A thread!

One of the richest Ethereum addresses is @0x_b1. They have ~99.9% of $300M+ deployed in various DeFi protocols.

My friend @n2ckchong did an analysis of the farms they are involved in.

Let's take a look at which coins they are particularly interested in.

(1/8)

(1/8)

One of the richest Ethereum addresses is @0x_b1. They have ~99.9% of $300M+ deployed in various DeFi protocols.

My friend @n2ckchong did an analysis of the farms they are involved in.

Let's take a look at which coins they are particularly interested in.

(1/8)

(1/8)

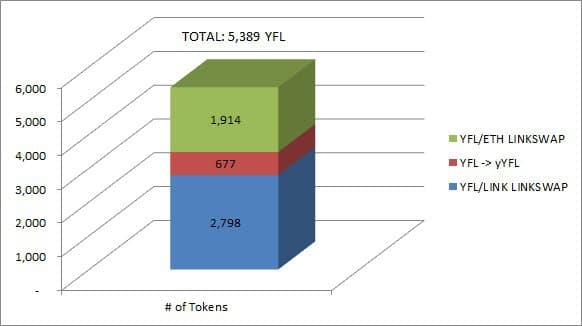

Besides 0xB1’s obvious positions in blue-chips, they’re an advocate for $YFL and have been accumulating a big position.

Their investment in the ecosystem is split between a few sources:

Staked/LPd YFL holdings ($4m+)

LINKSWAP LPs ($20m+)

(2/8)

Their investment in the ecosystem is split between a few sources:

Staked/LPd YFL holdings ($4m+)

LINKSWAP LPs ($20m+)

(2/8)

In aggregate they own over 10% of the supply, have never sold a single token, and added to their position as recently as 3-4 days ago.

$YFL is currently their 4th largest liquidity position on LINKSWAP following CRV, ETH, USDT, and USDC.

(3/8)

$YFL is currently their 4th largest liquidity position on LINKSWAP following CRV, ETH, USDT, and USDC.

(3/8)

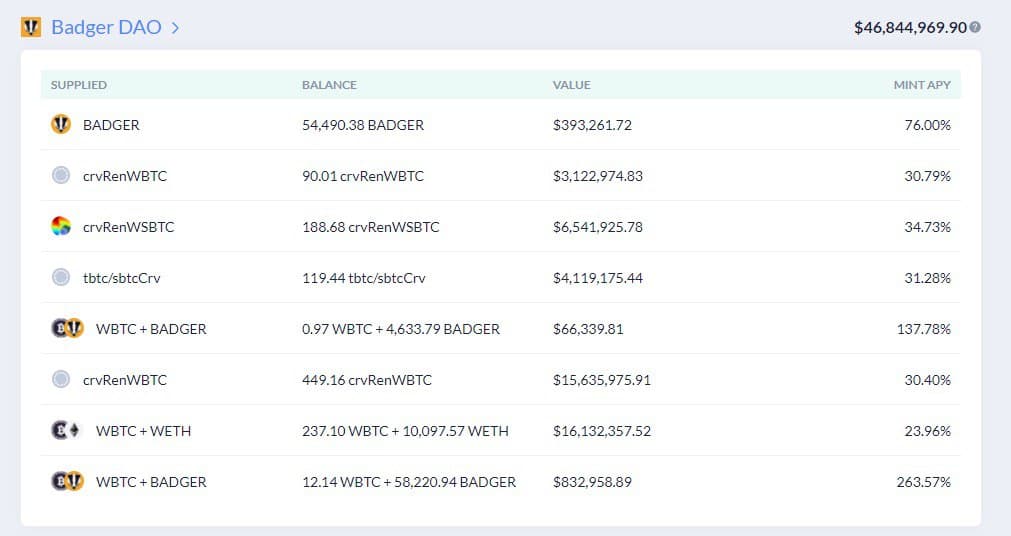

Another project that 0xb1 has taken a keen interest in is Badger, a protocol that allows Bitcoin holders to effectively utilize BTC to farm yields.

According to @n2ckchong, they are farming on this protocol using roughly $47 million in various Wrapped Bitcoin pools.

(4/8)

According to @n2ckchong, they are farming on this protocol using roughly $47 million in various Wrapped Bitcoin pools.

(4/8)

This isn’t too surprising given that Badger has rapidly become one of the most popular venues for farming using ETH-based Bitcoin.

0xB1 has predicted that the $BADGER token will never drop below $3.00 in 2021 and that $DIG will become “AMPL for BTC Maxis.”

(5/8)

0xB1 has predicted that the $BADGER token will never drop below $3.00 in 2021 and that $DIG will become “AMPL for BTC Maxis.”

(5/8)

KeeperDAO ($ROOK) is another position that 0xb1 has advocated for, and currently is farming using roughly $12m.

In a recent thread containing their 2021, they noted that ROOK will be “used for something interesting” but it remains unclear what they’re referring to.

(6/8)

In a recent thread containing their 2021, they noted that ROOK will be “used for something interesting” but it remains unclear what they’re referring to.

(6/8)

For now, $ESD and $DSD can both be best categorized as *experimental* stablecoins, but the seigniorage mechanisms backing them have proven to be promising.

0xB1 is dabbling with them, supplying nearly $3.5m across the ESD-USDC pool and the DSD-USDC pool.

(7/8)

0xB1 is dabbling with them, supplying nearly $3.5m across the ESD-USDC pool and the DSD-USDC pool.

(7/8)

I’m going to closely watch @0x_B1’s growth throughout the New Year.

No doubt they’ve become one of the most influential proponents of the DeFi space… Tracking their holdings could also become a popular investment strategy for DeFi “apes.”

(8/8)

No doubt they’ve become one of the most influential proponents of the DeFi space… Tracking their holdings could also become a popular investment strategy for DeFi “apes.”

(8/8)

Read on Twitter

Read on Twitter