Thread.

On my new post. This is a massive ~7k words piece!

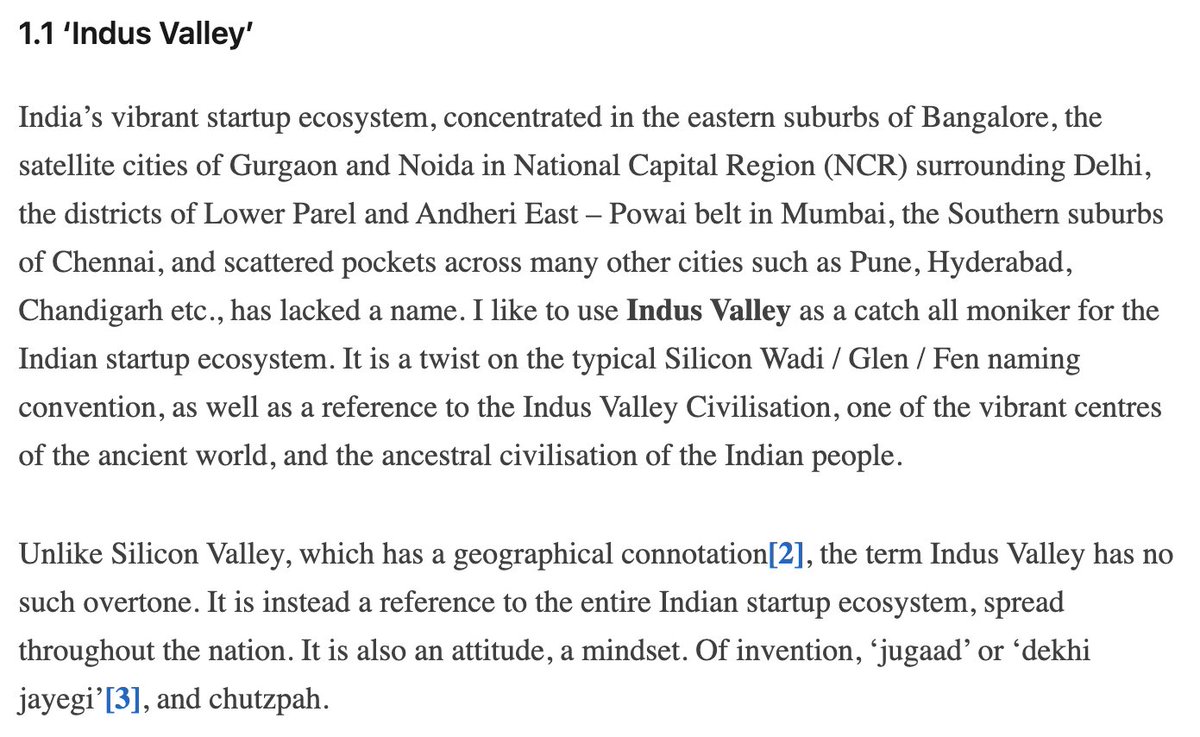

I write abt the 'Indus Valley' playbook. Indus Valley is tour desi startup ecosystem, and the Indus Valley playbook is the hacks, biz models & approaches needed to win in this unique ecosystem. https://www.linkedin.com/pulse/indus-valley-playbook-sajith-pai

On my new post. This is a massive ~7k words piece!

I write abt the 'Indus Valley' playbook. Indus Valley is tour desi startup ecosystem, and the Indus Valley playbook is the hacks, biz models & approaches needed to win in this unique ecosystem. https://www.linkedin.com/pulse/indus-valley-playbook-sajith-pai

First, the origin story.

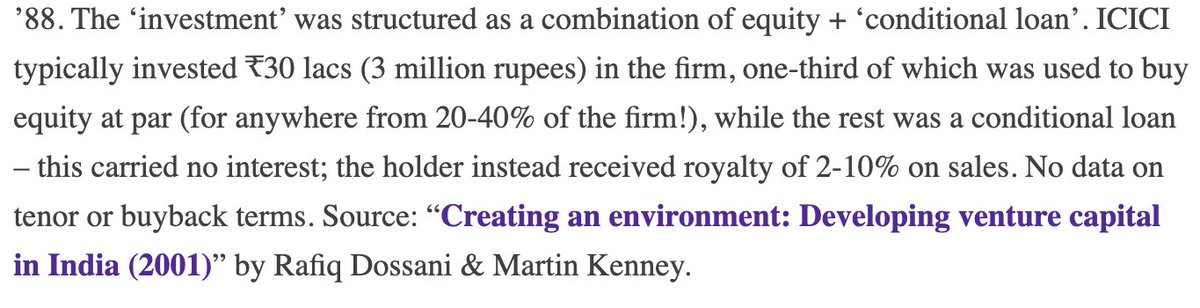

The Indian startup ecosystem was born in '85, when ICICI Ltd. did the 1st set of venture 'investments'.

They were structured unusually as a mix of equity + conditional loans.

Link to paper: https://drive.google.com/file/d/1jysvXlhE62gTjj6o5N6X2c9nxVd8Rbz6/view?usp=sharing

2/25

The Indian startup ecosystem was born in '85, when ICICI Ltd. did the 1st set of venture 'investments'.

They were structured unusually as a mix of equity + conditional loans.

Link to paper: https://drive.google.com/file/d/1jysvXlhE62gTjj6o5N6X2c9nxVd8Rbz6/view?usp=sharing

2/25

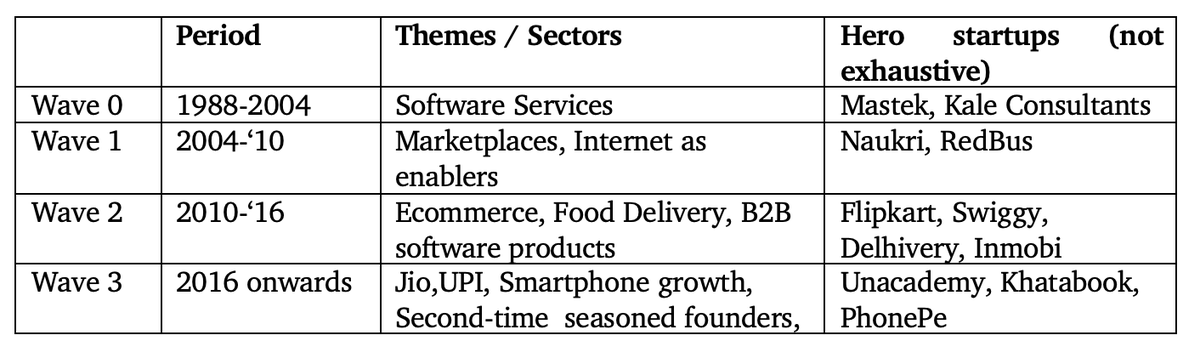

VC + the startup ecosystem steadily gathered steam in the '90s. Venture missed Infy, Wipro but got winners in Mastek and Kale Consultants.

After the late '90s boom, the '00-01 crash wiped out the nascent industry and a venture winter set in.

3/25

After the late '90s boom, the '00-01 crash wiped out the nascent industry and a venture winter set in.

3/25

As the decade wore on, the 1st wave of startup unicorns / soonicorns emerged - capital efficient cockroach startups such as @Naukri @redBus_in etc.

Soon @Flipkart @FreshworksInc etc emerged at the helm of Wave2. Hello ecommerce, hyperfunding, megarounds, Tiger etc.

4/25

Soon @Flipkart @FreshworksInc etc emerged at the helm of Wave2. Hello ecommerce, hyperfunding, megarounds, Tiger etc.

4/25

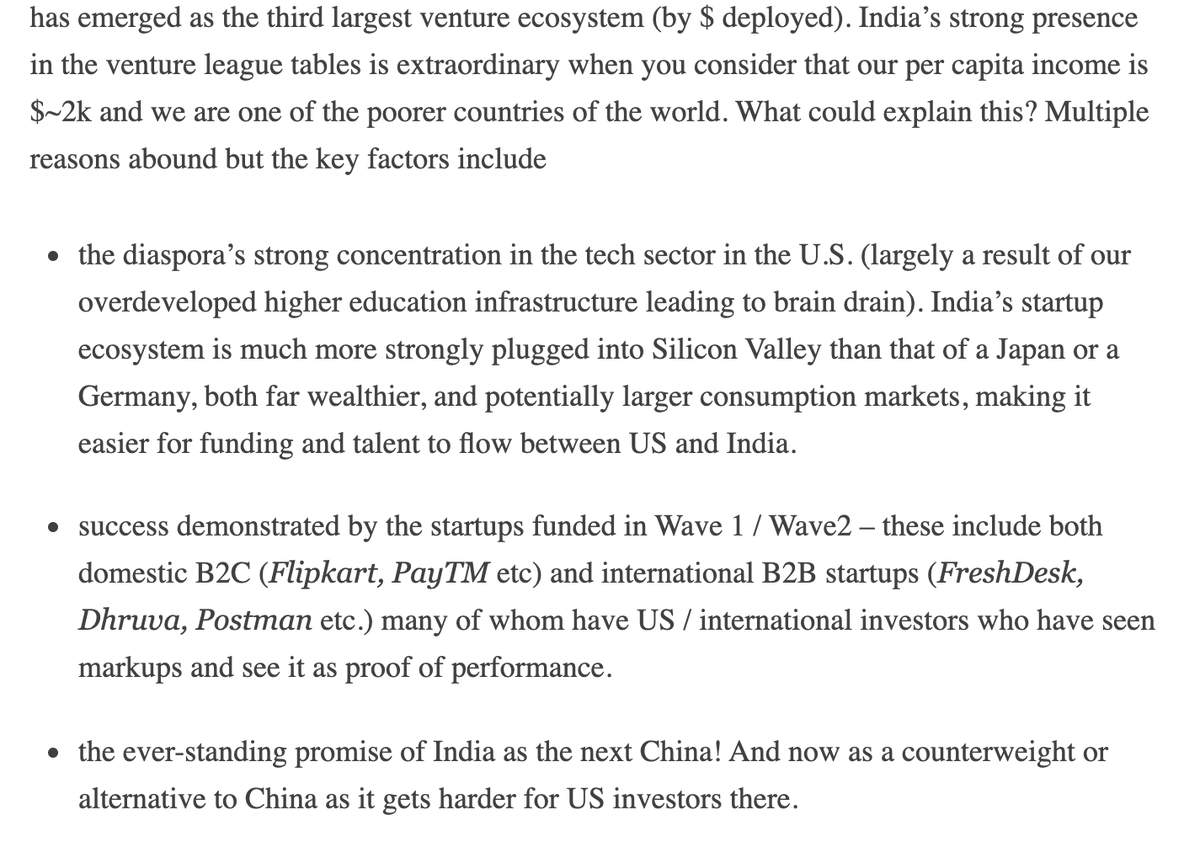

And now we have Wave3 post Jio. Hello UPI, 2nd time founders, edtech, mobile apps etc.

We have ~30 unicorns and we are the 3rd largest startup ecosystem by funding!

5/25

We have ~30 unicorns and we are the 3rd largest startup ecosystem by funding!

5/25

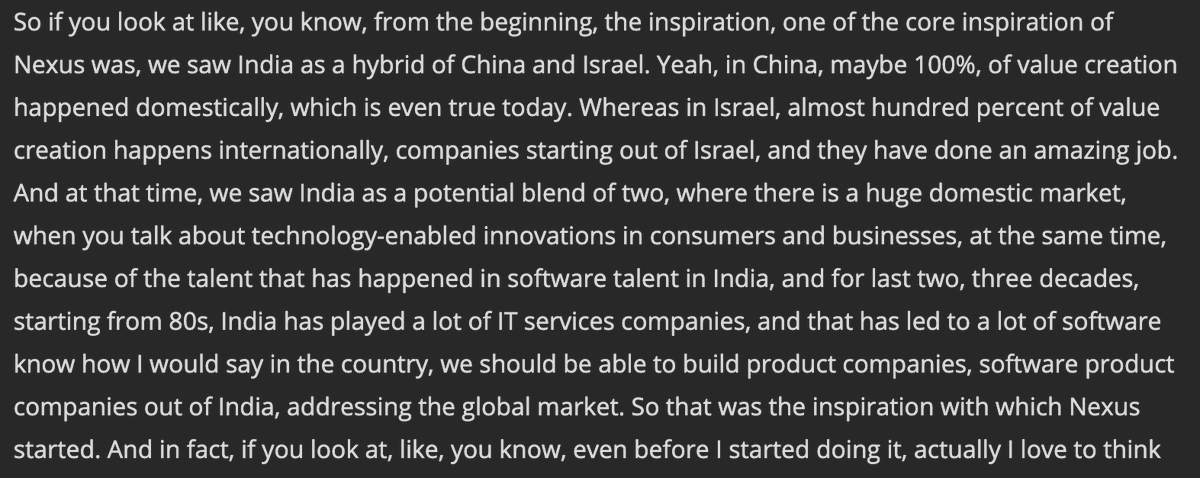

I love how @b_jishnu at @NexusVP sees India as a combo of Israel + China.

Image via his podcast w @siddharthaa7 @100xEntr

https://100xentrepreneur.com/podcasts/jishnu-bhattacharjee-managing-director-nexus-vp-on-the-success-recipe-of-druva-and-postman/

8/25

Image via his podcast w @siddharthaa7 @100xEntr

https://100xentrepreneur.com/podcasts/jishnu-bhattacharjee-managing-director-nexus-vp-on-the-success-recipe-of-druva-and-postman/

8/25

Indus Valley is guided + constrained by 5 forcing functions

- a small consuming class

- emergence of a 2-track consumer startup ecosystem

- presence of high-quality English-speaking tech workforce

- an underformalized enterprise space

- an over-indexed venture/startup ecosystem.

- a small consuming class

- emergence of a 2-track consumer startup ecosystem

- presence of high-quality English-speaking tech workforce

- an underformalized enterprise space

- an over-indexed venture/startup ecosystem.

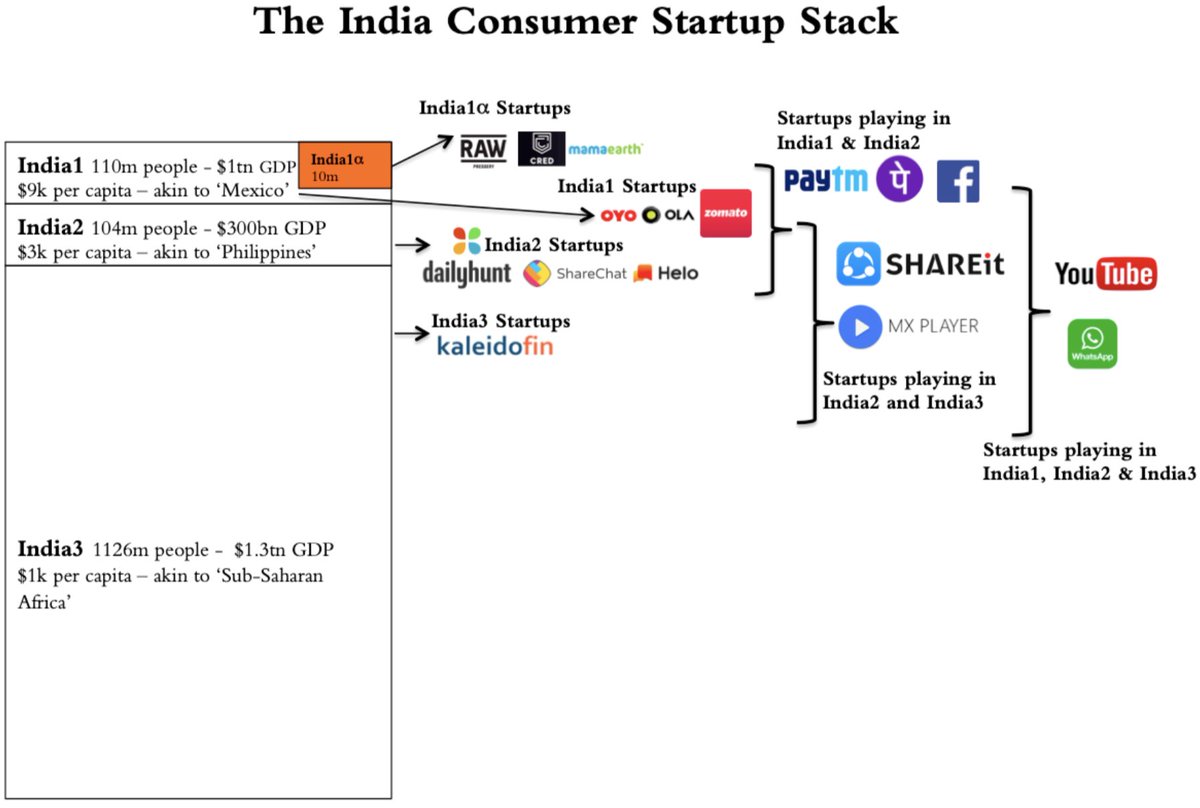

1+2) Much of spending thus far led by premium India1 consumers (~110m). India2 has another ~100m consumers but need distinct solutions given lower purchasing power.

Increasingly we are seeing the need for differentiated startup products to cater to these two markets.

10/25

Increasingly we are seeing the need for differentiated startup products to cater to these two markets.

10/25

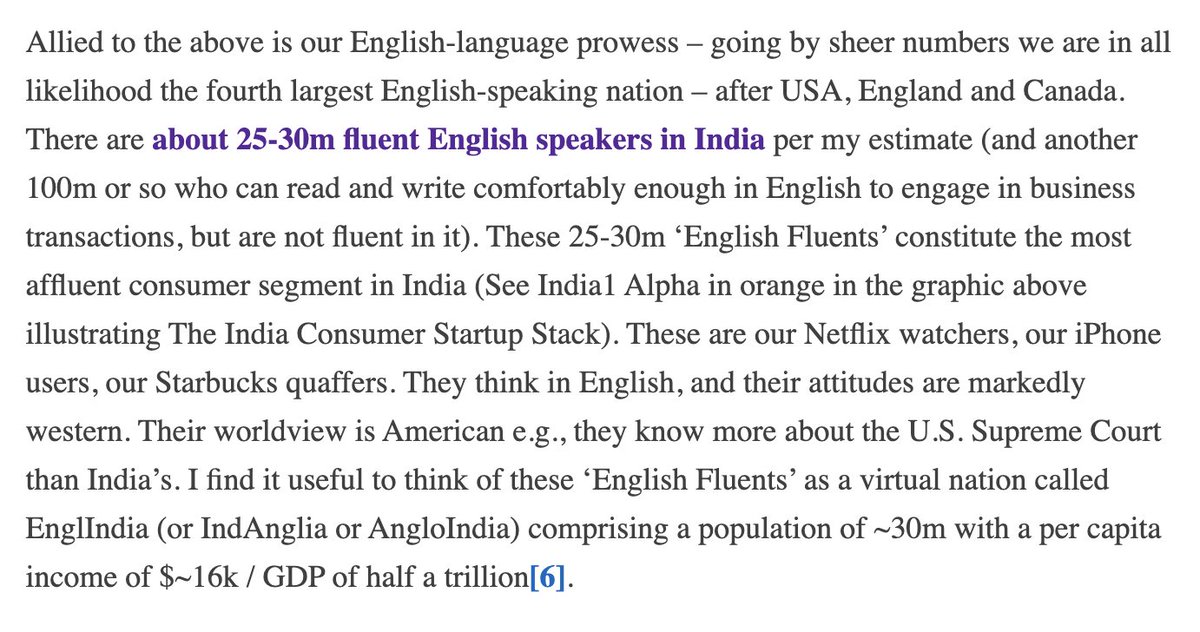

3) Y'day in @joinClubhouse @naval + @balajis spoke of India's english speaking STEM-trained workforce.

Well, it is impressive, but not as large as they think.

- we have 25-30m fluent English speakers in India

- We graduate 70-80k quality enggrs annually https://twitter.com/thatguyBG/status/1346718608831909888

Well, it is impressive, but not as large as they think.

- we have 25-30m fluent English speakers in India

- We graduate 70-80k quality enggrs annually https://twitter.com/thatguyBG/status/1346718608831909888

If all of India's fluent english speakers were a country, it would be 4th largest english speaking country in the world, and would be rich enough to be an OECD member.

12/25

12/25

4) India has a (relatively) undersized formal economy.

Manish Sabharwal of Teamlease: Only 19.5k companies with paid up capital > 10crs. 63m enterprises (vs US 32m but US is 9x our GDP). Only 5% of non-ag establishments > 5 people.

Hinders venture-scale enterprise businesses.

Manish Sabharwal of Teamlease: Only 19.5k companies with paid up capital > 10crs. 63m enterprises (vs US 32m but US is 9x our GDP). Only 5% of non-ag establishments > 5 people.

Hinders venture-scale enterprise businesses.

5) Oversized venture funding ecosystem. We are higher than UK and Germany in funds deployed! At per capita incomes of $2k!

3 reasons.

14/25

3 reasons.

14/25

What these forcing functions have done is to guide the development of distinct Indus Valley playbooks...let us go over some of them.

We will look at Indus Valley playbooks for etailing, edtech, short video apps, Bharat SaaS etc. There is more in the post though!

15/25

We will look at Indus Valley playbooks for etailing, edtech, short video apps, Bharat SaaS etc. There is more in the post though!

15/25

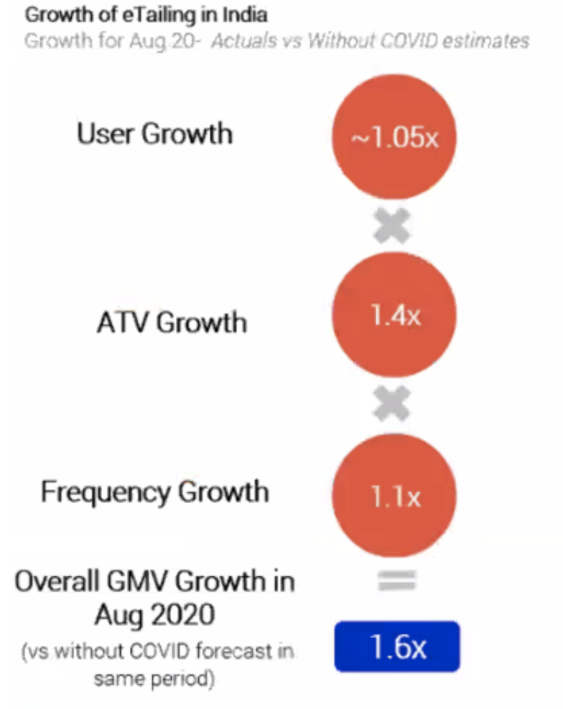

Etailing hasnt grown in India as we saw in China and U.S. (and they are at a base of $1200bn and $600bn respectively)

We saw etailing bump up from $27b in CY19 to $38b in CY20.

Why? Because we havent seen an expansion in online shoppers as this chart fm @RedSeer tells us.

16/25

We saw etailing bump up from $27b in CY19 to $38b in CY20.

Why? Because we havent seen an expansion in online shoppers as this chart fm @RedSeer tells us.

16/25

How is Indus Valley coping with the lack of new user growth generally?

We are beginning to see waves of innovation in etailing to get India2 customers on board - from social commerce ( @meeshoapp) to group buying ( @DealShareIndia) to video commerce ( @official_bulbul) and so on.

We are beginning to see waves of innovation in etailing to get India2 customers on board - from social commerce ( @meeshoapp) to group buying ( @DealShareIndia) to video commerce ( @official_bulbul) and so on.

Meanwhile we are seeing curation + discovery led shopping to get India1 to buy D2C brands. Innovators here include @CRED_club @FromLBB etc.

18/25

18/25

Similar India1 v India2 or rather India1A v India1/2 distinct models emerging in edtech.

India1A solving for identity: helping our kids with 'life as a cv' ( @Uable_real / @mastreelearning etc.)

India1/2 solving for access to content - crack that exam ( @unacademy @ClassplusApps)

India1A solving for identity: helping our kids with 'life as a cv' ( @Uable_real / @mastreelearning etc.)

India1/2 solving for access to content - crack that exam ( @unacademy @ClassplusApps)

If B2B SAAS led the wave of build in India for the world, we will see consumertech plays pick up that mantle soon - led by edtech. We will see a wave of edtech players launching + scaling abroad.

20/25

20/25

And what about consumer brand plays then? How Indian avocado startups can leverage Indiranagar and Bandra market fit to expand to East Coast / West Coast.

Interesting to visualize India as the 51st state of the US for B2C much like Israel was the 51st state of US for B2B.

22/25

Interesting to visualize India as the 51st state of the US for B2C much like Israel was the 51st state of US for B2B.

22/25

A speculation.

India1 audiences: monetized by ads

India2 audiences: in-app purchases, ecommerce and ads.

23/25

India1 audiences: monetized by ads

India2 audiences: in-app purchases, ecommerce and ads.

23/25

Phew! Time to wrap here!

I have given you a smattering of the content + playbooks in my essay. Do read!

Would love for you to think aloud and debate with me. What are the playbooks I have missed? What does your Indus Valley Playbook look like!?

25/25 https://www.linkedin.com/pulse/indus-valley-playbook-sajith-pai/

I have given you a smattering of the content + playbooks in my essay. Do read!

Would love for you to think aloud and debate with me. What are the playbooks I have missed? What does your Indus Valley Playbook look like!?

25/25 https://www.linkedin.com/pulse/indus-valley-playbook-sajith-pai/

Read on Twitter

Read on Twitter