1/

Zimbabwe Economy 2021 Whither?

Economists identify threats & opportunities. They’re neither optimist nor pessimists. Their job doesn’t require them to be. Threats & opportunities often become clear when data, patterns & trends are presented.

Zimbabwe Economy 2021 Whither?

Economists identify threats & opportunities. They’re neither optimist nor pessimists. Their job doesn’t require them to be. Threats & opportunities often become clear when data, patterns & trends are presented.

2/

This is why in America every month the Job report is dissected & nibbled down to its bare elements. No analyst is derided nor politically attacked. In Zim, the political environment has meant many great Economists not participating fully. This is a tragedy & loss to Zim.

This is why in America every month the Job report is dissected & nibbled down to its bare elements. No analyst is derided nor politically attacked. In Zim, the political environment has meant many great Economists not participating fully. This is a tragedy & loss to Zim.

3/

2021 is a challenging year globally & in particular Zim. Zim economy will not grow this year but will enter year 3 of its economic depression.

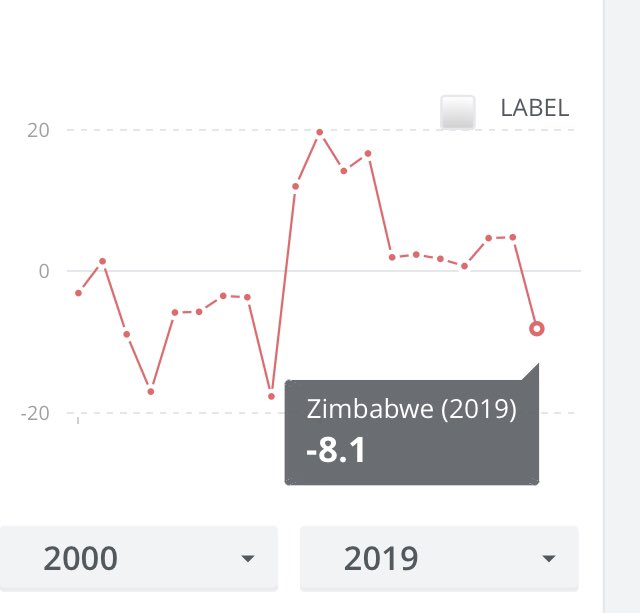

While GOZ estimated the economy declined by 4% in 2019 & estimating 8% decline in 2020. World Bank have released 2019 actuals

2021 is a challenging year globally & in particular Zim. Zim economy will not grow this year but will enter year 3 of its economic depression.

While GOZ estimated the economy declined by 4% in 2019 & estimating 8% decline in 2020. World Bank have released 2019 actuals

4/

In 2019, Zim actually declined by 8% & expected to decline by 15% in 2020. A cumulative 23% decline in 2yrs VERY similar to the 2002 & 2003 economic cycle when Zim declined by 8% & 16% respectively.

The trend from the graph attached is very clear. Can Zim reverse the trend?

In 2019, Zim actually declined by 8% & expected to decline by 15% in 2020. A cumulative 23% decline in 2yrs VERY similar to the 2002 & 2003 economic cycle when Zim declined by 8% & 16% respectively.

The trend from the graph attached is very clear. Can Zim reverse the trend?

5/

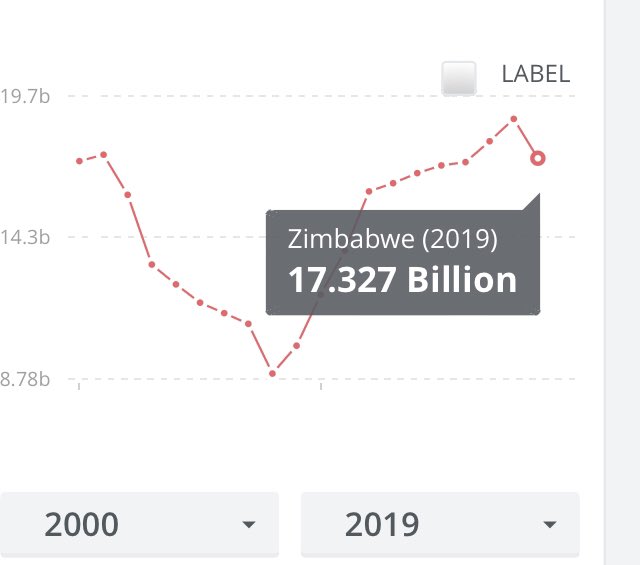

What it means is that in 2019 the Economy was NOT US$19bn as presented by MOF in its budget, but was US$17bn.

A 15% decline in 2020, puts GDP at US$14.7bn. Closer in size to the 2003 & 2011 years as presented in the graph.

What it means is that in 2019 the Economy was NOT US$19bn as presented by MOF in its budget, but was US$17bn.

A 15% decline in 2020, puts GDP at US$14.7bn. Closer in size to the 2003 & 2011 years as presented in the graph.

6/

2020 decline might have been the worst, & 2021 will decline but at a slower rate, perhaps negative 5%.

But consider the US$150m fathom money in our banking system. This wipes off all the combined Banks’-capital! A cause for worry & will follow closely how RBZ resolves this

2020 decline might have been the worst, & 2021 will decline but at a slower rate, perhaps negative 5%.

But consider the US$150m fathom money in our banking system. This wipes off all the combined Banks’-capital! A cause for worry & will follow closely how RBZ resolves this

7/

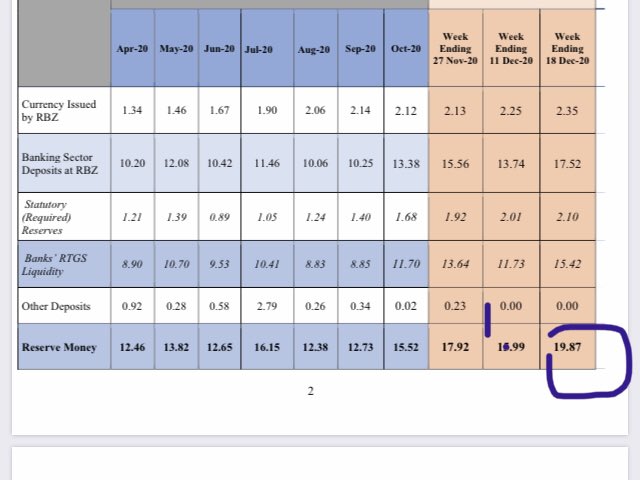

The worry is twin expansion of money supply & RBZ foreign debt.

Reserve money on 18 Dec 2020 was $19.87bn. That’s a 125% increase y-o-y. The impact will be inflation in 2021. It’s not true, that reserve money has been under control.

In 2019, Reserve Money increased by 160%.

The worry is twin expansion of money supply & RBZ foreign debt.

Reserve money on 18 Dec 2020 was $19.87bn. That’s a 125% increase y-o-y. The impact will be inflation in 2021. It’s not true, that reserve money has been under control.

In 2019, Reserve Money increased by 160%.

8/

While reserve money continues to increase unabated, the Forex Auction remains fixed at 81 vs 115 market rate. A 42% subsidy to importers. Exporters are being punished.

The unprecedented US$5bn RBZ debt carries “live” interest rate that must be paid. @5% thats US$200m.

While reserve money continues to increase unabated, the Forex Auction remains fixed at 81 vs 115 market rate. A 42% subsidy to importers. Exporters are being punished.

The unprecedented US$5bn RBZ debt carries “live” interest rate that must be paid. @5% thats US$200m.

9/

The global printing of money means a commodity boom for the next decade. because of its macroeconomic policies Zim will not enjoy the boom. Gold at an all time high, has seen Zim deliver 24tons vs 33tons at peak. 33 tonnes when price of gold was $1200/Oz. It’s now $1900

The global printing of money means a commodity boom for the next decade. because of its macroeconomic policies Zim will not enjoy the boom. Gold at an all time high, has seen Zim deliver 24tons vs 33tons at peak. 33 tonnes when price of gold was $1200/Oz. It’s now $1900

10/

Remittances have firmly dualised Zim economy, as families survive on diaspora welfare. Remittances bring in the USD cash that circulates in the informal sector.

Retailers confirm 40-50% usage of USD cash. While informal traders it’s closer to 80%. Natural dollarisation

Remittances have firmly dualised Zim economy, as families survive on diaspora welfare. Remittances bring in the USD cash that circulates in the informal sector.

Retailers confirm 40-50% usage of USD cash. While informal traders it’s closer to 80%. Natural dollarisation

11/

There is no evidence of a reversal in economic depression trend. Remittances are set to decline while real wages decline further in country, affecting consumption. Zim household consumption drives 60% of GDP.

There is no evidence of a reversal in economic depression trend. Remittances are set to decline while real wages decline further in country, affecting consumption. Zim household consumption drives 60% of GDP.

12/

It is of no use lying to each other in Cabinet & feeding the nation propaganda. It’s time to face the economic depression. No country taxes it’s way out of a depression.

It is of no use lying to each other in Cabinet & feeding the nation propaganda. It’s time to face the economic depression. No country taxes it’s way out of a depression.

13/

There is a unique opportunity to buttress the financial sector with formal remittances. US$2bn cash & more in goods is floating in the informal sectors & ends up floating abroad as locals take their savings & consumption out of Zim.

US$14.7bn economy cannot decline further

There is a unique opportunity to buttress the financial sector with formal remittances. US$2bn cash & more in goods is floating in the informal sectors & ends up floating abroad as locals take their savings & consumption out of Zim.

US$14.7bn economy cannot decline further

Read on Twitter

Read on Twitter