New paper alert:

New paper alert: In @NatureEnergyJnl we show that over time ren. energy (RE) firms face decreasing costs of debt (CoD) relative to non-RE firms.

In @NatureEnergyJnl we show that over time ren. energy (RE) firms face decreasing costs of debt (CoD) relative to non-RE firms. With my fabulous colleagues @KarolKempa and @UlfMoslener.

A short thread

: (1/6)

: (1/6)#energytwitter

To transform the energy system a lot of investment is needed. Debt is the major source of external funding to finance firm’s investment. But higher risks inherent to new low-carbon stuff vs. established but carbon-intensive sectors might lead to higher CoD for RE firms. (2/6)

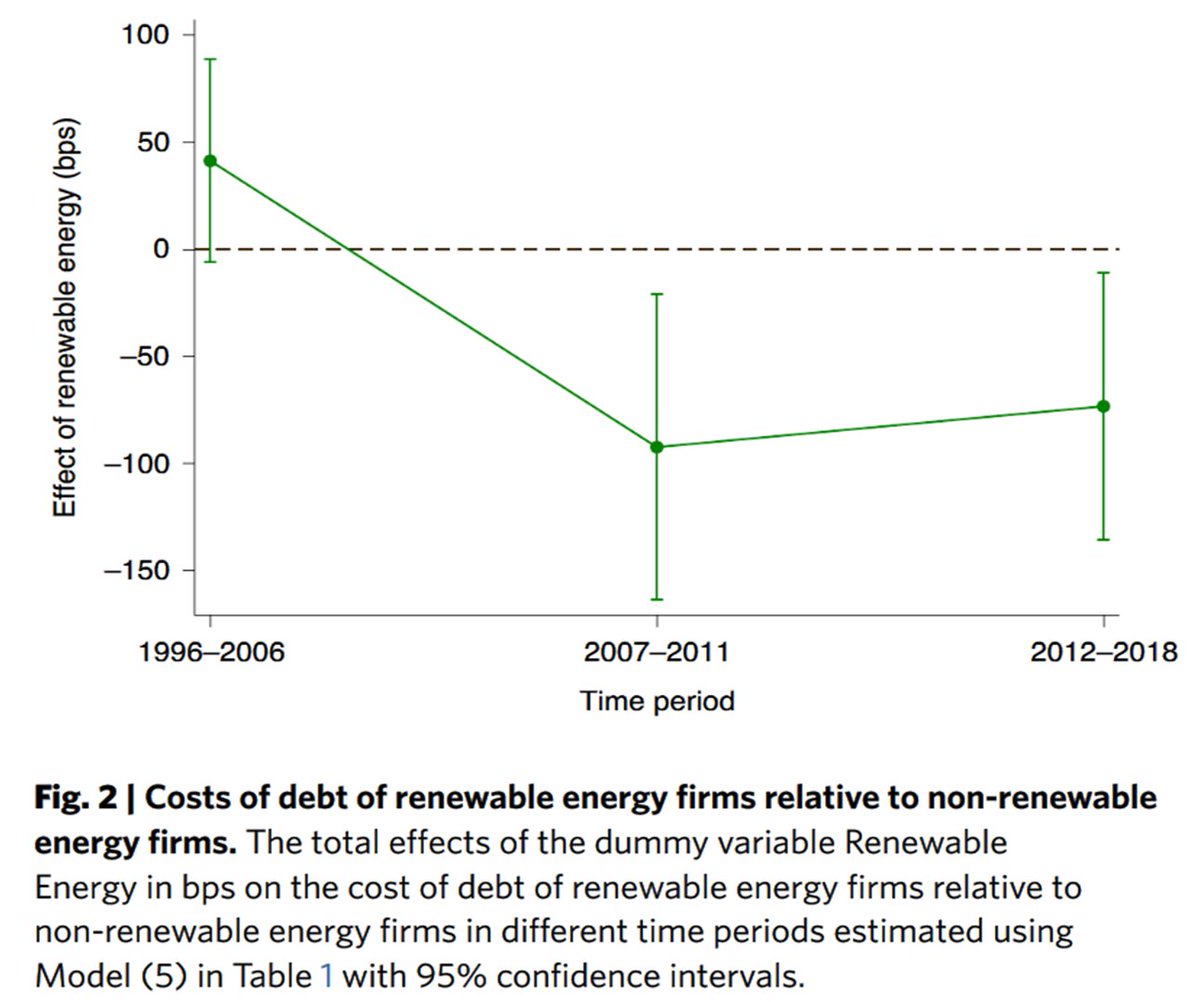

We combine data on loans w. firm-level data from 26 countries. Pre-2007, the CoD of RE firms are (weakly significant) higher than those of non-RE firms. After 2007, CoD of RE firms are 73 bps (after 2011) or even 92 bps (2007-2011) lower than those of non-RE firms. (3/6)

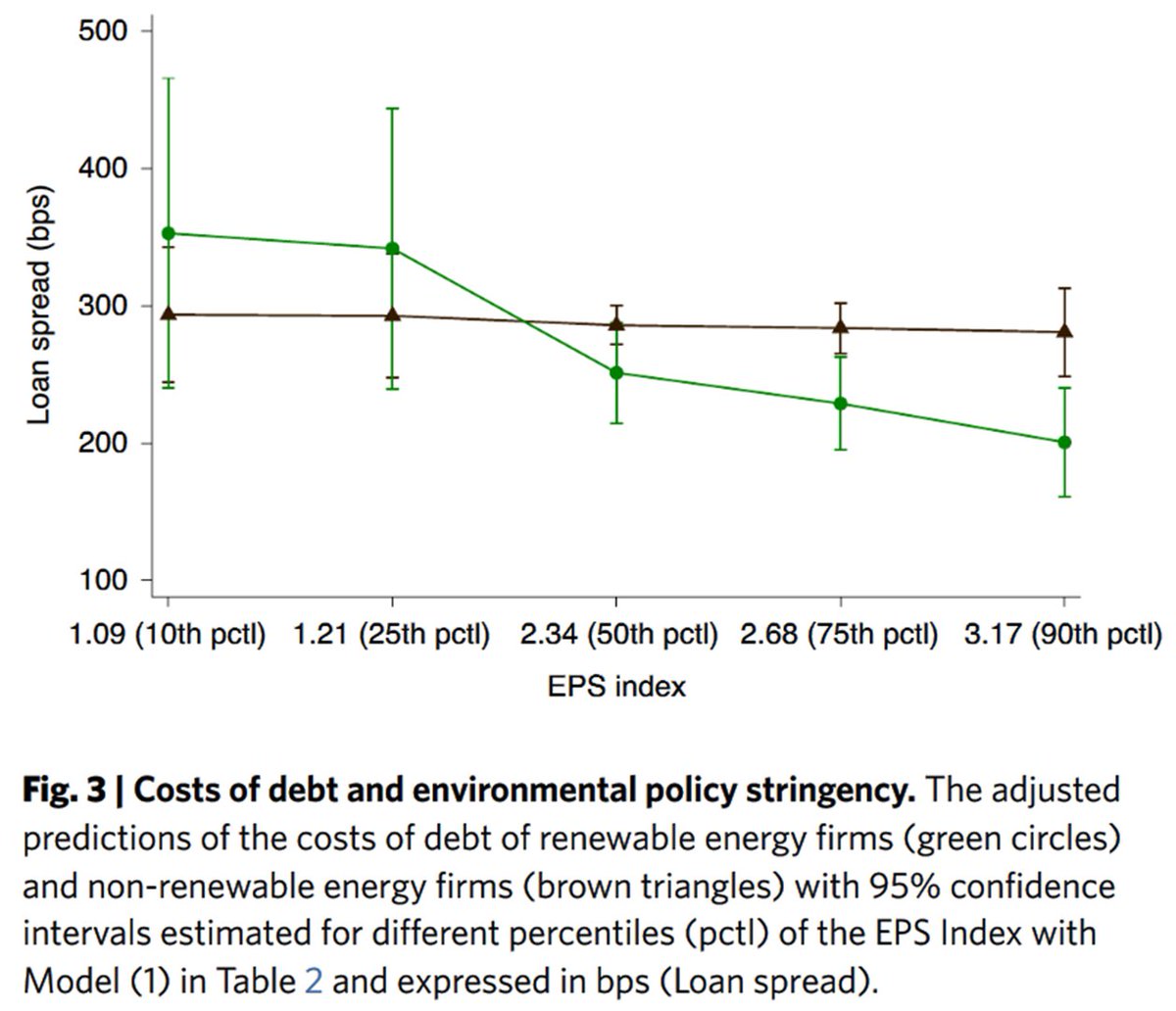

We also have evidence that policies are important for this. A credible policy provides a positive signal for the RE sector reducing the risk perceived by lenders. We show that 1 std. dev. increase of the OECD env. policy stringency index reduces rel. CoD of RE firms by 19% (4/6)

This has important policy implications. Our results suggest that environmental policies have an important risk-reducing effect in addition to directly affecting firm profits (as we already control for them). (5/6)

Read the paper here: https://rdcu.be/cc2BG

Find it here: https://www.nature.com/articles/s41560-020-00745-x

Supplementary info is here: https://static-content.springer.com/esm/art%3A10.1038%2Fs41560-020-00745-x/MediaObjects/41560_2020_745_MOESM1_ESM.pdf

Read Karol's cool "Behind the paper" blog post: https://socialsciences.nature.com/posts/financing-costs-of-renewable-energy-and-fossil-fuel-firms-a-reversal-of-fortunes

End (6/6)

Find it here: https://www.nature.com/articles/s41560-020-00745-x

Supplementary info is here: https://static-content.springer.com/esm/art%3A10.1038%2Fs41560-020-00745-x/MediaObjects/41560_2020_745_MOESM1_ESM.pdf

Read Karol's cool "Behind the paper" blog post: https://socialsciences.nature.com/posts/financing-costs-of-renewable-energy-and-fossil-fuel-firms-a-reversal-of-fortunes

End (6/6)

Oh no: the correct handle of Karol is @kempa_karol

Read on Twitter

Read on Twitter