Lots of folks misread this op-ed (research cited in @washingtonpost & @latimes editorials too).

This isn't about how we distribute $$ when we #cancelstudentdebt.

It is about *the value* we assign to each dollar of relief for different groups of people. https://www.washingtonpost.com/outlook/2020/12/28/student-loan-forgiveness-repayment-income-regressive/

This isn't about how we distribute $$ when we #cancelstudentdebt.

It is about *the value* we assign to each dollar of relief for different groups of people. https://www.washingtonpost.com/outlook/2020/12/28/student-loan-forgiveness-repayment-income-regressive/

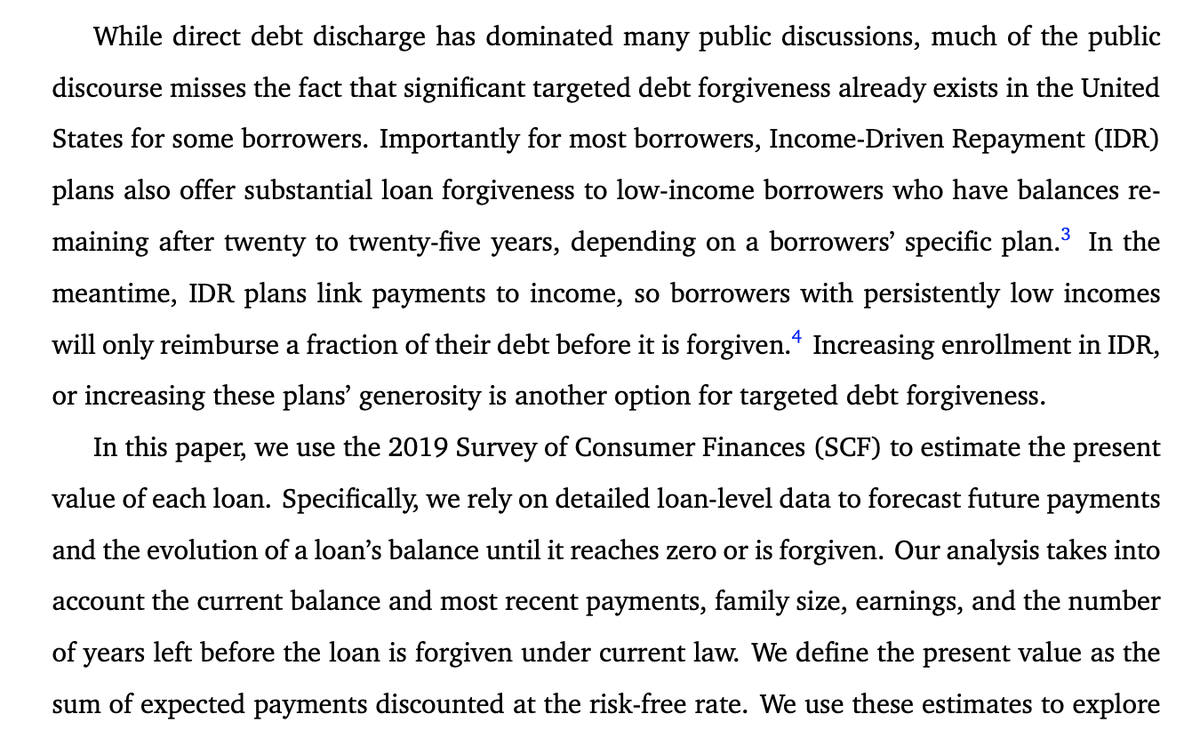

The authors model the "present value" of each $1 of cancellation based on borrowers' current incomes.

They find $1 is *worth less* to low-income people, relative to high earners.

They look at the distribution.

Ta-da! It is "not progressive."

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3739900

They find $1 is *worth less* to low-income people, relative to high earners.

They look at the distribution.

Ta-da! It is "not progressive."

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3739900

Importantly, this is *NOT* an estimate of where federal $$ "flows" if we #CancelStudentDebt.

It's not even a look at who has student debt right now.

It is a value judgement wrapped in the language of empiricism.

It's not even a look at who has student debt right now.

It is a value judgement wrapped in the language of empiricism.

How do they swing this?

The authors rely on magical thinking about the capacity of our existing system to deliver relief.

They conclude each $1 of cancellation isn't worth as much to low-income people b/c of income-driven repayment.

It ignores reality. https://twitter.com/louise_seamster/status/1343958905681010689?s=20

The authors rely on magical thinking about the capacity of our existing system to deliver relief.

They conclude each $1 of cancellation isn't worth as much to low-income people b/c of income-driven repayment.

It ignores reality. https://twitter.com/louise_seamster/status/1343958905681010689?s=20

The authors assume everyone eligible for IDR maxes out this benefit over decades & that (somehow) no one ever defaults again.

Thats not all!

They also *rewrite the rules* for who is eligible for IDR: 9 million defaulters are now eligible & so are parents.

~this~is~a~fantasy~

Thats not all!

They also *rewrite the rules* for who is eligible for IDR: 9 million defaulters are now eligible & so are parents.

~this~is~a~fantasy~

Many have spent decades focused on making the income-driven repayment scheme deliver for low-income people.

We wrote regulations, filed lawsuits, and testified before Congress and in statehouses across the country.

We've learned things along the way.

The authors ignore it all.

We wrote regulations, filed lawsuits, and testified before Congress and in statehouses across the country.

We've learned things along the way.

The authors ignore it all.

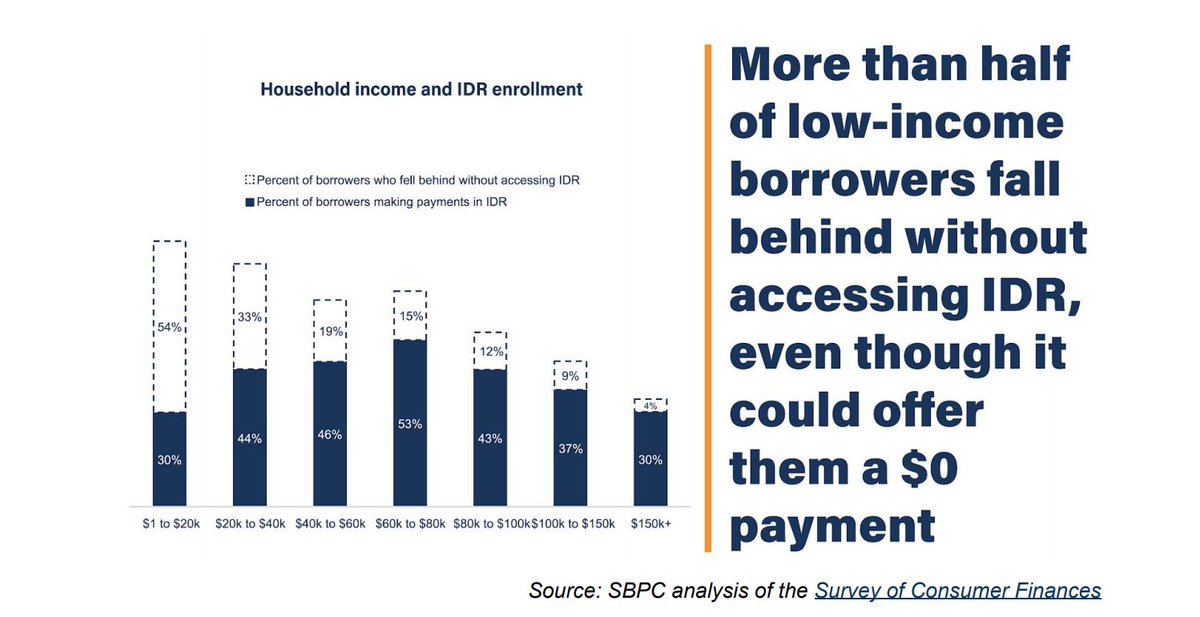

1) The student loan safety net is in tatters.

Low-income borrowers and low-balance borrowers miss out on the benefits of IDR. This is the largest cohort of people with student debt.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3726183

Low-income borrowers and low-balance borrowers miss out on the benefits of IDR. This is the largest cohort of people with student debt.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3726183

2) Student debt is a civil rights crisis.

The distribution of student debt burdens should never be discussed separate and apart from demographic disparities.

At this late hour, anyone who overlooks the roles of race & gender is being willfully ignorant. https://twitter.com/rooseveltinst/status/1343995201812013056

The distribution of student debt burdens should never be discussed separate and apart from demographic disparities.

At this late hour, anyone who overlooks the roles of race & gender is being willfully ignorant. https://twitter.com/rooseveltinst/status/1343995201812013056

3) #Corruption drives the student debt crisis.

The longer the time horizon, the higher the chances for abuse by companies tasked with administering IDR.

We need to radically rethink the student loan safety net *before* we assume millions can rely on it. https://www.consumerfinance.gov/about-us/newsroom/cfpb-sues-nations-largest-student-loan-company-navient-failing-borrowers-every-stage-repayment/

The longer the time horizon, the higher the chances for abuse by companies tasked with administering IDR.

We need to radically rethink the student loan safety net *before* we assume millions can rely on it. https://www.consumerfinance.gov/about-us/newsroom/cfpb-sues-nations-largest-student-loan-company-navient-failing-borrowers-every-stage-repayment/

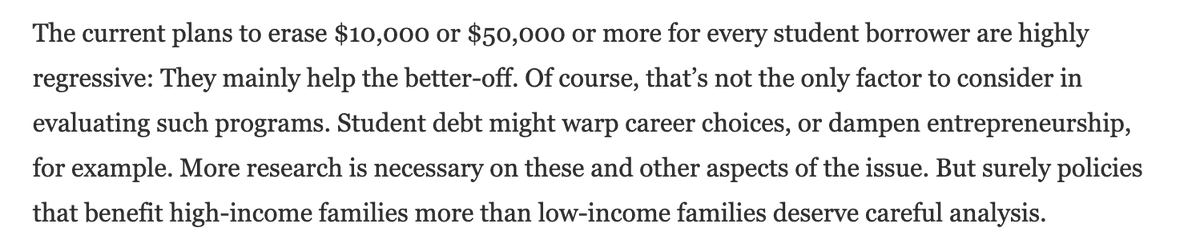

The research in this op-ed is dangerous.

It gives critics a powerful talking point that flies in the face of borrowers' experiences & rejects reams of new data. It wraps the point in an ivy league credential.

Yet evidence to the contrary arrives daily: https://twitter.com/Dcollier74/status/1345899328674684929?s=20

It gives critics a powerful talking point that flies in the face of borrowers' experiences & rejects reams of new data. It wraps the point in an ivy league credential.

Yet evidence to the contrary arrives daily: https://twitter.com/Dcollier74/status/1345899328674684929?s=20

Make no mistake: this op-ed is a shot @JoeBiden.

These empirical gymnastics mask the benefits of broad-based debt cancellation- a key campaign pledge & a chance to help millions w/o Congress.

Maybe these purported insights "deserve careful analysis" instead.

#CancelStudentDebt

These empirical gymnastics mask the benefits of broad-based debt cancellation- a key campaign pledge & a chance to help millions w/o Congress.

Maybe these purported insights "deserve careful analysis" instead.

#CancelStudentDebt

Say what you want about @BetsyDeVosED, but she knows a good grift when she sees it.

https://www.cbsnews.com/news/student-loan-forgiveness-betsy-devos-letter/

https://www.cbsnews.com/news/student-loan-forgiveness-betsy-devos-letter/

Read on Twitter

Read on Twitter