Thread: Let's break down the Digital Services Tax (DST).

You've probably received an email from KRA or seen an ad that the Digital Services Tax (DST) is now in effect, to be charged at the rate of 1.5% on the gross transaction value of the digital service provided.

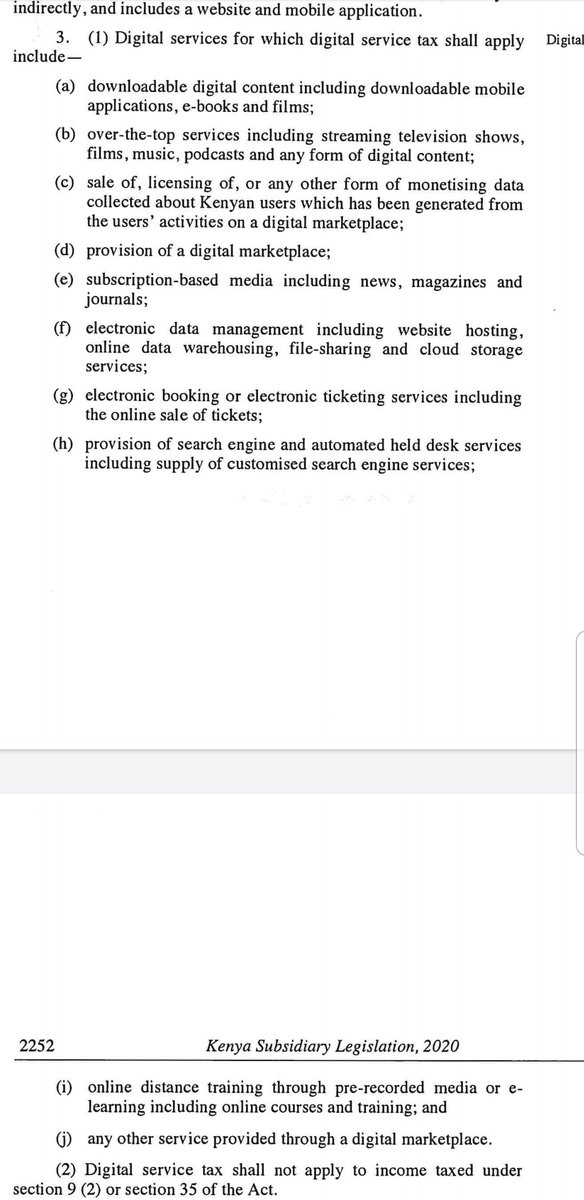

So, which digital services will be subject to the DST. Screenshot of the services listed in the regulations below:

Note that the list above isn't exhaustive, DST applies to any other service provided in a digital market place (defined as a platform enabling direct interaction between buyers & sellers via electronic means). I anticipate litigation on how KRA will apply this.

The definition of a digital market place is quite problematic by requiring the presence of buyers and sellers. It effectively excludes most of the freely accessible digital services & even if they monetize user data, DST only applies if they are within that definition.

Note that DST won't apply to digital financial services & online services by the government. For financial services - makes sense as a single payment for a digital service could be subject to double DST - 1.5% on digital service & 1.5% on the digital payment service used to pay.

Now, digital services for sales promotion, ad services & marketing (probably where influencers et al might fall under) won't be subject to DST coz the tax changes made earlier in April, subjected them to a withholding tax of 20% & the DST regulations exclude the payments from it.

For KE businesses, the DST will be an advance tax. Meaning, the DST deducted & paid to KRA on the digital services can be used by the biz to offset it's tax liability for that year. Basically, the tax it has to pay to KRA minus the total DST that had been deducted & remitted.

Impact being on immediate cash flows, if the business has a tax liability to offset in that year. Which is another issue....(continued)

From Jan 1, the minimum tax takes effect at 1% of a biz's revenue thus if a digital business, effectively 2.5% on its revenues. This will have a significant impact on their cash flows. Because both taxes are based on the gross revenues (that is without deducting any expenses).

So, when is DST payable? It's supposed to be due at the point of making the payment for the digital services, essentially, should be deducted by the user & paid to KRA. Considering the practicality of enforcing against individual users, this isn't the case.

For example, Netflix had approx. 29,500 subscribers in KE in 2020 - it would have meant that each subscriber would deduct the 1.5% when paying the subscription & remit the DST to KRA.

So, who pays? The obligation is on the service provider to deduct the 1.5% once they are paid by a user. Users have no obligation when it comes to DST.

But - KRA has plans to appoint digital service tax agents to collect & remit the DST. This will likely be financial/payment service providers - banks, M-PESA. E.g. when using your NCBA card to pay Netflix, NCBA (if appointed) will be required to deduct the 1.5% & process net.

How do you calculate? DST is calculated on the gross transaction value which is the amount you pay for a direct service (e.g. streaming service subscription), if a platform, the fee paid for use of the platform. On the latter - Uber should fall under it, so that...

If you pay 1000 to the driver/Uber on a ride and the driver pays 25% of the 1000 to Uber as commission, it is expected that the 1.5% will be charged on that commission amount. (There's potential litigation on what constitutes gross transaction value).

How does this affect you as a user/consumer? Well the service provider may increase the price of the service to cover the new DST expense, so you'll have to fork out more. Or they could absorb the expense and maintain the existing prices. (Rem there's also digital VAT now).

I genuinely hope this thread makes the DST more understandable. A few things may have been lost in translation but I'm open to learn and discuss. Also, I've left out other things to avoid a very long thread. Any questions, ask?

I should mention, this was specific to KE digital service providers & KE digital users. I haven't covered the impact on foreign digital service providers.

Small clarification on the below, re: influencers, sales promotion and marketing services. If you're resident in KE, you'll probably be subject to DST. The exemption is where the service is provided by a non-resident service provider. https://twitter.com/ndegwapower/status/1346516373242081281?s=19

Read on Twitter

Read on Twitter