THREAD on the EU-UK Trade Agreement

< Summary > We were initially pleasantly surprised at what seemed to be good protections on 'tax' as per social & environmental standards, but the detail reveals that assurances against UK backsliding nothing like as strong as implied (1/n)

< Summary > We were initially pleasantly surprised at what seemed to be good protections on 'tax' as per social & environmental standards, but the detail reveals that assurances against UK backsliding nothing like as strong as implied (1/n)

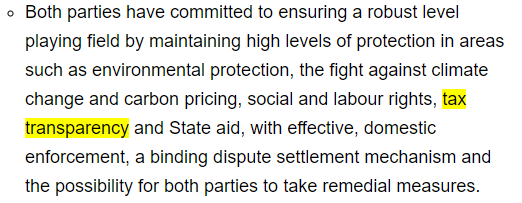

When the EU-UK Trade Agreement was announced on Christmas Eve it looked like 'tax' would be afforded the same protections as labour, social and environmental standards. This from the EU's announcement  (2/n)

(2/n)

(2/n)

(2/n)

But once the 1,000+ pages of detail of the EU-UK Trade Agreement were subsequently published, it became apparent that baseline UK tax conduct protections had not be enshrined with anything like the same vigour as labour, social and environmental standards (3/n)

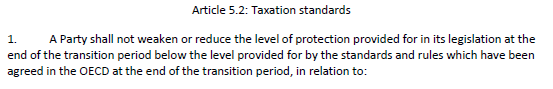

Significantly, whilst EU-UK Trade Agreement requires that UK labour, social & environmental standards must not fall below where they were end 2020: with 'tax', the requirement is that they not fall below the OECD global baselines (which is pretty basic and a much lower bar) (4/n)

Moreover, not only are the 'tax' baseline standards set much lower than for labour, social & environmental issues in the trade agreement... amazingly... there are also no non-regression or dispute settlement protections [AS IMPLIED IN THE INITIAL UK / EU ANNOUNCEMENTS] (5/n)

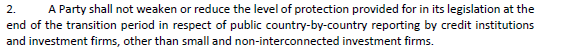

One exception to the lack securement of challenging tax transparency standards in UK/EU trade agreement is the requirement that public country by country reporting be maintained for the banking sector. A welcome EU innovation (that needs to be extended if anything) (6/n)

But equally noteworthy is the absence of requirements for public country by country reporting in the oil, gas, mining & forestry sectors (cf banking). This has been in place across the EU since 2016 with good compliance

So why continue pCbCR in banking but not extractives? (7/n)

So why continue pCbCR in banking but not extractives? (7/n)

Read on Twitter

Read on Twitter

![Moreover, not only are the 'tax' baseline standards set much lower than for labour, social & environmental issues in the trade agreement... amazingly... there are also no non-regression or dispute settlement protections [AS IMPLIED IN THE INITIAL UK / EU ANNOUNCEMENTS] (5/n) Moreover, not only are the 'tax' baseline standards set much lower than for labour, social & environmental issues in the trade agreement... amazingly... there are also no non-regression or dispute settlement protections [AS IMPLIED IN THE INITIAL UK / EU ANNOUNCEMENTS] (5/n)](https://pbs.twimg.com/media/Eq_ZT1NXMAAfCqx.png)