It’s my birthday today but I can’t resist commenting on the big moves in Growth/Value...

Today’s rise in the 10Y to above 1% has coincided with a massive blowout in the $QQQ / $IWN spread. Over 600bps today alone!

Remember, as @hkuppy put it, the “Big One” is still coming... https://twitter.com/bvddycorleone/status/1333199105951195139

Today’s rise in the 10Y to above 1% has coincided with a massive blowout in the $QQQ / $IWN spread. Over 600bps today alone!

Remember, as @hkuppy put it, the “Big One” is still coming... https://twitter.com/bvddycorleone/status/1333199105951195139

1- Let’s first think about this purely from a fundamental valuation (DCF) perspective:

Growth stocks are long duration assets and are thus more sensitive to rising rates. Since a larger bulk of their PV comes from expected growth in cash flows, they get smacked when rates rise.

Growth stocks are long duration assets and are thus more sensitive to rising rates. Since a larger bulk of their PV comes from expected growth in cash flows, they get smacked when rates rise.

2- Through this lens, we can make sense of today’s moves:

They are reflecting a higher likelihood of greater fiscal stimulus, and by extension greater inflation risk.

The entire Growth complex is merely starting to sniff out this inflation. This will ultimately be its undoing.

They are reflecting a higher likelihood of greater fiscal stimulus, and by extension greater inflation risk.

The entire Growth complex is merely starting to sniff out this inflation. This will ultimately be its undoing.

3- Think of it this way...

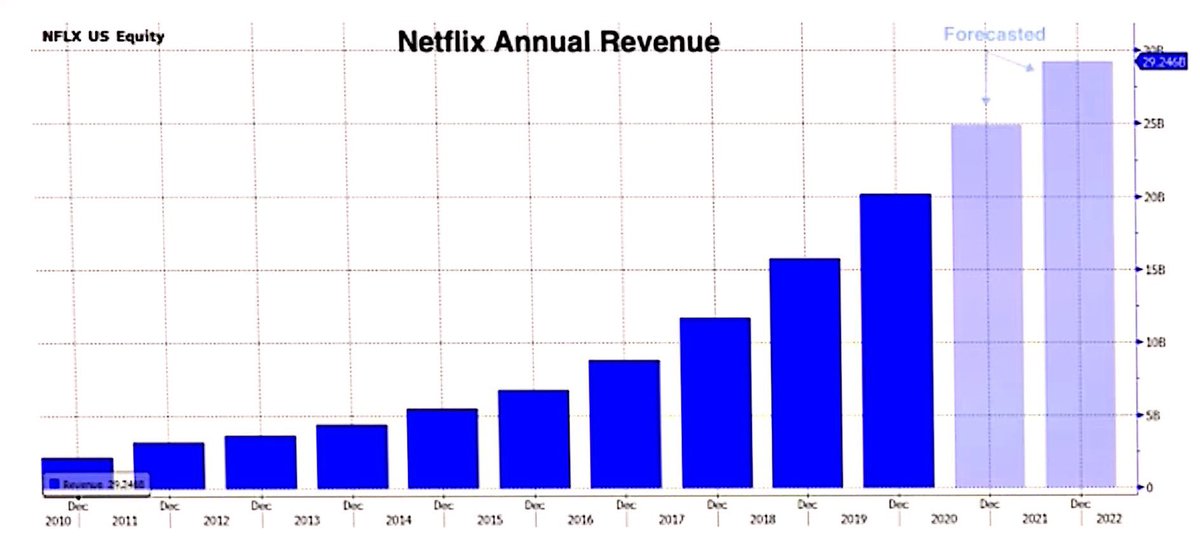

Take $NFLX for example. This is a chart (courtesy of @Convertbond) of Netflix’s annual revenues, with 2021 & 2022 forecasted figures.

Evidently, those future revenues would be worth a lot less today if we have inflation between now and then.

Take $NFLX for example. This is a chart (courtesy of @Convertbond) of Netflix’s annual revenues, with 2021 & 2022 forecasted figures.

Evidently, those future revenues would be worth a lot less today if we have inflation between now and then.

4- Now, try running that same exercise on all the Ponzi names out there trading at 20-50x+ sales with forecasts for huge, albeit make-believe, future earnings prospects...

Put simply, inflation will bring the Ponzi sector to its knees.

Put simply, inflation will bring the Ponzi sector to its knees.

5- Many have pushed back on this thesis, claiming “fundamentals are dead”.

Maybe true, but fundamentals will start mattering again as the Fed shifts focus from monetary policy (which favours asset inflation) to fiscal policy (which favours price inflation).

HT @jam_croissant https://twitter.com/jam_croissant/status/1334374038102306817

Maybe true, but fundamentals will start mattering again as the Fed shifts focus from monetary policy (which favours asset inflation) to fiscal policy (which favours price inflation).

HT @jam_croissant https://twitter.com/jam_croissant/status/1334374038102306817

6- All in all, today is just a taste of what I’ve been saying for months:

Inflation (And Rising Long Term Rates) Will Kill the Ponzi Sector and Catalyze the Long-Awaited Sector Rotation from Growth to Value.

And yes, inflation is coming... https://twitter.com/biancoresearch/status/1346871289999482884

Inflation (And Rising Long Term Rates) Will Kill the Ponzi Sector and Catalyze the Long-Awaited Sector Rotation from Growth to Value.

And yes, inflation is coming... https://twitter.com/biancoresearch/status/1346871289999482884

HT @jam_croissant @biancoresearch @pineconemacro @hkuppy @profplum99 @biotequity @Convertbond @TihoBrkan @contrarian8888 @johnauthers @Biohazard3737 @LT3000Lyall

As always, I welcome and appreciate thoughts and criticisms.

As always, I welcome and appreciate thoughts and criticisms.

Read on Twitter

Read on Twitter