Timing the market is when an investor tries to predict the short term stock market movements.

Usually, they get in and out of the market based on predictions regarding various economic factors.

Usually, they get in and out of the market based on predictions regarding various economic factors.

These can be rising interest rates, a recession, slow GDP growth, geopolitical events, etc.

Historically, only a handful of investors have managed to successfully time the market (George Soros, Michael Burry, Bill Ackman).

Historically, only a handful of investors have managed to successfully time the market (George Soros, Michael Burry, Bill Ackman).

The majority are favoring a buy and hold strategy (most notably Warren Buffett and Peter Lynch), i.e. buying companies at a fair value and holding through thick and thin.

Despite that, there are still people who think they will be able to time the market, i.e. sell before a downturn and buy again at the bottom.

This strategy has proven to be very risky and not successful.

Let's see what the numbers say.

This strategy has proven to be very risky and not successful.

Let's see what the numbers say.

Let's have three different investors John, Bob, and Eric.

All three invested a lump sum of $5,000 on January 3, 2020.

John was a very lucky investor in terms of market timing and made 10 investments of $10,000 at short-term market lows.

All three invested a lump sum of $5,000 on January 3, 2020.

John was a very lucky investor in terms of market timing and made 10 investments of $10,000 at short-term market lows.

Eric, on the other hand, was very unlucky and made 10 investments of $10,000 at short-term market highs.

Bob chose to make monthly contributions equal to $401.61, also known as dollar-cost averaging.

They all invested a total of $105,000 until September 30, 2020

Bob chose to make monthly contributions equal to $401.61, also known as dollar-cost averaging.

They all invested a total of $105,000 until September 30, 2020

John, despite being extremely lucky at market timing, made only $9,000 more than Bob in a 20-year span, only 4.6% more.

Eric, the unlucky one, made $14,000 less than Bob, or 8% less

Eric, the unlucky one, made $14,000 less than Bob, or 8% less

However, being so lucky at timing the market so many times with perfection is a very rare event.

Sometimes going in and out of the market might make you miss some high days before the top or after the bottom.

Sometimes going in and out of the market might make you miss some high days before the top or after the bottom.

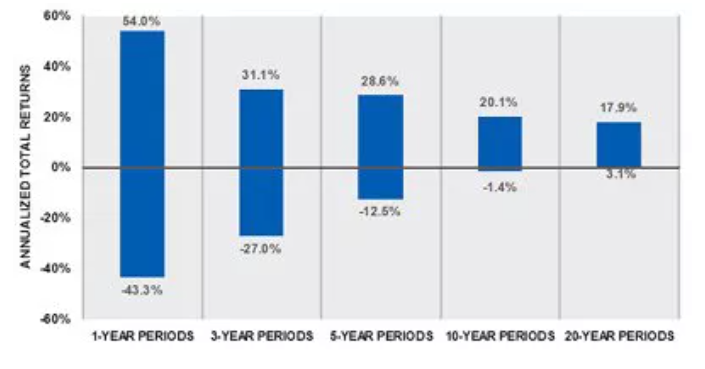

First, let's take a look at the range of returns of the S&P500 for different holding periods

According to research conducted by Charles Schwab Company in 2012, between 1926 and 2011, a 20-year holding period never produced a negative result

According to research conducted by Charles Schwab Company in 2012, between 1926 and 2011, a 20-year holding period never produced a negative result

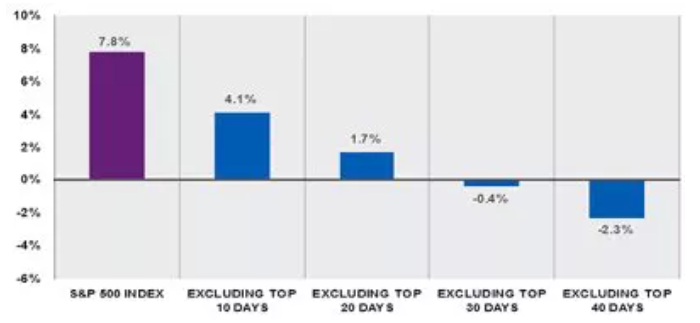

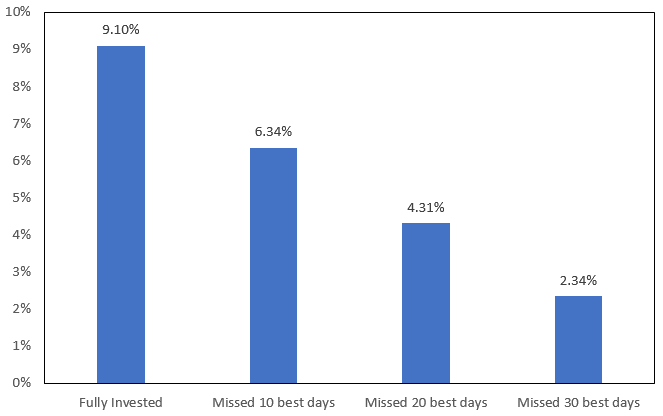

On a period from 1996 to 2011, the returns of the S&P 500 would be 7.8% annualized, while missing the 10 best days, results in only 4.1% annualized. This difference can create a huge difference in your portfolio value

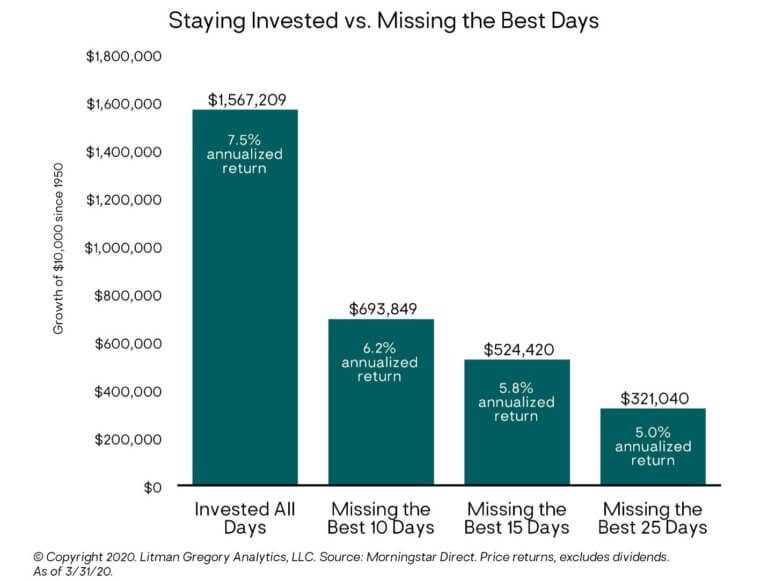

For example, an investor who invested $10,000 in the S&P 500 in 1950 would end up with more than $1.5 million (as of 3/31/2020) if they had remained fully invested (not including dividends). This comes down to have a 7.5% annualized return

However, the final value for an investor that missed the 10 best days is significantly lower, not even half of it.

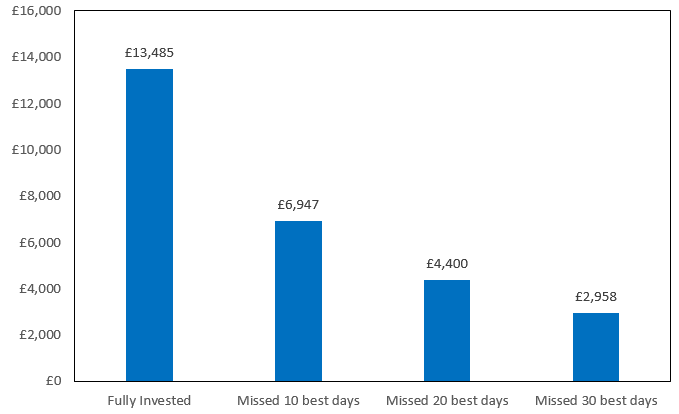

Similarly, in the UK stock market, a £1,000 investment in the FTSE 100 in 1989 would be worth more than £13,000 in January 2020, for an annualized return of 9.1%

On the other hand, missing the 10 best days brings your investment down to less than £7,000, less than half of the value of your portfolio if you had bought and held.

/END/

/END/

If you liked this thread, give a like and a retweet

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

For more educational threads on financial independence and investing for beginners see below for a collection of threads

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

https://twitter.com/itsKostasWithK/status/1345790210441928708?s=20

Read on Twitter

Read on Twitter