1/23

Having spent some time reading around the various vanadium market news, I believe we're about to see prices move north once more, be it that it may be in stages.

Prices across the board have gone quiet, following a minor pull back in China over the last week or so.

#BMN

Having spent some time reading around the various vanadium market news, I believe we're about to see prices move north once more, be it that it may be in stages.

Prices across the board have gone quiet, following a minor pull back in China over the last week or so.

#BMN

2/

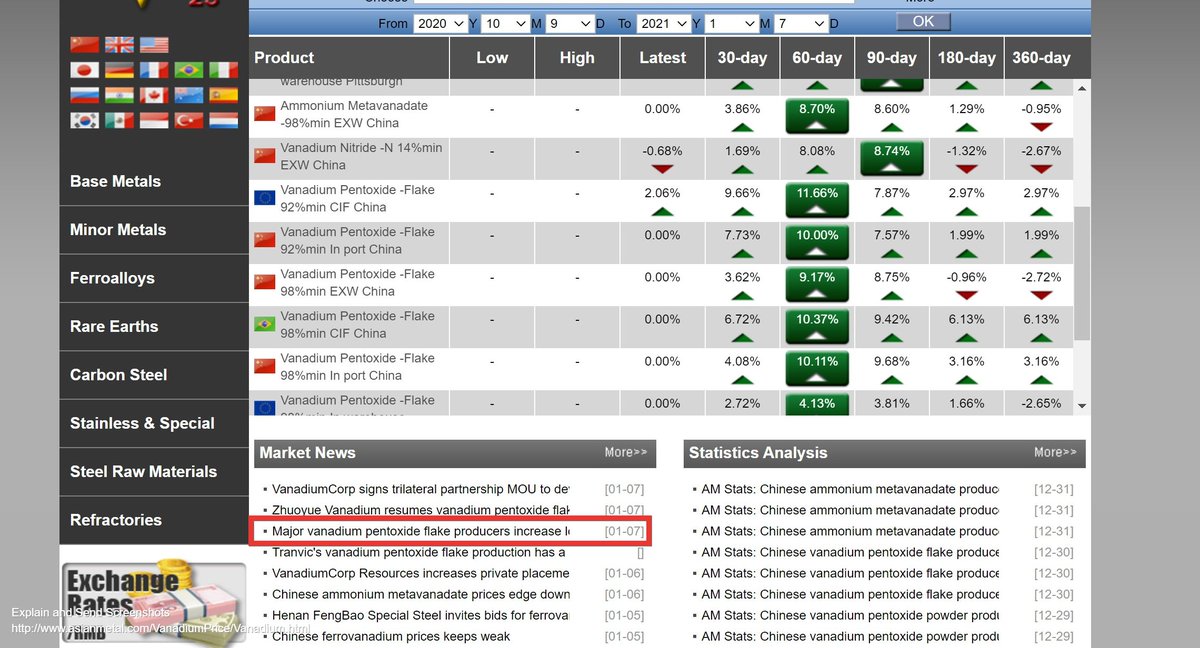

In addition, there are clear signs that downstream manufacturers are struggling to acquire raw material inputs such as Pentoxide flake.

I have seen several examples of this over/before the Christmas period and its popped its head up once more today (see marked story below)

In addition, there are clear signs that downstream manufacturers are struggling to acquire raw material inputs such as Pentoxide flake.

I have seen several examples of this over/before the Christmas period and its popped its head up once more today (see marked story below)

3/

The title being "major vanadium pentoxide flake producers increase long term prices for January."

It is these elements that help affirm my belief that we will see a another run up in prices, before the Chinese New Year in early Feb.

The title being "major vanadium pentoxide flake producers increase long term prices for January."

It is these elements that help affirm my belief that we will see a another run up in prices, before the Chinese New Year in early Feb.

4/

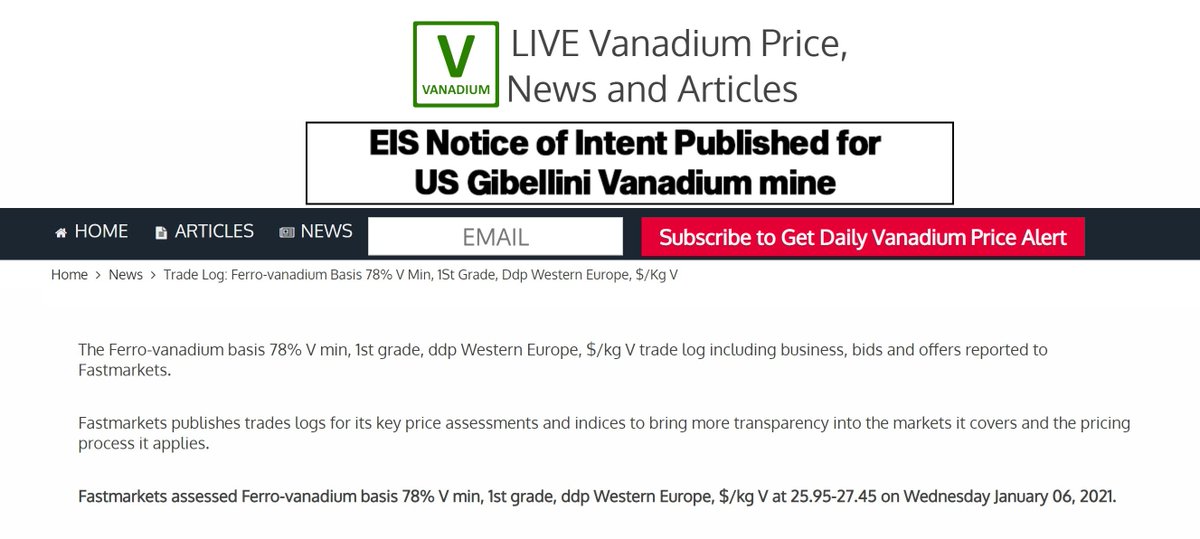

To this we can dd the fact that European FeV prices are now averaging c. $26.75 per kg, which means another of BMN's key markets is now more comfortably profitable, as we enter 2021.

Important to appreciate that BMN profitability for Nitrovan/FeV commences at around $24,

To this we can dd the fact that European FeV prices are now averaging c. $26.75 per kg, which means another of BMN's key markets is now more comfortably profitable, as we enter 2021.

Important to appreciate that BMN profitability for Nitrovan/FeV commences at around $24,

5/

be it that Nitrovan arguably realises a premium.

None of which of course includes Vanchem, which has a lower total cash cost and produces mainly different products, which BMN are clearly leveraging with Vametco to increase overall profitability.

be it that Nitrovan arguably realises a premium.

None of which of course includes Vanchem, which has a lower total cash cost and produces mainly different products, which BMN are clearly leveraging with Vametco to increase overall profitability.

6/

Still this push further into profitability really shouldn't be taken for granted because it significantly enhances the financial investment made by Orion because it signals that the business has stronger options, as positive cash flow increase.

Still this push further into profitability really shouldn't be taken for granted because it significantly enhances the financial investment made by Orion because it signals that the business has stronger options, as positive cash flow increase.

7/

Covid still remains a near term risk and must be monitored closely and not too easily dismissed but its a threat that should continue to diminish as the year unfolds and in terms of China, vanadium's biggest market, it remains (right now) under a tight leash.

Covid still remains a near term risk and must be monitored closely and not too easily dismissed but its a threat that should continue to diminish as the year unfolds and in terms of China, vanadium's biggest market, it remains (right now) under a tight leash.

8/

There are several areas of the BMN business I would like to have more insight into, as we start 2021 but the plans for the Orion funds and the programme of events that will unfold from it, are certainly very high on my agenda.

This is not only related to actual overall...

There are several areas of the BMN business I would like to have more insight into, as we start 2021 but the plans for the Orion funds and the programme of events that will unfold from it, are certainly very high on my agenda.

This is not only related to actual overall...

9/

...increases in production for the group but also how soon Vanchem can expand and therefore deliver even more diversified products, as well as those electrolyte chemicals, which combined, further de-risk the business as a whole.

To all of the above, we must then add in the...

...increases in production for the group but also how soon Vanchem can expand and therefore deliver even more diversified products, as well as those electrolyte chemicals, which combined, further de-risk the business as a whole.

To all of the above, we must then add in the...

10/

...speculative element.

Commodities are clearly back in favour with the expectation that pent up consumer spending, will follow as successful roll out and effect of current vaccines.

Vanadium as good a case as any in that world, particularly given that China is benefiting..

...speculative element.

Commodities are clearly back in favour with the expectation that pent up consumer spending, will follow as successful roll out and effect of current vaccines.

Vanadium as good a case as any in that world, particularly given that China is benefiting..

11/

...as much as anyone from the stimulus checks being and about to be fed, to so many Americans.

That means further expansion and further demand in Chinese steel markets, which surely isn't going unnoticed and will surely lead to speculation.

Said speculation will only be...

...as much as anyone from the stimulus checks being and about to be fed, to so many Americans.

That means further expansion and further demand in Chinese steel markets, which surely isn't going unnoticed and will surely lead to speculation.

Said speculation will only be...

12/

...fueled further, if the market gets a sniff that these raw material shortages are a short term theme in 2021.

All of which feeds back into BMN and their brownfield expansion plans, which are the fastest means of expanding vanadium supply (stone coal aside).

...fueled further, if the market gets a sniff that these raw material shortages are a short term theme in 2021.

All of which feeds back into BMN and their brownfield expansion plans, which are the fastest means of expanding vanadium supply (stone coal aside).

13/

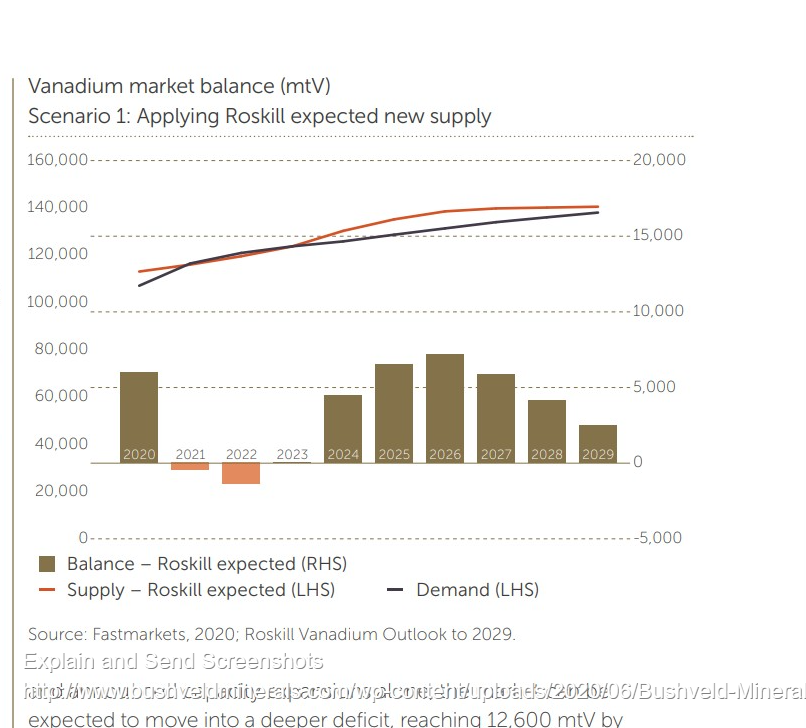

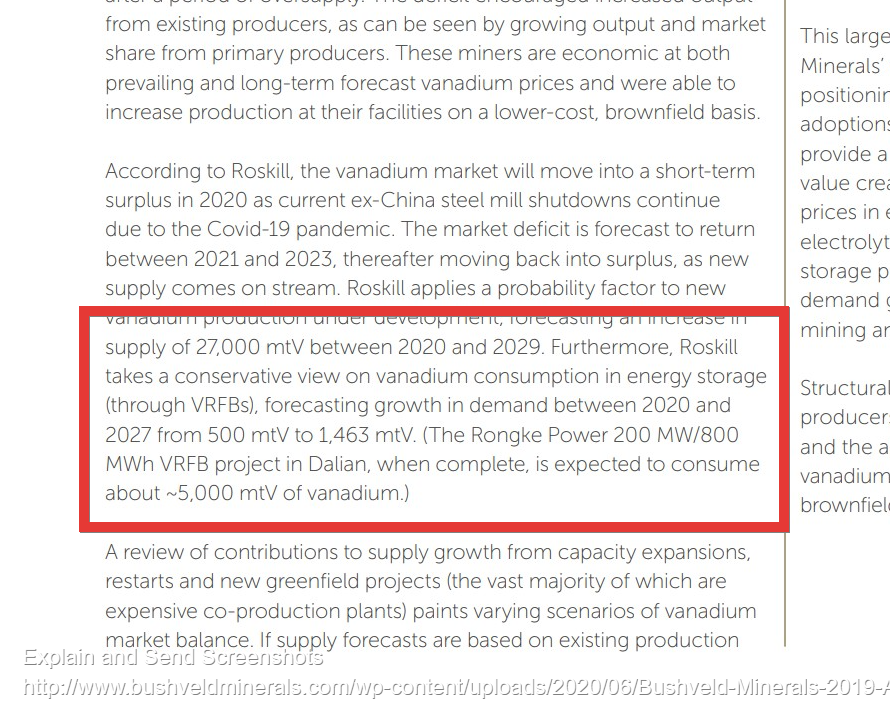

BMN are clearly aware of these elements, having themselves backed a (be it fairly limited) V supply shortage in 2021. So their plans and their execution periods and their ability to accelerate, will be well of analysis when they come.

BMN are clearly aware of these elements, having themselves backed a (be it fairly limited) V supply shortage in 2021. So their plans and their execution periods and their ability to accelerate, will be well of analysis when they come.

14/

This is further significantly enhanced by the fact that the above Roskill scenario, only allows for VRFB demand to rise from 500mtV in 2020, to 1,463mtV by 2027, meaning limited demand over 500mtV between 2021-23, as Roskill apply a expanding scale.

This is further significantly enhanced by the fact that the above Roskill scenario, only allows for VRFB demand to rise from 500mtV in 2020, to 1,463mtV by 2027, meaning limited demand over 500mtV between 2021-23, as Roskill apply a expanding scale.

15/

That scenario is highly unlikely correct as overly conservative parameters are always applied.

Dalian phase 2 at 100MW, is a prime example of that.

Invinity alone as of Oct 2020, had pushing 30MWh of work ready to go for 2021 and that clearly won't be the end of it,

That scenario is highly unlikely correct as overly conservative parameters are always applied.

Dalian phase 2 at 100MW, is a prime example of that.

Invinity alone as of Oct 2020, had pushing 30MWh of work ready to go for 2021 and that clearly won't be the end of it,

16/

as they gain even greater traction in 2021.

That 30MWh alone is c. 160mtV of vanadium demand, from one VRFB company.

So its easy to see that the 2021 deficit has legs and could be/should be, even wider than is currently anticipated.

as they gain even greater traction in 2021.

That 30MWh alone is c. 160mtV of vanadium demand, from one VRFB company.

So its easy to see that the 2021 deficit has legs and could be/should be, even wider than is currently anticipated.

17/

So we have a pending commodities bull market, a core steel market product, a potentially widening deficit driven by 2 markets, speculation and to top it all off, a possible reflation trend, driven by money supply expanding.

All of which points towards a very successful...

So we have a pending commodities bull market, a core steel market product, a potentially widening deficit driven by 2 markets, speculation and to top it all off, a possible reflation trend, driven by money supply expanding.

All of which points towards a very successful...

18/

...year for an already cashed up BMN, which has done its business in good time, in order to take advantage of this pending opportunity...

and we didn't even begin to talk about their green credentials, their VRFB aspirations, their assault on one of the biggest combined...

...year for an already cashed up BMN, which has done its business in good time, in order to take advantage of this pending opportunity...

and we didn't even begin to talk about their green credentials, their VRFB aspirations, their assault on one of the biggest combined...

19/

...VRFB projects in the world to date, which itself (given the size of its packages), if vanadium related, will only add to the V supply deficit in 2021/22.

Plus their guaranteed supply contracts with Invinity and Enerox, a story that is itself still to be told.

...VRFB projects in the world to date, which itself (given the size of its packages), if vanadium related, will only add to the V supply deficit in 2021/22.

Plus their guaranteed supply contracts with Invinity and Enerox, a story that is itself still to be told.

20/

All of which helps delivers the first fully integrated vanadium supply chain platform, which despite the wait, is being delivered with almost perfect timing, into the world we find ourselves in 2021.

I have said it many times before, a well balanced BMN business,

All of which helps delivers the first fully integrated vanadium supply chain platform, which despite the wait, is being delivered with almost perfect timing, into the world we find ourselves in 2021.

I have said it many times before, a well balanced BMN business,

21/

that is delivering strongly on steel and VRFB market supply (it doesn't need to be their own projects, merely demonstrate repeatable diversified supply into green labelled projects), itself demonstrates an ability to buck the cycle trend and deliver profits even during...

that is delivering strongly on steel and VRFB market supply (it doesn't need to be their own projects, merely demonstrate repeatable diversified supply into green labelled projects), itself demonstrates an ability to buck the cycle trend and deliver profits even during...

22/

...a downturn in mining.

At that point being an investor in BMN becomes even more exciting.

It has felt like BMN has been in a lull for a very long time but the reality is that during that time, a lot of the dirty work got done and its that work that should now start to...

...a downturn in mining.

At that point being an investor in BMN becomes even more exciting.

It has felt like BMN has been in a lull for a very long time but the reality is that during that time, a lot of the dirty work got done and its that work that should now start to...

23/

...show itself as this major energy revolution really starts to unfold.

That's why its my biggest holding and one of a very limited number of what i call alpha investments in my portfolio because the potential is in my view, absolutely enormous.

...show itself as this major energy revolution really starts to unfold.

That's why its my biggest holding and one of a very limited number of what i call alpha investments in my portfolio because the potential is in my view, absolutely enormous.

Read on Twitter

Read on Twitter