What if I told you a glove manufacturer would beat AMZN in a 5YR return CAGR. Would you believe me?

Thanks to COVID, that’s exactly what Top Glove $BVA did.

One couple took $42K in life savings to $10B market value.

Let’s learn how they did it. https://macro-ops.com/top-glove-bva-sgx-17-returns-in-a-boring-glove-maker/

Thanks to COVID, that’s exactly what Top Glove $BVA did.

One couple took $42K in life savings to $10B market value.

Let’s learn how they did it. https://macro-ops.com/top-glove-bva-sgx-17-returns-in-a-boring-glove-maker/

1/ BVA is the world’s largest maker of nitrile, surgical and latex gloves.

They crank out 90B gloves/yr w/ 2K customers across 195 countries.

Their strong competitive advantage allows them to generate 21YR CAGRS:

- 28% rev growth

- 38% PAT growth

- 21% avg PAT margin

Wild.

They crank out 90B gloves/yr w/ 2K customers across 195 countries.

Their strong competitive advantage allows them to generate 21YR CAGRS:

- 28% rev growth

- 38% PAT growth

- 21% avg PAT margin

Wild.

2/ Founder-led Business

BVA was founded by Lim Wee-Chai in 1991. Chai and his wife invested their life savings ($42KUSD) to create the biz.

This turned out to be a great bet.

The couple turned their $42K investment into a $10B EV company in <30 years.

Chai still owns 26%.

BVA was founded by Lim Wee-Chai in 1991. Chai and his wife invested their life savings ($42KUSD) to create the biz.

This turned out to be a great bet.

The couple turned their $42K investment into a $10B EV company in <30 years.

Chai still owns 26%.

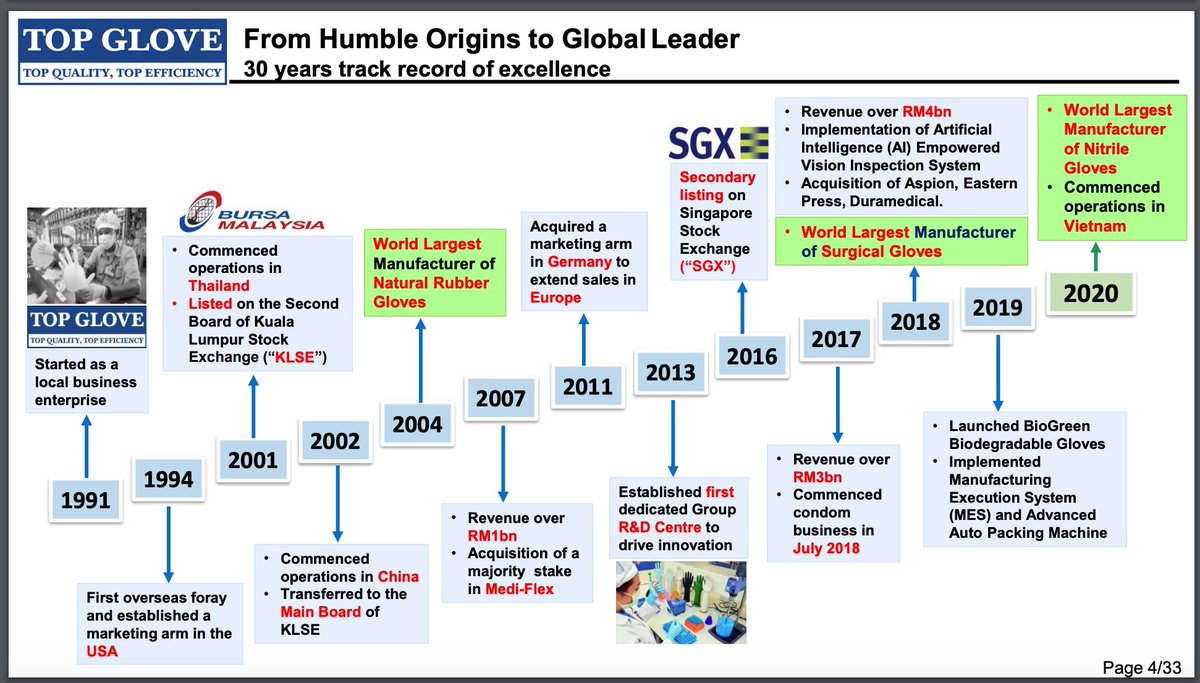

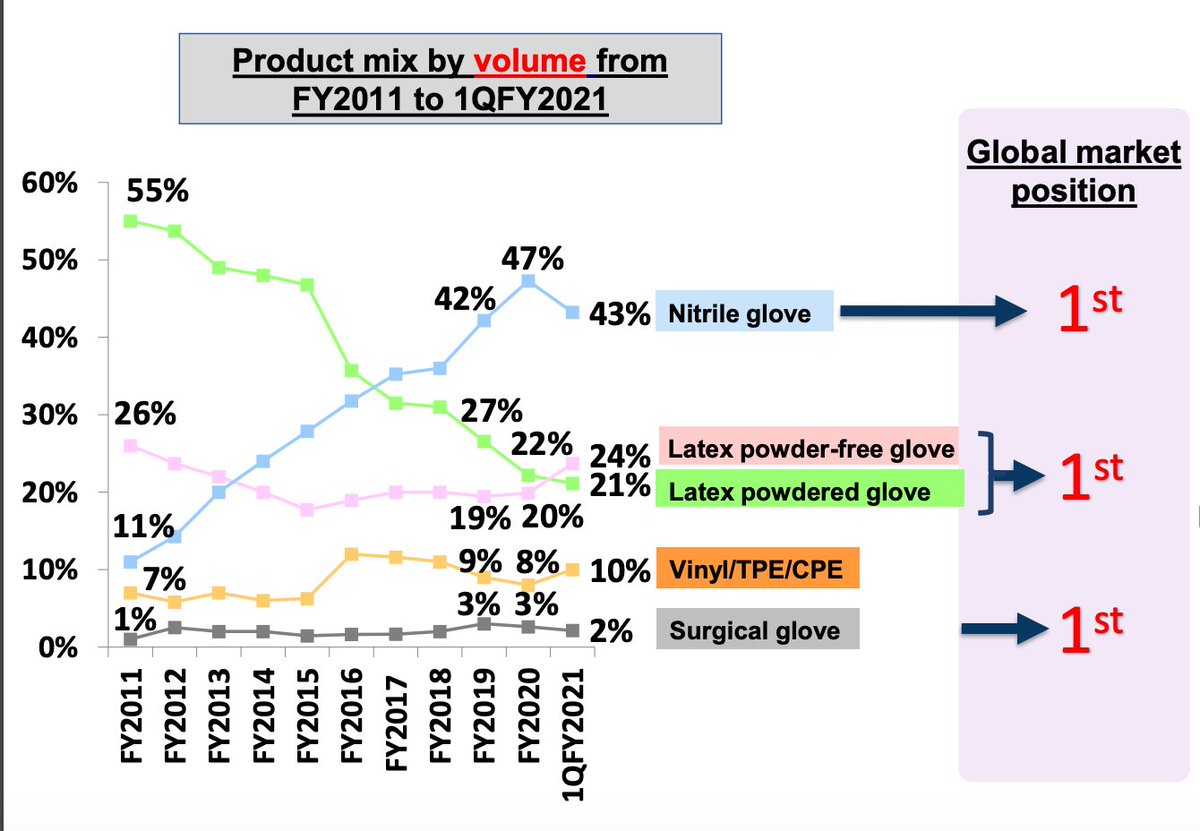

3/ Reaching No.1 in Gloves

Top Glove took the No.1 spot in natural rubber gloves 13 years after formation.

14 years later, BVA gained No.1 ranking in surgical gloves.

Then in 2020 they took No.1 share in nitrile gloves.

Wash, rinse, repeat.

Top Glove took the No.1 spot in natural rubber gloves 13 years after formation.

14 years later, BVA gained No.1 ranking in surgical gloves.

Then in 2020 they took No.1 share in nitrile gloves.

Wash, rinse, repeat.

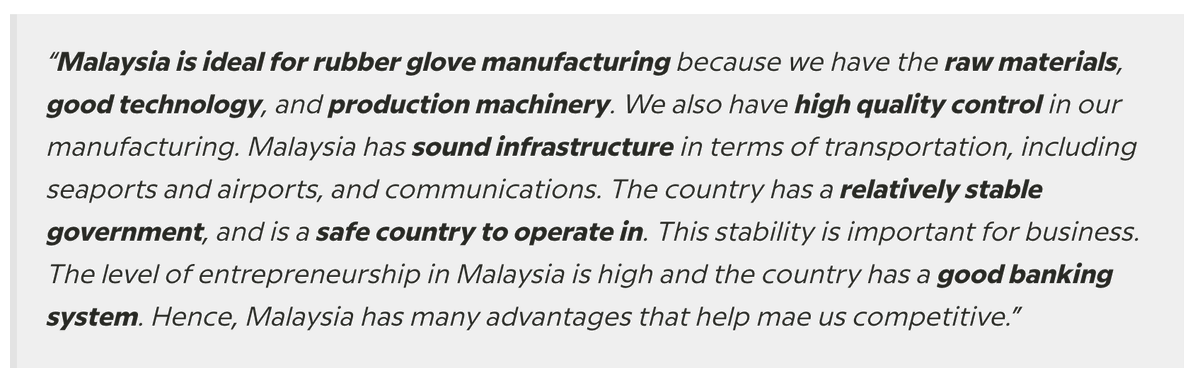

4/ Malaysia = Rubber Glove Paradise

Malaysia produces 46% of the world’s total rubber supply and leads the world in rubber product manufacturing.

Chai explains the inherent benefits in a 2017 interview (see below):

Malaysia produces 46% of the world’s total rubber supply and leads the world in rubber product manufacturing.

Chai explains the inherent benefits in a 2017 interview (see below):

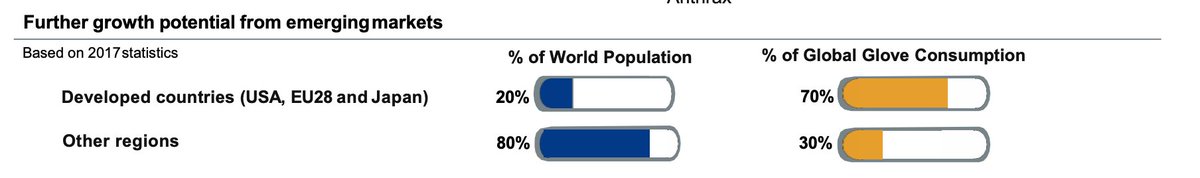

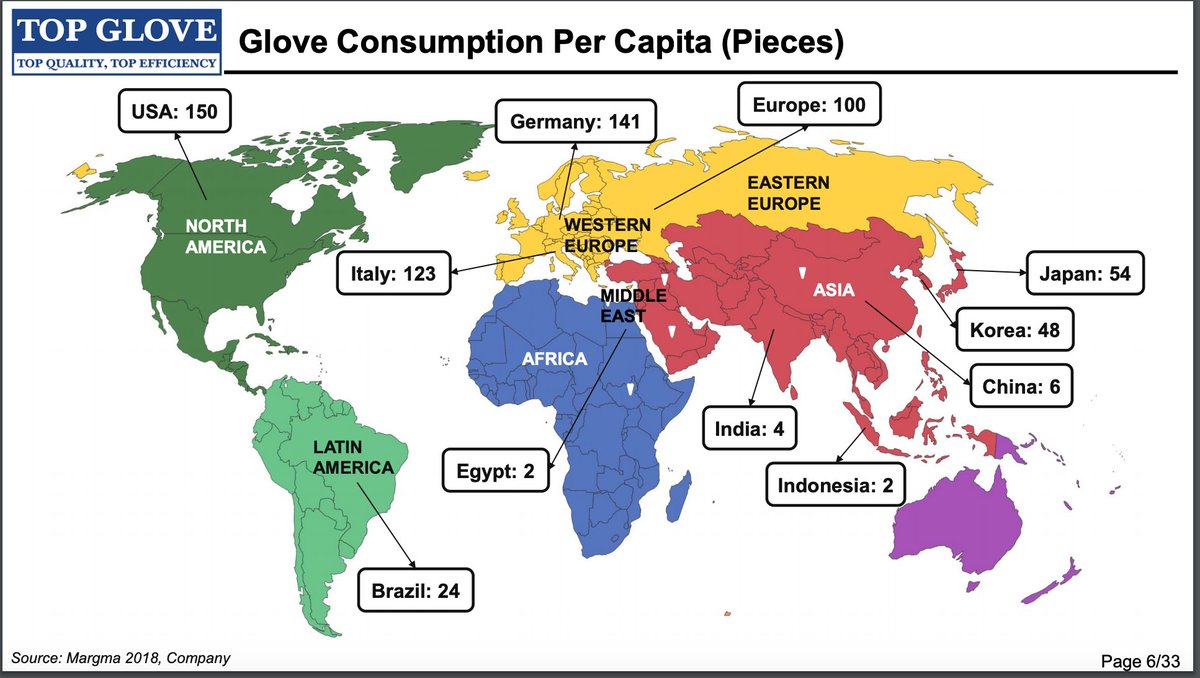

5/ Who’s Buying The Gloves?

Thx to COVID, everyone! That aside, 70% of the demand comes from developed countries. Yet developed makes up ~20% of the total population.

That means developing nations (80% of the population) account for 30% of the demand

Thx to COVID, everyone! That aside, 70% of the demand comes from developed countries. Yet developed makes up ~20% of the total population.

That means developing nations (80% of the population) account for 30% of the demand

6/ Geographic Demand Tailwinds

On a per-capita basis, developing nations have a LONG way to go to match developed country demand.

Some of the lowest per-capita glove demand includes:

- Brazil (24)

- China (6)

- India (4)

- Indonesia (2)

On a per-capita basis, developing nations have a LONG way to go to match developed country demand.

Some of the lowest per-capita glove demand includes:

- Brazil (24)

- China (6)

- India (4)

- Indonesia (2)

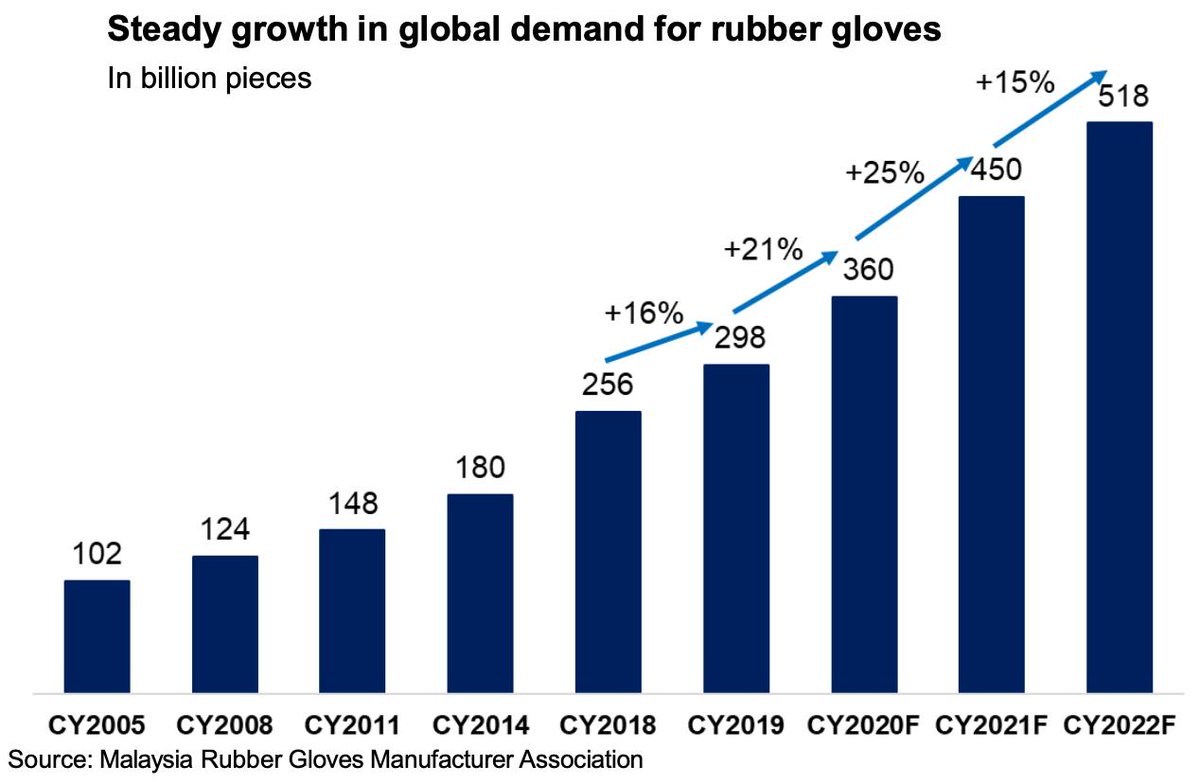

7/ Other Demand Drivers (Besides COVID)

BVA mentions 5 main drivers for global glove demand going forward:

- Medical staff/healthcare demand

- Increased hygiene standards

- Growing aging population

- Healthcare regulations

- New virus threats

Or ~518B gloves demanded by 2022

BVA mentions 5 main drivers for global glove demand going forward:

- Medical staff/healthcare demand

- Increased hygiene standards

- Growing aging population

- Healthcare regulations

- New virus threats

Or ~518B gloves demanded by 2022

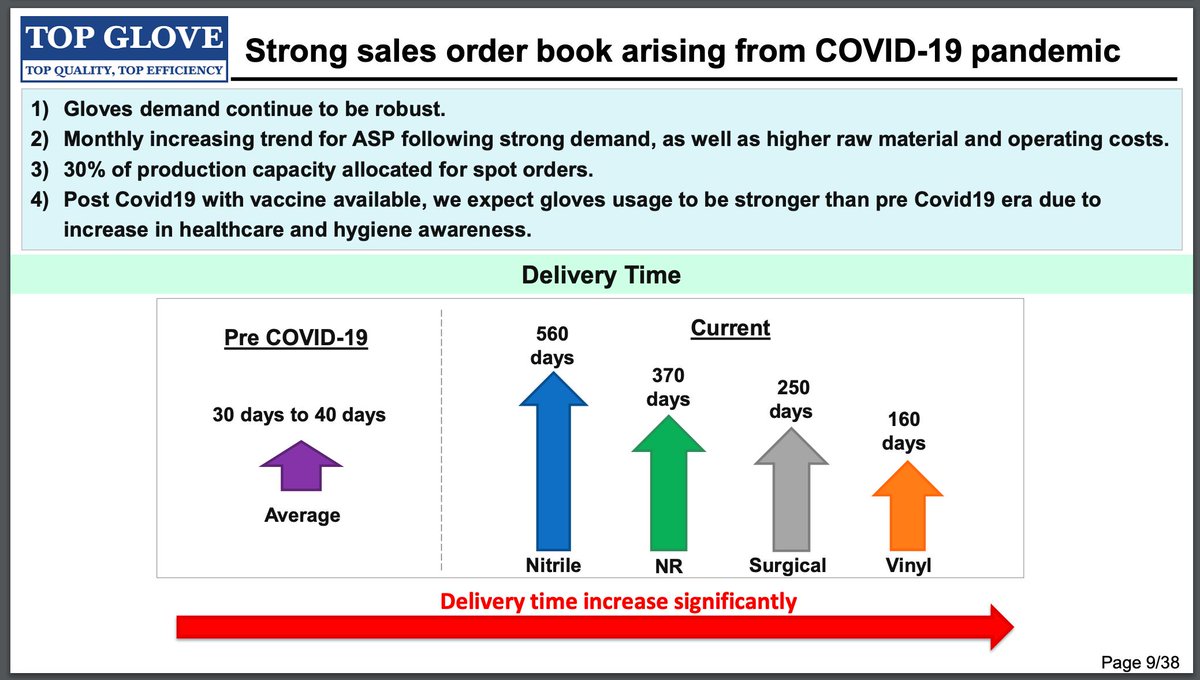

8/ Can Habits Lead To Sustainably Higher Demand?

Habits form between 18 to 254 days. In that case, COVID created lasting habits.

Add non-medical industry use which we haven’t seen. In turn, we’d see global glove demand continue at levels nobody thought would be sustainable.

Habits form between 18 to 254 days. In that case, COVID created lasting habits.

Add non-medical industry use which we haven’t seen. In turn, we’d see global glove demand continue at levels nobody thought would be sustainable.

9/ Why Choose Top Glove

Top Glove posses a few key advantages over competitors:

- Scale of Distribution

- Leading Market Position

- Exceptional Founder

- Unbeatable R&D Investment

Let’s break these down …

Top Glove posses a few key advantages over competitors:

- Scale of Distribution

- Leading Market Position

- Exceptional Founder

- Unbeatable R&D Investment

Let’s break these down …

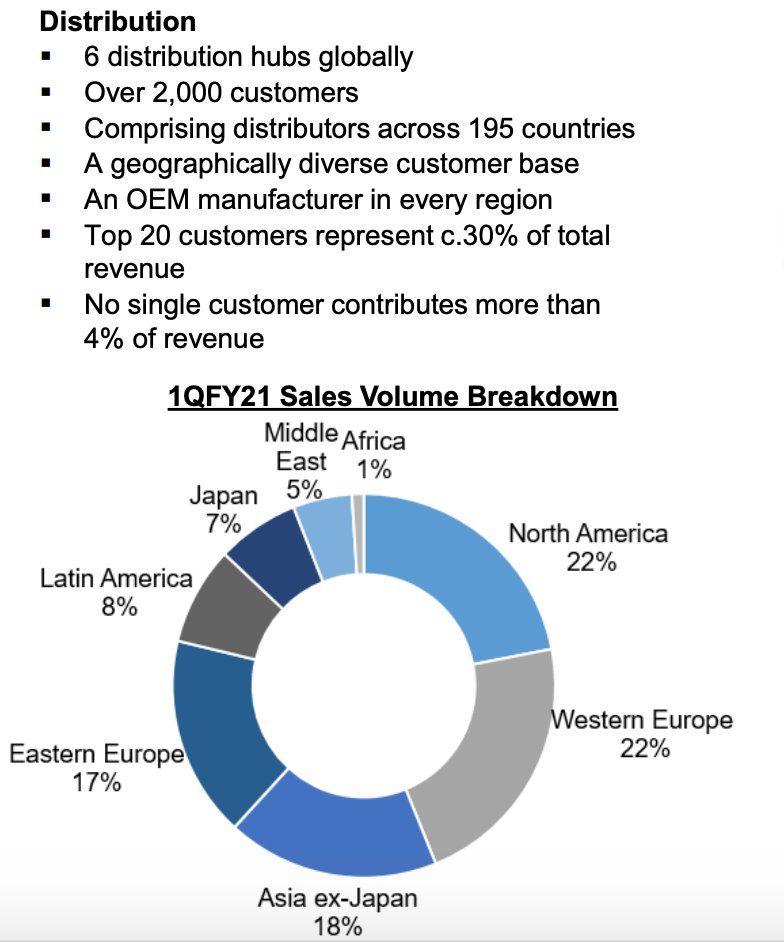

10/ Scale of Distribution

BVA has 6 distribution “hubs” in the US, Germany, China, Vietnam, Thailand, Malaysia, and Brazil. Plus an OEM manufacturer in every region.

These distribution centers supply gloves to 195 countries and over 2,000 customers. No cust >4%. of revenues

BVA has 6 distribution “hubs” in the US, Germany, China, Vietnam, Thailand, Malaysia, and Brazil. Plus an OEM manufacturer in every region.

These distribution centers supply gloves to 195 countries and over 2,000 customers. No cust >4%. of revenues

11/ Global Market Position

Top Glove is #1 in nitrile gloves, latex (powder/powder-free) gloves, surgical gloves and accounts for 25% of global glove supply.

The company generates 56% of its revenue from nitrile, 35% from latex-based gloves, and 4% from surgical.

Top Glove is #1 in nitrile gloves, latex (powder/powder-free) gloves, surgical gloves and accounts for 25% of global glove supply.

The company generates 56% of its revenue from nitrile, 35% from latex-based gloves, and 4% from surgical.

12/ Exceptional Founder

Limi Wee-Chai is an exceptional leader. He puts his money where his mouth is and buys company stock when it falls.

He even issued a massive special dividend that’ll hit in November 2021.

One knock: he might care too much about stock price

Limi Wee-Chai is an exceptional leader. He puts his money where his mouth is and buys company stock when it falls.

He even issued a massive special dividend that’ll hit in November 2021.

One knock: he might care too much about stock price

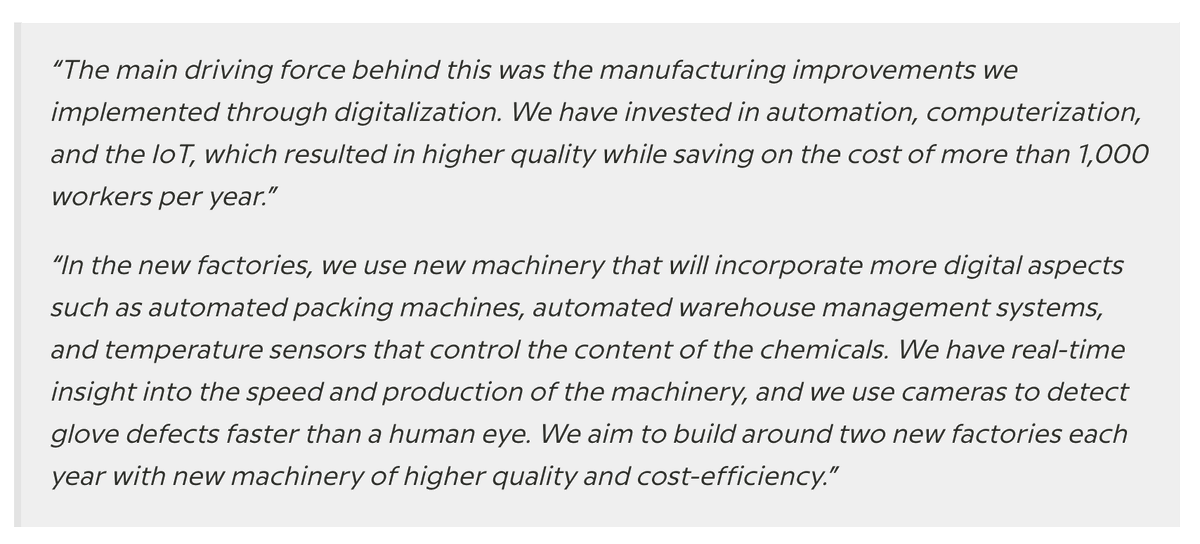

13/ Unbeatable R&D Investment

Wee-Chai’s goal is to build two new factories a year and accelerate its R&D department.

So far they’ve turned R&D from a team of 20 to a small army of 160.

Here are Chai’s thoughts on capital investment …

Wee-Chai’s goal is to build two new factories a year and accelerate its R&D department.

So far they’ve turned R&D from a team of 20 to a small army of 160.

Here are Chai’s thoughts on capital investment …

14/ A Year of Super-Normal Profits

Take 2021 numbers and frame them on the wall. It’s unlikely the company will touch that level of performance in the next decade.

So BVA announced a special dividend. 70% p/o of from Q2 - Q4 2021.

That's ~17% returns at current stock price

Take 2021 numbers and frame them on the wall. It’s unlikely the company will touch that level of performance in the next decade.

So BVA announced a special dividend. 70% p/o of from Q2 - Q4 2021.

That's ~17% returns at current stock price

15/ 2022 & Beyond

Revenue will revert to industry norms (12-15%/year) which should get BVA to $4.67B by 2025.

Given immense competition and sale price compression, we estimate EBITDA margins compress to ~30% by 2025 ($1.4B)

Revenue will revert to industry norms (12-15%/year) which should get BVA to $4.67B by 2025.

Given immense competition and sale price compression, we estimate EBITDA margins compress to ~30% by 2025 ($1.4B)

16/ Embedded Price Expectations

At the current price, Mr. Market’s assuming 0% rev growth after 2022 while EBITDA margins compress to 20% (1,500bps retraction).

20% EBITDA margins make more sense than 0% rev growth after 2022.

At the current price, Mr. Market’s assuming 0% rev growth after 2022 while EBITDA margins compress to 20% (1,500bps retraction).

20% EBITDA margins make more sense than 0% rev growth after 2022.

17/ Why The Opportunity Exists

BVA has a lot of hair.

Products were banned by the US due to labor issues.

It went against COVID protocol and continued operating factories.

They were the hot-bed of COVID in Malaysia!

There were claims employees slept in shipping containers

BVA has a lot of hair.

Products were banned by the US due to labor issues.

It went against COVID protocol and continued operating factories.

They were the hot-bed of COVID in Malaysia!

There were claims employees slept in shipping containers

18/ Why Opportunity Exits Pt.2

There’s also a heavy retail trading presence in Malaysia. This equaled lots of weak hands as the stock price lost momentum.

Are the strong hands/yield chasers here to pick up the slack?

There’s also a heavy retail trading presence in Malaysia. This equaled lots of weak hands as the stock price lost momentum.

Are the strong hands/yield chasers here to pick up the slack?

19/ Risks

We also see a few more risks besides the ones previously mentioned:

- Currency risk

- CEO that obsesses over stock price

- Influx of supply & lower ASP

- Raw material cost inflation

- 2021 high water mark

- Shareholder dilution (~3%/year)

We also see a few more risks besides the ones previously mentioned:

- Currency risk

- CEO that obsesses over stock price

- Influx of supply & lower ASP

- Raw material cost inflation

- 2021 high water mark

- Shareholder dilution (~3%/year)

20/ Concluding Thoughts

BVA is a great business w/ loads of hair experiencing super-natural profits.

2020/21 will be a high-water mark for years. But current profits allow BVA to pay huge dividends & reinvest to expand capacity.

It's an interesting idea & would love pushback

BVA is a great business w/ loads of hair experiencing super-natural profits.

2020/21 will be a high-water mark for years. But current profits allow BVA to pay huge dividends & reinvest to expand capacity.

It's an interesting idea & would love pushback

Read on Twitter

Read on Twitter