2020 marked the year when institutions arrived (for more on this check out @RyanWatkins_ and @YoungCryptoPM 2020 BTC review)

Is all this institutional money making crypto markets more efficient?

A quick thread https://twitter.com/RyanWatkins_/status/1343577325548531713

Is all this institutional money making crypto markets more efficient?

A quick thread https://twitter.com/RyanWatkins_/status/1343577325548531713

2/ The Efficient Market Hypothesis (EMH) implies today's information is useless to predict asset returns because all available information has been priced in by the market.

This means the correlation (ρ) between today's return and tomorrow's return should be 0 in theory

This means the correlation (ρ) between today's return and tomorrow's return should be 0 in theory

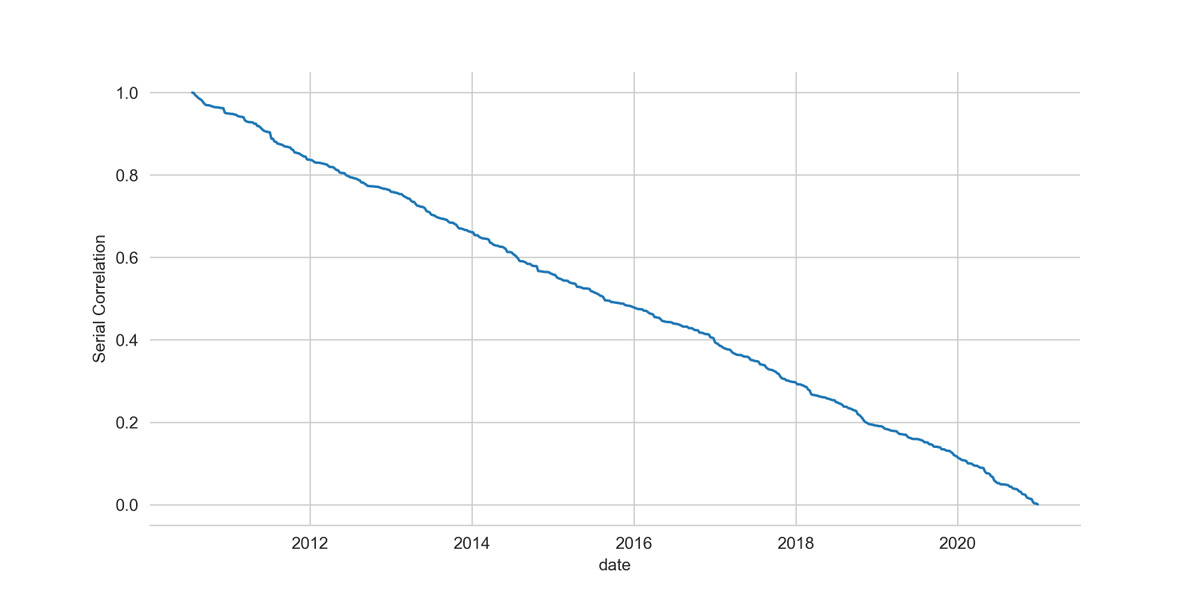

3/ If we use autocorrelation as a measure of market efficiency, ρ might be expected to be close to 1 during the early days of an asset class and become progressively smaller converging to 0 as the market becomes more efficient

4/ However this isn't true for crypto markets, or even traditional equity markets for that matter!

The degree of efficiency, measured as the first-order autocorrelation, varies through time in a cyclical fashion

The degree of efficiency, measured as the first-order autocorrelation, varies through time in a cyclical fashion

5/ In BTC's case, ρ has ranged from .33 to as low as -.5 showing that predictability waxes and wanes, instead of slowly declining as the EMH predicts

The results imply that there are *plenty* of market inefficiencies active managers can exploit using simple investment strategies

The results imply that there are *plenty* of market inefficiencies active managers can exploit using simple investment strategies

Read on Twitter

Read on Twitter