62% TPV Growth & Profitable

62% TPV Growth & Profitable

A competitor to $LSPD $SQ $ADYEY $PYPL and #STRIPE

A competitor to $LSPD $SQ $ADYEY $PYPL and #STRIPE TPV grew 62% YoY and recorded $ 41M in EBITDA (+59% YoY)

TPV grew 62% YoY and recorded $ 41M in EBITDA (+59% YoY) BUT, even after a rebranding, its plagued with NEGATIVE customer reviews

BUT, even after a rebranding, its plagued with NEGATIVE customer reviewsWill it make it?

Here is an EASY thread

Nuvei $NVEI.TO is an electronic payment processing company based in Canada  It went public in Sept. 2020 in Toronto

It went public in Sept. 2020 in Toronto

Today, the company counts over 800 employees, is active in more than 200 markets and processes 450 payment methods in 150 currencies https://www.reuters.com/article/us-nuvei-corp-ipo-idUSKBN25S69X

Today, the company counts over 800 employees, is active in more than 200 markets and processes 450 payment methods in 150 currencies https://www.reuters.com/article/us-nuvei-corp-ipo-idUSKBN25S69X

It went public in Sept. 2020 in Toronto

It went public in Sept. 2020 in Toronto Today, the company counts over 800 employees, is active in more than 200 markets and processes 450 payment methods in 150 currencies https://www.reuters.com/article/us-nuvei-corp-ipo-idUSKBN25S69X

Today, the company counts over 800 employees, is active in more than 200 markets and processes 450 payment methods in 150 currencies https://www.reuters.com/article/us-nuvei-corp-ipo-idUSKBN25S69X

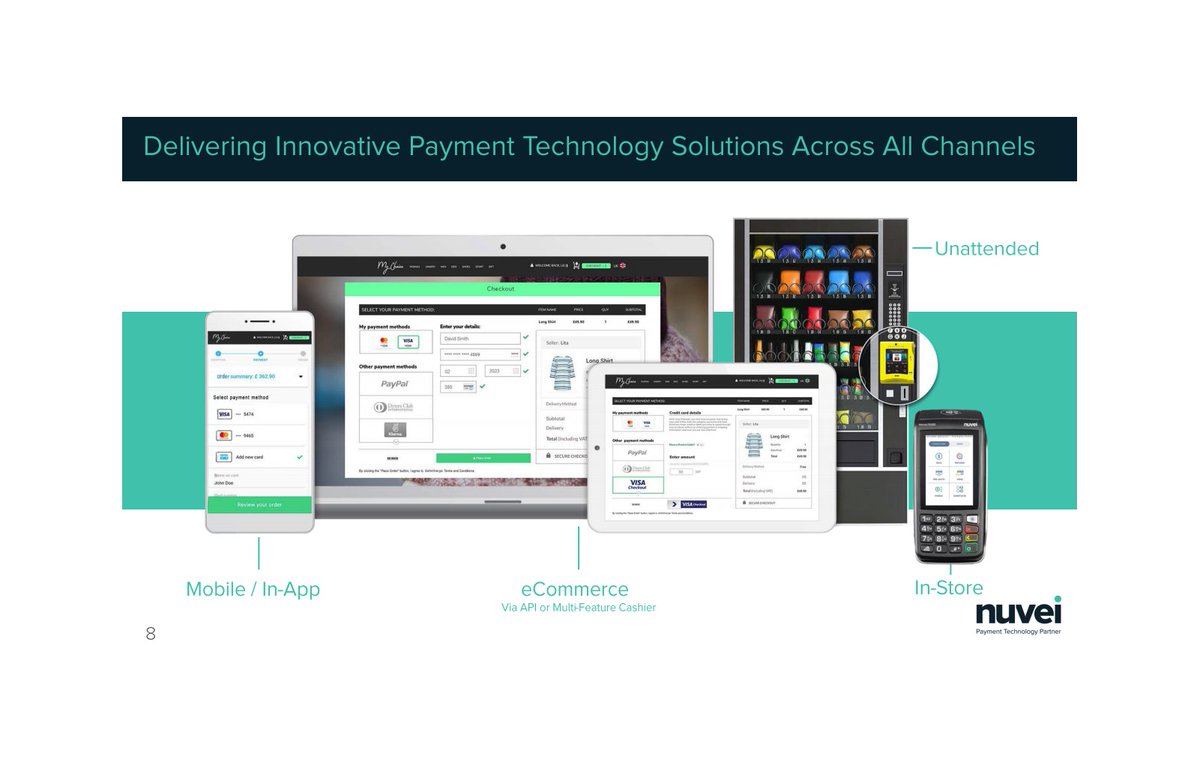

$NVEI enables merchants to accept all kind of payments (safely & easily) through an acquirer agnostic gateway

Merchants can use Nuvei’s tools for their digital checkout online, on mobile, in-store (at the point of sale) across all platforms and devices

Merchants can use Nuvei’s tools for their digital checkout online, on mobile, in-store (at the point of sale) across all platforms and devices

Merchants can use Nuvei’s tools for their digital checkout online, on mobile, in-store (at the point of sale) across all platforms and devices

Merchants can use Nuvei’s tools for their digital checkout online, on mobile, in-store (at the point of sale) across all platforms and devices

This is the Payment Service Providers (PSP) and Merchant Accounts Providers (MAP) space

Here is a technical breakdown of PSPs and MAPS in the “A short intermezzo on Stripe and PSPs”-section https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

Here is a technical breakdown of PSPs and MAPS in the “A short intermezzo on Stripe and PSPs”-section https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

Here is a technical breakdown of PSPs and MAPS in the “A short intermezzo on Stripe and PSPs”-section https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

Here is a technical breakdown of PSPs and MAPS in the “A short intermezzo on Stripe and PSPs”-section https://getbenchmark.substack.com/p/adyen-and-the-virtual-economy-boom

This space is crowded with global and local alternatives, to name a FEW:

This space is crowded with global and local alternatives, to name a FEW:$ADYEY

$SQ

$PYPL

#STRIPE

$LSPD

$FIS

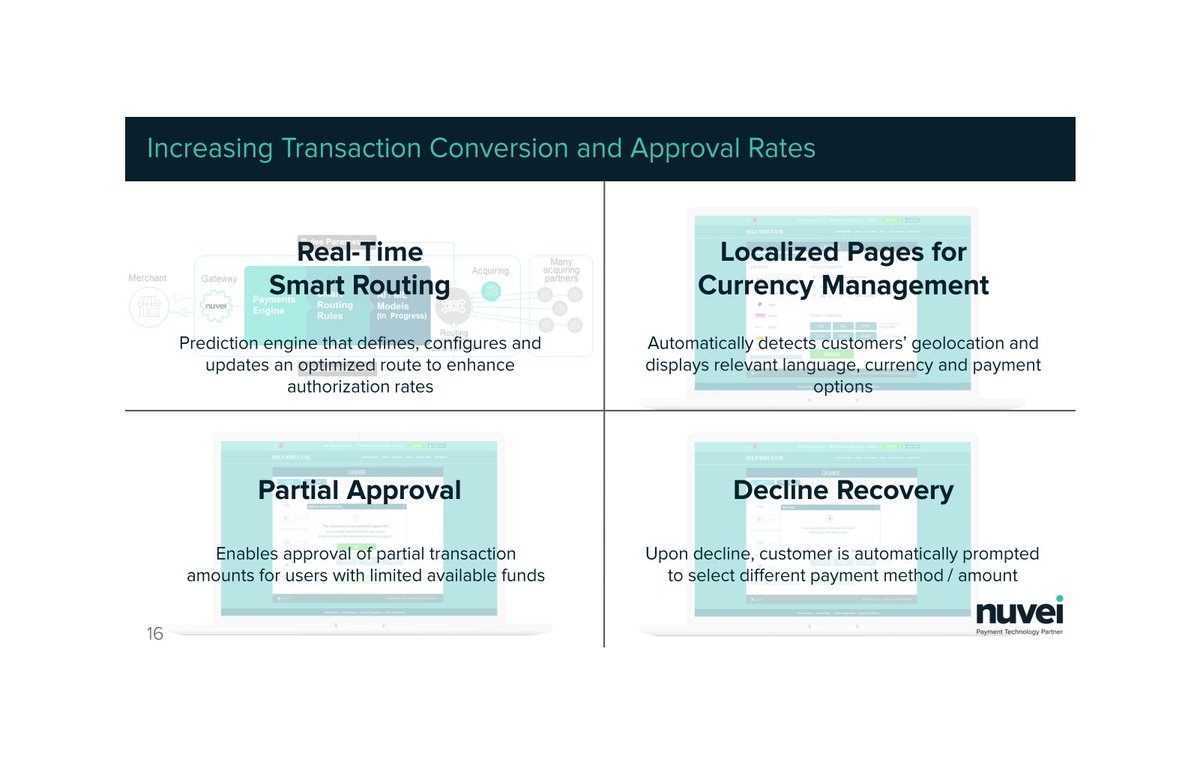

In order to win, $NVEI has filled its tool with features to maximise conversions

“Real-time smart routing” enhances communications with key players (merchant, gateway, acquirers) to speed up transactions

“Real-time smart routing” enhances communications with key players (merchant, gateway, acquirers) to speed up transactions

“Real-time smart routing” enhances communications with key players (merchant, gateway, acquirers) to speed up transactions

“Real-time smart routing” enhances communications with key players (merchant, gateway, acquirers) to speed up transactions

“Localised pages” for currency management in order to always display the local currency

“Localised pages” for currency management in order to always display the local currency “Partial approvals” to unlock transactions for users who may lack some funds

“Partial approvals” to unlock transactions for users who may lack some funds “Decline recovery“ to propose a new payment method to customers whose payment did not work

“Decline recovery“ to propose a new payment method to customers whose payment did not work

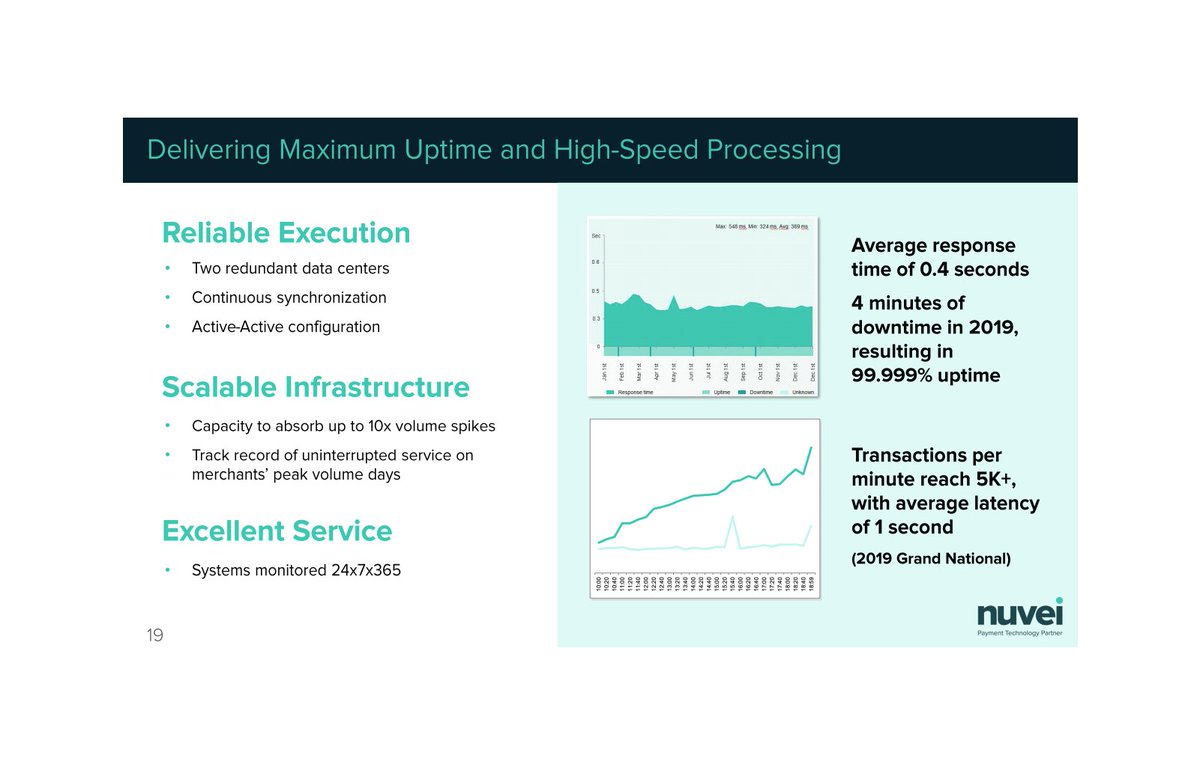

This is backed up by robust infrastructure on Nuvei’s side

Nuvei scored an average response time of 0.4 seconds

Nuvei scored an average response time of 0.4 seconds

Only registered 4 minutes of downtime in 2019, good for a 99.999% uptime

Only registered 4 minutes of downtime in 2019, good for a 99.999% uptime

Nuvei scored an average response time of 0.4 seconds

Nuvei scored an average response time of 0.4 seconds Only registered 4 minutes of downtime in 2019, good for a 99.999% uptime

Only registered 4 minutes of downtime in 2019, good for a 99.999% uptime

Nuvei looks strong until now!

It has built the full stack of apps and systems required to run payment operation on a global scale

It has built the full stack of apps and systems required to run payment operation on a global scale

It now serves over 50K customers & exposes itself to organically growing sectors such as online gaming, social gaming and online marketplaces

It now serves over 50K customers & exposes itself to organically growing sectors such as online gaming, social gaming and online marketplaces

It has built the full stack of apps and systems required to run payment operation on a global scale

It has built the full stack of apps and systems required to run payment operation on a global scale It now serves over 50K customers & exposes itself to organically growing sectors such as online gaming, social gaming and online marketplaces

It now serves over 50K customers & exposes itself to organically growing sectors such as online gaming, social gaming and online marketplaces

The online payments market is huge

The online payments market is huge $SQ expects the “business” market to be worth $ 100B and the “consumers” market to be worth $ 60B

$SQ expects the “business” market to be worth $ 100B and the “consumers” market to be worth $ 60B  According to Allied Market Research, the global mobile payment market will grow to $ 12T by 2027

According to Allied Market Research, the global mobile payment market will grow to $ 12T by 2027  Up from $ 1.5T in 2019

Up from $ 1.5T in 2019

Markets And Markets expects the global payment gateway market to reach $ 87B in 2025

Markets And Markets expects the global payment gateway market to reach $ 87B in 2025  Up from $ 31B in 2016

Up from $ 31B in 2016 Mordor Intelligence expects the global gateway market to grow to $ 43B in 2025 up from $ 17B in 2019

Mordor Intelligence expects the global gateway market to grow to $ 43B in 2025 up from $ 17B in 2019  For a CAGR of 16%

For a CAGR of 16%

Frost & Sullivan forecast the Chinese mobile payments market to grow to $ 97T by 2023

Frost & Sullivan forecast the Chinese mobile payments market to grow to $ 97T by 2023  From $30T in 2017

From $30T in 2017 Markets And Markets expects the digital payment market to double in size by 2025 to $ 154B

Markets And Markets expects the digital payment market to double in size by 2025 to $ 154B  from $ 79B in 2020

from $ 79B in 2020

PayPal projects its TAM to be at $110T

PayPal projects its TAM to be at $110T  This represents payment volume (in Q2 ’20, payment volume stood at $222B for $ 5.2 B in sales)

This represents payment volume (in Q2 ’20, payment volume stood at $222B for $ 5.2 B in sales) According to eMarketer, the mobile commerce & eCommerce purchase volume is expected to double to $ 6.3T by 2024, up from $ 3.4T in 2019

According to eMarketer, the mobile commerce & eCommerce purchase volume is expected to double to $ 6.3T by 2024, up from $ 3.4T in 2019

That’s what we want  A large market evolving towards technology driven solutions

A large market evolving towards technology driven solutions

Eating away incumbent’s market share Banks, financing institutions and legacy POS systems

Banks, financing institutions and legacy POS systems

A large market evolving towards technology driven solutions

A large market evolving towards technology driven solutions

Eating away incumbent’s market share

Banks, financing institutions and legacy POS systems

Banks, financing institutions and legacy POS systems

But what makes $NVEI better than other alternatives?

“it’s certainly not the worst company we’ve seen, it doesn’t offer anything special or unique that would help it stand out from the rest of its competitors.”

“it’s certainly not the worst company we’ve seen, it doesn’t offer anything special or unique that would help it stand out from the rest of its competitors.”

From Merchant Maverick https://www.merchantmaverick.com/reviews/pivotal-payments-review/

https://www.merchantmaverick.com/reviews/pivotal-payments-review/

“it’s certainly not the worst company we’ve seen, it doesn’t offer anything special or unique that would help it stand out from the rest of its competitors.”

“it’s certainly not the worst company we’ve seen, it doesn’t offer anything special or unique that would help it stand out from the rest of its competitors.”From Merchant Maverick

https://www.merchantmaverick.com/reviews/pivotal-payments-review/

https://www.merchantmaverick.com/reviews/pivotal-payments-review/

“Nuvei rates as an average merchant services provider according to our rating system.”

“Nuvei rates as an average merchant services provider according to our rating system.”“The company’s rebranding does not appear to have included any significant structural changes, so merchants can expect the service and pricing that Pivotal Payments was known for.”

“Considering that Pivotal Payments was rated as one of the worst merchant account providers in the industry”

From Card Payment Options https://www.cardpaymentoptions.com/credit-card-processors/nuvei/

https://www.cardpaymentoptions.com/credit-card-processors/nuvei/

From Card Payment Options

https://www.cardpaymentoptions.com/credit-card-processors/nuvei/

https://www.cardpaymentoptions.com/credit-card-processors/nuvei/

“The positive customer testimonials are far outnumbered by the quantity of complaints, but Pivotal Payments does have a small selection of testimonials on its website.”

“The positive customer testimonials are far outnumbered by the quantity of complaints, but Pivotal Payments does have a small selection of testimonials on its website.”From Card Fellow

https://www.cardfellow.com/credit-card-processors/pivotal-payments

Nuvei rebranded itself and was previously named “Pivotal Payments”

Nuvei rebranded itself and was previously named “Pivotal Payments” Users often complained about Pivotal Payment’s sales tactic as independent sales were in charge of sales

Users often complained about Pivotal Payment’s sales tactic as independent sales were in charge of sales

“Another concern we have with Nuvei is its continued use of independent sales agents. This practice has led to hundreds of complaints across the processing industry”

“[…] today many providers are switching to a full-time, salaried sales staff to improve the quality of the sales experience and retain merchants for a much longer period.”

From Merchant Maverick

Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy

Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy

From Merchant Maverick

Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy

Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy

Financials Check

Financials Check

Sales grew 32% in Q3 ’20 to $ 94m up from $ 71m a year earlier

Sales grew 32% in Q3 ’20 to $ 94m up from $ 71m a year earlier Total volume processed increased by 62% YoY to $ 11.5B up from $ 7.1B a year earlier

Total volume processed increased by 62% YoY to $ 11.5B up from $ 7.1B a year earlier Gross margins at 82%, constant YoY

Gross margins at 82%, constant YoY

SG&A expenses reached $ 61m in Q3 ’20, down from $ 63m a year earlier

SG&A expenses reached $ 61m in Q3 ’20, down from $ 63m a year earlier Adjusted EBITDA reached $ 41m up 59% YoY from $ 26m a year earlier

Adjusted EBITDA reached $ 41m up 59% YoY from $ 26m a year earlier It has $ 444m in current assets versus $ 365m in current liabilities

It has $ 444m in current assets versus $ 365m in current liabilities

THE BOTTOM LINE

THE BOTTOM LINE

$NVEI is a challenger in the payment solutions race, it has built the stack required to compete in a global scale

$NVEI is a challenger in the payment solutions race, it has built the stack required to compete in a global scale Its operations are robust, providing high uptime and is able to scale with additional demand, reflected in the constant gross margins

Its operations are robust, providing high uptime and is able to scale with additional demand, reflected in the constant gross margins

Nuvei turned a profit and managed to keep its operating expenses constant

Nuvei turned a profit and managed to keep its operating expenses constant Nuvei suffers from poor customer reviews as users complain about its sales agents’ tactics

Nuvei suffers from poor customer reviews as users complain about its sales agents’ tactics Nuvei went through a full rebranding but failed to change its image

Nuvei went through a full rebranding but failed to change its image

On a high level, its doesn’t offer any feature that competition doesn’t offer as well

On a high level, its doesn’t offer any feature that competition doesn’t offer as well Competition from TIER-1 players such as $SQ $PYPL #STRIPE and $ADYEY required $NVEI to score high on all metrics

Competition from TIER-1 players such as $SQ $PYPL #STRIPE and $ADYEY required $NVEI to score high on all metrics We stay on the sidelines

We stay on the sidelines

$DHER.DE is on our watchlist

$DHER.DE is on our watchlist  To Be Reviewed SOON

To Be Reviewed SOON

Disclaimer - This is not investment advice in any form and investors are responsible for conducting their own research before investing.

Sources

✑ Investor presentation

✑ Company website

✑ Card Fellow

✑ Merchant Maverick

✑ Card Payment Options

✑ Reuters

✑ Merchant Maverick

✑ Mordor Intelligence

✑ Allied Market Research

✑ Markets And Markets

✑ Frost & Sullivan

✑ Card Payment Options

✑ Reuters

✑ Merchant Maverick

✑ Mordor Intelligence

✑ Allied Market Research

✑ Markets And Markets

✑ Frost & Sullivan

Hope you liked this thread!

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

For more content, follow us on Twitter

For more content, follow us on Twitter

EASY BRIEFINGS delivered straight to your inbox

EASY BRIEFINGS delivered straight to your inbox  Don’t MISS IT

Don’t MISS IT  https://getbenchmark.substack.com

https://getbenchmark.substack.com

Read on Twitter

Read on Twitter

![“[…] today many providers are switching to a full-time, salaried sales staff to improve the quality of the sales experience and retain merchants for a much longer period.”From Merchant Maverick Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy “[…] today many providers are switching to a full-time, salaried sales staff to improve the quality of the sales experience and retain merchants for a much longer period.”From Merchant Maverick Yet, independent sales agents still belong to Nuvei’s Go-To-Market strategy](https://pbs.twimg.com/media/Eq_ekwfXMAAmDrQ.jpg)