Last year, at the peak of the Covid shut down, we sold our company http://intermix.io to private equity firm @xenonpartners

It was a lesson learned on timing, capitalization, and knowing where your exit doors are before you need them.

A thread

It was a lesson learned on timing, capitalization, and knowing where your exit doors are before you need them.

A thread

My co-founder Paul and I had raised our seed round in 2018. We were lucky to have @uncorkcap lead our round with @S28capital following.

Both firms are incredible partners for any entrepreneur, I consider it a privilege to work with them. https://techcrunch.com/2018/06/27/intermix-io-looks-to-help-data-engineers-find-their-worst-bottlenecks/

Both firms are incredible partners for any entrepreneur, I consider it a privilege to work with them. https://techcrunch.com/2018/06/27/intermix-io-looks-to-help-data-engineers-find-their-worst-bottlenecks/

Beforehand, in 2017, @pauaventures in Berlin had done our pre-seed to help us get going. My German roots obviously helped.

Paua took a huge bet based on a prototype we had built and our vision that data products and analytics engineering would be the next big thing.

Paua took a huge bet based on a prototype we had built and our vision that data products and analytics engineering would be the next big thing.

If you’re an entrepreneur in Germany, with an engineering-centric product, then there’s no better firm than @pauaventures to raise from in my book. They are true risk-takers.

FYI, they’re also early investors in @pipedrive and @stripe - just sayin’ …

But I digress.

FYI, they’re also early investors in @pipedrive and @stripe - just sayin’ …

But I digress.

Back to 2018.

With a fresh $3.5M round in funding, we were off to the races. As an analytics product, we had to invest most of that money into R&D.

Great early customers such as @Postmates, @Plaid, @WeWork, @geteero and @udemy were driving our product roadmap.

With a fresh $3.5M round in funding, we were off to the races. As an analytics product, we had to invest most of that money into R&D.

Great early customers such as @Postmates, @Plaid, @WeWork, @geteero and @udemy were driving our product roadmap.

The data teams at these companies were (and still are) on the cusp of what’s possible working with data in the cloud.

By working with these teams, we saw what we had always believed - data the #1 growth driver for all these businesses.

By working with these teams, we saw what we had always believed - data the #1 growth driver for all these businesses.

In very simple terms, to use data, you need to run lots and lots of queries.

Running lots of queries puts a lot of pressure on data infrastructure.

Because you want to give your data consumers as many liberties as possible, data teams often have have no clue what’s going on.

Running lots of queries puts a lot of pressure on data infrastructure.

Because you want to give your data consumers as many liberties as possible, data teams often have have no clue what’s going on.

Enter our product.

We had built a dashboard that gave analytics engineers a visual representation of the complex data flows.

Our dashboard was a nice way to travel back in time (days, months and even years) and ask “what happened with our data?”

We had built a dashboard that gave analytics engineers a visual representation of the complex data flows.

Our dashboard was a nice way to travel back in time (days, months and even years) and ask “what happened with our data?”

At the core of every data stack is a data warehouse.

When we started intermix, at the time the market leader was @awscloud Amazon Redshift.

@GCPcloud’s BigQuery was a distant second.

@SnowflakeDB was on the horizon, but nobody was really talking about them quite yet.

When we started intermix, at the time the market leader was @awscloud Amazon Redshift.

@GCPcloud’s BigQuery was a distant second.

@SnowflakeDB was on the horizon, but nobody was really talking about them quite yet.

As the market leader, we had hitched our wagon to Amazon Redshift.

Walk into any start-up in SF back then, and they were using Redshift. As far as we could tell, everybody was using Redshift.

Snowflake had shipped a product, but still felt early. https://twitter.com/gregrahn/status/613528759367380992?s=20

Walk into any start-up in SF back then, and they were using Redshift. As far as we could tell, everybody was using Redshift.

Snowflake had shipped a product, but still felt early. https://twitter.com/gregrahn/status/613528759367380992?s=20

And so business was going well for us.

We had customers, a growing funnel, and I was going through the motion of “founder-led selling”, i.e. figuring out the end-to-end sales motion when you’re starting from scratch.

Lots of lessons learned there too, for another thread…

We had customers, a growing funnel, and I was going through the motion of “founder-led selling”, i.e. figuring out the end-to-end sales motion when you’re starting from scratch.

Lots of lessons learned there too, for another thread…

We went from $0 to $500K in ARR in little time, on track to reach the magic $1M in ARR.

But then suddenly, the top of the funnel slowed down, conversions took longer, and despite great product engagement, we even had some churn.

What happened?

But then suddenly, the top of the funnel slowed down, conversions took longer, and despite great product engagement, we even had some churn.

What happened?

@SnowflakeDB had entered the scene as a formidable competitor to Redshift. Redshift users were migrating to Snowflake as the better product.

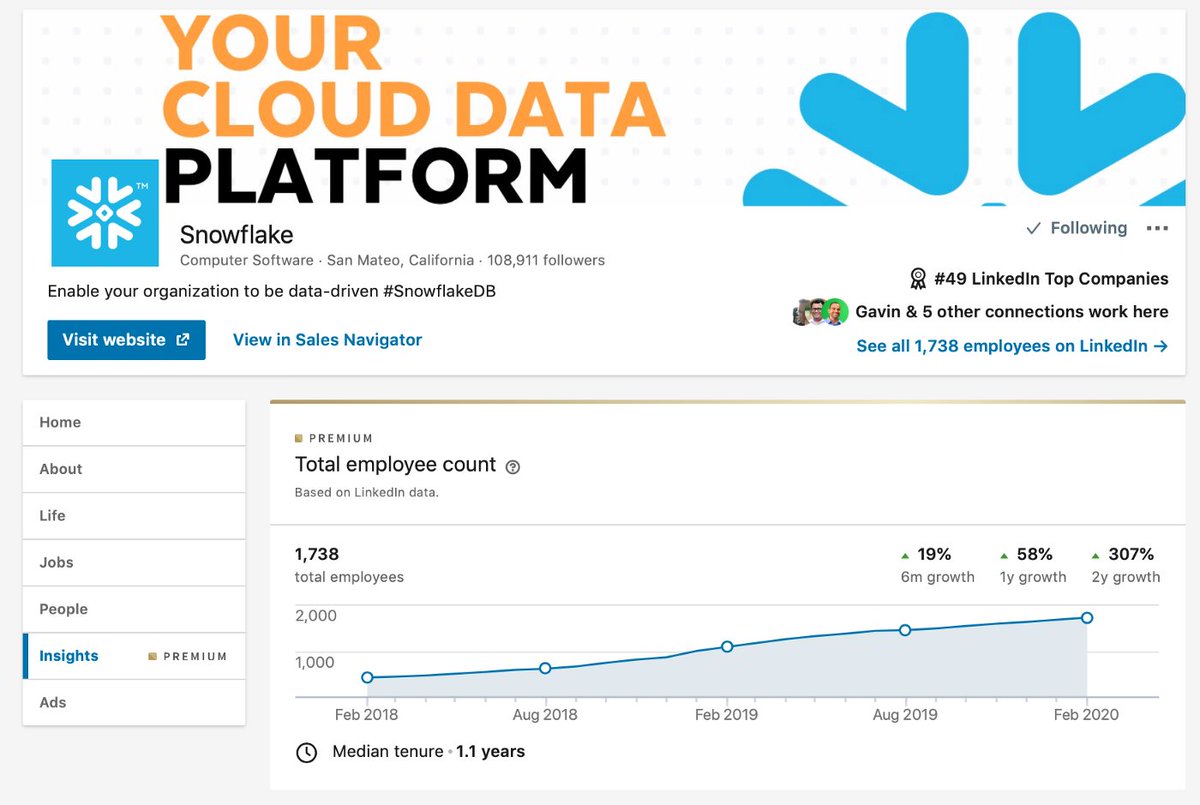

Check out Snowflake’s headcount growth (screenshot from Feb ’20)

Our problem: We had a Redshift story, but no Snowflake story.

Check out Snowflake’s headcount growth (screenshot from Feb ’20)

Our problem: We had a Redshift story, but no Snowflake story.

So here we were, roughly half-way through our funding, with about 12 months of runway left.

Growth was flattening, and we had no story for the market leader in data warehousing.

Something needed to change.

Growth was flattening, and we had no story for the market leader in data warehousing.

Something needed to change.

Luckily, our customers who had migrated to Snowflake told us that they wanted an “intermix for Snowflake”.

This was mid 2019.

This was mid 2019.

To make it all work, we had to accomplish three things:

1. Re-engineer the product and UI

2. Migrate existing customers to the new product

3. Recruit Snowflake users for product input

And all of this while keeping the business running.

That’s a lot!

1. Re-engineer the product and UI

2. Migrate existing customers to the new product

3. Recruit Snowflake users for product input

And all of this while keeping the business running.

That’s a lot!

But we managed to do it.

Crazy what you can accomplish under pressure. We turned around on a dime.

By @AWSreInvent, we had a new product to show. Our customers trusted us and were following us into the “new” direction.

We were also now collaborating with @SnowflakeDB.

Crazy what you can accomplish under pressure. We turned around on a dime.

By @AWSreInvent, we had a new product to show. Our customers trusted us and were following us into the “new” direction.

We were also now collaborating with @SnowflakeDB.

Growth was still flat, but at least now we had options and a story!

To play it safe and extend our runway, we had raised some venture debt from @SVB_Financial - another great partner!

So that was the situation in December 2019. We had reasons to be optimistic for 2020.

To play it safe and extend our runway, we had raised some venture debt from @SVB_Financial - another great partner!

So that was the situation in December 2019. We had reasons to be optimistic for 2020.

January 2020 was when we started going out to pave the way for our next fundraise.

But we looked and felt like a seed stage company again. We had to to prove out product-market-fit again, for the “new” product.

And that’s when Covid hit us. Like a ton of bricks.

But we looked and felt like a seed stage company again. We had to to prove out product-market-fit again, for the “new” product.

And that’s when Covid hit us. Like a ton of bricks.

The funding markets had dried up within a matter of few days. It was the “flight to quality” as they say, only the hyper-growth companies were getting any money.

We had to find a plan B, and that meant finding a home for the company via an acquisition.

We had to find a plan B, and that meant finding a home for the company via an acquisition.

Luckily, I still had relationships from my Corp Dev days and knew how to run a process. Just like in sales, you need to create a wide funnel of qualified buyers, figure out the fit, and move to closure.

The problem was that the whole market was cratering!

Nobody was buying!

The problem was that the whole market was cratering!

Nobody was buying!

In that situation @xenonpartners was exactly that - a great partner!

We closed within three (!) weeks. That’s because our operations & books were pristine. —> @KruzeConsulting @scottorn @GundersonLaw

Not the outcome everybody had hoped for, but better than the alternative.

We closed within three (!) weeks. That’s because our operations & books were pristine. —> @KruzeConsulting @scottorn @GundersonLaw

Not the outcome everybody had hoped for, but better than the alternative.

We were able to pull it off because we stood together as a team.

That’s also why it’s so important to pick the right partners at the seed stage. With @uncorkcap @S28capital and @pauaventures and @SVB_Financial we had just that, they had our back.

That’s also why it’s so important to pick the right partners at the seed stage. With @uncorkcap @S28capital and @pauaventures and @SVB_Financial we had just that, they had our back.

This is the short version of a much more detailed story.

You can read the whole roller coaster here on Medium

https://larskamp.medium.com/why-we-sold-intermix-io-to-private-equity-in-a-shifting-market-5bdb3e4e30a4

You can read the whole roller coaster here on Medium

https://larskamp.medium.com/why-we-sold-intermix-io-to-private-equity-in-a-shifting-market-5bdb3e4e30a4

and I forgot to mention @hnshah who helped us think through the product pivot and how to approach it.

Hiten is another human and investor you want in your corner!

Hiten is another human and investor you want in your corner!

Read on Twitter

Read on Twitter