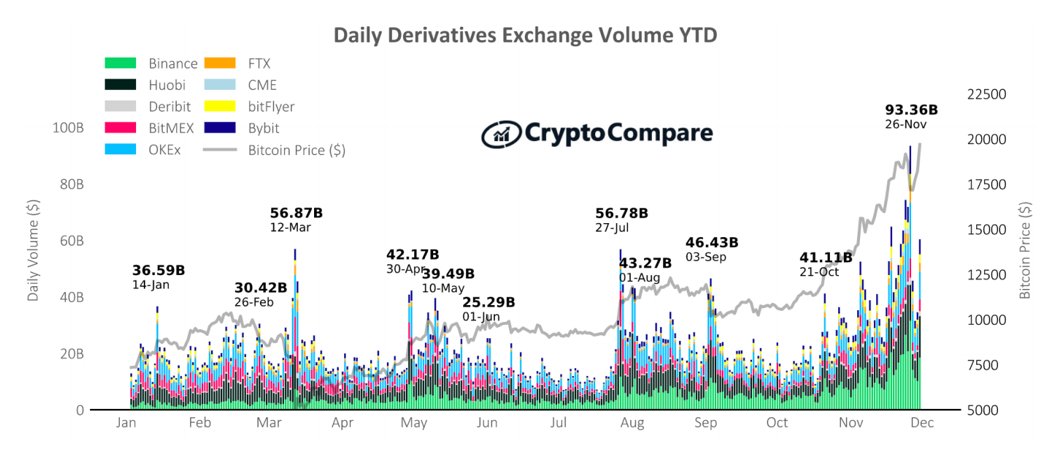

13) - The incumbent derivatives exchanges have set a new ATH daily volume record in 2020, reaching $93.36 billion in November. This number almost doubled the previous record of $56.87 billion on the 12th of March 2020.

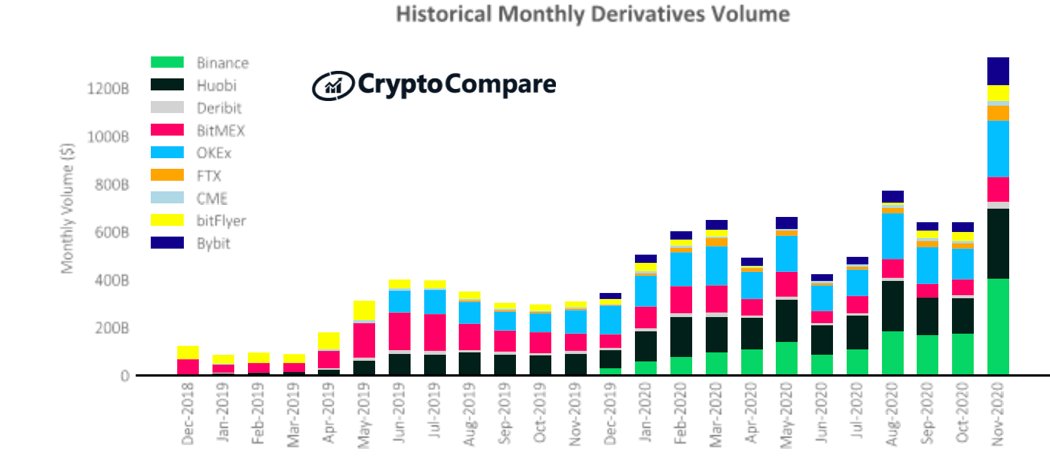

14) - Total monthly crypto derivatives volume almost doubled in the month of November to a new ATH of $1.32 trillion, while total spot volume rose to $906 billion. The derivatives market now accounts for nearly 60% of the entire crypto market, up from ~50% in the month of October

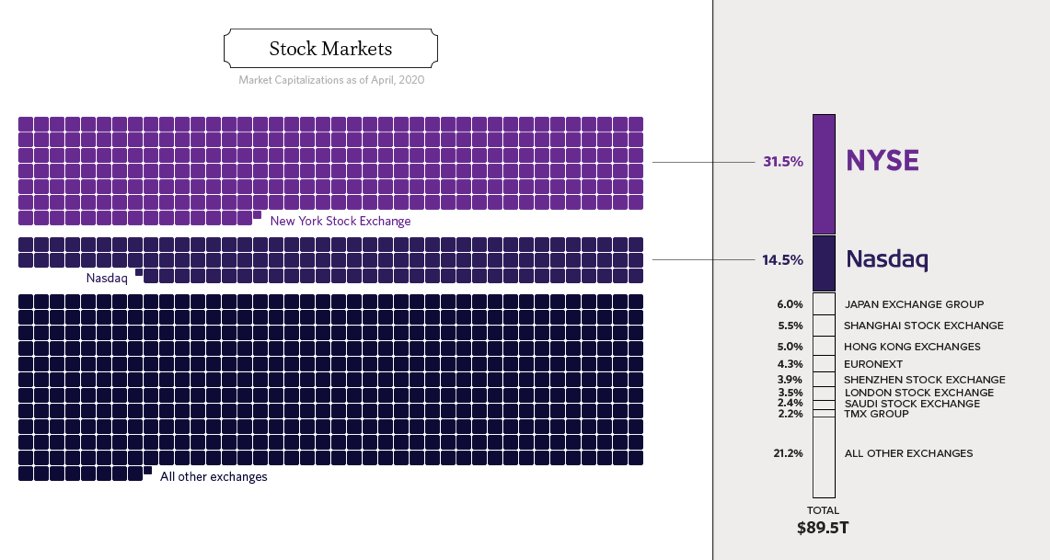

15) - Derivatives @ 60% of total market may sound impressive, until you look at TradFi. Some estimates put the derivatives market as worth more than the world’s total financial assets. Estimating the combined value of global stocks + debt to 343 trillion, and low-end estimates…

16) ... of the combined gross + notional value of the global derivatives market at 570 trillion, the traditional derivatives market is ~66% higher than global debt + equity. High-end est. of market size ($1 quadrillion in notional value) would put this percentage much higher.

17) - For a visual look at the sheer scale of the traditional derivatives market, and where we got these estimates, Visual Capitalist ( https://www.visualcapitalist.com/all-of-the-worlds-money-and-markets-in-one-visualization-2020/) is worth a look.

18) The Indian Crypto Landscape

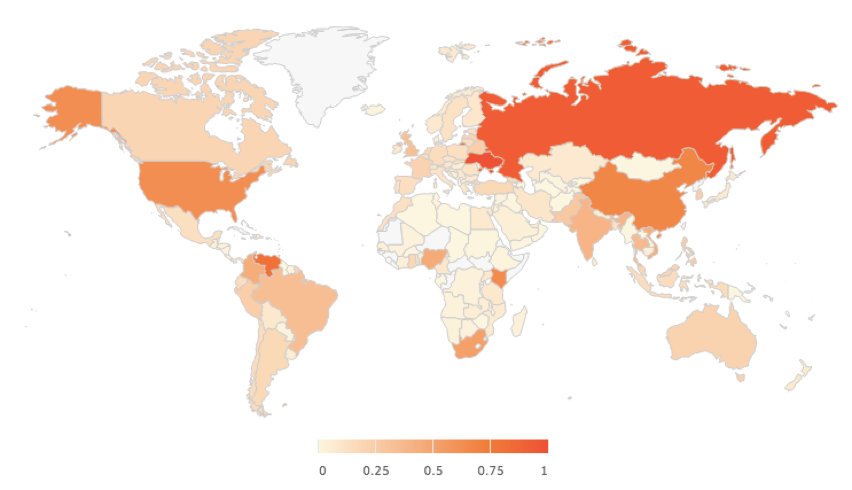

- India is growing in crypto adoption, and still has a lot of potential.

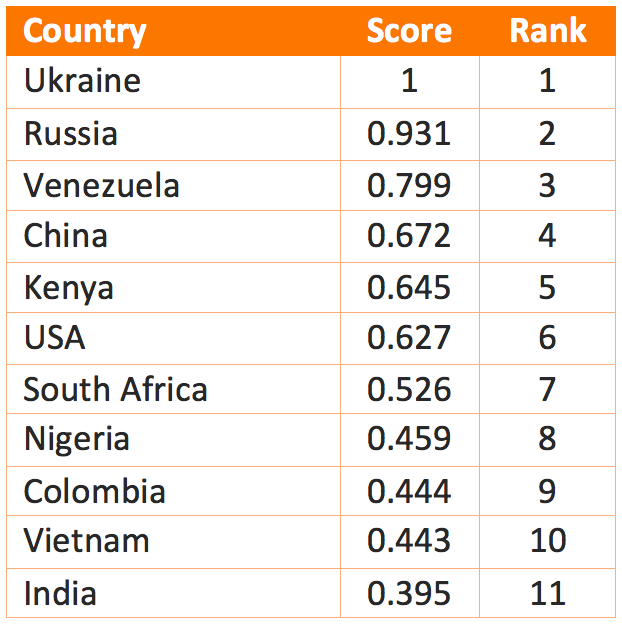

- Chainalysis Global Crypto Adoption Index places India as 11th globally.

- India is growing in crypto adoption, and still has a lot of potential.

- Chainalysis Global Crypto Adoption Index places India as 11th globally.

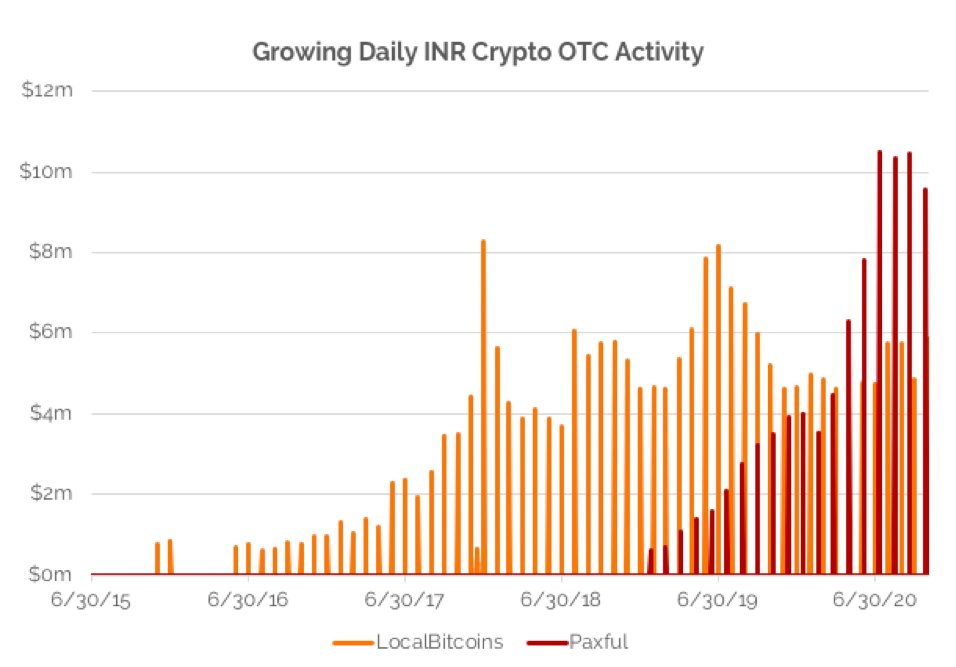

19) - Another oft-cited measure of adoption is LocalBitcoins volume, including this report from August 2018 (source: http://coin.dance ):

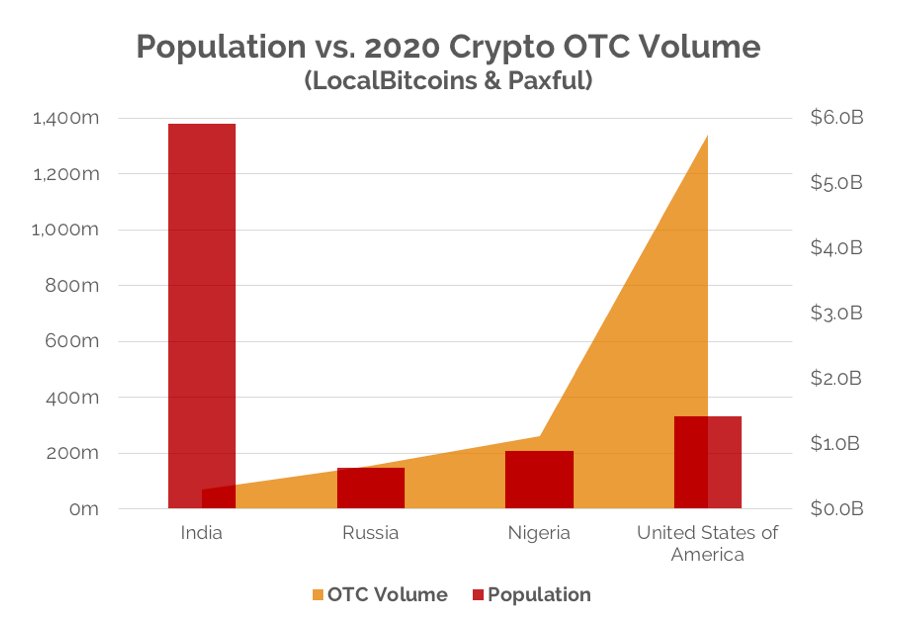

20) - We did our own up-to-date research using data published by LocalBitcoins and Paxful as a proxy for interest in crypto among the general public for some of the top countries listed for adoption:

21) - As you can see India has still of lot of growth potential compared to other nations in adoption by the general public, and interest is growing:

22) - While crypto popularity among the general public is a long term positive sign for Delta, the key engine of future growth for the company lies in India’s untapped pool of sophisticated traders.

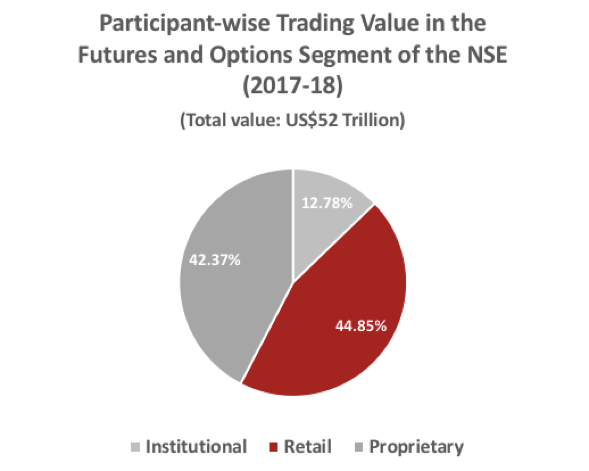

23) - The appetite among Indian traders for derivatives in undeniable. In 2019, the National Stock Exchange of India (NSE) surpassed the US based CME Group to become the world’s largest derivatives market by volume (Source: https://www.fia.org/media/2407 ):

24) - Delta has global ambitions with a unique opportunity to dominate the Indian market in crypto derivatives and use this base to grow internationally. We expect growth in crypto derivatives to outpace spot in the future as the product mix falls more in line with TradFi.

25) - We believe is on par or better with many other players in global crypto derivatives in innovation and speed of execution.

26) - Delta is in a unique position to become a major player in the global crypto derivatives industry, leveraging its foothold in the growing Indian crypto derivatives market, being led by a team who understands the market intimately and has the know-how to execute.

27) - This is Delta Exchange:

28) Delta Exchange

- The Delta team led by @pankaj_delta_ex is among the best qualified we have encountered. Cofounders have worked in financial markets & derivatives trading at Citi, UBS and GIC. CTO is a serial entrepreneur with a track record of building products at scale.

- The Delta team led by @pankaj_delta_ex is among the best qualified we have encountered. Cofounders have worked in financial markets & derivatives trading at Citi, UBS and GIC. CTO is a serial entrepreneur with a track record of building products at scale.

29) - Current daily volume on the exchange averages around $70 million, however we believe that is just the beginning.

30) - The team are carving out a niche as the go-to crypto exchange for sophisticated traders. Looking at a breakdown of the traditional derivatives market in India; retail traders are the largest participants, narrowly beating institutionals:

31) - These traders view crypto as just another asset class and can be more easily on-boarded than first timers.

32) - As Delta is led by a team of veteran derivatives experts, they are in a better position to onboard sophisticated traders and prop desks because they know the industry and the people in it.

33) - In addition, the team are constantly adding new features to the platform and creating incentives using the native platform token; DETO. These features include:

34) -- Introduction of AMMs; AMMs will be created where anyone can commit capital. Delta will provide algorithms & intelligence for these pools. DETO, the native token of Delta, will be rewarded and distributed amongst LPs in proportion of their share of the pool.

35) -- Trade incentives: Traders will receive DETO as cash-back in proportion to their trading on Delta Exchange.

36) -- Users who use DETO can pay some of their trade fees in DETO (up to 25% of the fee) and avail of a minimum price floor of $0.10.

37) -- Once a stable price for DETO is available, staking yield will be provided to backstop the insurance fund. This will disincentivise farm & dump.

38) Conclusion

In summary, India is a growing cryptocurrency market and established derivatives market with tremendous opportunity for the right team and product. Dominating this market creates a strong base to expand into the growing global derivatives market.

In summary, India is a growing cryptocurrency market and established derivatives market with tremendous opportunity for the right team and product. Dominating this market creates a strong base to expand into the growing global derivatives market.

39) Delta is a sophisticated exchange built buy a team who understands the derivatives and crypto markets and has the know-how to seize market share. We look forward to helping them realize their potential in the future.

Read on Twitter

Read on Twitter