So the best place to start with our investing threads is “How is investing halal?”

I’ll be referring to the guidance given by Mufti Taqi Usmani and Mufti Faraz Adam throughout (the OGs in Islamic finance). This thread might be long but I hope it gives clarity.

I’ll be referring to the guidance given by Mufti Taqi Usmani and Mufti Faraz Adam throughout (the OGs in Islamic finance). This thread might be long but I hope it gives clarity.

Essentially, companies can be split into 3 categories: Shariah compliant business and financials, non-Shariah compliant business, and Shariah compliant business with mixed financials.

Here’s a breakdown of each category.

Here’s a breakdown of each category.

1. Shariah compliant business and financials:

These are businesses where the business itself is halal (halal food, clothing, medicine, tech) AND the financials are halal (no interest bearing debt or interest income etc.)

In todays world, you won’t be finding any like this.

These are businesses where the business itself is halal (halal food, clothing, medicine, tech) AND the financials are halal (no interest bearing debt or interest income etc.)

In todays world, you won’t be finding any like this.

This is because the modern economic system is not an Islamic one. A company can leave their cash in a interest bearing account or take out interest bearing loans because that’s just what’s out there. Unless we live in an entirely Islamic economic system, we can’t avoid this.

2. Non-Shariah compliant business:

Now, this one is easy. If the business itself is haram, avoid investing entirely. So, no banks (majority of income purely gained from interest), no breweries (alcohol), no mediums that profit of pornography/music etc etc.

You get it.

Now, this one is easy. If the business itself is haram, avoid investing entirely. So, no banks (majority of income purely gained from interest), no breweries (alcohol), no mediums that profit of pornography/music etc etc.

You get it.

3. Shariah compliant business but mixed financials:

Now here’s the bit where we have to go into more detail. Don’t fall asleep cos this is where it’s important.

Many companies fall into this area where their business is Shariah compliant but they have debt or money in a bank.

Now here’s the bit where we have to go into more detail. Don’t fall asleep cos this is where it’s important.

Many companies fall into this area where their business is Shariah compliant but they have debt or money in a bank.

The contemporary scholars permit the investing in companies such as these but with a ‘screening criteria’. This is to ensure that the interest income is negligible and the debt levels are low. So, what conditions, agreed by the scholars, make up this criteria?

Remember, a company has to meet ALL the following conditions to be permissible.

Condition 1: The business is actually halal and ethical. So companies in clean energy, tech, clothing etc. are all great! However, are they involved in something unethical? Do your research!

Condition 1: The business is actually halal and ethical. So companies in clean energy, tech, clothing etc. are all great! However, are they involved in something unethical? Do your research!

The rest of the conditions I’ll be detailing are set and agreed by Mufti Taqi Usmani, Mufti Faraz Adam and used by all these guys:

Condition 2: Total interest-bearing debt is no greater than 33% of the total assets of the company.

Condition 3: Impermissible income (eg interest) is no greater than 5% of total revenue

Condition 4: The sum of the illiquid assets is greater or equal to 20% of total assets

Condition 3: Impermissible income (eg interest) is no greater than 5% of total revenue

Condition 4: The sum of the illiquid assets is greater or equal to 20% of total assets

Condition 5: The market cap is larger than the net liquid assets.

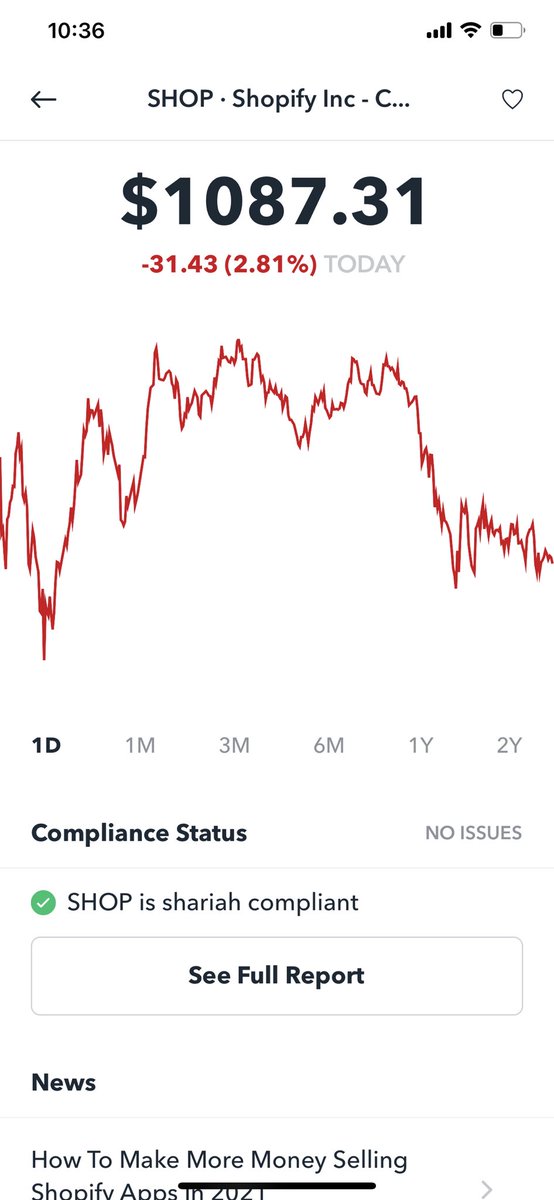

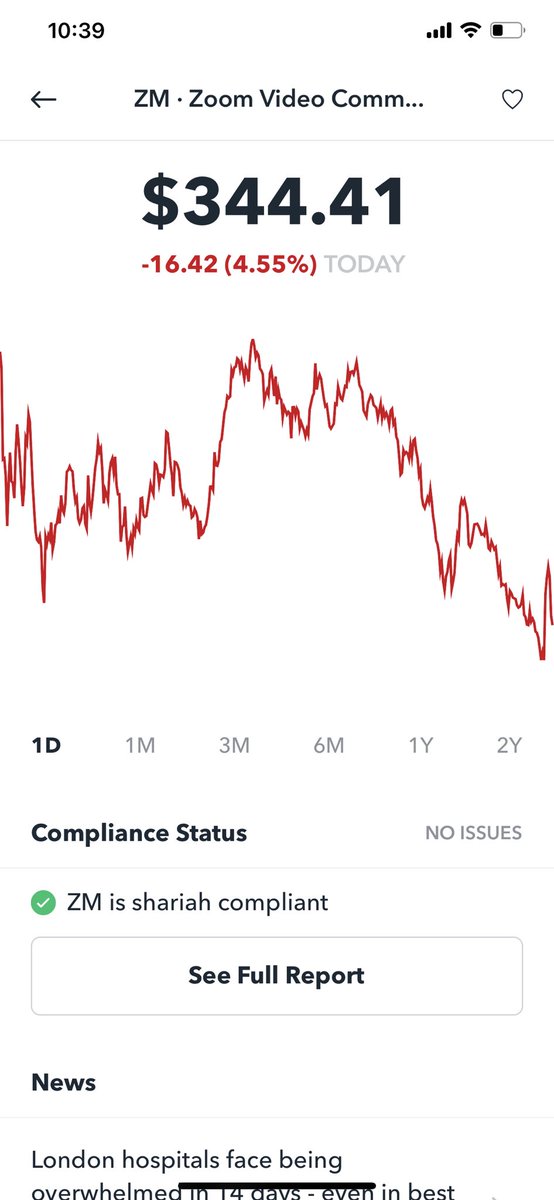

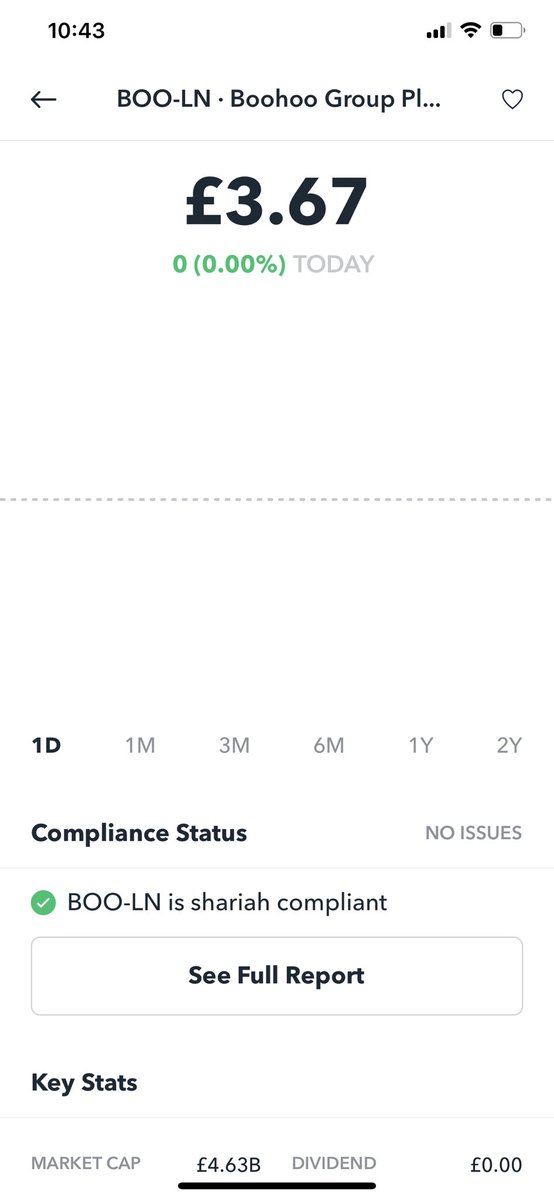

Now, some of these might sound like gibberish to you so Alhamdulillah for @zoyafinancial who do the checks for you.

Just type in what stock you’re looking at, and see if it’s compliant or not. Very handy!

Now, some of these might sound like gibberish to you so Alhamdulillah for @zoyafinancial who do the checks for you.

Just type in what stock you’re looking at, and see if it’s compliant or not. Very handy!

Just be careful though, @zoyafinancial don’t really have any “ethics” check when they screen. I think it’s purely financial. For example, I wouldn’t invest in Boohoo due to confirmed slave labour reports, but on Zoya, it’s halal. Basically, do your own research always!

Okay so, that just about covers that. Here’s a link to a full article from the amazing guys at @IFguru that go into it all in a bit more detail: https://forum.islamicfinanceguru.com/t/fatwa-is-share-stock-trading-halal-can-you-invest-in-the-stock-market/16

Lastly, if you’d like to start investing, the easiest platform with the least fees has to be Trading212. Especially in the UK.

So, here’s a referral link that’ll give you a free share worth up to £100 once you deposit money

http://www.trading212.com/invite/FzKe289r

So, here’s a referral link that’ll give you a free share worth up to £100 once you deposit money

http://www.trading212.com/invite/FzKe289r

I’ll do daily threads that basically covers everything I know. Which isn’t much so will probs be like 3 more threads  .

.

Make dua for me pls. Jzk khair

.

.Make dua for me pls. Jzk khair

Read on Twitter

Read on Twitter