nCino $NCNO -> $69.33, MC $6.7B, P/S 36

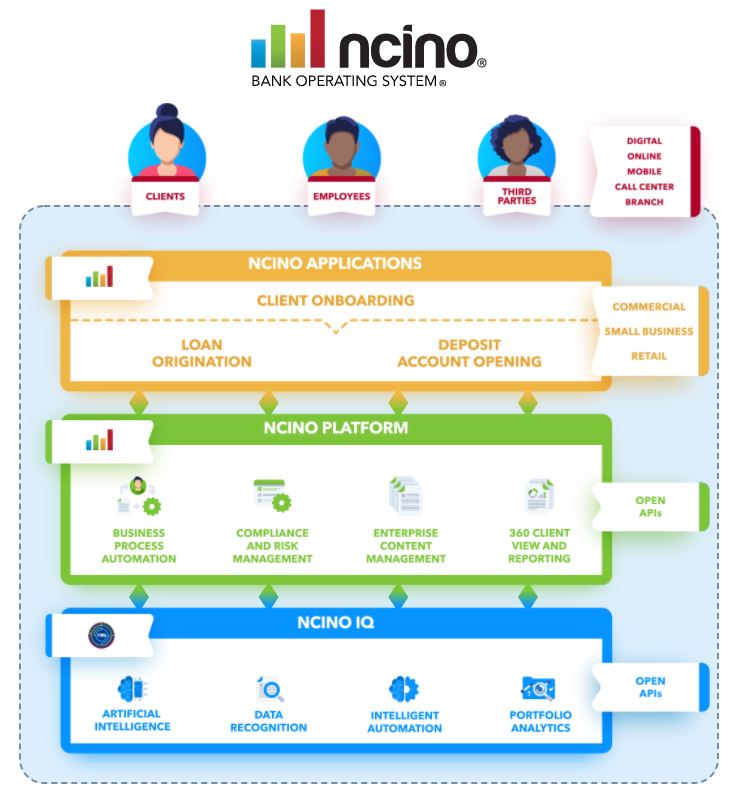

A single end-to-end cloud-based solution that enables financial institutions to increase transparency, efficiency and profitability while ensuring regulatory compliance.

I am long $NCNO

A single end-to-end cloud-based solution that enables financial institutions to increase transparency, efficiency and profitability while ensuring regulatory compliance.

I am long $NCNO

Brief History:

nCino was originally a part of Live Oak Bancshares $LOB...

Fun tidbit: nCino's name is a play on the Spanish word "encino," which means live oak.

nCino was originally a part of Live Oak Bancshares $LOB...

Fun tidbit: nCino's name is a play on the Spanish word "encino," which means live oak.

Management:

Glassdoor ratings

->Co-Founder and CEO Pierre Naude 99% approval (140 reviews)

->Company rated 4.7 overall, experiencing a hiring surge

Ranked as one of the best places to work by American Banker

Link-> https://www.glassdoor.com/Overview/Working-at-nCino-EI_IE838848.11,16.htm

Glassdoor ratings

->Co-Founder and CEO Pierre Naude 99% approval (140 reviews)

->Company rated 4.7 overall, experiencing a hiring surge

Ranked as one of the best places to work by American Banker

Link-> https://www.glassdoor.com/Overview/Working-at-nCino-EI_IE838848.11,16.htm

Technology Partners:

->Working with Accenture/Deloitte/PwC to support the delivery and implementation

->Partnered with $DOCU for agreements

->Built on the Salesforce CRM, $CRM had a 13.2% ownership as of S-1, similar to $VEEV

Link-> https://www.ncino.com/about/technology-partners

->Working with Accenture/Deloitte/PwC to support the delivery and implementation

->Partnered with $DOCU for agreements

->Built on the Salesforce CRM, $CRM had a 13.2% ownership as of S-1, similar to $VEEV

Link-> https://www.ncino.com/about/technology-partners

Ecosystem:

Will acquire companies to build out end-to-end platform.

->acquired Visible Equity to accelerate digital transformation/data warehousing

->acquired FinSuite for the data recognition capabilities

Bank operating system helpful for all forms of financial inst.

Will acquire companies to build out end-to-end platform.

->acquired Visible Equity to accelerate digital transformation/data warehousing

->acquired FinSuite for the data recognition capabilities

Bank operating system helpful for all forms of financial inst.

Net Retention Rate:

147% net retention rate on S-1

Small subsets of the ecosystem like the application feature help get customers in the door, then they upsell

->127% increase in their customers account opening completion rates

->40% decrease in loan closing time

147% net retention rate on S-1

Small subsets of the ecosystem like the application feature help get customers in the door, then they upsell

->127% increase in their customers account opening completion rates

->40% decrease in loan closing time

Financials:

One of the strongest balance sheets I have seen recently where 78.6% of their total liabilities are deferred revenue.

*IPO in July and secondary in Oct

Rev split 80/20 between subscription and professional services

->12.2% of rev international (98% growth YoY)

One of the strongest balance sheets I have seen recently where 78.6% of their total liabilities are deferred revenue.

*IPO in July and secondary in Oct

Rev split 80/20 between subscription and professional services

->12.2% of rev international (98% growth YoY)

Q3 (10/31/20) BS:

->$378M in cash

->Strong increasing current ratio of 4.8

->Minimal long term debt

->Strong and decreasing debt to TNW of 0.26

->$378M in cash

->Strong increasing current ratio of 4.8

->Minimal long term debt

->Strong and decreasing debt to TNW of 0.26

Q3 (10/31/20) IS/Cash Flows:

->Revenue growth of 43% 3Q YoY (down from 2Q 52%)

->58% GM (up from 54% 2Q)

->Cash from Ops for 9 mos of $21.1M and FCF +

->Performance obligations of $453M, of which 66% will be recognized as revenue in the next 24 months

->Revenue growth of 43% 3Q YoY (down from 2Q 52%)

->58% GM (up from 54% 2Q)

->Cash from Ops for 9 mos of $21.1M and FCF +

->Performance obligations of $453M, of which 66% will be recognized as revenue in the next 24 months

3Q Quote:

“nCino operates one code base across the platform, & we typically roll out major product improvements each spring/fall with incremental enhancements more frequently. So a $1B community bank is leveraging the same tech as the largest global banks in our installed base.”

“nCino operates one code base across the platform, & we typically roll out major product improvements each spring/fall with incremental enhancements more frequently. So a $1B community bank is leveraging the same tech as the largest global banks in our installed base.”

3Q Quote:

“With a full 2020 release, nIQ is, for the first time, integrated into the Bank Operating System. Using artificial intelligence, data analytics, and machine learning, nIQ allows financial institutions to leverage data and make more informed decisions in real time.”

“With a full 2020 release, nIQ is, for the first time, integrated into the Bank Operating System. Using artificial intelligence, data analytics, and machine learning, nIQ allows financial institutions to leverage data and make more informed decisions in real time.”

3Q Quote:

“Our customer success teams lead the way, leveraging their close relationships with customers to understand the pain points and inefficiencies in their day. This feedback helps directly inform our product road map.”

“Our customer success teams lead the way, leveraging their close relationships with customers to understand the pain points and inefficiencies in their day. This feedback helps directly inform our product road map.”

Biggest Risks:

->Adoption by large commercial banks thinking they can create their own product (of which they have failed) - $BAC, $TD currently clients

->Lock-up ends January 11th

->Mrkt Cap of 6.7B leading to P/S of 36, EV to Rev 34

->Adoption by large commercial banks thinking they can create their own product (of which they have failed) - $BAC, $TD currently clients

->Lock-up ends January 11th

->Mrkt Cap of 6.7B leading to P/S of 36, EV to Rev 34

Growth:

->TAM of $10B

->Just over 1% penetrated from a cust. perspective

->SaaS banking rev projected growth to $29B in 2023, 17% CAGR

->No clearly identifiable competition (maybe $JKHY but they are a partner with $NCNO)

->147% net retention rate

->Hiring for int'l growth

->TAM of $10B

->Just over 1% penetrated from a cust. perspective

->SaaS banking rev projected growth to $29B in 2023, 17% CAGR

->No clearly identifiable competition (maybe $JKHY but they are a partner with $NCNO)

->147% net retention rate

->Hiring for int'l growth

*Enjoyed putting this together for my own investing. Hope you glean some info from it. I like to try to make investing accessible to everyone, so that will always be my focus with any threads I share. Cheers!

Read on Twitter

Read on Twitter