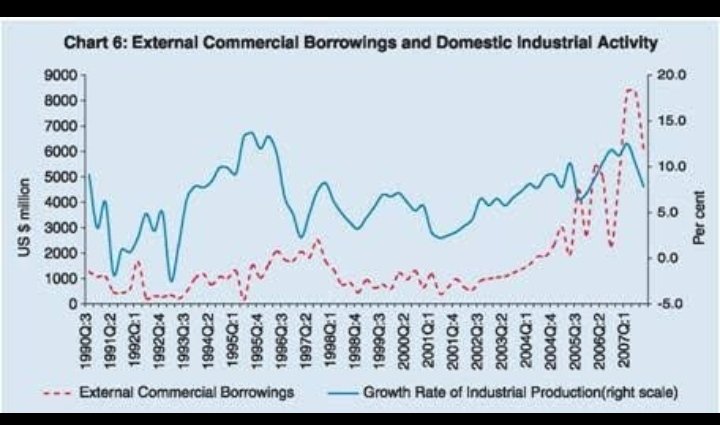

To add further as dollar liquidity glut reaches the eurodollar market, generally we see a sharp jump in ext com borrwing (ECB) by Indian corporates. Now this is something tricky to predict whether it will happen this time. Bcoz we don't know whether corp will invest quickly or... https://twitter.com/RaviYadav_39/status/1346811449184645122

will they continue with their wait and watch strategy to see a sustainable demand recovery and higher capacity utilisation. Whatever be the case this time, we shld nudge them better to hedge their FX positions, something which shld have been done after GFC too. That caused a...

lot of damage to corp BS and ofcourse to our exchange rate as well, during taper tantrum. But see the sharp jump in ECB after 2002 in charts

I guess banks are still raising capital through ECBs, during previous cycles, good quality NBFCs too have raised equity and funding capital through ECB. So non-financial ECB is something worth tracking, how quickly does that pick up. Thats will be a leading indcator for pvt invst

I usually don't tag anyone on twitter, i hope its okay if i tag you all sometimes?  .

.

@Me_Predictor @akshayalladi @swarajk224 @accountantvarun @ShazCoder

.

.@Me_Predictor @akshayalladi @swarajk224 @accountantvarun @ShazCoder

Read on Twitter

Read on Twitter