China just launched the national Carbon market.

Ministry of Ecology and Environment published ETS management rules, 2019-2020 allocation plan & list of 2225 enterprises:

http://mee.gov.cn/xxgk2018/xxgk/xxgk02/202101/t20210105_816131.html

http://mee.gov.cn/xxgk2018/xxgk/xxgk03/202012/t20201230_815546.html

my take on key highlights of #CNETS

my take on key highlights of #CNETS

Ministry of Ecology and Environment published ETS management rules, 2019-2020 allocation plan & list of 2225 enterprises:

http://mee.gov.cn/xxgk2018/xxgk/xxgk02/202101/t20210105_816131.html

http://mee.gov.cn/xxgk2018/xxgk/xxgk03/202012/t20201230_815546.html

my take on key highlights of #CNETS

my take on key highlights of #CNETS

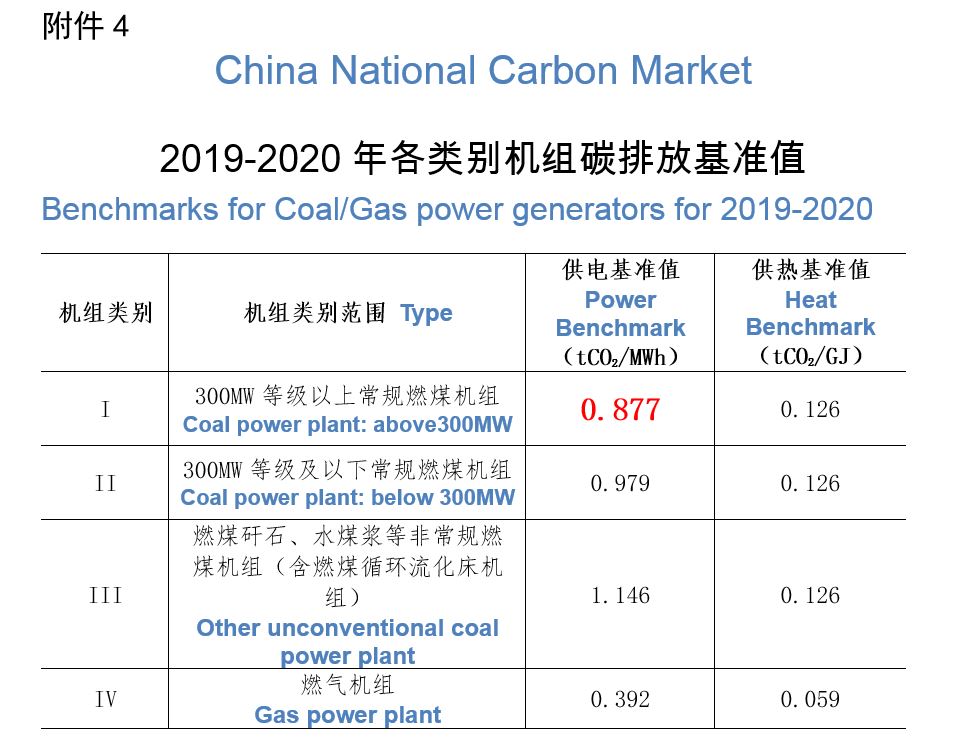

China national ETS will begin with intensity-based target, applying benchmarks to coal/gas-fired power generation, in contrast to absolution Cap in EU ETS etc.

First compliance period will cover two years, 2019 and 2020. Compliance deadline is not set yet.

First compliance period will cover two years, 2019 and 2020. Compliance deadline is not set yet.

Currently Gas power plants do not have compliance obligation above their free allocation.

2019 Coal generation was 4560 TWh, 2020 likely similar level.

2019 Coal generation was 4560 TWh, 2020 likely similar level.

So #CNETS total 2019-2020 allocation could reach 8 to 8.5 Gt, depending on opt-out of pilot ETS.

2019 Coal generation was 4560 TWh, 2020 likely similar level.

2019 Coal generation was 4560 TWh, 2020 likely similar level.So #CNETS total 2019-2020 allocation could reach 8 to 8.5 Gt, depending on opt-out of pilot ETS.

As for now, #CNETS will allocate allowances for free, with the goal to gradually introduce “paid allocation” (auctioning?)

Offsets: covered enterprises could use CCER up to 5% of yearly emissions for compliance. Renewables CCER projects are included.

Offsets: covered enterprises could use CCER up to 5% of yearly emissions for compliance. Renewables CCER projects are included.

Offsets: covered enterprises could use CCER up to 5% of yearly emissions for compliance. Renewables CCER projects are included.

Offsets: covered enterprises could use CCER up to 5% of yearly emissions for compliance. Renewables CCER projects are included.

When will trading in #CNETS start?

Enterprises need to submit preliminary allocation numbers by 29 Jan. So first trade in Q1?

Registry and Trading systems are finalized, but policy framework still lacks regulations on Registry/Trading/Settlement.

Enterprises need to submit preliminary allocation numbers by 29 Jan. So first trade in Q1?

Registry and Trading systems are finalized, but policy framework still lacks regulations on Registry/Trading/Settlement.

#CNETS emitters threshold:

#CNETS emitters threshold: yearly GHG > 26000 ton CO2eq

Trading Participants: Emitters and institutions & individuals fulfilling requirements. (yet to be defined).

Trading Participants: Emitters and institutions & individuals fulfilling requirements. (yet to be defined). Non-compliance fine: 20k to 30k yuan and deduction of next year’s free allocation

Non-compliance fine: 20k to 30k yuan and deduction of next year’s free allocation

#CNETS likely starts with generous allocation:

0.877 tCO2/MWh benchmark is roughly 2019 average emissions factor of coal fleet (306.4g coal)

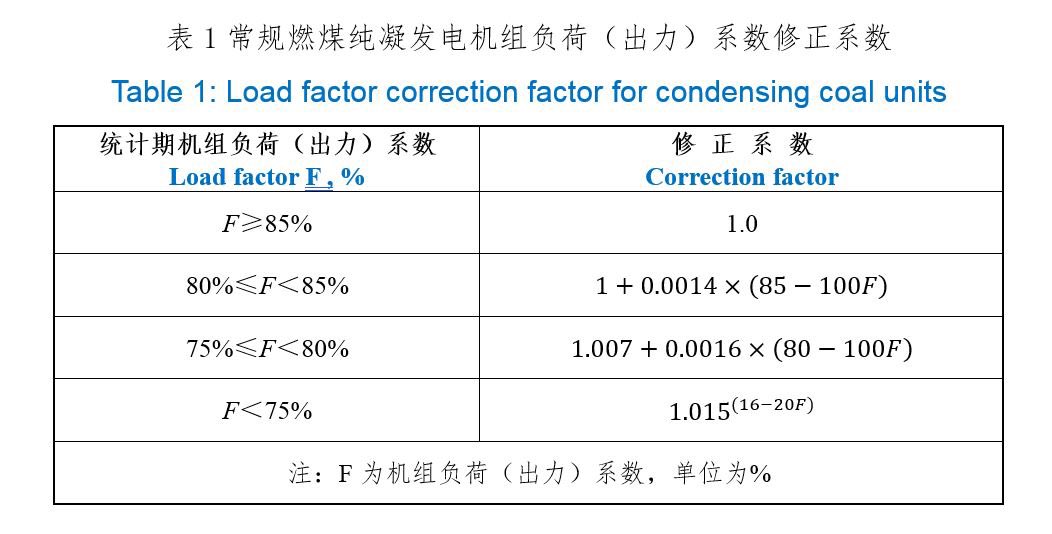

However, the 'load factor' correction will boost allocation by ~10% for plants running at half load, de facto 0.96.

0.877 tCO2/MWh benchmark is roughly 2019 average emissions factor of coal fleet (306.4g coal)

However, the 'load factor' correction will boost allocation by ~10% for plants running at half load, de facto 0.96.

Major utilities in China aim to reduce their fleet’s coal intensity down to 300g or lower (<0.858 tCO2/MWh).

In addition, the 2019-2020 allocation plan also put 20% upper limit on enterprise’s allowance shortage, less pressure on inefficient coal plants.

In addition, the 2019-2020 allocation plan also put 20% upper limit on enterprise’s allowance shortage, less pressure on inefficient coal plants.

What is the outlook for carbon price in China ETS?

What is the outlook for carbon price in China ETS? With generous allocation, most power companies will have sufficient allowances, for now.

As a reference, prices have stayed between 1 to 15 euro (5-100 yuan per ton) in China’s existing pilot ETS.

Despite the lax allocation at the beginning of #CNETS, regulators have indicated benchmarks will be tightened in the future.

Moreover, China pledges to peak emissions before 2030 and 2060 #CarbonNeutral, which will also require stricter ETS target.

Moreover, China pledges to peak emissions before 2030 and 2060 #CarbonNeutral, which will also require stricter ETS target.

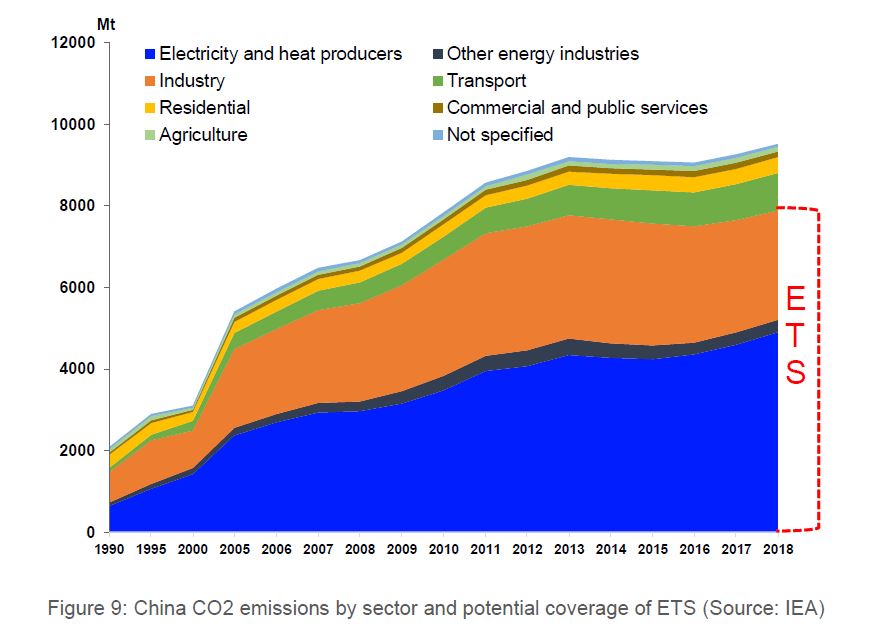

Starting with power sector only, China national carbon market will gradually expand and cover industry sectors as well by 2025.

This means that 70-80% of China's CO2 emissions could be subject to the ETS, an important tool for achieving climate goal.

This means that 70-80% of China's CO2 emissions could be subject to the ETS, an important tool for achieving climate goal.

How will China's utility cope with carbon market?

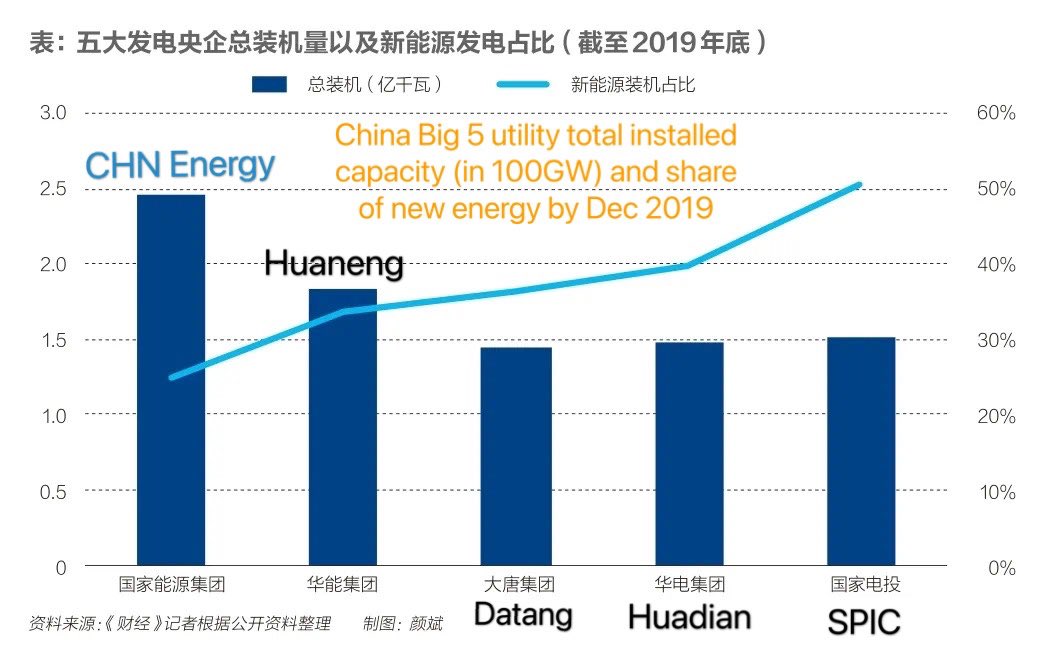

Big 5 utility plan to apply “Centralized carbon allowances management & trading strategy”.

CHN Energy, 1/6 of yearly ETS emissions, published this op-ed on ETS preparation:

https://bit.ly/3rWnJmX

Big 5 utility plan to apply “Centralized carbon allowances management & trading strategy”.

CHN Energy, 1/6 of yearly ETS emissions, published this op-ed on ETS preparation:

https://bit.ly/3rWnJmX

I am really excited to watch the next steps in China carbon market:

allowance allocation, trading, verified emissions, auctioning, new sector.

and the ETS in the context of 14th FYP, 2030 emissions peaking, 2035 Beautiful China and 2060 Carbon neutrality.

allowance allocation, trading, verified emissions, auctioning, new sector.

and the ETS in the context of 14th FYP, 2030 emissions peaking, 2035 Beautiful China and 2060 Carbon neutrality.

@EUClimateAction has conducted numerous policy dialogue and cooperation projects, supporting the design and implementation of China's nationwide emissions trading system and sharing the valuable experiences (lessons) from EU ETS: https://ec.europa.eu/clima/policies/international/cooperation/china_en

@EUClimateAction has conducted numerous policy dialogue and cooperation projects, supporting the design and implementation of China's nationwide emissions trading system and sharing the valuable experiences (lessons) from EU ETS: https://ec.europa.eu/clima/policies/international/cooperation/china_en

Read on Twitter

Read on Twitter