@APompliano @saxena_puru Here ya go

i) I've been using BTC as savings over USD since 2013. Even those who bought the 20k top in 2017 would have their wealth preserved today. Rather than looking at periodic volatility, look at aggregate gains for SoV.

Also: price discovery https://twitter.com/saxena_puru/status/1346798938586636290

https://twitter.com/saxena_puru/status/1346798938586636290

i) I've been using BTC as savings over USD since 2013. Even those who bought the 20k top in 2017 would have their wealth preserved today. Rather than looking at periodic volatility, look at aggregate gains for SoV.

Also: price discovery

https://twitter.com/saxena_puru/status/1346798938586636290

https://twitter.com/saxena_puru/status/1346798938586636290

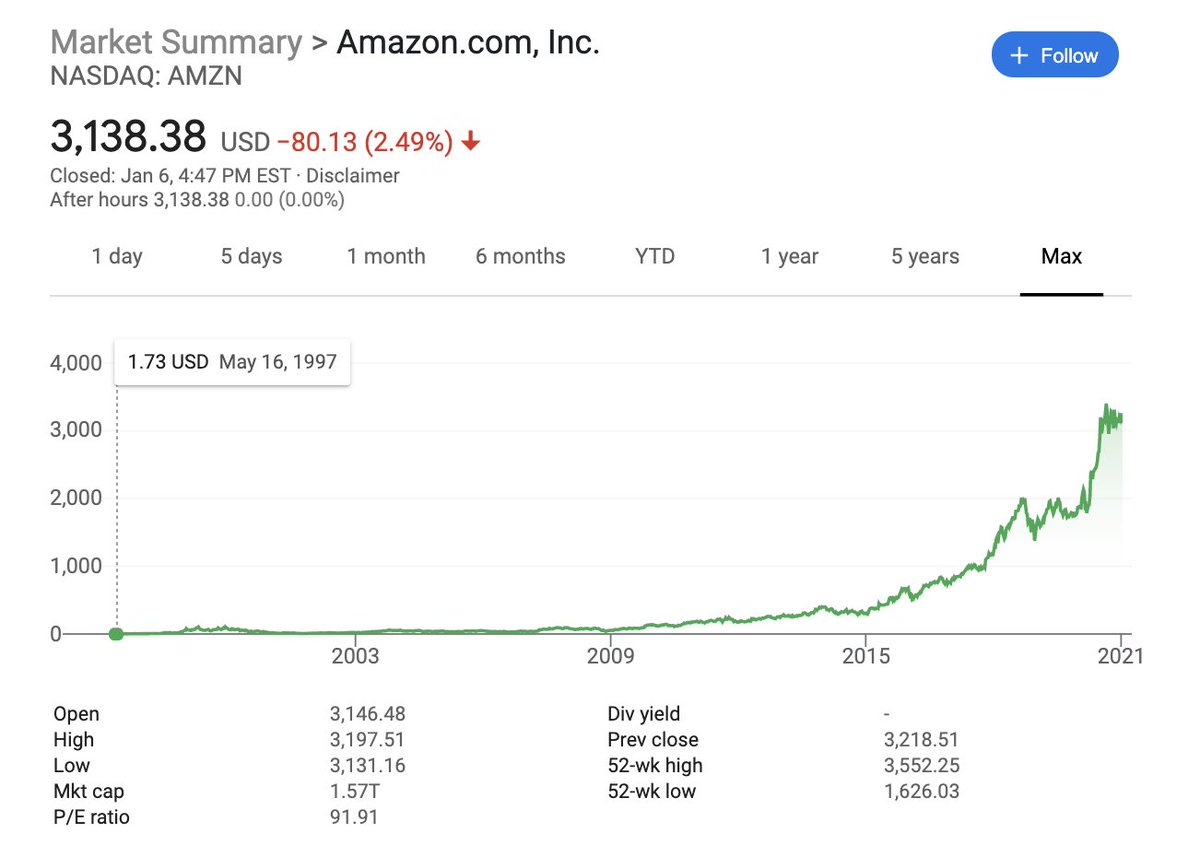

ii) As pointed above, Bitcoin's in price discovery mode as the world begins to take seriously its potential as a non-sovereign asset that can take properties of currency and gold.

i.e. Just as $AMZN rose as its status as a retailer rose, $BTC's price will for its SoV narrative

i.e. Just as $AMZN rose as its status as a retailer rose, $BTC's price will for its SoV narrative

ii-cont) As the market moves toward accepting BTC as a better form of money/digital gold/SoV, we can expect volatility to decrease over time. Even gold experienced >60% volatility in its lifetime.

iii) The safe haven/hedge narrative is being explored and priced in by the markets. Too early to expect 0 correlation, and even gold, which is widely accepted as a safe haven asset, experienced its high volatility during the 08-09 crisis. Think longer term.

iv) There are companies that reduce that risk for merchants like BitPay. Again, I'd encourage long term thinking. Looking at volatility during a period of growth/adoption is foolish. Imagine looking at a real-time price chart for a startup's valuation during growth.

v) Being a unit of account changes historically. Before coinage, cows were a unit of account.

vi) Similarly, cows also used to be MoE. The concept of money has evolved and will continue to improve as technology advances and requirements of society change

vi) Similarly, cows also used to be MoE. The concept of money has evolved and will continue to improve as technology advances and requirements of society change

vi-cont) BTC today is a good MoE because it meets several properties of money as-understood-today: fungible, portable, divisible, durable, tradable-with-deep-liquidity, etc.

vii) Scaling issues will be solved. Remember dial-up internet?

viii) Personal opinion: No. Rather than a "Bitcoin standard" the world simply has an alternative. Instead of the traditional notion of a currency that's tied to a nation, we now have the first non-sovereign asset with properties of both cash (MoE) and gold (SoV)

viii-cont) Can govts ban it? Yes it's a threat. And the market will price it accordingly.

Personally I believe govts will end up embracing it. Because Bitcoin is people-powered money; and I believe the world needs something like it. We have enough people who will fight for it.

Personally I believe govts will end up embracing it. Because Bitcoin is people-powered money; and I believe the world needs something like it. We have enough people who will fight for it.

ix) You can create credit systems based on underlying instruments with finite supply. If anything, such systems based on BTC will enforce greater accountability than ever before.

Anyway, fiat won't disappear.

Anyway, fiat won't disappear.

x) Like the above, fiat won't disappear. But there will be larger consequences of stimulus policies. Note: this isn't an argument that fiscal/monetary stimulus in itself is bad. Like other debt-based tools, it's an instrument that can bear success if used properly

xi) I don't think this can be answered in a tweet but here's some food for thought: imagine the current world + BTC as established global hard money; stimulus packages in fiat can occur, but without proper execution, that stimulus'd fiat will incur devaluation against BTC

xii) You limited and defined yourself the scope of a "store of value" in this sentence.

A currency doesn't have "intrinsic value" just from "full backing of the government". All money and value is rooted in trust. I recommend the book The Ascent of Money by Niall Ferguson

A currency doesn't have "intrinsic value" just from "full backing of the government". All money and value is rooted in trust. I recommend the book The Ascent of Money by Niall Ferguson

xii-cont) The whole point of #Bitcoin  is that there is value in a non-sovereign digital asset which is created in a distributed manner via proof of work, with globally achieved consensus in its total supply and issuance, with users of all kind able to participate without borders

is that there is value in a non-sovereign digital asset which is created in a distributed manner via proof of work, with globally achieved consensus in its total supply and issuance, with users of all kind able to participate without borders

is that there is value in a non-sovereign digital asset which is created in a distributed manner via proof of work, with globally achieved consensus in its total supply and issuance, with users of all kind able to participate without borders

is that there is value in a non-sovereign digital asset which is created in a distributed manner via proof of work, with globally achieved consensus in its total supply and issuance, with users of all kind able to participate without borders

xiii) Almost every human today has agreed to convert their time, energy, and LIFE into some form of money. It's sad, but it's how we have built our society.

Bitcoin requires energy and time to create, and people currently attribute increasing amounts of value to it.

Bitcoin requires energy and time to create, and people currently attribute increasing amounts of value to it.

xiii-cont) People globally are voting that they choose to store their converted form of time and energy into BTC, because they believe it is worth holding a form of money separated from governments and the monetary policies decided by the powerful and few.

xiii-cont) And that demand above is what causes the valuation of BTC to go up, as its utility for being a reliable SoV/MoE is explored. Respectfully, if you view bitcoin as zero-sum, I cannot in good conscience believe you find anything in the market to be wealth generating.

Read on Twitter

Read on Twitter