Quick thread on Ollie's Bargain Outlet (NAS: OLLI). OLLI's is a US discount retailer that sells buyout goods (similar to Big Lots / Ross) with a footprint of around 400 current stores and a target of 1050

1/ OLLI sells everything and anything (dented dishwashers to wedding dresses). They uniquely cater to rural markets and a lower-income consumer base compared to their peers like Ross or TJ Maxx

2/ I believe the market doesn't understand how versatile the OLLI store is. It's one of the few stores that can succeed in both rural and urban markets.

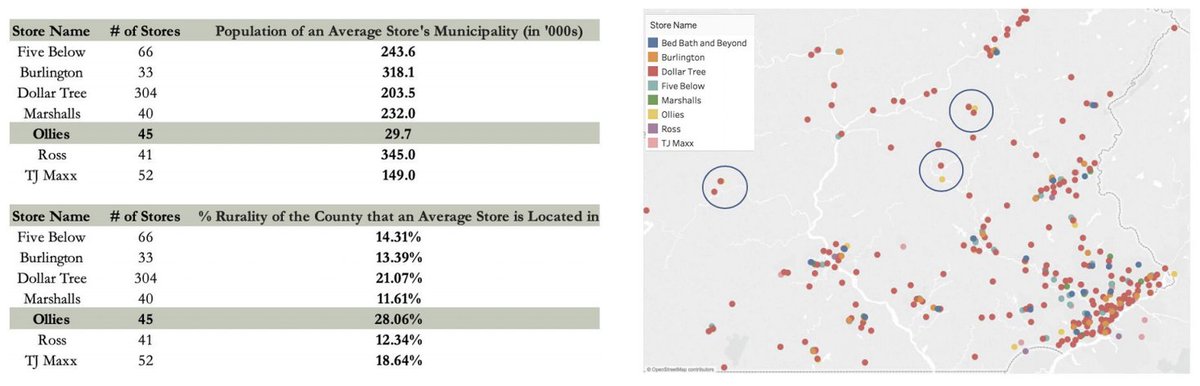

3/ Their success across markets indicates OLLI's ability to grow past 1050 stores (case study: BBBY). Below, I've included an alternative data analysis that indicates OLLI's % rurality relative to their peers in Pennsylvania

4/ This analysis should give investors conviction in their ability to succeed across markets (case studies: Cranberry Township and Cherry Hill stores)

5/ OLLI also maintains competitive advantages in merchandising, price, and brand that should be enough to battle against other public discount players, smaller scaled competitors, and any new upstarts

6/ Even with an increase in white space and their growing competitive advantages, my key question around OLLI is if they can open more than 50 stores a year. A max of 50 new stores a year will cause OLLI's EBITDA growth to quickly slow from 15-20% to HSD - low teens

7/ This was just a quick snapshot of my analysis on OLLI. Read the full piece on https://10bagger.substack.com/

DMs are open for discussion / feedback

DMs are open for discussion / feedback

Read on Twitter

Read on Twitter