Viewing futures and making decisions.

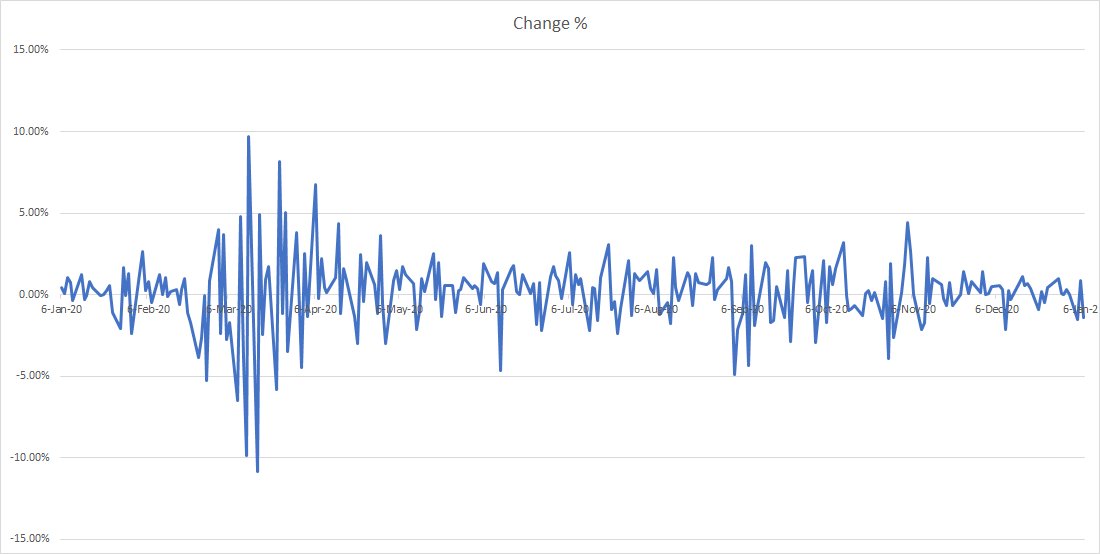

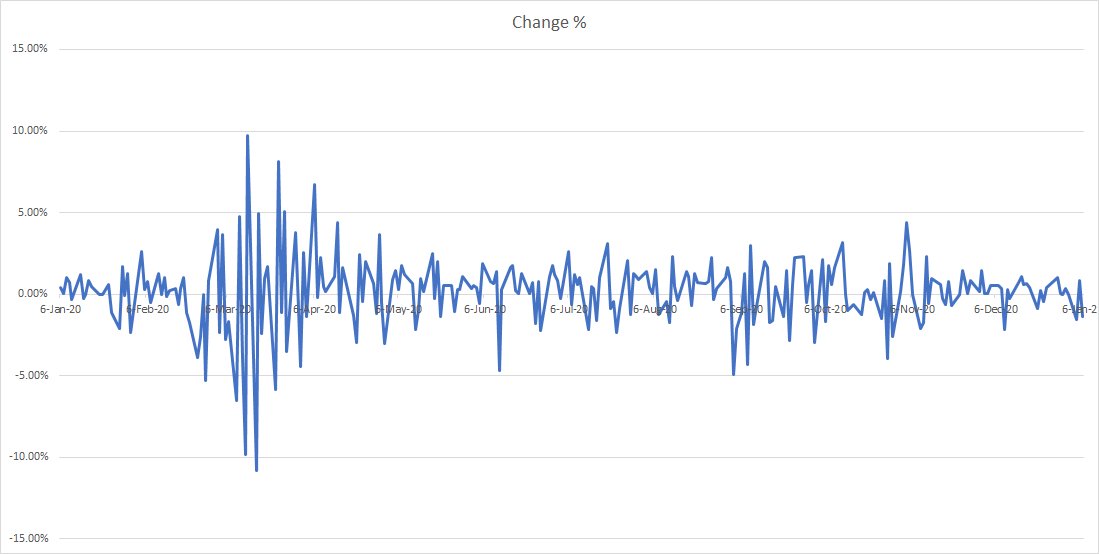

Yesterday I was challenged by friends to "not be a talking head" and stick to what I do best - gather data and analyze, instead of prognosticating. So here you go. In this thread I looked at NASDAQ 100 futures from Jan 1 2020 to Jan 6 2021

Yesterday I was challenged by friends to "not be a talking head" and stick to what I do best - gather data and analyze, instead of prognosticating. So here you go. In this thread I looked at NASDAQ 100 futures from Jan 1 2020 to Jan 6 2021

2. NASDAQ futures 100 data is available at http://Investing.com if you wish to analyze yourself. Please do if you have time / inclination.

Data is for 265 trading days. Of those days, 61% (162) days the actual open of NASDAQ was HIGHER than implied open

Data is for 265 trading days. Of those days, 61% (162) days the actual open of NASDAQ was HIGHER than implied open

3. In 37% of the days (98), the actual open of NADAQ was lower than implied open

In 4 days (1.5%) the implied open was on target.

In 4 days (1.5%) the implied open was on target.

4. The most interesting part is the variance over mean. In only 29 (on the upside) 31 (downside) was the variance above or below the 2% variance range.

What this means is - 77% of the time - NASDAQ futures accurately predicted the OPEN of NASDAQ. Which is pretty awesome

What this means is - 77% of the time - NASDAQ futures accurately predicted the OPEN of NASDAQ. Which is pretty awesome

5. If you see the graph (below again), it is not hard to gather that the variance deviations were in March - So VIX was very useful during that period alone would be my guess.

Looking at the graph and data few more observations.

Futures are very good at predicting down opens

Looking at the graph and data few more observations.

Futures are very good at predicting down opens

6. When futures point down, and over 1% down the end of the day in 65% of the cases has been lower. But on the days when futures pointe up over 1% only 34% of the cases did NASDAQ "close" at higher than 1%

7. There is so much more to unpack, but this thread will get long.

Summary

1. If futures point UP over 1% its good. If futures point DOWN over 1% it is going to be horrible

2. If futures are between 0.5% and 1% up or down, in 83% of the cases they will accurately predict the day

Summary

1. If futures point UP over 1% its good. If futures point DOWN over 1% it is going to be horrible

2. If futures are between 0.5% and 1% up or down, in 83% of the cases they will accurately predict the day

Read on Twitter

Read on Twitter